Plant-based Meat Market Outlook:

Plant-based Meat Market size was valued at USD 11.3 billion in 2025 and is projected to reach USD 69.7 billion by the end of 2035, rising at a CAGR of 19.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of plant-based meat is estimated at USD 13.6 billion.

The demand for plant-based meat market products is increasingly shaped by structural pressures on global protein supply, and the public sector prioritizes food security and resource efficiency. The Food and Agriculture Organization reports that global meat consumption is growing at a rate of 5% to 6% per year, with further growth concentrated in urbanizing middle-income economies. At the same time, the Breakthrough Institute data in March 2023 estimates that livestock accounts for roughly 14.5% of global anthropogenic greenhouse gas emissions, promoting the government to encourage diversification of protein sources within national food strategies. Further, it is expected that the total domestic protein demand will continue to rise while the federal nutrition assistance programs served a million people, reinforcing institutional interest in scalable, shelf-stable non-animal protein options that reduce the exposure to supply shocks and price volatility.

Public health and regulatory signals further reinforce the market trajectory. The WHO links high intake of processed and red meat to increased risk of non-communicable diseases. In the response, several national dietary guidelines now emphasize plant-forward eating patterns. For example, the U.S. Dietary Guidelines for Americans highlight legumes, pulses, and soy-based foods as preferred protein as part of long-term resilience planning. The FAO March 2023 estimates that the global food demand will increase by nearly 60% by 2050, driven by population growth and income gains, placing pressure on governments and institutional buyers to secure the protein supplies with lower water and land intensity. Against this backdrop, plant-based meat has moved from a niche retail category toward a strategic component of foodservice public procurement and emergency nutrition planning, mainly where policy objectives align around emissions reduction, health outcomes, and supply chain stability.

Key Plant-based Meat Market Insights Summary:

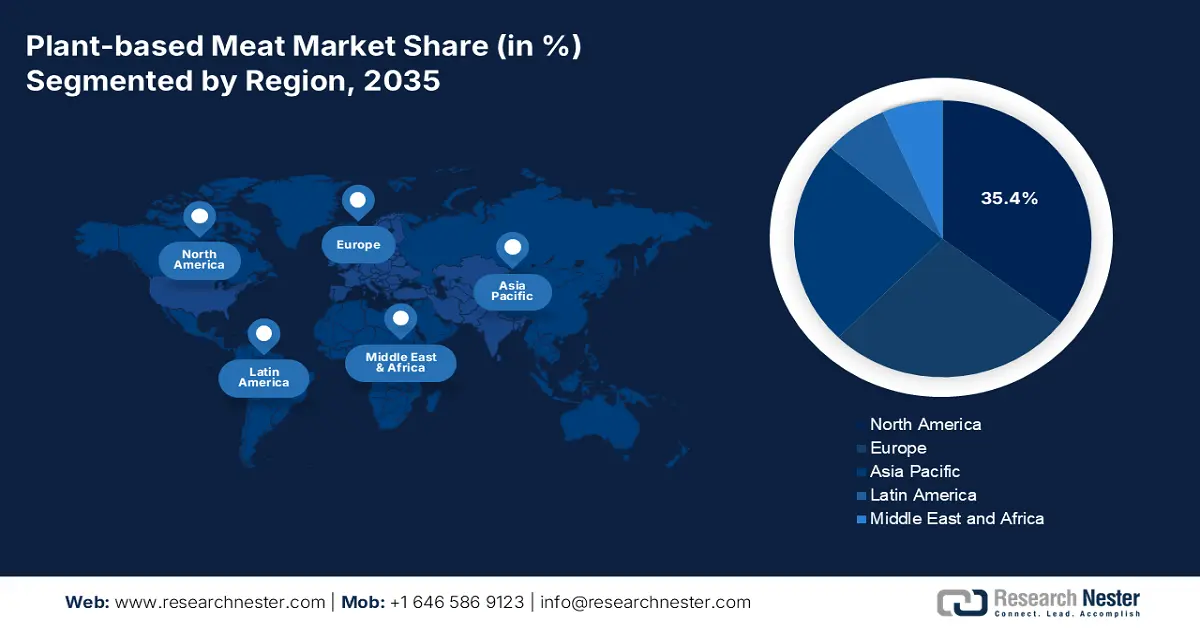

Regional Highlights:

- North America is projected to capture a 35.4% share by 2035 in the plant-based meat market, anchored by strong consumer awareness, well-established retail and foodservice networks, and sustained private-sector investment.

- Asia Pacific is anticipated to grow at a CAGR of 12.4% during 2026-2035, propelled by rapid urbanization, expanding flexitarian demographics, and government-backed initiatives supporting sustainable food systems.

Segment Insights:

- The frozen sub-segment under the storage segment is expected to secure a 55.4% share by 2035 in the plant-based meat market, reinforced by its effectiveness in maintaining product quality, extending shelf life, and leveraging expanding retail freezer infrastructure.

- The retail segment within the distribution channel segment is set to lead by 2035, strengthened by broad consumer accessibility, strategic shelf placement near conventional meat, and the accelerating presence of private-label brands enhancing purchase frequency.

Key Growth Trends:

- Strategic government R&D & innovation funding

- Agricultural policy support for plant protein crops

Major Challenges:

- High production and R&D costs

- Ingredient supply chain and scalability

Key Players: Beyond Meat (U.S.), Impossible Foods (U.S.), Kellogg's (MorningStar Farms) (U.S.), Conagra Brands (Gardein) (U.S.), Tofurky (U.S.), Unilever (Netherlands), Oatly (Sweden), THIS (UK), Rügenwalder Mühle (Germany), Heura Foods (Spain), Nestlé (Switzerland), Nissin Foods (Japan), Fuji Oil Holdings (Daiz) (Japan), v2food (Australia), Fable Food Co. (Australia), UNLIMEAT (South Korea), GoodDot (India), Blue Tribe Foods (India), Phuture Foods (Malaysia), Tival (Innovopro) (Israel).

Global Plant-based Meat Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.3 billion

- 2026 Market Size: USD 13.6 billion

- Projected Market Size: USD 69.7 billion by 2035

- Growth Forecasts: 19.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, China, Canada

- Emerging Countries: India, Japan, South Korea, Australia, Brazil

Last updated on : 6 January, 2026

Plant-based Meat Market - Growth Drivers and Challenges

Growth Drivers

- Strategic government R&D & innovation funding: Direct government investment in alternative protein R&D is de-risking and stimulating technological scaling, mainly for fermentation and cultivated meat, which benefit plant-based ingredient innovation. The data from GFI in May 2024 highlights that Canada’s 2021 investment of USD 150 million in Protein Industries Canada, a supercluster, specifically targets plant-based protein processing. This funding lowers the capital barrier for startups and co-funds projects with the industry partners. The actionable insight is for the companies to actively seek public-private partnerships and apply for the non-dilutive government grants focused on the food tech ingredient functionality and sustainable agriculture. Concurrently, the European Union's Horizon Europe program has allocated significant funding to projects like PLENITUDE, aimed at optimizing plant protein crop yields and processing, further demonstrating the global policy push to build foundational supply chain capacity.

- Agricultural policy support for plant protein crops: Government spending on the plant protein crops boosts the upstream economics for market. The report from the International Institute for Sustainable Development in February 2024 shows that the global soybean production surged to 388,098 metric tons, which is higher than in 2021, supported by the federal crop insurance and commodity programs. In the EU, the Common Agricultural Policy provides coupled support for protein crops to reduce the reliance on imported feed. The USDA's August 2023 report indicates that soybean exports reached 2.3 billion bushels, exceeding the raw material availability at scale. These policies stabilize the input supply and pricing, lowering the production risk for plant-based meat manufacturers and encouraging capacity expansion targeted at food service and institutional channels.

- Retail and foodservice regulatory support: Local government policies are directly influencing the retail landscapes. For example, Denmark’s action plan for the plant-based foods includes measures to boost the availability in public kitchens and retail. The Danish Veterinary and Food Administration supports this with a market dialogue and labelling guidance. For manufacturers, this means markets with formal government strategies offer more predictable entry paths and potential partnership opportunities with retailers incentivized to expand the category shelf space. The emerging trend is municipal-level initiatives, like Green Tuesday programs in cities, which create local B2B demand spikes. Similarly, the city of New York's adoption of plant-powered Fridays in public schools demonstrates that municipal procurement mandates can directly translate into scaled, recurring demand for manufacturers.

Challenges

- High production and R&D costs: Developing and scaling plant-based meat that replicates animal protein requires a significant capital investment in food science, ingredient sourcing, and specialized equipment. This creates a high barrier to entry and pressures margins. For example, Beyond Meat reported substantial and ongoing R&D and operational expenses as it scales, impacting profitability. A report by the Good Food Institute notes that achieving cost parity with conventional meat is a primary industry challenge requiring continuous investment in production efficiency.

- Ingredient supply chain and scalability: Securing consistent, high-quality, and affordable volumes of the key proteins is a major logistical challenge. Fluctuations in the crop yield or price can disrupt production. Ingredion, a major supplier, invests heavily in vertically integrated and diversified pea protein supply chains to ensure reliability for its manufacturing clients. This challenge underlines the need for entrants to secure robust supplier partnerships or invest in their own supply infrastructure to mitigate risk and scale effectively.

Plant-based Meat Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

19.9% |

|

Base Year Market Size (2025) |

USD 11.3 billion |

|

Forecast Year Market Size (2035) |

USD 69.7 billion |

|

Regional Scope |

|

Plant-based Meat Market Segmentation:

Storage Segment Analysis

Within the storage segment, the frozen sub-segment is dominating in the plant-based meat market and is expected to hold the share value of 55.4% by 2035. The segment is driven by the vital role in preserving product quality, extending shelf life for both consumers and retailers, and providing the logistical flexibility necessary for a nascent category. Frozen formats are mainly vital for products such as nuggets, patties, and seafood alternatives, where maintaining texture is paramount. A key driver is the expansion of dedicated freezer space in retail, making these products highly visible and convenient. A recent study on retail trends of frozen plant-based meat and poultry products consistently showed higher unit sales velocity in tracked multi-outlet channels compared to some refrigerated counterparts, indicating a strong consumer reliance on this format for pantry stocking and meal planning. The segment’s growth is further solidified by its alignment with consumer habits for frozen convenience foods and its lower rate of in-store waste for retailers.

Distribution Channel Segment Analysis

Under the distribution channel segment, the retail segment is leading the segment in the plant-based meat market. This dominance is built on three pillars: universal consumer accessibility, the strategic development of dedicated plant-based meat sections adjacent to traditional animal protein, and the rapid expansion of private label brands from major grocery chains, which compete on price and build category trust. Placing products directly in the path of the mainstream flexitarian shopper during their routine grocery trip is the channel’s core strength, driving trial and repeat purchases via high visibility and convenience. The key statistical indicator of this entrenched retail presence comes from the data from the USDA, September 2025, which indicates that 90% of the food sales are from the domestic market. Placing products directly in the path of the mainstream flexitarian shopper during their routine grocery trip is the channel’s core strength, driving trial and repeat purchases via high visibility and convenience.

Product Type Segment Analysis

Burger Patties remain the flagship and highest revenue product type within the market. Their continued leadership stems from their role as a primary familiar entry point for the new consumers and their central focus for the R&D investment from leading brands aiming to perfect taste and texture. Further, strategic large-scale partnerships with global Quick Service Restaurants have been instrumental in embedding plant-based patties into mainstream food culture. A special article from the USDA Economic Research Service on the alternative protein market noted that, despite a competitive landscape, the plant-based ground beef alternatives category, encompassing patties and grounds, maintained a notable market share, representing a sustainable portion of total category dollar sales and serving as a key indicator of overall category health and consumer acceptance during the review period.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Source |

|

|

Distribution Channel |

|

|

End user |

|

|

Storage |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Plant-based Meat Market - Regional Analysis

North America Market Insights

The North America is dominating the plant-based meat market and is poised to hold the market share of 35.4% by 2035. The market is driven by high consumer awareness, robust retail and foodservice distribution, and substantial private investment. The key trends include the product innovation focused on improving taste and texture, the expansion of fast food partnerships, and a growing focus on health and sustainability claims. The market is transitioning from early adoption to mainstream integration, with growth now driven by category optimization, price parity initiatives, and increased competition from private label offerings. Regulatory clarity on labeling alongside governmental support for alternative protein research, such as Canada’s Protein Industries Canada supercluster, provides a stable foundation for long term innovation and scaling. The region remains the global revenue leader, but growth rates are moderating as the market matures.

The U.S. market is defined by consolidation and a strategic shift toward sustainable growth and operational efficiency. The prime trends of the market are the intense competition leading to price reductions and a strong focus on improving nutritional profiles. The NLM study in April 2022 indicates that nearly 80% of the U.S. consumers have heard about the plant-based meat alternatives, and around 65% had consumed some form of plant-based meat or plant protein. Further, 20% to 22% consumed such products at least weekly, indicating the trial is widespread. Moreover, consumer interest in alternative proteins remains a significant factor in the protein market, influencing agricultural outlooks. The Plant Based Foods Association indicates that while the growth has normalized, the category maintains a stable, multi-billion-dollar presence in grocery stores, indicating deep market integration.

The plant-based meat market in Canada is distinguished by proactive federal and provincial government strategies positioning the country as a global supplier of plant proteins. Canada plays a strategically important role in the global plant-based meat value chain, supported by the strong upstream protein ingredient capacity, export orientation, and growing domestic consumption. The Government of Canada in July 2025 shows that the country has exported over USD 2.4 billion worth of plant-based and animal protein ingredients, with the U.S. absorbing 77.4% of the total export value, underscoring Canada’s position as a key supplier to the North America plant-based meat manufacturers. Further, the non-animal-derived proteins accounted for 75% of the total protein ingredient volume sales, driven mainly by soy protein concentrate and wheat gluten, which are core inputs for meat and seafood substitutes. Demand is concentrated in processed meat alternatives, ready meals, baked goods, and snacks, reflecting strong integration of plant-based meat into staple food categories rather than niche segments.

New product Launches of Plant-Based Food and Drinks in Canada

|

Product Attributes |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

Total |

|

Meat substitutes |

42 |

76 |

53 |

47 |

72 |

30 |

320 |

|

Nutritional and meal replacement drinks |

40 |

66 |

22 |

31 |

24 |

11 |

194 |

|

Snack/cereal/energy bars |

21 |

48 |

23 |

20 |

45 |

13 |

170 |

|

Processed cheese |

13 |

8 |

22 |

31 |

33 |

29 |

136 |

|

Plant based drinks (dairy alternatives) |

10 |

24 |

31 |

32 |

32 |

3 |

132 |

Source: Government of Canada July 2025

APAC Market Insights

The Asia Pacific is the fastest-growing plant-based meat market and is expected to grow at a CAGR of 12.4% during the forecast period 2026 to 2035. The market is driven by the rising consciousness of environmental concerns and a growing flexitarian population. The key drivers include massive urbanization, increasing disposable incomes, and strategic government initiatives supporting food security and sustainable agriculture. The prime trend is the strong localization of products to align with diverse regional cuisines and taste preferences strong localization of products to align with diverse regional cuisines and taste preferences, moving beyond the Western-style burgers to include alternatives for dumplings, curry, and noodles. The market is also defined by the rapid retail modernization and aggressive investment from both local corporations and international players.

China represents a high potential and early-stage market for the market. The market is shaped by the rising urban demand, food innovation investment, and evolving regulatory frameworks. While China remains the world’s largest consumer of meat, demand for plant-based meat alternatives is increasing mainly in urban, younger, and flexitarian consumer segments, supported by the expanding restaurant, hotel, and institutional adoption. The USDA report in January 2021 indicates that the most plant-based meat alternatives in China are currently priced above conventional meat promoting producers to prioritize beef and pork analogues, which command higher market prices. The production relies largely on domestically sourced soy, legume rice, and fundamental proteins, with manufacturers using advanced extrusion and fibrous protein technologies to improve taste and texture.

International and Domestic Plant-Based Meat Alternative Companies

|

Company |

Products |

Production |

Distribution Channels |

Main Ingredients |

|

Bee & Cheery |

Beef jerky, Pork stuffing |

Domestic |

Own retail, on-line stores |

- |

|

Beyond Meat |

Minced beef, Meatball, Sausage, Beef patty |

Imported from the United States; in 2020, announced it will open a production factory in China |

HRI sector: Starbucks |

Pea, mung bean, fava bean, brown rice |

|

Hey Maet |

Chinese style minced pork, Beef patty, Sausage, Minced beef, Beef cube, Chicken nugget |

Domestic |

HRI sector |

Soybean protein, pea protein, corn |

|

PFI Foods |

Chinese style minced pork, Others |

Domestic |

Tmall and JD.com on-line stores, HRI sector |

Soy protein, pea protein |

|

Starfield |

Beef meat ball, Beef patty, Minced beef |

Domestic |

HRI sector: Papa Johns, Elementfresh, Sizzler, Jin Ding Xuan, Gaga, Dicos, etc. |

Soy protein, beetroot (for coloring) |

Source: USDA January 2021

Japan represents a steadily developing plant-based meat market and is supported by a sizeable plant protein ingredient base, high import activity, and established demand for the protein enriched foods. The Government of Canada report in July 2025 highlights that Japan imported USD 1.2 billion worth of plant-based and animal protein ingredients, reflecting a strong reliance on international supply chains that also serve domestic meat alternative production. Non-animal-derived protein accounted for 40.7% of the total protein volume, led by soy protein concentrate and soy protein isolate, which are the core inputs for plant-based formulations. These data make Japan an ingredient-driven, import-dependent market where plant-based meat growth is likely to be incremental and closely tied to innovation in soy-based formulations and convenient meal formats.

Value Imports of Plant-Based and Animal Protein Ingredients (USD million)

|

HS code |

Description |

2019 |

2020 |

2021 |

2022 |

2023 |

CAGR* % 2019-2023 |

|

350400029 |

Protein substances and derivatives, nowhere else specified |

167.6 |

181.4 |

193.3 |

223.0 |

225.2 |

7.7 |

|

350400021 |

Vegetable proteins and derivatives |

63.8 |

68.1 |

92.4 |

100.9 |

80.9 |

6.1 |

|

350400010 |

Peptones and derivatives, hide powder |

43.1 |

46.2 |

50.1 |

49.4 |

50.1 |

3.9 |

|

350220 |

Milk albumin, >80% proteins by weight (including concentrates of 2 or more whey proteins) |

126.5 |

149.8 |

217.4 |

346.8 |

267.6 |

20.6 |

Source: The Government of Canada, July 2025

Europe Market Insights

The plant-based meat market in Europe is a global leader and a dynamic growth engine, which is primarily driven by a powerful convergence of consumer demand and supportive policy. Consumer interest is strong, with high awareness of the health and environmental benefits of reducing meat consumption. This demand is strategically amplified by the European Union’s Farm to Fork Strategy, a core pillar of the European Green Deal, which explicitly aims to make the food systems sustainable and actively promotes a shift toward more plant-based diets. The market growth is defined by a significant product diversification, moving from basic burgers and sausages to advanced whole cut alternatives such as plant-based steaks and seafood. The retail landscape is highly competitive with the rapid expansion of both the pioneering dedicated brands and private label ranges from major supermarket chains, which is vital for driving down prices and achieving mainstream adoption.

Germany represents one of Europe’s most advanced and demand-ready plant-based meat markets and is supported by the sustained shifts in consumer behavior and a broader protein transition agenda. The NLM study in June 2024 indicates that the per capita consumption of meat in Germany has reduced steadily, including a 8% YoY drop from 2021 to 2022. On the other hand, the plant-based meat sales increased by more than 42% form 2020 to 2022, which shows a structural rather than cyclical change. The share of vegans and vegetarians rose from 6% in 2022 to 10% in 2023, with an even larger flexitarian population reducing the intake of meat for ethical, environmental, and health reasons. The demand remains price-sensitive, favoring scalable plant-based meat over emerging cell-based options that are not yet commercially available.

The UK possesses one of Europe’s most mature and commercially advanced plant-based meat markets, defined by high consumer awareness and intense retail competition. The growth is driven by the rapid expansion of private-label product lines from major supermarkets, which have made plant-based options affordable and ubiquitous, effectively mainstreaming the category. While specific agricultural subsidies for the sector are limited, the post Brexit policy environment under the Agriculture Act incentivizes sustainable farming and land use, indirectly benefiting supply chains for plant-based ingredients. The NLM study in April 2025 indicates that the meat alternatives technology is hugely driven by the food corporations, such as Unilever in the UK. Further, the recent acquisition of Meatless Farm and Clive’s Purely Plants by the Vegan Food Group demonstrates a critical market trend toward consolidation where specialized entities are building integrated portfolios to achieve scale, operational efficiency, and stronger bargaining power in both retail and foodservice channels.

Key Plant-based Meat Market Players:

- Beyond Meat (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Impossible Foods (U.S.)

- Kellogg's (MorningStar Farms) (U.S.)

- Conagra Brands (Gardein) (U.S.)

- Tofurky (U.S.)

- Unilever (Netherlands)

- Oatly (Sweden)

- THIS (UK)

- Rügenwalder Mühle (Germany)

- Heura Foods (Spain)

- Nestlé (Switzerland)

- Nissin Foods (Japan)

- Fuji Oil Holdings (Daiz) (Japan)

- v2food (Australia)

- Fable Food Co. (Australia)

- UNLIMEAT (South Korea)

- GoodDot (India)

- Blue Tribe Foods (India)

- Phuture Foods (Malaysia)

- Tival (Innovopro) (Israel)

- Beyond Meat has been a primary catalyst for the plant-based meat market, strategically focusing on making its products indistinguishable from animal protein. Its key initiatives involve heavy R&D investment for ingredient and texture refinement and securing high-profile partnerships with global quick restaurants such as McDonald’s, KFC, and Starbucks to achieve mainstream adoption and trial. In 2024, the company made a net revenue of USD 326,452 thousand.

- Impossible Foods has reshaped the competitive landscape of the plant-based meat market via its proprietary use of heme, which delivers a meat-like flavor and bleeding quality. Its core strategy involves dominating the foodservice channel first with the flagship partnership, including Burger King, before expanding into retail. The company vertically integrates its key ingredient production and aggressively pursues international market expansion.

- Kellogg’s operates via its MorningStar Farms brand leverages its immense scale and distribution as a historic incumbent in the plant-based meat market. Its strategic initiatives focus on portfolio diversification and renovation, reformulating its entire line to be vegan and launching new modern products such as the Incogmeato line to compete with newer meat-mimicking brands.

- Conagra Brands via its Gardein subsidiary, applies its deep expertise in frozen food manufacturing to the plant-based meat market. Its strategy capitalizes on the strength of the frozen aisle, offering a diverse range of affordable, convenient, and globally inspired meal solutions such as mandarin orange crispy chick’s and fishless filets. The company in 2025 made a net sale of USD 11,612.8.

- Tofurky employs a distinct mission-driven strategy within the plant-based meat market with a long-standing focus on whole food ingredients and catering to core vegetarian and vegan consumers. Its initiatives include expanding beyond its iconic holiday roasts into the deli slices, sausages, and tempeh products, often using traditional fermentation methods.

Here is a list of key players operating in the global market:

The global plant-based meat market is very competitive and is dominated by pioneering U.S. brands such as Beyond Meat and Impossible Foods, which drive innovation and mainstream retail/foodservice penetration. Major food companies such as Nestlé, Unilever, and Kellogg’s leverage vast distribution networks to scale rapidly. Strategic initiatives are multi-layered with the heavy investment in R&D to enhance texture and taste, aggressive partnerships with global QSRs, and portfolio expansion into diverse meat and seafood analogues. For example, in August 2025, Perkins Coie advised Daring Foods, the leading plant-based chicken brand in the U.S., in its acquisition by v2food. The acquisition includes a strategic partnership with the Japan-based ingredients company Ajinomoto Co. Europe, and Asia Pacific players are focusing on the regional tastes and local ingredient sourcing to capture the local markets while simultaneously seeking export opportunities in a crowded but growing global landscape.

Corporate Landscape of the Plant-based Meat Market:

Recent Developments

- In November 2025, Beyond Meat, Inc., a leader in plant-based meat, announced the launch of its all-new Beyond Beef 2-Pack at retailers across Canada, making the latest version of its plant-based ground beef product more accessible to consumers.

- In September 2025, JBS, the largest meat company in the world, has announced the launch of a new plant-based collective to represent its European plant-based brands. The Vegetarian Butcher Collective includes the plant-based brands such as Vivera and The Vegetarian Butcher.

- In March 2025, Unilever announced that it has received a binding offer from Vivera to acquire The Vegetarian Butcher. The brand was bought by Unilever from founder Jaap Korteweg and has since then delivered strong double-digit growth on average, expanded to a presence in more than 55 markets worldwide - both in retail and in foodservice.

- Report ID: 3155

- Published Date: Jan 06, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Plant-based Meat Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.