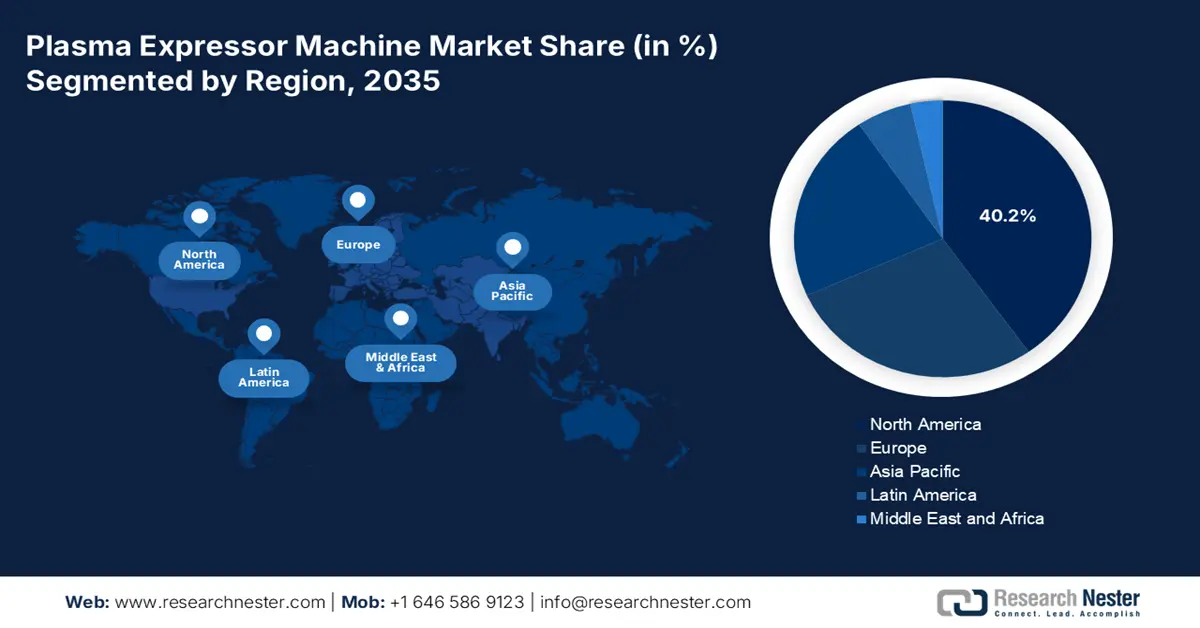

Plasma Expressor Machine Market - Regional Analysis

North America Market Insights

North America market is expected to garner the largest share of 40.2% by the end of 2035. The market’s upliftment in the region is highly attributed to the inelastic and escalating need for life-saving plasma-derived drugs for aiding rare and chronic diseases, technological integration and automation, administrative policies, and generous funding. According to an article published by NLM in July 2023, whole-exome sequencing (WES) caters to an estimated 1% to 2% of the overall genome, and is considered a suitable sequencing approach that usually focuses on achieving the protein-coding regions of the genome, thus making it suitable for the market in the region.

The plasma expressor machine market in the U.S. is growing significantly, owing to the robust trend towards technological and consolidation integration. In addition, the presence of notable collection centers that are adopting completely connected and automated systems to expand plasma yield and ensure administrative compliance is also uplifting the market in the country. Besides, as per an article published by the Annals of Blood in March 2024, the aspect of plasma blood management is increasingly evident and results in suitable cost-savings, ranging from USD 50 per patient to USD 3,000 per patient. This includes different activities, such as reducing unnecessary transfusions, peri-operative blood conservation, and pre-operative anemia management, thus suitable for boosting the market in the country.

The plasma expressor machine market in Canada is also growing due to the tactical push for national self-sufficiency in the plasma supply, which has led to a surge in public investment, especially in regional plasma collection facilities to diminish dependency on imported plasma. Besides, as per an article published by NLM in June 2022, the country readily depends on paid donations in the U.S. to successfully supply over 80% of plasma, which is also utilized to create plasma-based products to aid different illnesses. Additionally, Canada-based Blood Services (CBS) unveiled the latest plasma collection facilities, with 12 to 16 beds, which is bolstering the market’s exposure.

Medical Factors Driving the Market in North America (2024)

|

Components |

Cost Rate |

Cost Amount |

|

Labor |

56% |

USD 890 billion |

|

Other |

22% |

USD 352 billion |

|

Suppliers |

13% |

USD 202 billion |

|

Drugs |

9% |

USD 144 billion |

Source: AHA

APAC Market Insights

Asia Pacific market is expected to emerge as the fastest-growing region during the projected timeline. The market’s upliftment in the overall region is highly subject to the rapid expansion in the healthcare facility, a rise in government and private investment in ensuring blood safety, along with the aspect of a growing patient population needing plasma-driven therapies for chronic diseases, immunodeficiencies, and bleeding disorders. Meanwhile, the May 2024 WHO data report indicated that Indonesia witnessed an upsurge in dengue incidence, with 88,593 confirmed incidences and 621 deaths, thereby enhancing the market’s demand in the overall region.

The plasma expressor machine market in China is gaining increased traction, owing to the government’s increased focus on the Healthy China 2030 initiative, which has readily prioritized the creation of a regional plasma fractionation sector. Additionally, the National Medical Products Administration (NMPA) has successfully cleared an increase in the number of plasma collection facilities. Besides, as per an article published by LabMed Discovery in September 2024, hemophilia is extremely common in the country, accounting for almost 2.7 per 100,000 to 3.0 per 100,000, which is also uplifting the market’s demand.

The plasma expressor machine market in India is also developing due to the government’s strategy to introduce standard and suitable health and medical schemes, such as Ayushman Bharat, along with an increase in budget to ensure blood safety optimization. As per the October 2025 Observer Research Foundation article, the country’s yearly blood demand is approximately 14.6 million units, and between 2024 and 2025, the country successfully collected 14,601,147 units. This denotes a 15% increase over 12,695,363 units in previous years. In addition, nearly 70% of the supply originated from non-remunerated and voluntary donors, thereby boosting the market’s growth.

Europe Market Insights

Europe market is expected to experience steady growth by the end of the predicted timeline. The market’s growth in the overall region is highly fueled by the existence of strict regulatory oversight, a robust push for plasma self-sufficiency, as well as technological modernization. According to an article published by the JPAC in March 2024, the Commission Directive 2002/98/EC and the Commission Directive 2004/33/EC of the region, since their initiation in February 2005, have readily set suitable standards for successfully collecting and evaluating human blood, along with blood components, thereby suitable for uplifting the market.

The plasma expressor machine market in Germany is gaining increased exposure, owing to the presence of the Federal Ministry of Health, which readily supports a strong environment for plasma collection, along with governmental agencies for biomedicines and vaccines. As per the March 2025 MDPI article, the pediatric-based vaccine coverage rate has been 74% as of 2023 for children of 2 years, while it is 23.3% for adults between the age range of 60 to 74 years. Therefore, this has created a huge growth opportunity for the overall market to grow and gain more acceptance in the country.

The plasma expressor machine market in France is also developing due to increased guidance by the French National Authority for Health, which has emphasized self-sufficiency for plasma-specific drugs. In addition, the regional initiative for blood has effectively dictated tactical investments, which is also fueling the overall market in the country. In this regard, the French Blood Establishment has successfully and publicly put forward plans to enhance plasma collection through apheresis over the years. This is considered an objective that has effectively necessitated suitable capital investment in automated expressor machines, thereby positively influencing the domestic health expenditure for this particular technology.