Physical Vapor Deposition Market Outlook:

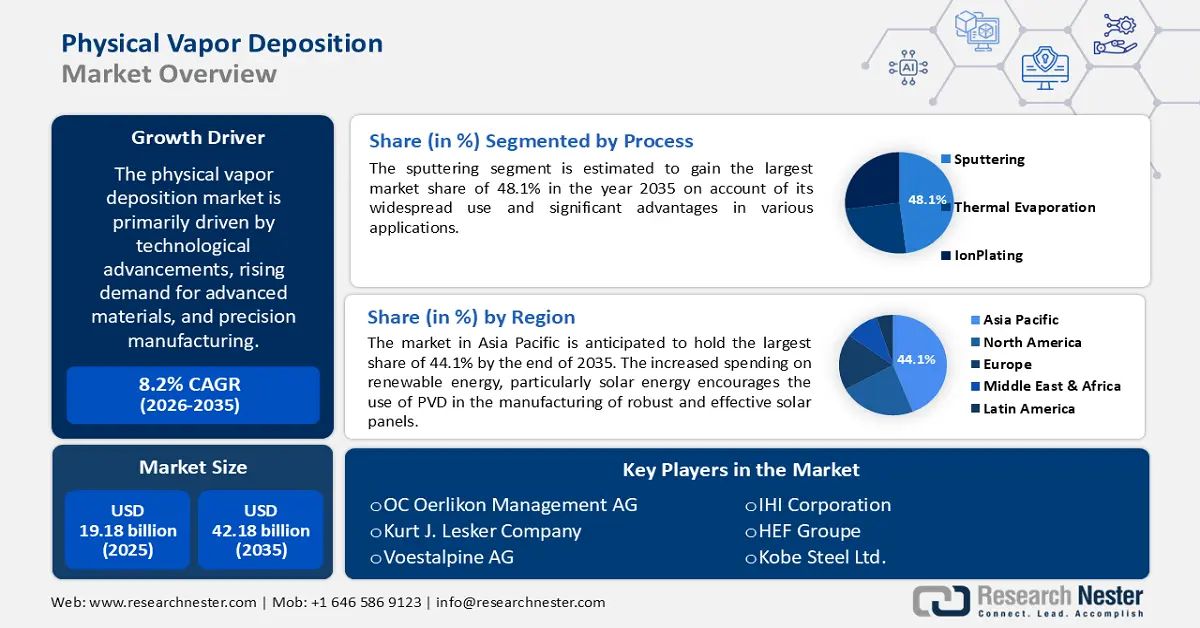

Physical Vapor Deposition Market size was valued at USD 19.18 billion in 2025 and is set to exceed USD 42.18 billion by 2035, registering over 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of physical vapor deposition is estimated at USD 20.6 billion.

Physical vapor deposition (PVD) techniques are used to apply thin films and coatings to enhance product durability, performance, and aesthetic appeal. The physical vapor deposition market is primarily driven by technological advancements, rising demand for advanced materials, and precision manufacturing. Innovations such as advanced sputtering and evaporation techniques enhance the quality and uniformity of coatings. For instance, magnetron sputtering is a physical vapor deposition process that offers a wide deposition range, high deposition speed, easy control, large coating area, and strong film adhesion. These advantages have driven the adoption of magnetron sputtering in the manufacturing of lithium batteries.

Additionally, there is a growing consumer preference for eco-friendly products, including those with sustainable coatings. In contrast to alternative coating techniques, PVD coatings are more environmentally friendly as they typically use fewer hazardous chemicals and produce less waste. For instance, titanium nitride (TiN) is an environmentally safe technology as it does not generate toxic byproducts.

Key Physical Vapor Deposition Market Insights Summary:

Regional Highlights:

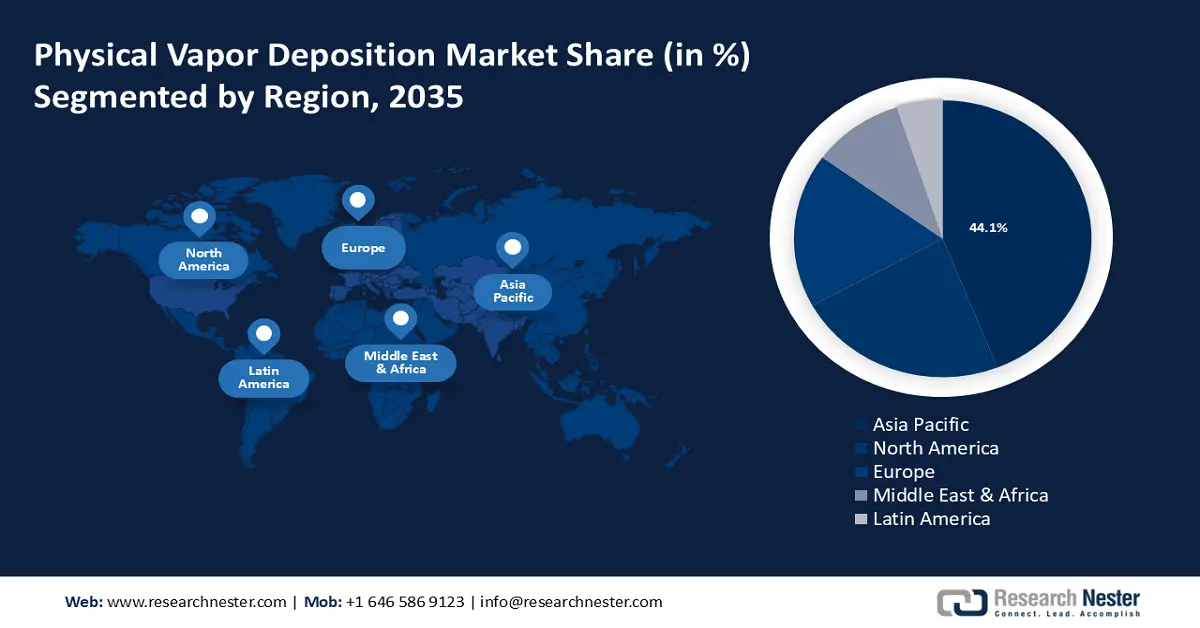

- The Asia Pacific physical vapor deposition market achieves a 44% share by 2035, driven by increased spending on renewable energy, particularly solar energy, encouraging the use of PVD in manufacturing.

- The North America market will exhibit substantial growth during the forecast timeline, driven by rising environmental concerns and adoption of cleaner manufacturing technologies.

Segment Insights:

- The sputtering segment in the physical vapor deposition market is expected to achieve significant growth till 2035, driven by high usage in semiconductor thin-film applications.

- The electronics semiconductors segment in the physical vapor deposition market is expected to capture a significant share by 2035, attributed to rising demand for microelectronics and AI-driven innovations.

Key Growth Trends:

- Growth in medical device industry

- Increasing production of automobiles

Major Challenges:

- Varying cost of raw materials

- Lack of competent workforce

Key Players: OC Oerlikon Management AG, Kurt J. Lesker Company, Voestalpine AG, IHI Corporation, HEF Groupe, Kobe Steel Ltd., Lafer S.p.A., Inorcoat.

Global Physical Vapor Deposition Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 19.18 billion

- 2026 Market Size: USD 20.6 billion

- Projected Market Size: USD 42.18 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 17 September, 2025

Physical Vapor Deposition Market Growth Drivers and Challenges:

Growth Drivers

- Growth in medical device industry - Medical devices requires coatings that are biocompatible, resistant to corrosion, and capable of withstanding sterilization processes. PVD coatings, such as chromium nitrite (CrN), titanium aluminum nitride (TiAIN), and titanium boron nitride (TiBN), meet these requirements, making them suitable for implants and surgical instruments.

Moreover, leading medical device manufacturers are increasingly adopting PVD technology to meet higher performance standards and regulatory requirements. This adoption is driven by the benefits of PVD coatings in extending device lifespan and improving patient outcomes. For instance, Kurt J. Lesker Company manufactures a wide range of PVD thin film deposition devices for diverse medical device applications. The devices include TORUS Mag Keeper, TORUS Circular HV, and PRO Line PVD 75 to optimize system base pressures, automate substrate loading, and decrease pump down times, thereby, improving patient outcomes. - Expansion of the solar energy sector - PVD is a key technology in the production of thin films and coatings used in solar panels. As solar energy adoption increases, the demand for efficient and durable photovoltaic cells rises, thus, driving the need for PVD techniques. Additionally, governments and private sectors are investing in solar and other renewable energy technologies. This investment often includes funding for advanced manufacturing technologies such as PVD.

Fundings and investments in the solar sector have fostered R&D in PVD technologies, For instance, a 2024 report published by the International Energy Agency (IEA) stated that the global investment in the manufacturing of five important clean energy technologies—solar PV, wind, batteries, electrolyzers, and heat pumps—increased by more than 70% from 2022 to USD 200 billion in 2023, accounting for almost 4% of global GDP growth. - Increasing production of automobiles - Automobiles increasingly use PVD coatings for enhanced durability, aesthetics, and the overall performance of various components, such as engine parts, exterior trims, and wheels. As automobile production increases, the demand for advanced coatings on parts and components also. rises. As per the International Organization of Motor Vehicle Manufacturers (OICA), the estimated world vehicle motor production in 2023 was approximately 93.5 million units. Moreover, as car manufacturers push for more advanced and efficient vehicles, including hybrid and electric models, the need for specialized coatings can further drive physical vapor deposition market.

Challenges

- Varying cost of raw materials – PVD processes require materials such as copper, titanium, zirconium, stainless steel, and aluminum. The prices of these raw materials can be volatile due to factors such as supply chain disruptions, geopolitical issues, or change in mining regulations. Increase in raw material cost lead to higher production expenses for PVD equipment and coatings. This may result in higher prices for end-users, potentially slowing down adoption in cost-sensitive industries or applications.

- Lack of competent workforce – PVD technology is complex and requires specialized skills in material science, engineering, and precise manufacturing techniques. A shortage of skilled professionals, including engineers and technicians, can limit the ability of companies to develop, maintain, and improve PVD systems.

Physical Vapor Deposition Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 19.18 billion |

|

Forecast Year Market Size (2035) |

USD 42.18 billion |

|

Regional Scope |

|

Physical Vapor Deposition Market Segmentation:

Process Segment Analysis

Sputtering segment is anticipated to account for physical vapor deposition market share of around 48.1% by 2035 on account of its widespread use and significant advantages in various applications. For instance, sputtering is extensively used for depositing thin films in semiconductor devices, including metallization, dielectric layers, and interconnects. As semiconductor devices become more advanced, sputtering technology continues to evolve to meet these needs. Further, for applications such as touchscreens and LED displays, sputtering is used to deposit transparent conductive oxides like indium oxide (ITO). These materials provide conductivity while remaining transparent to visible light.

Additionally, optical filter manufacturers frequently use sputtering technology to produce high-precision filters. Sputtering is particularly well-suited for this application due to its ability to deposit thin, uniform layers with precise control over thickness and composition. For instance, Semrock, a business unit of IDEX Health & Science, manufactures all of its optical filters using sophisticated Ion Beam Sputtering (IBS) technology, resulting in patented state-of-the-art filters with exceptionally durable hard glass coatings on a single hard glass substrate.

End-user Segment Analysis

The electronics semiconductors segment is expected to register significant physical vapor deposition market revenue in the coming years. This growth is attributed to an increase in demand for microelectronics led by technological advancements, a growing need for smart gadgets, and the adoption of cutting-edge innovations including 5G and artificial intelligence (AI). For instance, the global microelectronics industry reached over USD 325 billion in 2022.

Additionally, AI and machine learning algorithms are increasingly used to optimize the design of semiconductor devices and improve manufacturing processes. In the context of PVD, AI can help refine deposition techniques, improve film uniformity, and predict the outcomes of different deposition parameters, leading to higher quality and performance of semiconductor components.

Our in-depth analysis of the physical vapor deposition market includes the following segments:

|

Type |

|

|

Process |

|

|

End-user |

|

|

Substrate |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Physical Vapor Deposition Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is anticipated to dominate majority revenue share of 44% by 2035. The increased spending on renewable energy, particularly solar energy encourages the use of PVD in the manufacturing of robust and effective solar panels. The region has emerged as the global leader in solar PV installations, with a strong growth rate driven by factors such as growing awareness of renewable energy sources. Particularly, Asia's solar energy capacity was estimated to be over 602 thousand megawatts in 2022.

The physical vapor deposition market in China is estimated to expand at a substantial CAGR as the country is one of the biggest producers of aircraft. Aerospace components are subjected to extreme stress which necessitates the use of PVD coating solutions to enable these components to comply with the stringent safety regulations.

The physical vapor deposition market in India is growing due to advancements in technology and increasing industrial demands. The country’s focus on developing its semiconductor and electronics industries is a key factor driving the adoption of PVD technology.

Increased spending on renewable energy in South Korea is expected to drive the physical vapor deposition market by boosting demand for advanced coatings and materials used in solar panels, wind turbines, and other renewable energy technologies. This trend will lead to greater investments in PVD technology and innovation.

North America Market Insights

North America region is anticipated to observe substantial growth through 2035. The rising environmental concerns are significantly driving the PVD market in the region. Environmental regulations and sustainability goals are pushing industries to adopt cleaner manufacturing technologies. PVD is valued for its low environmental impact and typically generates less waste and uses fewer harmful chemicals.

The U.S. physical vapor deposition market is a major contributor to the global PVD industry, with significant investments in R&D and manufacturing capabilities. Government agencies and private companies are investing heavily in PVD research. Federal grants and subsidies, along with venture capital funding, support advancements in PVD technology and applications.

The expansion of healthcare industry in Canada is likely to create substantial opportunities for physical vapor deposition market as the demand for advanced medical devices and technologies grows. PVD coatings are used to enhance the performance and longevity of medical devices and instruments.

Physical Vapor Deposition Market Players:

- Angstrom Engineering Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- OC Oerlikon Management AG

- Kurt J. Lesker Company

- Voestalpine AG

- IHI Corporation

- HEF Groupe

- Kobe Steel Ltd.

- Lafer S.p.A.

- Inorcoat

Numerous important companies in the physical vapor deposition market are starting several tactical projects to increase their market share and strengthen their positions in the industry. It is predicted that the top five companies will control the majority of the market share by taking calculated risks, expanding, forming agreements, and participating in joint ventures.

Recent Developments

- In July 2024, OC Oerlikon Management AG a global leader in PVD surface solutions announced the launch of BALORA TECH PRO to replace the need for hazardous materials such as cobalt to improve the performance and endurance of vital components used in the aerospace and power generating industries.

- In April 2023, Kurt J. Lesker Company opened a brand-new PED Thin Films Lab that has multiple PVD tools that can deposit metals, insulators, dielectrics, and organic materials. The lab has state-of-the-art metrology equipment, including ellipsometry, reflectometry, and surface profilometry, that will help invent thin-film technologies.

- Report ID: 6297

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Physical Vapor Deposition Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.