Global Plant Factory Market

- An Outline of the Global Plant Factory Market

- Study Objective

- Market Definition

- Market Segmentation

- Assumptions and Abbreviations

- Research Methodology & Approach

- Research Process

- Primary Research

- Manufacturers

- Suppliers/Distributors

- End Users

- Secondary Research

- Market Size Estimation

- Summary of the Report for Key Decision Makers

- Market Drivers

- Market Restraints

- Major Opportunities

- Major Trends

- Government Regulation: How they would aid business?

- Technology Analysis

- Industry Risk Analysis

- Industry Pricing Benchmarking

- SWOT Analysis

- Comparative Positioning of the Current Technologies

- Industry Growth Outlook

- Industry Supply Chain Analysis

- Startups in the Industry

- Regional Demand Analysis

- Recent News on Plant Factory Market

- Latest Projects Initiated by Key Players and Government Organizations

- Farming Research Facility Expansion

- Research Agreement for Different Plants/Crops

- Mergers and Acquisition (M&A) Analysis

- Plant Factory Stages/Ecosystem

- Components Used in Plant Factory Facility

- Components Manufacturer

- Technology Innovation

- Investment or Funding Received by Key Players

- Strategic Initiative Adopted by Key Players

- Comparative Feature Analysis

- Competitive Positioning: Key Players

- Competitive Model

- Company Market Share

- Business Profile of Key Enterprises

- AeroFarms

- Detailed Overview

- Assessment of Key Offerings

- Analysis of Growth Strategies

- Exhaustive Analysis on Key Financial Indicators

- Recent Developments and Strategies

- BrightFarms

- Bowery Farming Inc.

- ESPEC MIC CORP.

- Farmship, Inc.

- FF Agro Technologies Pvt Ltd

- Freight Farms

- Gotham Greens

- Hydrofarm Holdings Group Inc.0

- iFarm

- Indoor Harvest Farms Pvt Ltd

- Keystone Technology Inc.

- Leaf Factory Tokyo Co., Ltd.

- Letcetra Agritech Private Limited

- M Hydroponic Research Co., Ltd

- Mebiol Inc.

- Mitsubishi Chemical Group

- MIRAI Co., Ltd.

- Plenty Unlimited Inc.

- Sky Greens

- Spread Co., Ltd.

- Taikisha Ltd.

- Triton Foodworks

- Urban Crop Solutions BV

- UrbanKisaan

- Vertical Harvest

- AeroFarms

- Global Plant Factory Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Global Plant Factory Market Segmentation Analysis (2024-2037)

- By Facility

- Greenhouses, Market Value (USD Million), and CAGR, 2024-2037F

- Indoor farms, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Light Type

- Sunlight, Market Value (USD Million), and CAGR, 2024-2037F

- Full artificial light Market Value (USD Million), and CAGR, 2024-2037F

- By Crop Type

- Leafy Greens, Market Value (USD Million), and CAGR, 2024-2037F

- Fruits and Vegetables, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Technology

- Hydroponics, Market Value (USD Million), and CAGR, 2024-2037F

- Aeroponics, Market Value (USD Million), and CAGR, 2024-2037F

- Aquaponics, Market Value (USD Million), and CAGR, 2024-2037F

- LED Lightning, Market Value (USD Million), and CAGR, 2024-2037F

- Soil-Based Systems, Market Value (USD Million), and CAGR, 2024-2037F

- Hybrid Systems, Market Value (USD Million), and CAGR, 2024-2037F

- By Region

- North America, Market Value (USD Million), and CAGR, 2024-2037F

- Europe, Market Value (USD Million), and CAGR, 2024-2037F

- Asia Pacific Excluding Japan, Market Value (USD Million), and CAGR, 2024-2037F

- Japan, Market Value (USD Million), and CAGR, 2024-2037F

- Latin America, Market Value (USD Million), and CAGR, 2024-2037F

- Middle East and Africa, Market Value (USD Million), and CAGR, 2024-2037F

- By Facility

- Cross Analysis Facility w.r.t. Light Type

- Cross Analysis Light Type w.r.t. Crop Type

- North America Plant Factory Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Plant Factory Market Segmentation Analysis (2024-2037)

- By Facility

- Greenhouses, Market Value (USD Million), and CAGR, 2024-2037F

- Indoor farms, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Light Type

- Sunlight, Market Value (USD Million), and CAGR, 2024-2037F

- Full artificial light Market Value (USD Million), and CAGR, 2024-2037F

- By Crop Type

- Leafy Greens, Market Value (USD Million), and CAGR, 2024-2037F

- Fruits and Vegetables, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Technology

- Hydroponics, Market Value (USD Million), and CAGR, 2024-2037F

- Aeroponics, Market Value (USD Million), and CAGR, 2024-2037F

- Aquaponics, Market Value (USD Million), and CAGR, 2024-2037F

- LED Lightning, Market Value (USD Million), and CAGR, 2024-2037F

- Soil-Based Systems, Market Value (USD Million), and CAGR, 2024-2037F

- Hybrid Systems, Market Value (USD Million), and CAGR, 2024-2037F

- By Country

- US, Market Value (USD Million), and CAGR, 2024-2037F

- Canada, Market Value (USD Million), and CAGR, 2024-2037F

- By Facility

- Cross Analysis Facility w.r.t. Light Type

- Cross Analysis Light Type w.r.t. Crop Type

- Europe Plant Factory Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Plant Factory Market Segmentation Analysis (2024-2037)

- By Facility

- Greenhouses, Market Value (USD Million), and CAGR, 2024-2037F

- Indoor farms, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Light Type

- Sunlight, Market Value (USD Million), and CAGR, 2024-2037F

- Full artificial light Market Value (USD Million), and CAGR, 2024-2037F

- By Crop Type

- Leafy Greens, Market Value (USD Million), and CAGR, 2024-2037F

- Fruits and Vegetables, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Technology

- Hydroponics, Market Value (USD Million), and CAGR, 2024-2037F

- Aeroponics, Market Value (USD Million), and CAGR, 2024-2037F

- Aquaponics, Market Value (USD Million), and CAGR, 2024-2037F

- LED Lightning, Market Value (USD Million), and CAGR, 2024-2037F

- Soil-Based Systems, Market Value (USD Million), and CAGR, 2024-2037F

- Hybrid Systems, Market Value (USD Million), and CAGR, 2024-2037F

- By Country

- UK, Market Value (USD Million), and CAGR, 2024-2037F

- Germany, Market Value (USD Million), and CAGR, 2024-2037F

- France, Market Value (USD Million), and CAGR, 2024-2037F

- Italy, Market Value (USD Million), and CAGR, 2024-2037F

- Spain, Market Value (USD Million), and CAGR, 2024-2037F

- Netherland, Market Value (USD Million), and CAGR, 2024-2037F

- Russia, Market Value (USD Million), and CAGR, 2024-2037F

- Rest of Europe, Market Value (USD Million), and CAGR, 2024-2037F

- By Facility

- Cross Analysis Facility w.r.t. Light Type

- Cross Analysis Light Type w.r.t. Crop Type

- Asia Pacific Excluding Japan Plant Factory Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Plant Factory Market Segmentation Analysis (2024-2037)

- By Facility

- Greenhouses, Market Value (USD Million), and CAGR, 2024-2037F

- Indoor farms, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Light Type

- Sunlight, Market Value (USD Million), and CAGR, 2024-2037F

- Full artificial light Market Value (USD Million), and CAGR, 2024-2037F

- By Crop Type

- Leafy Greens, Market Value (USD Million), and CAGR, 2024-2037F

- Fruits and Vegetables, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Technology

- Hydroponics, Market Value (USD Million), and CAGR, 2024-2037F

- Aeroponics, Market Value (USD Million), and CAGR, 2024-2037F

- Aquaponics, Market Value (USD Million), and CAGR, 2024-2037F

- LED Lightning, Market Value (USD Million), and CAGR, 2024-2037F

- Soil-Based Systems, Market Value (USD Million), and CAGR, 2024-2037F

- Hybrid Systems, Market Value (USD Million), and CAGR, 2024-2037F

- By Country

- China, Market Value (USD Million), and CAGR, 2024-2037F

- India, Market Value (USD Million), and CAGR, 2024-2037F

- Indonesia, Market Value (USD Million), and CAGR, 2024-2037F

- South Korea, Market Value (USD Million), and CAGR, 2024-2037F

- Australia, Market Value (USD Million), and CAGR, 2024-2037F

- Singapore, Market Value (USD Million), and CAGR, 2024-2037F

- Rest of Asia Pacific Excluding Japan, Market Value (USD Million), and CAGR, 2024-2037F

- By Facility

- Cross Analysis Facility w.r.t. Light Type

- Cross Analysis Light Type w.r.t. Crop Type

- Japan Plant Factory Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Plant Factory Market Segmentation Analysis (2024-2037)

- By Facility

- Greenhouses, Market Value (USD Million), and CAGR, 2024-2037F

- Indoor farms, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Light Type

- Sunlight, Market Value (USD Million), and CAGR, 2024-2037F

- Full artificial light Market Value (USD Million), and CAGR, 2024-2037F

- By Crop Type

- Leafy Greens, Market Value (USD Million), and CAGR, 2024-2037F

- Fruits and Vegetables, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Technology

- Hydroponics, Market Value (USD Million), and CAGR, 2024-2037F

- Aeroponics, Market Value (USD Million), and CAGR, 2024-2037F

- Aquaponics, Market Value (USD Million), and CAGR, 2024-2037F

- LED Lightning, Market Value (USD Million), and CAGR, 2024-2037F

- Soil-Based Systems, Market Value (USD Million), and CAGR, 2024-2037F

- Hybrid Systems, Market Value (USD Million), and CAGR, 2024-2037F

- By Facility

- Cross Analysis Facility w.r.t. Light Type

- Cross Analysis Light Type w.r.t. Crop Type

- Latin America Plant Factory Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Plant Factory Market Segmentation Analysis (2024-2037)

- By Facility

- Greenhouses, Market Value (USD Million), and CAGR, 2024-2037F

- Indoor farms, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Light Type

- Sunlight, Market Value (USD Million), and CAGR, 2024-2037F

- Full artificial light Market Value (USD Million), and CAGR, 2024-2037F

- By Crop Type

- Leafy Greens, Market Value (USD Million), and CAGR, 2024-2037F

- Fruits and Vegetables, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Technology

- Hydroponics, Market Value (USD Million), and CAGR, 2024-2037F

- Aeroponics, Market Value (USD Million), and CAGR, 2024-2037F

- Aquaponics, Market Value (USD Million), and CAGR, 2024-2037F

- LED Lightning, Market Value (USD Million), and CAGR, 2024-2037F

- Soil-Based Systems, Market Value (USD Million), and CAGR, 2024-2037F

- Hybrid Systems, Market Value (USD Million), and CAGR, 2024-2037F

- By Country

- Brazil, Market Value (USD Million), and CAGR, 2024-2037F

- Argentina, Market Value (USD Million), and CAGR, 2024-2037F

- Mexico, Market Value (USD Million), and CAGR, 2024-2037F

- Rest of Latin America, Market Value (USD Million), and CAGR, 2024-2037F

- By Facility

- Cross Analysis Facility w.r.t. Light Type

- Cross Analysis Light Type w.r.t. Crop Type

- Middle East & Africa Plant Factory Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Plant Factory Market Segmentation Analysis (2024-2037)

- By Facility

- Greenhouses, Market Value (USD Million), and CAGR, 2024-2037F

- Indoor farms, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Light Type

- Sunlight, Market Value (USD Million), and CAGR, 2024-2037F

- Full artificial light Market Value (USD Million), and CAGR, 2024-2037F

- By Crop Type

- Leafy Greens, Market Value (USD Million), and CAGR, 2024-2037F

- Fruits and Vegetables, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Technology

- Hydroponics, Market Value (USD Million), and CAGR, 2024-2037F

- Aeroponics, Market Value (USD Million), and CAGR, 2024-2037F

- Aquaponics, Market Value (USD Million), and CAGR, 2024-2037F

- LED Lightning, Market Value (USD Million), and CAGR, 2024-2037F

- Soil-Based Systems, Market Value (USD Million), and CAGR, 2024-2037F

- Hybrid Systems, Market Value (USD Million), and CAGR, 2024-2037F

- By Country

- GCC, Market Value (USD Million), and CAGR, 2024-2037F

- Israel, Market Value (USD Million), and CAGR, 2024-2037F

- South Africa, Market Value (USD Million), and CAGR, 2024-2037F

- Rest of Middle East & Africa, Market Value (USD Million), and CAGR, 2024-2037F

- By Facility

- Cross Analysis Facility w.r.t. Light Type

- Cross Analysis Light Type w.r.t. Crop Type

- Global Economic Scenario

- About Research Nester

Plant Factory Market Outlook:

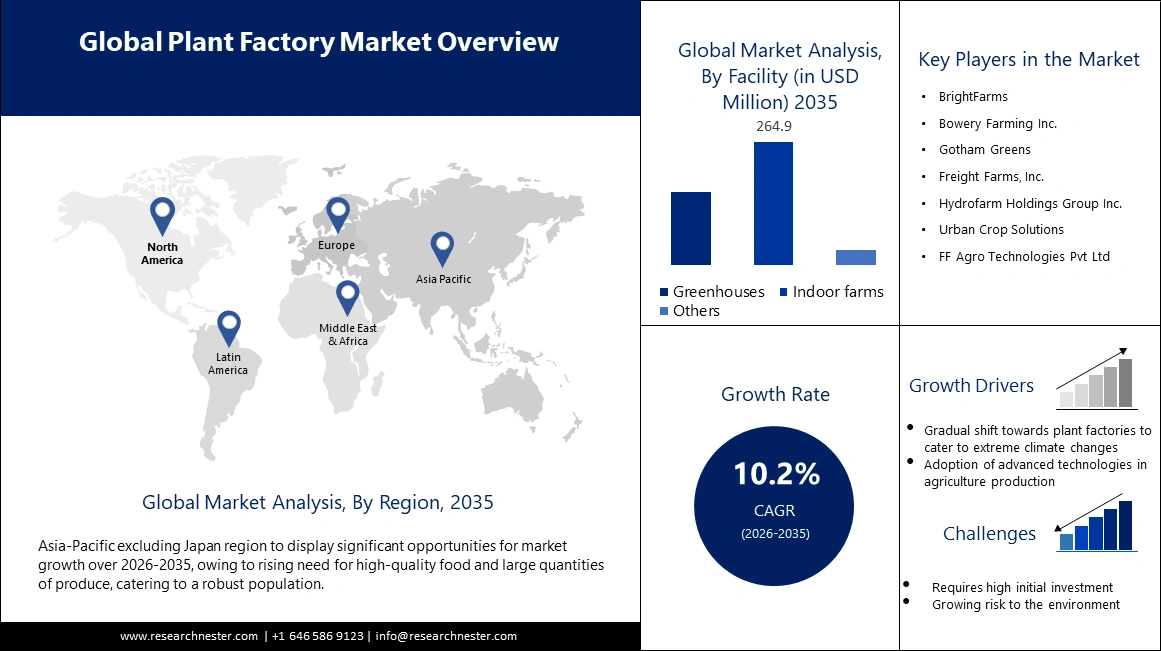

Plant Factory Market size was valued at USD 3.79 billion in 2025 and is likely to cross USD 10.01 billion by 2035, expanding at more than 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of plant factory is assessed at USD 4.14 billion.

The plant factory market is steadily growing due to the increase in the use of controlled environment agriculture (CEA) technologies. Hydroponics, aeroponics, and vertical farming have made it possible to grow nutrient-rich crops such as magnesium-containing green vegetables for supplement preparation. In September 2024, Plenty Unlimited Inc. announced plans to expand its research and development center in Wyoming to improve crop yield by optimizing light intensity and nutrients. With increasing urbanization, plant factories are the best approach to food security and the production of supplement quality crops.

Government actions are even more encouraging for the development of the sector. In December 2024, the Malaysian government launched GPP KiTa as a regulatory structure for plant factory approval for urban agriculture. Likewise, the Global Report on Food Crisis (GRFC) 2023 exposed that 282 million people suffered from acute hunger, underlining the importance of increasing yields among crops. Due to increasing concern for food safety, plant factories are witnessing a surge in adoption as they offer a reliable way of growing crops, free from contamination of pests and diseases, with minimal environmental impact.

Key Plant Factory Market Insights Summary:

Regional Highlights:

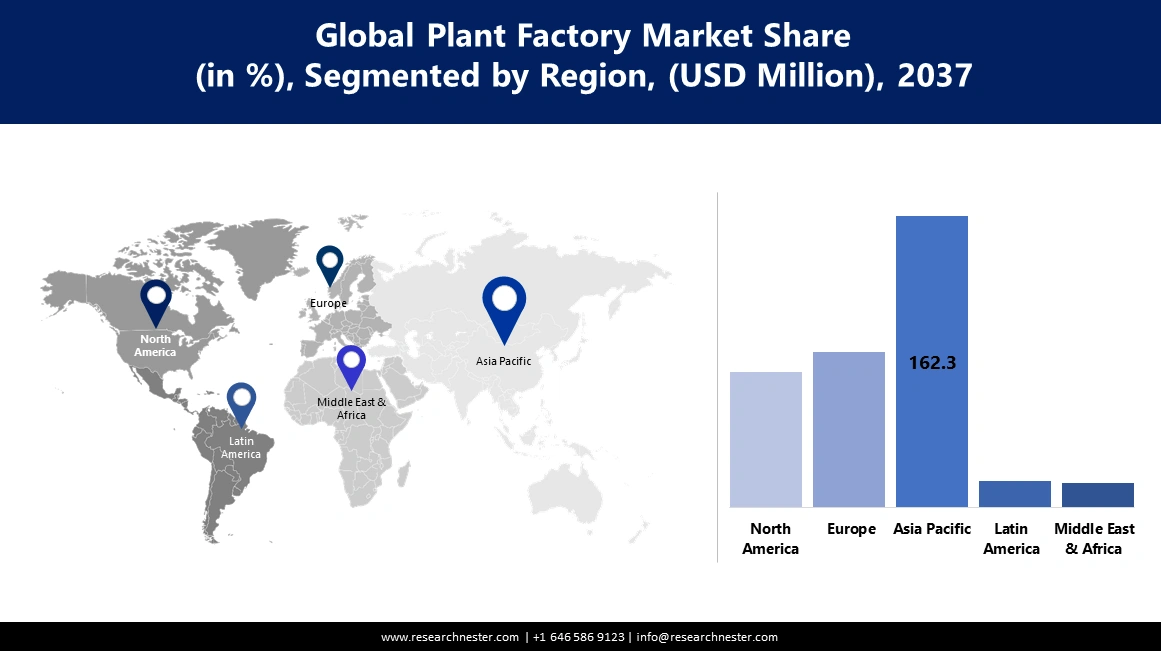

- The Asia Pacific plant factory market will secure over 35.40% share by 2035, driven by urbanization, food security measures, and policies and incentives.

- The North America market will exhibit substantial growth during the forecast timeline, driven by rising plant factory investments and consumption of green food.

Segment Insights:

- The artificial light segment in the plant factory market is anticipated to achieve significant growth till 2035, driven by the ability to control lighting conditions in the greenhouse.

- The indoor farms segment in the plant factory market is expected to experience significant growth over the forecast period 2026-2035, driven by the growing need for food production that is not affected by climatic conditions while being highly productive.

Key Growth Trends:

- Adoption of AI in modern agriculture

- Achieving food security and sustainable production

Major Challenges:

- High energy consumption in indoor farming

- Lack of consumer confidence and knowledge

Key Players: AeroFarms, BrightFarms, Bowery Farming Inc., ESPEC MIC CORP., Farmship, Inc., FF Agro Technologies Pvt Ltd, Freight Farms, Gotham Greens, Hydrofarm Holdings Group Inc., iFarm, Indoor Harvest Farms Pvt Ltd, Keystone Technology Inc., Leaf Factory Tokyo Co., Ltd.

Global Plant Factory Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.79 billion

- 2026 Market Size: USD 4.14 billion

- Projected Market Size: USD 10.01 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 17 September, 2025

Plant Factory Market Growth Drivers and Challenges:

Growth Drivers

- Adoption of AI in modern agriculture: AI technology has entered the field of indoor farming by improving crop health checks, feeding and climate regulation. In February 2024, the Universitas Gadjah Mada (UGM) launched Smart Agri Plant Factory, which combines hydroponics, AI nutrient systems, and precision lighting for better crop yield quality. This facility enhances magnesium concentration in plants especially for magnesium glycinate supplements production. Artificial intelligence in agriculture also helps in having a consistent yield, low costs for labor, and better utilization of resources. For this reason, the ability to regulate nutrients in real time makes it a suitable technology for functional food manufacturing.

- Achieving food security and sustainable production: The interest in localized indoor farm production has been boosted by the growing urban population and climate change impacts, which reduce food transport pollution. In September 2024, Urban Crop Solutions installed the first vertical farming tower at Agrotopia, with both artificial and sunlight for crop production all year round. They use limited water, improve crop quality, and offer fresh and locally grown crops to the plant factory market. Agriculture indoors is suitable for the growth of crops that are rich in magnesium to make up for the nutrient deficiency of supplements. With increasing pressure on governments to adopt sustainable agriculture, vertical farms are proving to be crucial to feeding cities.

- Increased funding in vertical farming technologies: Governments and private investors are investing more capital into vertical farming to improve food production and agriculture. In February 2024, Oishii raised USD 134 million to scale up high-density indoor farming, which shows great confidence in controlled environment agriculture. Capital investments are being made towards the development of automated plant factories for the production of nutrient-dense crops, such as magnesium-containing plants for supplement production. By minimizing the area and water usage, these facilities support the sustainable use of natural resources in agriculture. The use of robotics, artificial intelligence, and smart lighting in vertical farms makes production to be efficient, productive, and cost effective.

Challenges

- High energy consumption in indoor farming: Plant factories that use artificial lighting consume a lot of energy, as a result, they are costly to run and unsustainable. The use of LED and climate control systems on a large scale contributes to carbon emissions. Thus, there is a need for energy-efficient products. Ministries and scholars are looking at solar farms and energy recovery systems to reduce electricity usage. Limiting dependence on non-renewable sources of energy is still a major issue in the expansion of plant factories around the world.

- Lack of consumer confidence and knowledge: Although the adoption of indoor farming has many advantages, consumer knowledge and acceptance of hi-tech farming are still low in many parts of the world. There is a strong link between fresh produce and traditional farming, hence making it a challenge to plant factory market crops grown through vertical farming. It is therefore crucial to increase awareness of the public by informing them on the nutritional values of the produce, the absence of pesticide usage in plant factories and the sustainable nature of this form of farming. Supermarkets, food brands, and supplement manufacturing companies are working with indoor farmers to enhance the acceptance of the products by the consumers.

Plant Factory Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 3.79 billion |

|

Forecast Year Market Size (2035) |

USD 10.01 billion |

|

Regional Scope |

|

Plant Factory Market Segmentation:

Facility Segment Analysis

Indoor farms segment is expected to capture over 58.9% plant factory market share by 2035 as there is a growing need for food production that is not affected by climatic conditions while at the same time being highly productive. In March 2024, a Tokyo-based startup company called HarvestX Inc. received USD 2.46 million to enhance the indoor farming system. Growing populations in urban areas mean that indoor farms offer solutions to address food insecurity issues. CEA is effective in maintaining nutrient quality hence, suitable for functional food markets. Hydroponic and aeroponic systems are being adopted more often to improve yields while occupying less land and water.

Light Type Segment Analysis

By the end of 2035, among the light type, the artificial light segment is set to hold over 81.9% plant factory market share, due to the ability to control the lighting conditions in the greenhouse. In March 2023, Mitsubishi Chemical Group established the AN artificial light plant factory that focuses on the production of magnesium-rich crops for supplements and functional food. Advanced lighting systems help maintain standard plant quality by controlling spectral distribution and light intensity, making it mandatory for modern plant factories. The application of LED, UV, and infrared technologies makes it possible to increase the efficiency of photosynthesis and the yield of crops.

Our in-depth analysis of the plant factory market includes the following segments:

|

Facility |

|

|

Light Type |

|

|

Crop Type |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Plant Factory Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific in plant factory market is expected to dominate around 35.4% revenue share by the end of 2035, due to urbanization, food security measures, and policies and incentives. According to the FAO, to achieve SDG 2 (Zero Hunger), more than 3 million people in the region need to be lifted out of hunger each month by December 2030. This calls for the need to come up with a solution that can feed the world’s growing population through large-scale production like vertical farming and plant factories.

India Production Linked Incentive (PLI) Scheme is significantly encouraging investment in agriculture, and the country is now well-equipped to feed consumers. The PLI scheme has been announced with INR 1.97 lakh crore (more than USD 26 billion) for 14 core manufacturing sectors, such as controlled environment agriculture. This kind of financial support is likely to promote the advancement of vertical farming in India and transform the food production system by minimizing the impact of climate change on traditional agriculture.

China is at the forefront of the use of automation in plant factories using artificial intelligence to improve yields. In February 2024, the Institute of Urban Agriculture (IUA) and the Chinese Academy of Agricultural Sciences (CAAS) introduced robots that can produce and harvest lettuce in 35 days with the help of an artificial intelligence control system. This state-of-the-art automation technology helps in continuously monitoring the environment and control of the conditions that are required for the growth of plants in vertical farms in order to enhance productivity. Due to these factors, China is anticipated to lead in high-tech farming innovations due to its increasing rate of innovations in Agri-Tech.

North America Market Insights

North America region is poised to witness substantial growth through 2035, due to the rising plant factory investments and consumption of green food. The increasing utilization of controlled-environment agriculture (CEA) is responding to issues of climate change, food scarcity, and increasing urbanization. Governments and private investors are investing in high-tech vertical farming solutions to increase the food supply chain and production all year round.

The U.S. continues to lead the global plant factory investments as the country seeks to cultivate more crops in controlled environment structures in response to the growing consumer appetite for locally grown crops that are free from pesticide residues. In February 2024, the largest real estate investment trust (REIT), Realty Income, dedicated USD 1 billion to vertical farming investment, demonstrating high levels of belief in indoor farming. AI climate control and LED-based lighting of plant factories are helping to increase efficiency and crop yields, thereby enhancing plant factory market growth in the U.S.

Canada is experiencing the rising trend of vertical farming due to climate change and high dependence on imported foods. Efforts have been made by the government and private sectors to improve agricultural technology for an efficient plant factory in the urban and rural regions. The consumer’s increased concern for fresh and locally grown produce has led to the growth of plant factories using hydroponic and aeroponic systems for the production of plants. For these reasons, plant factories are turning into a viable solution to the challenges resulting from climate change for Canada agricultural sector.

Plant Factory Market Players:

- AeroFarms

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BrightFarms

- Bowery Farming Inc.

- ESPEC MIC CORP.

- Farmship, Inc.

- FF Agro Technologies Pvt Ltd

- Freight Farms

- Gotham Greens

- Hydrofarm Holdings Group Inc.0

- iFarm

- Indoor Harvest Farms Pvt Ltd

- Keystone Technology Inc.

- Leaf Factory Tokyo Co., Ltd.

- Letcetra Agritech Private Limited

- M Hydroponic Research Co., Ltd

- Mebiol Inc.

- Mitsubishi Chemical Group

- MIRAI Co., Ltd.

- Plenty Unlimited Inc.

- Sky Greens

- Spread Co., Ltd.

- Taikisha Ltd.

- Triton Foodworks

- Urban Crop Solutions BV

- UrbanKisaan

- Vertical Harvest

The plant factory market is saturated, and key players in the field are utilizing automation, sustainability, and optimal nutrient control. Some of the leading companies are AeroFarms, BrightFarms, Bowery Farming Inc., Gotham Greens, and Freight Farms. These firms are opening huge vertical farms with artificial intelligence climate control and LED lighting in order to achieve higher yields and better quality crops. Innovations in plant genetics, smart sensors, and precision irrigation are being made to increase productivity and decrease resource use.

In November 2024, Plantas Group acquired Green Innovations Ltd., a company specializing in modular vertical farming technologies. This acquisition could support the efficient cultivation of magnesium-dense crops used in magnesium glycinate production. Furthermore, investment by companies demonstrates that plant factories are revolutionizing the production of nutrient-rich foods for functional foods and supplements. The automation, diversification, and efficiency in crop nutrition make the plant factories the future of high-yield farming in the industry.

Here are some leading companies in the plant factory market:

Recent Developments

- In August 2024, BrightFarms expanded its crop production to include magnesium-rich leafy greens and herbs, providing consumers with natural sources of essential minerals, including magnesium glycinate precursors. This expansion aims to meet the growing demand for magnesium supplements and promote overall health and wellness.

- In March 2024, Kao Corporation developed the Smart Garden Meguri plant factory, utilizing CO₂ recycling to accelerate plant growth while reducing water consumption by 40%. This innovative approach could enhance magnesium-rich crop cultivation for supplement applications, contributing to sustainable and efficient magnesium production.

- In July 2023, Spread joined 30+ vertical farming companies in the Vertical Farming Manifesto, committing to sustainable agriculture. Their initiatives may enhance the availability of magnesium-rich crops used in magnesium glycinate supplements, supporting a more sustainable and accessible supply chain for magnesium supplements.

- Report ID: 6287

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Plant Factory Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.