Plant-based Meat Market - Regional Analysis

North America Market Insights

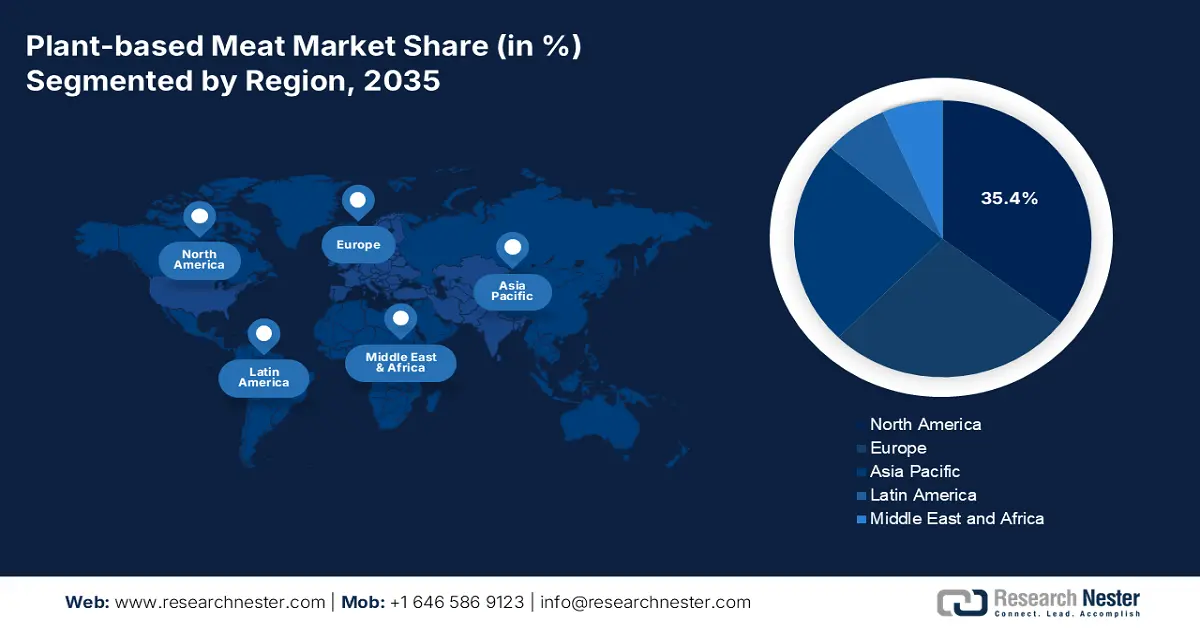

The North America is dominating the plant-based meat market and is poised to hold the market share of 35.4% by 2035. The market is driven by high consumer awareness, robust retail and foodservice distribution, and substantial private investment. The key trends include the product innovation focused on improving taste and texture, the expansion of fast food partnerships, and a growing focus on health and sustainability claims. The market is transitioning from early adoption to mainstream integration, with growth now driven by category optimization, price parity initiatives, and increased competition from private label offerings. Regulatory clarity on labeling alongside governmental support for alternative protein research, such as Canada’s Protein Industries Canada supercluster, provides a stable foundation for long term innovation and scaling. The region remains the global revenue leader, but growth rates are moderating as the market matures.

The U.S. market is defined by consolidation and a strategic shift toward sustainable growth and operational efficiency. The prime trends of the market are the intense competition leading to price reductions and a strong focus on improving nutritional profiles. The NLM study in April 2022 indicates that nearly 80% of the U.S. consumers have heard about the plant-based meat alternatives, and around 65% had consumed some form of plant-based meat or plant protein. Further, 20% to 22% consumed such products at least weekly, indicating the trial is widespread. Moreover, consumer interest in alternative proteins remains a significant factor in the protein market, influencing agricultural outlooks. The Plant Based Foods Association indicates that while the growth has normalized, the category maintains a stable, multi-billion-dollar presence in grocery stores, indicating deep market integration.

The plant-based meat market in Canada is distinguished by proactive federal and provincial government strategies positioning the country as a global supplier of plant proteins. Canada plays a strategically important role in the global plant-based meat value chain, supported by the strong upstream protein ingredient capacity, export orientation, and growing domestic consumption. The Government of Canada in July 2025 shows that the country has exported over USD 2.4 billion worth of plant-based and animal protein ingredients, with the U.S. absorbing 77.4% of the total export value, underscoring Canada’s position as a key supplier to the North America plant-based meat manufacturers. Further, the non-animal-derived proteins accounted for 75% of the total protein ingredient volume sales, driven mainly by soy protein concentrate and wheat gluten, which are core inputs for meat and seafood substitutes. Demand is concentrated in processed meat alternatives, ready meals, baked goods, and snacks, reflecting strong integration of plant-based meat into staple food categories rather than niche segments.

New product Launches of Plant-Based Food and Drinks in Canada

|

Product Attributes |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

Total |

|

Meat substitutes |

42 |

76 |

53 |

47 |

72 |

30 |

320 |

|

Nutritional and meal replacement drinks |

40 |

66 |

22 |

31 |

24 |

11 |

194 |

|

Snack/cereal/energy bars |

21 |

48 |

23 |

20 |

45 |

13 |

170 |

|

Processed cheese |

13 |

8 |

22 |

31 |

33 |

29 |

136 |

|

Plant based drinks (dairy alternatives) |

10 |

24 |

31 |

32 |

32 |

3 |

132 |

Source: Government of Canada July 2025

APAC Market Insights

The Asia Pacific is the fastest-growing plant-based meat market and is expected to grow at a CAGR of 12.4% during the forecast period 2026 to 2035. The market is driven by the rising consciousness of environmental concerns and a growing flexitarian population. The key drivers include massive urbanization, increasing disposable incomes, and strategic government initiatives supporting food security and sustainable agriculture. The prime trend is the strong localization of products to align with diverse regional cuisines and taste preferences strong localization of products to align with diverse regional cuisines and taste preferences, moving beyond the Western-style burgers to include alternatives for dumplings, curry, and noodles. The market is also defined by the rapid retail modernization and aggressive investment from both local corporations and international players.

China represents a high potential and early-stage market for the market. The market is shaped by the rising urban demand, food innovation investment, and evolving regulatory frameworks. While China remains the world’s largest consumer of meat, demand for plant-based meat alternatives is increasing mainly in urban, younger, and flexitarian consumer segments, supported by the expanding restaurant, hotel, and institutional adoption. The USDA report in January 2021 indicates that the most plant-based meat alternatives in China are currently priced above conventional meat promoting producers to prioritize beef and pork analogues, which command higher market prices. The production relies largely on domestically sourced soy, legume rice, and fundamental proteins, with manufacturers using advanced extrusion and fibrous protein technologies to improve taste and texture.

International and Domestic Plant-Based Meat Alternative Companies

|

Company |

Products |

Production |

Distribution Channels |

Main Ingredients |

|

Bee & Cheery |

Beef jerky, Pork stuffing |

Domestic |

Own retail, on-line stores |

- |

|

Beyond Meat |

Minced beef, Meatball, Sausage, Beef patty |

Imported from the United States; in 2020, announced it will open a production factory in China |

HRI sector: Starbucks |

Pea, mung bean, fava bean, brown rice |

|

Hey Maet |

Chinese style minced pork, Beef patty, Sausage, Minced beef, Beef cube, Chicken nugget |

Domestic |

HRI sector |

Soybean protein, pea protein, corn |

|

PFI Foods |

Chinese style minced pork, Others |

Domestic |

Tmall and JD.com on-line stores, HRI sector |

Soy protein, pea protein |

|

Starfield |

Beef meat ball, Beef patty, Minced beef |

Domestic |

HRI sector: Papa Johns, Elementfresh, Sizzler, Jin Ding Xuan, Gaga, Dicos, etc. |

Soy protein, beetroot (for coloring) |

Source: USDA January 2021

Japan represents a steadily developing plant-based meat market and is supported by a sizeable plant protein ingredient base, high import activity, and established demand for the protein enriched foods. The Government of Canada report in July 2025 highlights that Japan imported USD 1.2 billion worth of plant-based and animal protein ingredients, reflecting a strong reliance on international supply chains that also serve domestic meat alternative production. Non-animal-derived protein accounted for 40.7% of the total protein volume, led by soy protein concentrate and soy protein isolate, which are the core inputs for plant-based formulations. These data make Japan an ingredient-driven, import-dependent market where plant-based meat growth is likely to be incremental and closely tied to innovation in soy-based formulations and convenient meal formats.

Value Imports of Plant-Based and Animal Protein Ingredients (USD million)

|

HS code |

Description |

2019 |

2020 |

2021 |

2022 |

2023 |

CAGR* % 2019-2023 |

|

350400029 |

Protein substances and derivatives, nowhere else specified |

167.6 |

181.4 |

193.3 |

223.0 |

225.2 |

7.7 |

|

350400021 |

Vegetable proteins and derivatives |

63.8 |

68.1 |

92.4 |

100.9 |

80.9 |

6.1 |

|

350400010 |

Peptones and derivatives, hide powder |

43.1 |

46.2 |

50.1 |

49.4 |

50.1 |

3.9 |

|

350220 |

Milk albumin, >80% proteins by weight (including concentrates of 2 or more whey proteins) |

126.5 |

149.8 |

217.4 |

346.8 |

267.6 |

20.6 |

Source: The Government of Canada, July 2025

Europe Market Insights

The plant-based meat market in Europe is a global leader and a dynamic growth engine, which is primarily driven by a powerful convergence of consumer demand and supportive policy. Consumer interest is strong, with high awareness of the health and environmental benefits of reducing meat consumption. This demand is strategically amplified by the European Union’s Farm to Fork Strategy, a core pillar of the European Green Deal, which explicitly aims to make the food systems sustainable and actively promotes a shift toward more plant-based diets. The market growth is defined by a significant product diversification, moving from basic burgers and sausages to advanced whole cut alternatives such as plant-based steaks and seafood. The retail landscape is highly competitive with the rapid expansion of both the pioneering dedicated brands and private label ranges from major supermarket chains, which is vital for driving down prices and achieving mainstream adoption.

Germany represents one of Europe’s most advanced and demand-ready plant-based meat markets and is supported by the sustained shifts in consumer behavior and a broader protein transition agenda. The NLM study in June 2024 indicates that the per capita consumption of meat in Germany has reduced steadily, including a 8% YoY drop from 2021 to 2022. On the other hand, the plant-based meat sales increased by more than 42% form 2020 to 2022, which shows a structural rather than cyclical change. The share of vegans and vegetarians rose from 6% in 2022 to 10% in 2023, with an even larger flexitarian population reducing the intake of meat for ethical, environmental, and health reasons. The demand remains price-sensitive, favoring scalable plant-based meat over emerging cell-based options that are not yet commercially available.

The UK possesses one of Europe’s most mature and commercially advanced plant-based meat markets, defined by high consumer awareness and intense retail competition. The growth is driven by the rapid expansion of private-label product lines from major supermarkets, which have made plant-based options affordable and ubiquitous, effectively mainstreaming the category. While specific agricultural subsidies for the sector are limited, the post Brexit policy environment under the Agriculture Act incentivizes sustainable farming and land use, indirectly benefiting supply chains for plant-based ingredients. The NLM study in April 2025 indicates that the meat alternatives technology is hugely driven by the food corporations, such as Unilever in the UK. Further, the recent acquisition of Meatless Farm and Clive’s Purely Plants by the Vegan Food Group demonstrates a critical market trend toward consolidation where specialized entities are building integrated portfolios to achieve scale, operational efficiency, and stronger bargaining power in both retail and foodservice channels.