Pipe Laying Vessel Market Outlook:

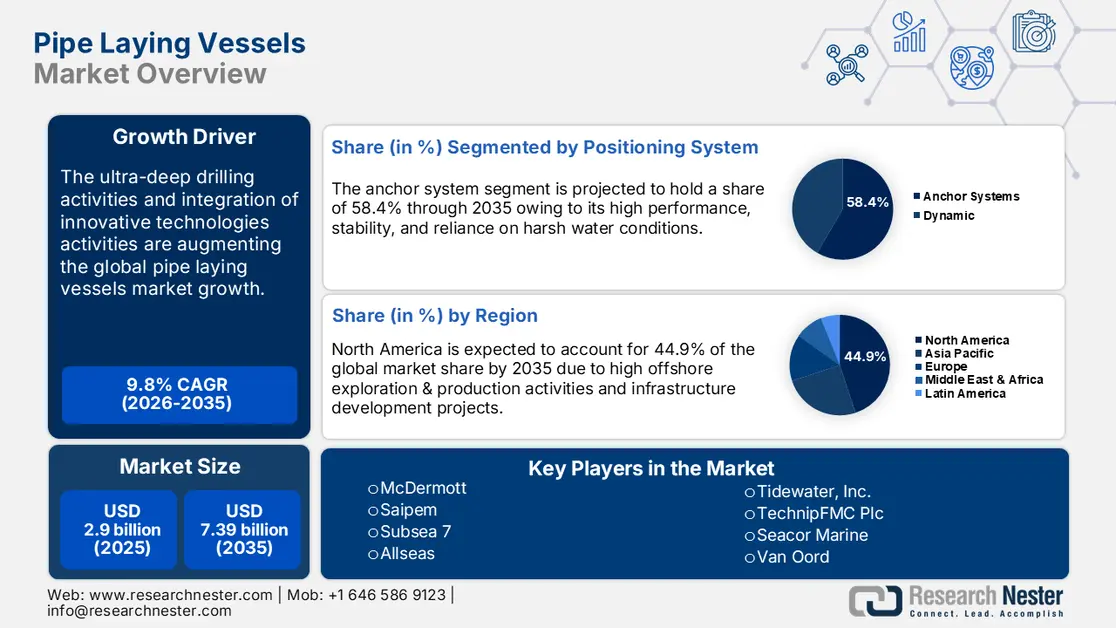

Pipe Laying Vessel Market size was valued at USD 2.9 billion in 2025 and is expected to reach USD 7.39 billion by 2035, expanding at around 9.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of pipe laying vessel is evaluated at USD 3.16 billion.

The rising global energy demands are significantly driving the consumption of natural oil and gas. The depletion of onshore reserves is propelling offshore exploration and production of oil and gases, which is directly fueling the demand for pipe laying vessel. The global capital expenditures on offshore exploration and production are set to be totaled at USD 293.0 billion in 2025. The importance of pipe laying vessel for the transportation and installation of pipelines for offshore oil and gas fields is substantially contributing to their sales growth. For instance, in June 2024, the National Oceanic and Atmospheric Administration (NOAA) revealed that globally around 26.1% of the seafloor had been mapped with modern technologies mounted to large vessel.

According to the Global Energy Monitor report, Guyana, Iran, Namibia, the U.S., China, and Indonesia are some of the top countries with high oil and gas discoveries. Furthermore, the U.S. Energy Information Administration (EIA) revealed that the oil and natural gas production in the Federal Offshore Gulf of Mexico amounted to around 15.0% of the total crude oil production in the U.S. in 2022. Thus, high offshore oil and gas exploration and production activities are generating lucrative opportunities for pipe laying vessel manufacturers.

Key Pipe Laying Vessel Market Insights Summary:

Regional Insights:

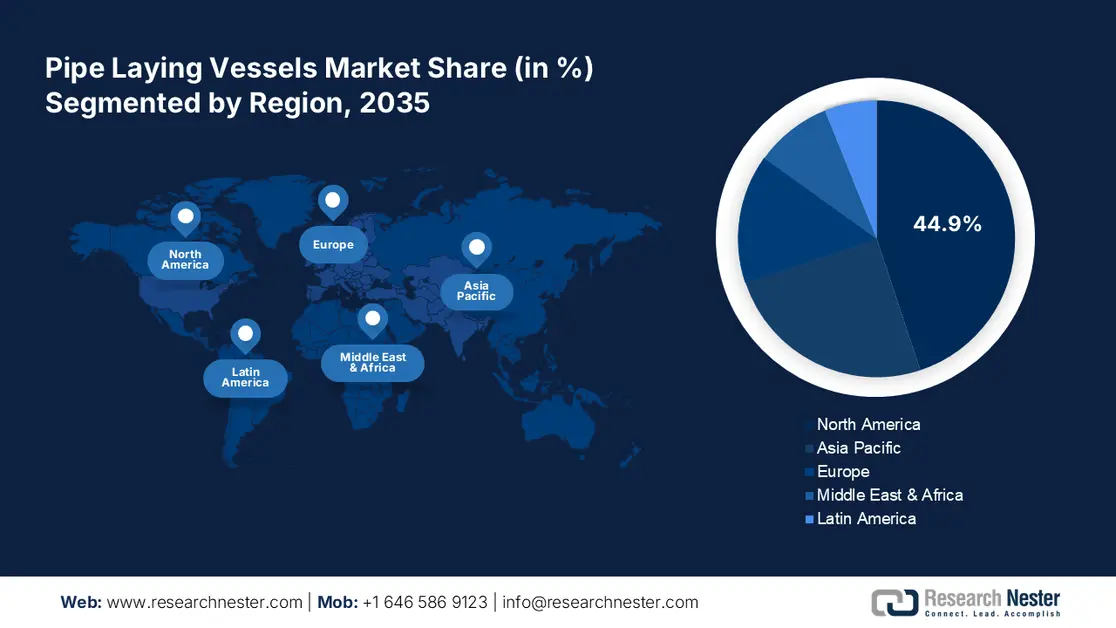

- By 2035, the North America pipe laying vessel market is projected to secure over 44.9% share, owing to rising oil and gas projects.

- By 2035, the Asia Pacific region is anticipated to advance rapidly at a swift CAGR, impelled by high energy demand.

Segment Insights:

- The anchor position system segment in the pipe laying vessel market is expected to command nearly 58.4% share by 2035, propelled by its ability to offer reliable and stable positioning in harsh and deep-water conditions.

- The S-lay barges segment is set to retain a dominant share through 2035, supported by the rise in offshore oil and gas exploration.

Key Growth Trends:

- Integration of innovative technologies

- Rise in ultra deep drilling

Major Challenges:

- High capex requirement

- Strict environmental and safety concerns

Key Players: McDermott, Saipem, Subsea 7, Allseas, Tidewater, Inc., TechnipFMC Plc, Seacor Marine, Van Oord, Boskalis, Hyundai Heavy Industries, Royal IHC, Telford Offshore, Leighton Offshore.

Global Pipe Laying Vessel Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.9 billion

- 2026 Market Size: USD 3.16 billion

- Projected Market Size: USD 7.39 billion by 2035

- Growth Forecasts: 9.8%

Key Regional Dynamics:

- Largest Region: North America (44.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Norway, South Korea, Netherlands

- Emerging Countries: India, Brazil, Indonesia, Malaysia, United Arab Emirates

Last updated on : 2 December, 2025

Pipe Laying Vessel Market - Growth Drivers and Challenges

Growth Drivers

- Integration of innovative technologies: Technological advancements are substantially enhancing the capabilities of pipe laying vessel, contributing to the overall pipe laying vessel market growth. The vessel integrated with dynamic positioning systems, high-performance cranes, and digital technologies such as automation, artificial intelligence (AI), machine learning (ML), predictive analytics, and the Internet of Things (IoT) increase efficiency and mitigate human errors associated with pipe laying vessel operations, which further acts as major factor augmenting to their sales growth. For instance, in November 2024, Miros Group announced the launch of an innovative wave and vessel motion prediction technology. PredictifAI technology effectively pairs X-band radar and local high-accuracy wave height measurements with AI to monitor sea and weather conditions in real-time. Thus, PredictifAI-equipped vessel are set to effectively enhance the efficiency and safety of offshore operations.

- Rise in ultra-deep drilling: The rise in deep-water and ultra-deep-water projects is significantly driving the demand for advanced pipe laying vessel. The modern design of these vessel which makes them capable of operating in over 3000 meters of deep water contributes to their sales growth. For instance, in September 2024, Transocean Ltd. a leader in offshore contract drilling services for oil and gas wells revealed that it secured a 12-month contract for Deepwater Atlas with bp in the U.S. Gulf of Mexico. The project is estimated to start by the Q2 of FY 28 with an investment of around USD 232.0 million.

Challenges

- High capex requirement: The high capital expenditure is one of the major factors hampering the overall pipe laying vessel market. The development or acquisition of these technologically advanced and high-performance material-equipped pipe laying vessel requires substantial investment. This is often a challenging factor for smaller companies or start-ups, which hinders pipe laying vessel market competitiveness.

- Strict environmental and safety concerns: The pipe laying vessel requirement is associated with offshore oil and gas projects, which are subject to stringent safety and environmental regulations. The non-compliance with these regulations or the occurrence of disaster events such as the Deepwater oil spill increases operational costs and leads to reputational damage to the company.

Pipe Laying Vessel Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.8% |

|

Base Year Market Size (2025) |

USD 2.9 billion |

|

Forecast Year Market Size (2035) |

USD 7.39 billion |

|

Regional Scope |

|

Pipe Laying Vessel Market Segmentation:

Positioning Systems Segment Analysis

Anchor position system segment is expected to capture around 58.4% pipe laying vessel market share by the end of 2035. The prime factor fueling the sales of anchor system pipe laying vessel is their ability to offer reliable and stable positionings in harsh and deep-water conditions. Low maintenance and cost-effectiveness also contribute to the rising demand for ancho system pipe laying vessel. The long track record of offering safety and vessel handling drives end users to invest in anchor positioning systems. Continuous innovations are directly fueling the sales of innovative anchor systems. For instance, in April 2023, Viking Anchor announced the debut of Odin, a steel plow anchor. Integrated with advanced materials, Odin offers high performance, durability, and safety assurance.

Installation Segment Analysis

The S-lay barges segment is estimated to hold a dominant pipe laying vessel market share throughout the forecast period. The rise in offshore oil and gas exploration are prime factor augmenting the sales of S-lay barges. The effectiveness of the S-lay method in deep water and challenging conditions uplifts its demand for the installation of subsea pipelines. Advancements in underwater pipeline constructions are also augmenting the demand for S-lay method compared to other counterparts such as the J-method. The growth in the subsea oil and gas projects is set to propel the demand for S-lay barges in the coming years.

Our in-depth analysis of the pipe laying vessel market includes the following segments:

|

Installation |

|

|

Positioning System |

|

|

Depth |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pipe Laying Vessel Market - Regional Analysis

North America Market Insights

North America pipe laying vessel market is predicted to capture revenue share of over 44.9% by 2035. The rising oil and gas projects, increasing investments in offshore activities, supportive regulatory policies, and integration of digital technologies are contributing to the overall pipe laying vessel market growth. The infrastructure upgrades and increasing energy demand are also driving the demand for advanced pipe laying vessel for oil and gas explorations.

In the U.S., the rising offshore oil and gas exploration activities especially in the Gulf of Mexico are driving the demand for pipe laying vessel for installation and maintenance of underwater pipelines. For instance, in October 2024, Chevron Corporation revealed its move to expand U.S. Gulf of Mexico production to 300,000 net barrels of oil equivalent (BOE) per day by 2026. In September 2024, the company began the water injection process at its St. Malo offshore field.

In Canada, similar to the U.S. the high offshore oil & gas exploration and production activities are augmenting the demand for advanced pipe laying vessel. The Canadian Association of Petroleum Producers reveals that over 300 exploration wells have been drilled in Atlantic Canada offshore. Furthermore, the pipeline infrastructure upgrade projects are creating lucrative opportunities for pipe laying vessel manufacturers.

Asia Pacific Market Insights

The Asia Pacific pipe laying vessel market is estimated to increase at a swift CAGR during the projected period. The high energy demand, rising foreign direct investments in the oil and gas sector, technological innovations in vessel manufacturing, and the government’s investments in maritime construction are collectively fueling the pipe laying vessel market growth. China, India, Japan, and South Korea are high-earning marketplaces for pipe laying vessel manufacturers.

India’s expanding offshore oil and gas exploration and production activities are boasting the use of advanced pipe laying vessel to increase production efficiency. Oil and gas is the 8th core sector that contributes to the decision-making of the economy. The India Brand Equity Foundation (IBEF) study estimates that the country’s oil demand is anticipated to account for a 2x growth to reach 11 million bp/d by 2045. The government’s open policy for foreign direct investments in the refinery activities is further expected to push the sales of pipe laying vessel.

In China, the rapid offshore oil and gas exploration and development activities are primarily driving the pipe laying vessel market growth. Technological advancements are leading to the development of modern pipe laying vessel. For instance, in December 2023, Ulstein revealed that its heavy lift pipelay vessel JSD6000 manufactured at ZPMC shipyard successfully completed its trial and returned to the ZPMC Changxing Base.

Pipe Laying Vessel Market Players:

- McDermott

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Saipem

- Subsea 7

- Allseas

- Tidewater, Inc.

- TechnipFMC Plc

- Seacor Marine

- Van Oord

- Boskalis

- Hyundai Heavy Industries

- Royal IHC

- Telford Offshore

- Leighton Offshore

The pipe laying vessel market is competitive owing to the strong presence of industry giants. Entry and survival in this market for new companies are often challenging due to high capital expenditures. The leading companies are collaborating with high-tech companies and other players to develop innovative pipe laying vessel. Advanced technologies are enhancing the capabilities of pipe laying vessel and driving the attention of end users to invest in them. Continuous product launches are significantly uplifting the revenue share of the key market players. Some producers are also concentrating on global expansion strategies to boost their pipe laying vessel market reach.

Some of the key players include:

Recent Developments

- In October 2024, McDermott announced that its heavy-lift and rigid pipelay vessel Derrick Lay Vessel 2000 (DLV2000) received a SUSTAIN-1 classification award. This is the first marine construction vessel of its class to receive sustainability certification from the American Bureau of Shipping (ABS)

- In February 2024, Saipem received approval from the Australian Commonwealth regulator NOPSEMA to restart Castorone vessel pipelay operations. Following the offshore trunkline installation incident that occurred on 30th January in Australia, the company is more focused on safety aspects.

- Report ID: 6896

- Published Date: Dec 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pipe Laying Vessel Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.