Pigmentation Disorder Treatment Market Outlook:

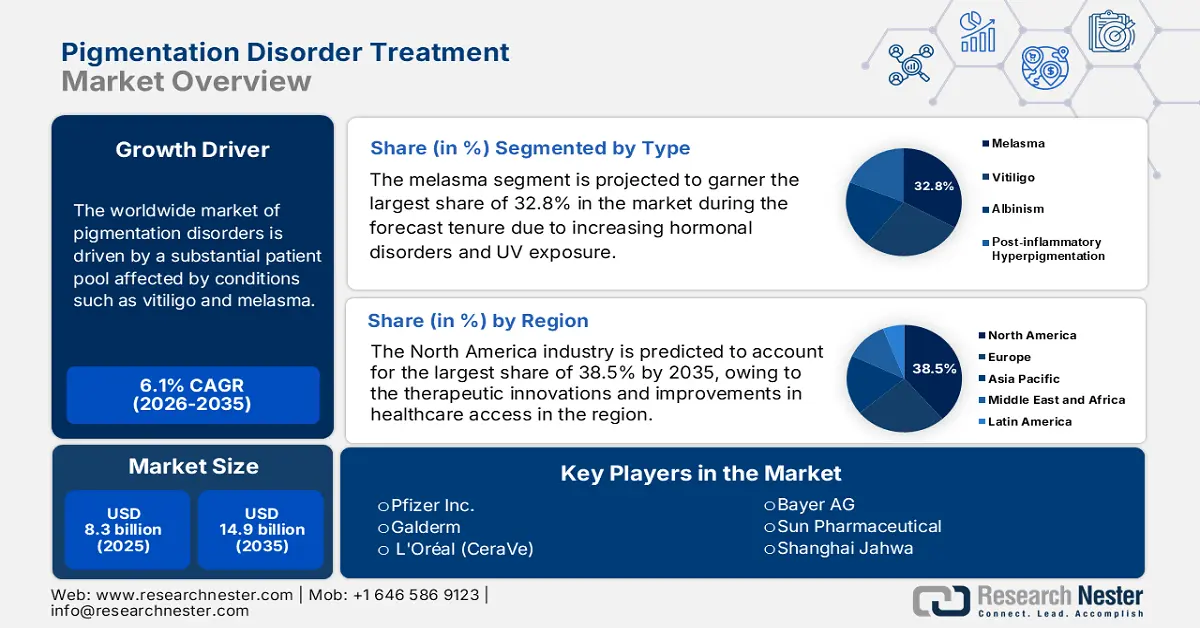

Pigmentation Disorder Treatment Market size was valued at USD 8.3 billion in 2025 and is projected to reach USD 14.9 billion by the end of 2035, rising at a CAGR of 6.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of pigmentation disorder treatment is assessed at USD 8.8 billion.

The worldwide market of pigmentation disorders serves a substantial patient pool affected by conditions such as vitiligo and melasma. As per an article published by the NLM in June 2022, the prevalence of vitiligo in the world population ranges from 0.5% to 2%, whereas the data from the Frontiers report in July 2024 revealed that the worldwide prevalence of melasma is nearly 41%. Rising UV exposure, hormonal imbalances, and genetic predisposition are key factors driving the market, particularly in Asia-Pacific and North America, where dermatological care accessibility is extremely high. On the other hand, governments across developing economies are expanding healthcare infrastructure, thereby resulting in improved diagnosis rates and treatment adoption.

Furthermore, the supply chain facility for pigmentation disorder treatment involves active pharmaceutical ingredients (APIs) such as hydroquinone, corticosteroids, and tacrolimus, which are primarily sourced from China and India, according to the U.S. International Trade Commission. The U.S. is the leading exporter of hydroquinone, exporting worth USD 51.2 million in 2024, based on the OEC report. Besides the manufacturing of medical devices, including laser systems and microdermabrasion equipment, which takes place in the U.S., Germany, and Japan, wherein assembly lines are concentrated in specialized medtech hubs such as Bavaria and Massachusetts, thus positively influencing market growth.

Key Pigmentation Disorder Treatment Market Insights Summary:

Regional Highlights:

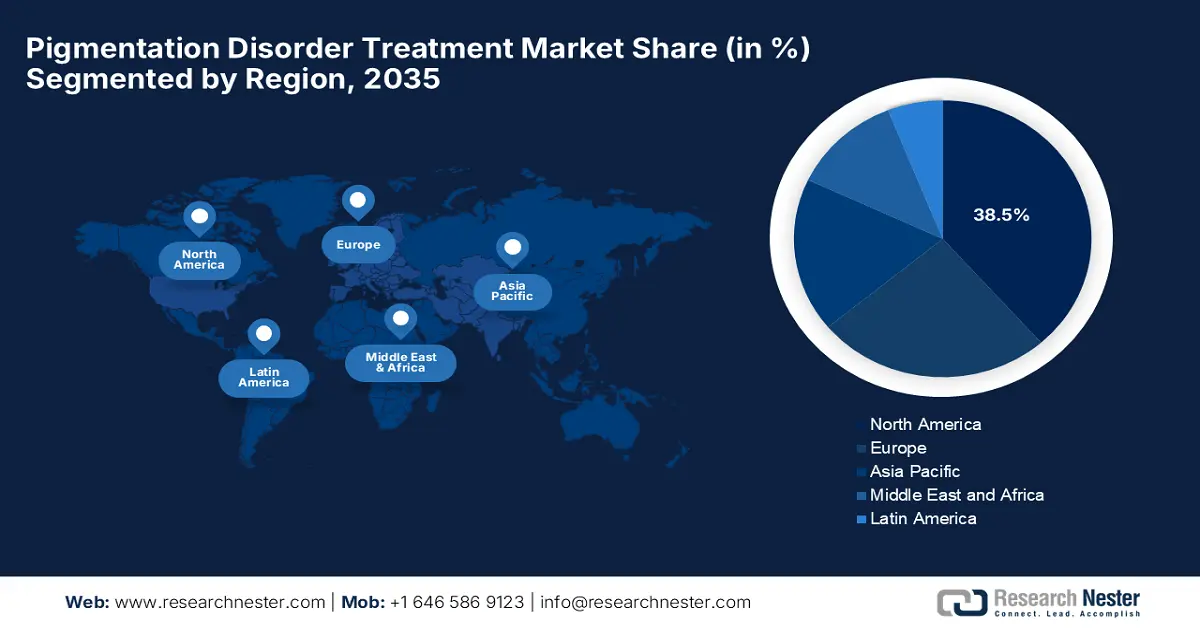

- North America is projected to dominate the pigmentation disorder treatment market with a 38.5% share by 2035, driven by high melasma prevalence, advanced healthcare infrastructure, and strong R&D investments.

- Asia Pacific is expected to be the fastest-growing region by 2035, fueled by rising pollution, growing cosmetic awareness, and adoption of AI diagnostics in dermatology.

Segment Insights:

- The Melasma segment is projected to capture the largest share of 32.8% by 2035 in the pigmentation disorder treatment market, driven by rising hormonal disorders and increased UV exposure.

- The Topical Drugs segment is expected to witness significant growth by 2035, owing to the widespread use of hydroquinone-based skin-lightening treatments and increased demand for regulated formulations.

Key Growth Trends:

- Personal spending trends

- Continued innovations in pharmaceutical and MedTech

Major Challenges:

- Limitations in terms of diagnostics

- Competition from alternative therapies

Key Players: Pfizer Inc., Galderma, L'Oréal (CeraVe), Bayer AG, Sun Pharmaceutical, Shanghai Jahwa, Allergan (AbbVie), LG Chem, Mylan (Viatris), CSL Behring, HRA Pharma, Himalaya Wellness, Incyte Corporation, Pharmaniaga, Hugel Inc., Maruho Co., Ltd., Torii Pharmaceutical, Daiichi Sankyo, Kose Corporation, POLA Pharma

Global Pigmentation Disorder Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.3 billion

- 2026 Market Size: USD 8.8 billion

- Projected Market Size: USD 14.9 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, Canada, Japan

- Emerging Countries: India, South Korea, China, Brazil, United Arab Emirates

Last updated on : 25 September, 2025

Pigmentation Disorder Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Personal spending trends: The aspect of amplifying personal spending readily drives growth in the pigmentation disorder treatment market. For instance, the report from DEFNPPA in February 2024 notes that in the U.S., patients paid USD 3,490 on average for vitiligo treatments costs. Besides the Ministry of Health, the Labour and Welfare Ministry revealed that in Japan, the exacerbated drug costs on untreated melasma treatments highlighting the potential for affordable therapeutic measures. Therefore, the launch of generic drugs such as hydroquinone alternatives has the complete potential to capture the market of price-sensitive economies.

- Continued innovations in pharmaceutical and MedTech: There has been a surge in innovations, which is significantly fueling the upliftment of the market. In this regard, Pfizer’s JAK3 inhibitor called ritlecitinib deliberately reduced vitiligo repigmentation time in Phase III trials. Besides, the U.S. FDA in 2024 stated that L’Oréal’s AI skin diagnostic improved melasma detection accuracy. Further, the study by NIH notes that the clinical trials are active for stem cell therapies dedicated to vitiligo treatment, hence a positive market outlook.

- Public and private research grants: The existence of substantial R&D funds from both public and private entities is yet another driver for the market to expand at a robust pace. Therefore, NIH in August 2024 made an allocation of USD 685,465,000 for dermatology R&D, including the allocation towards pigmentation disorders. Also, Europe’s Horizon granted a significant amount to vitiligo gene therapy research, hence attracting more players to establish their footprint in this sector.

Trials in Comparing Hydroquinone to Other Skin-Lightening Agents

|

Treatment Groups |

Results |

Conclusions |

|

4% HQ 0.75% KA and 2.5% Vitamin C |

Decrease in MASI score in weeks 0-12, significant change from weeks 0-4 with 4% HQ treatment Decrease in MASI score in weeks 0-12, no significant change from weeks 0-4 with 0.75% KA treatment |

The results of treatment with hydroquinone have an earlier onset than treatment with KA |

|

Group A, control Group B, 2% HQ Group C, 2% KA Group D, 4% HQ Group E, 4% KA Group F, 2% HQ and 2% KA Group G, 4% HQ and 4% KA Group H, 4% HQ, 4% KA, and aloe vera |

Groups B and D showed greater disruption of the stratum corneum Groups F, G, and H showed less disruption of the stratum corneum Groups A, C, and E did not cause observable disruption to the stratum corneum |

Hydroquinone may cause greater disruption of the stratum corneum, while KA and aloe vera may ameliorate these effects |

|

3% TA, 4% HQ |

More significant decrease in MASI score and MI in 3% TA group |

3% TA cream and 4% hydroquinone cream are effective in decreasing MASI score and MI |

|

0.2% Thiamidol-side vs. untreated side of face 0.2% Thiamidol-side vs. 2.0% HQ-side |

Significant decrease in MASI score in thiamidol-treated side vs. untreated Decrease in MASI scores in both treated sides, more significant improvement in thiamidol-treated side, some worsening noted in HQ-treated sides |

0.2% Thiamidol is more effective in the treatment of epidermal melasma than 2.0% hydroquinone |

Source: NLM, November 2023

Challenges

- Limitations in terms of diagnostics: The pigmentation disorder treatment market faces considerable risks in terms of diagnostic limitations. Africa has 0 to 3 dermatologists per million population, resulting in misdiagnosis rates, based on IJDVL report in December 2023. On the other hand, in India, the rural areas lack access to Wood’s lamps, which are extremely essential for melasma diagnoses. Therefore, AI diagnostics have the complete potential to capitalize on this sector, but the existence of prolonged approval timelines hinders adoption in almost all nations.

- Competition from alternative therapies: The aspect of alternative therapies is a major bottleneck for the market to capture the desired capital. The herbal medicine market is actively raising and treating the melasma patients in Japan. Meanwhile, in India, the Ayurvedic treatments are growing, thereby reducing the adoption of pharmaceuticals. Further, in the U.S., patients are spending billions yearly on unregulated skin whitening supplements, thereby causing a huge obstacle for the industry to expand.

Pigmentation Disorder Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 8.3 billion |

|

Forecast Year Market Size (2035) |

USD 14.9 billion |

|

Regional Scope |

|

Pigmentation Disorder Treatment Market Segmentation:

Type Segment Analysis

Melasma segment is projected to garner the largest share of 32.8% in the pigmentation disorder treatment market during the forecast tenure. The segment’s dominance is attributed to the increasing hormonal disorders and UV exposure. Therefore, the Australian Journal of General Practice report in December 2024 observed that these disorders are extremely common among women aged 30 to 50, wherein oral contraceptives and pregnancy are key contributors. Besides, WHO states that the higher melasma prevalence is witnessed in tropical regions due to the higher UV exposure.

Treatment Segment Analysis

Topical drugs segment is expected to grow at a considerable rate, in the market by the end of 2035. The data from NLM in November 2023 revealed that hydroquinone is the majority of prescribed skin-lightening treatments, with dose ranges from 2% to 5%, supporting market dominance. On the other hand, in 2021 U.S. FDA imposed a ban on high doses of hydroquinone, which deliberately increased demand for regulated formulations, hence denoting a wider segment scope.

End user Segment Analysis

Dermatology clinics segment is anticipated to hold a significant share in the pigmentation disorder treatment market during the discussed timeframe. The growth in the segment originates from affordable costs and technological advancements. AAD organization notes that laser therapies are performed in these clinics, which necessitate expert guidance. On the other hand, the American Society for Laser Medicine reports that there has been an annual growth in clinic-based pigment correction since 2020, hence suitable for standard market growth.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Treatment |

|

|

End user |

|

|

Distribution Channel |

|

|

Treatment Modality |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pigmentation Disorder Treatment Market - Regional Analysis

North America Market Insights

North America is dominating the pigmentation disorder treatment market and is expected to hold a share of 38.5% by the end of 2035. The dominance is driven by a high prevalence of melasma cases, advanced healthcare infrastructure, and strong R&D investment. Private insurers in the region are enabling reimbursements marking a 68.3% reimbursement for laser therapy. Besides, the combination therapies, such as hydroquinone retinoids, have demonstrated greater efficacy than monotherapies as per an NIH clinical study report. Further tele-dermatology is emerging at a robust rate, with care offered to rural patients yearly.

U.S. market is demonstrating robust growth and is backed by government funding transitions and distinguished treatment advancements. A key trend is the transition toward combination treatments and new biologics, facilitated by the FDA fast-track designation programs. Government assistance is significant; the National Institute of Arthritis and Musculoskeletal and Skin Diseases (NIAMS), a part of the NIH, invested around USD 125,000 in 2023 on vitiligo and albinism research. Reimbursement from Medicare and Medicaid is a key driver of demand, with CMS policy growing to cover more laser and light-based procedures that are considered medically necessary, thereby increasing patient access and market size.

Canada is also continuously growing in the market, highly attributed to provincial healthcare reforms, research grants, and pricing regulations. In this regard, as per the Kitchener City News in May 2024, the number of dermatologists in the province increased by 5.5 per cent in 2021, highlighting the growing need for skin related treatment. Besides University of Toronto states that stem cells network has dedicated a total of USD 33 million in regenerative medicine research projects and clinical trials across Canada in 2025, covering various diseases including rare disorders and skin conditions.

Trade Data on Hydroquinone in 2023

|

Country |

Trade Flow |

Value 1000USD |

|

U.S. |

Export |

63,671.25 |

|

U.S. |

Import |

1,030.65 |

|

Canada |

Export |

0.19 |

|

Canada |

Import |

534.97 |

Source: WITS

APAC Market Insights

Asia Pacific is the fastest-growing region in the market and is expected to represent a considerable growth rate by 2035. This became possible with the existence of rising pollution rates and increasing cosmetic awareness. This can be evidenced from the NLM report in May 2025, which observed a 40% of women are suffering from relapsing hyperpigmentation disorder with urban UV exposure. On the other hand, there has been a great adoption of AI diagnostics in South Korea, wherein clinics are currently equipped with exclusive detection equipment, creating an optimistic market opportunity.

China’s pigmentation disorder treatment market is growing consistently, driven by increasing cases of vitiligo, melasma, and post-inflammatory hyperpigmentation due to the higher UV exposure, pollution, and lifestyle. Growing awareness of dermatological health, higher disposable incomes, and demand for aesthetic procedures are boosting the adoption of topical drugs, chemical peels, and laser therapies. Government support of dermatology research and the existence of high-end urban clinics further strengthen market growth, making China a critical hub in Asia's market.

India is steadily growing and leading the position in the regional pigmentation disorder treatment market highly subject to the affordable generics and public health programs. In this regard, the Ministry of Health & Family Welfare in December 2024 noted that the out-of-pocket expenditure of total health expenditure is 39.4% in 2022, including skin-related diseases. This highlights the growing demand for enhancements in prioritizing healthcare budgets and enhancements in the diagnosis of pigmentation disorder treatment.

Europe Market Insights

Europe is considered to be the second largest stakeholder in the market. The country’s progress in this field is subject to rising aging populations and a huge UV exposure. The study by the European Environment Agency, reported in June 2022 found that UV exposure increases skin cancer risk and increases almost 4% of all cancer cases. In addition, the region’s Health Data Space dedicated an investment for pigmentation R&D with a prime focus on AI diagnostics and JAK inhibitors, hence indicating a positive market outlook.

Germany is expected to have the largest revenue share in Europe by 2035, based on its largest population in the EU, a highly funded and robust healthcare system, and a high early adopter culture for new medical technologies. The nation's high per capita healthcare spending, according to the Federal Ministry of Health, allows access to cutting-edge laser treatments and new drugs. Growth is further fueled by a highly developed regulatory framework that efficiently integrates new treatments into standard care, ensuring rapid market penetration for new entrants.

France also follows Europe’s pigmentation disorder treatment market, grabbing a significant share of 20.7% during the forecast timeline. Key factors propelling growth in the country’s market include HAS policy shifts and biologic evolution. As evidence, Haute Autorité de santé (HAS) report in January 2025 notes that 90% of people in the region are using digital health tools for care and support. Further, AI-enabled fractional laser treatments are adopted in many clinics to analyze skin conditions and adjust laser settings, for safe, precise, and personalized treatments.

Key Pigmentation Disorder Treatment Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Galderma

- L'Oréal (CeraVe)

- Bayer AG

- Sun Pharmaceutical

- Shanghai Jahwa

- Allergan (AbbVie)

- LG Chem

- Mylan (Viatris)

- CSL Behring

- HRA Pharma

- Himalaya Wellness

- Incyte Corporation

- Pharmaniaga

- Hugel Inc.

- Maruho Co., Ltd.

- Torii Pharmaceutical

- Daiichi Sankyo

- Kose Corporation

- POLA Pharma

The global market is hosting intensifying competition between Western pharmaceutical giants such as Pfizer, Galderma, and Asia-based cosmetic-dermatology hybrids such as Shanghai Jahwa, Kose. Premiumization of biologics, emerging market penetration, and technological convergence are a few strategies implemented by key players to elevate the market development internationally. Besides Japan, Japan-based firms lead in terms of formulation science, whereas the Europe-based firms dominate in the aspect of medical aesthetics.

Here is a list of key players operating in the market:Below are the areas covered for each company in the market:

Recent Developments

- In January 2025, VYNE Therapeutics completes enrollment in Phase 2b trial evaluating VYN201 for the treatment of nonsegmental vitiligo. This evaluation marks as an important milestone for the program and reflects the continued strong execution of our clinical team.

- In October 2024, Kaya Clinic launches Klear AI, which is an AI platform, which provides provides hyper-personalized skincare diagnostics. The platform is used to kin conditions in-depth and recommends tailored treatments, including pigmentation reductions.

- In October 2024, Japan Tissue Engineering Co., Ltd., announces the NHI listing of autologous cultured epidermis maintaining melanocytes JACEMIN for the treatment of vitiligo.

- In February 2024, Arcutis Biotherapeutics collaborates with Sato Pharmaceutical Co., Ltd., and announces the strategic collaboration and licensing agreement for the development, manufacture, and commercialization of topical roflumilast in Japan.

- Report ID: 8124

- Published Date: Sep 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.