Pipeline Transportation Market Outlook:

Pipeline Transportation Market size was valued at USD 22.92 billion in 2025 and is set to exceed USD 40.28 billion by 2035, registering over 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of pipeline transportation is estimated at USD 24.12 billion.

The growth in the pipeline transportation market is majorly impelled by the growing energy consumption across the world due to rapid urbanization and industrialization. According to an IEA report published in 2024, the global demand for power is poised to grow at a higher rate of 3.4% by the end of 2026. The report further states, that in 2023, the additional electricity demand from outside advanced economies was led by China rose by 6.4% due to its enlarging services and industrial sectors. This is further pushing the limits of existing power grids, raising the need for transporting supplies for more electricity generation. Further, it inflates the need for pipeline network expansion, penetrating growth in this industry.

Heavy energy production and transportation on the other hand raise concerns about maintaining their operational efficacy during the supply. This has led to a growing focus on integrating technological advancements in the pipeline transportation market to mitigate these problems. Many tech companies are now introducing innovative methods and solutions for better performance and compliance. For instance, in September 2024, Baker Hughes launched CarbonEdge to optimize and streamline operations and reporting for CCUS projects. The end-to-end solution is equipped with an integrated dashboard to offer real-time data and alerts on CO2 flows across the system including pipeline transportation.

Key Pipeline Transportation Market Insights Summary:

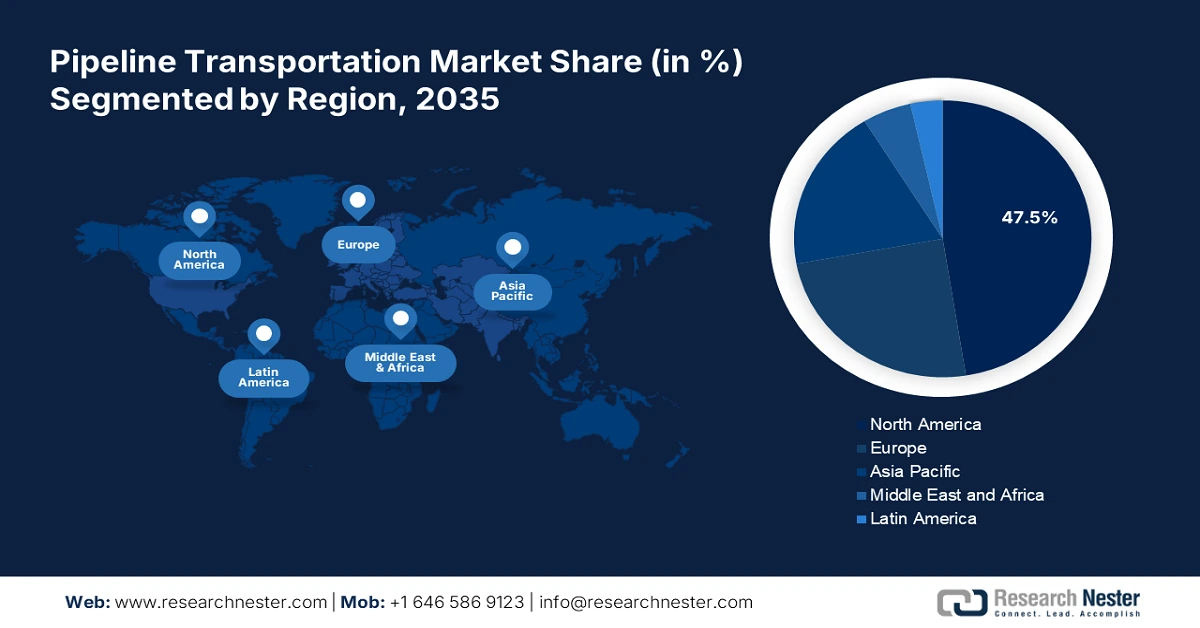

Regional Highlights:

- North America commands a 47.5% share in the Pipeline Transportation Market, driven by North America's efforts to develop advanced infrastructure for industrial exports and imports, fostering robust growth through 2026–2035.

- Europe’s pipeline transportation market is set for significant growth by 2035, attributed to increasing need for energy security and renewable energy transport in Europe.

Segment Insights:

- The Oil & Gas segment is forecasted to secure a 45.9% share by 2035, propelled by heavy demand for crude oil and natural gas in industries like automotive and manufacturing.

- The Transmission Pipeline segment of the Pipeline Transportation Market is anticipated to hold a significant share by 2035, driven by its ability to transport heavy volumes of fluids over long distances.

Key Growth Trends:

- Creating supply channels for green energy

- Ongoing investments in the infrastructure

Major Challenges:

- Rising concerns for safety and security

- Economic and environmental limitations

- Key Players: ABB, Emerson Electric Co., ESRI, FMC Technologies, Rockwell Automation, Inc, Schneider Electric, Siemens, Trimble Navigation Limited, IDS GmbH, Baker Hughes, Halliburton, National Oilwell Varco, John Wood Group PLC.

Global Pipeline Transportation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 22.92 billion

- 2026 Market Size: USD 24.12 billion

- Projected Market Size: USD 40.28 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47.5% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, Canada, China, Russia, Germany

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Pipeline Transportation Market Growth Drivers and Challenges:

Growth Drivers

-

Creating supply channels for green energy: The increasing pressure on the traditional power grid is forcing governments to utilize the support from the pipeline transportation market in acquiring green electricity generation resources. Country leaders are now taking the initiative to create a new supply chain of renewable energy essentials through pipelines, creating opportunities for this industry. For instance, in March 2024, PNGRB announced its progress in creating a 24000 km network of upgraded natural gas transmission lines for transporting green hydrogen. It is blending natural gas with hydrogen to supply renewable energy resources for fertilizer plants, refineries, and heavy iron & steel industries.

- Ongoing investments in the infrastructure: The growing focus on securing an uninterrupted supply of raw materials to empower industries has increased investment in the pipeline transportation market. Countries are outstretching distribution networks of industrial assets by allotting these pipelines. For instance, in May 2024, the Ministry of Petroleum and Mineral Resources of Egypt announced its plan to launch a new pipeline of fuel by investing USD 36 million. They drafted the plan to connect the El-Alamein area and surrounding regions with the MIDOR oil refinery in Alexandria's Amreya Free Zone, transporting petroleum products.

Challenges

-

Rising concerns for safety and security: Overcoming the risk of using the aging infrastructure is still a challenge in the future growth of the pipeline transportation market. Due to economic constraints, many operators often refuse to upgrade their existing pipeline systems. This may further increase the possibility of accidents, leaks, and explosions, discouraging other consumers from adopting. The prevalence of terrorism and vandalism also can disrupt operations and damage infrastructure, restricting the progress of this sector.

- Economic and environmental limitations: High initial investment is one of the major setbacks in the pipeline transportation market. In addition, fluctuating oil and gas prices may impact the profit margin, preventing companies from participating. Further, the non-viability of pipeline projects can create an economic barrier between manufacturers and service providers in this sector. The expensive maintenance and operations can strain the resources of the investors, forcing them to withdraw their development plans.

Pipeline Transportation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 22.92 billion |

|

Forecast Year Market Size (2035) |

USD 40.28 billion |

|

Regional Scope |

|

Pipeline Transportation Market Segmentation:

Application (Oil & Gas, Water, Coal)

Oil & gas segment is estimated to account for pipeline transportation market share of more than 45.9% by the end of 2035. The segment is generating the majority of revenue due to the heavy demand for crude oil and natural gas in various industries including automotive, coatings, and manufacturing. In addition, many companies are focused on developing a reliable supply channel to serve the enlarging residential consumer base. For instance, in March 2021, PNGRB authorized around 33,764 km of natural gas pipeline network across India to create a national gas grid. The network expansion vision of the country already established 19,998 km of operating pipelines and continues the construction of the rest 15,369 km in the same year.

Type (Transmission Pipeline, Distribution Pipeline, Gathering Pipeline)

In terms of type, the transmission pipeline segment is projected to hold a significant share by the end of 2035 due to its capability to transport a heavy volume of fluids over long distances. The large-diameter pipelines are specially designed to endure the high pressure of liquid assets passing across regions and countries. By offering affordable and efficient methods of transportation of valuable resources such as crude oil, petroleum products, and natural gas, many production houses tend to invest heavily in this segment. For instance, in October 2024, YPF announced the completion of its pipeline project. It is capable of delivering 160,000 barrels of crude oil per day from the Vaca Muerta shale play to a local oil refinery and of exporting the same to Chile.

Our in-depth analysis of the global pipeline transportation market includes the following segments:

|

Application |

|

|

Type |

|

|

Solution |

|

|

Service |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pipeline Transportation Market Regional Analysis:

North America Market Analysis

In pipeline transportation market, North America region is poised to hold more than 47.5% revenue share by 2035. The region is leading global growth with its efforts to garner advanced infrastructure for exporting and importing industrial essentials. In addition, the well-developed domestic countries are proactively taking part in creating a large consumer base for this sector through their lead in global trade in these materials. According to the 2022 OEC report, the U.S. and Canada were among the largest exporters of natural gas, reaching USD 17.3 billion and USD 19 billion respectively. On the other hand, another 2022 OEC report states that the U.S. became the 2nd largest importer of crude petroleum in the world, accounting for USD 199 billion.

The U.S. is creating a great scope of business for both global and domestic leaders in the pipeline transportation market with its extensive infrastructure. This inspires companies to create better networks of exports and imports, inflating demand in this sector. For instance, in July 2024, ADCC Pipeline, the joint venture of Whistler Pipeline LLC and Cheniere Energy, Inc. started providing commercial services for supplying natural gas. The new pipeline is capable of delivering 1.7 billion cubic feet of natural gas per day to the Cheniere Corpus Christi Liquefaction facility from Agua Dulce Header in South Texas.

With a widespread network and reservoir of oil, gases, and other raw materials, Canada is expected to foster the potential for lucrative growth in the pipeline transportation market. The country is now strengthening its cross-border relationships with large consumers by increasing supply. For instance, in May 2023, Marubeni partnered with Pembina Pipeline Corporation to jointly develop a low-carbon hydrogen and ammonia supply chain from Western Canada to the Asia landscape. The project includes the development of a global-scale production facility in the Alberta Industrial Heartland. Such projects further inflate the demand in this industry.

Europe Market Statistics

The pipeline transportation market in Europe is estimated to capture a significant share by the end of 2035 with increasing need for energy security and development of new energy sources. Countries such as Russia are establishing more efficient transit points to cope with the inflating demand in this sector. This is further attracting companies to participate in leveraging the efficiency of transportation for renewable energy resources. For instance, in November 2024, Tenaris announced its participation in the SafeH2Pipe Joint Industry Project for the safe transportation of hydrogen and hydrogen blends through pipelines in Europe. With the partnering companies, Tenaris aims to develop new guidelines for material selection and qualification.

The UK is predicted to offer lucrative opportunities for global leaders in the pipeline transportation market. The country is now focusing on securing resources for green energy generation, creating scope for advancement in this sector. For instance, in November 2024, Exolum started a project to transport and store green hydrogen on a commercial scale by leveraging existing storage and pipeline network in the UK. The company aims to create an innovative transport model for liquid hydrogen by utilizing LOHC.

Germany is expected to garner notable revenue from the pipeline transportation market due to increasing investments from domestic leaders. Many companies are now participating in the country’s goal to implement clean energy sources by establishing reliable networks. For instance, in July 2024, EnBW announced its plans to invest around USD 1 billion to secure the future hydrogen economy of the country by participating in the pipeline projects. The investment was made to support the national hydrogen core network by converting existing pipelines.

Key Pipeline Transportation Market Players:

- ABB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Emerson Electric Co.

- ESRI

- FMC Technologies

- Rockwell Automation, Inc.

- Schneider Electric

- Siemens

- Trimble Navigation Limited

- IDS GmbH

- Baker Hughes

- Halliburton

- National Oilwell Varco

- John Wood Group PLC

The global pipeline transportation market is slowly but steadily shifting towards upgrading the supply network to import or export clean energy-generation materials such as hydrogen. In addition, traditional distribution methods and mediums are also being improved to reduce the carbon footprint. This further creates a new scope of investment for global leaders. For instance, in August 2024, ArcelorMittal launched a new steel, HyMatch for the construction of hydrogen pipelines. The advanced properties of the R&D metal are designed to support the hydrogen gas infrastructure while reducing carbon emissions in manufacturing facilities.

Such key players include:

Recent Developments

- In November 2024, Schneider Electric partnered with Prisma Phototonics to offer an advanced monitoring solution, PrismaFlow for faster detection of pipeline occurrence. The new system is equipped with hyper-scan fiber sensing technology, delivering accurate, real-time monitoring of pipeline systems.

- In March 2023, ABB India delivered integrated automation and control solutions to monitor and manage the 130 km cross-border oil pipeline between India and Bangladesh. The company allocated ABB Ability SCADAvantage, Remote Terminal Units (RTU), and a leak detection system to enable safe, secure, and reliable operation.

- Report ID: 6838

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pipeline Transportation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.