Photoresist Stripper Market Outlook:

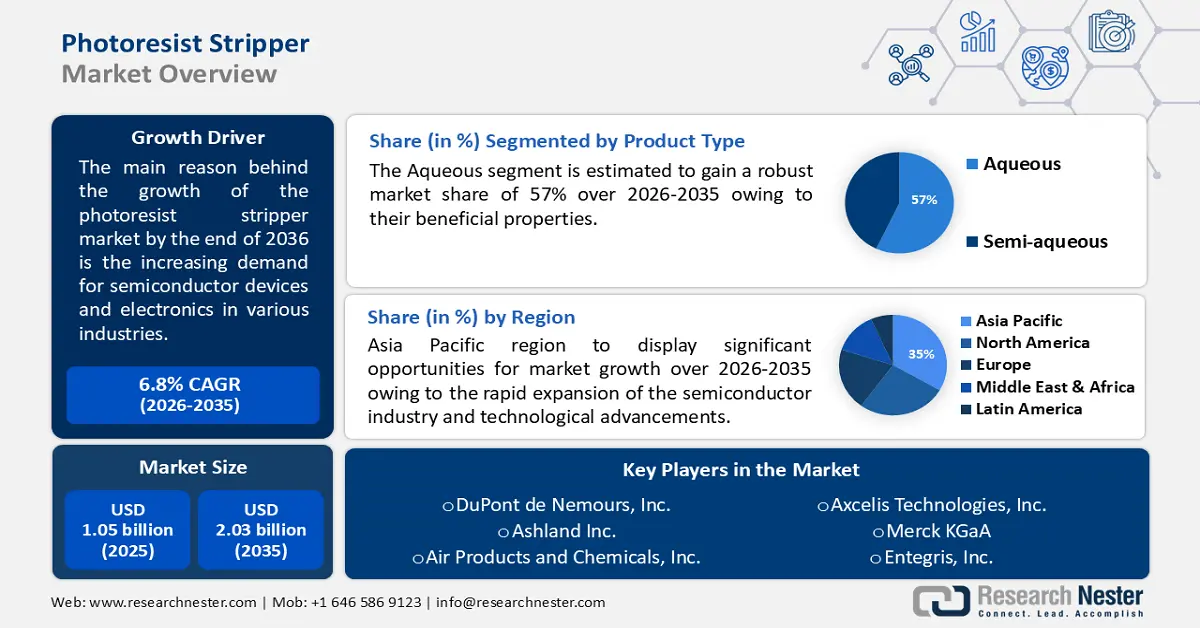

Photoresist Stripper Market size was valued at USD 1.05 billion in 2025 and is likely to cross USD 2.03 billion by 2035, expanding at more than 6.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of photoresist stripper is assessed at USD 1.11 billion.

The market is witnessing expansion due to the increasing demand for semiconductor devices and electronics in various industries, including automotive, healthcare, and telecommunications.

For instance, in 2022, global semiconductor sales will exceed USD 618 billion, a more than 30% increase in just two years. Using photoresist strippers to remove photoresist coatings from semiconductor wafer surfaces is an essential step in producing high-quality semiconductor devices. The photoresist strippers market is developing as a result of the increased need for high-performance microchips, sensors, semiconductor manufacturing machinery, and other electronic components.

In addition to these, factors that are believed to fuel the growth of the market are the increasing demand for high-performance electronic devices such as smartphones, tablets, and laptops, along with the growing demand for advanced automotive electronics and the adoption of IoT and AI technologies.

Key Photoresist Stripper Market Insights Summary:

Regional Highlights:

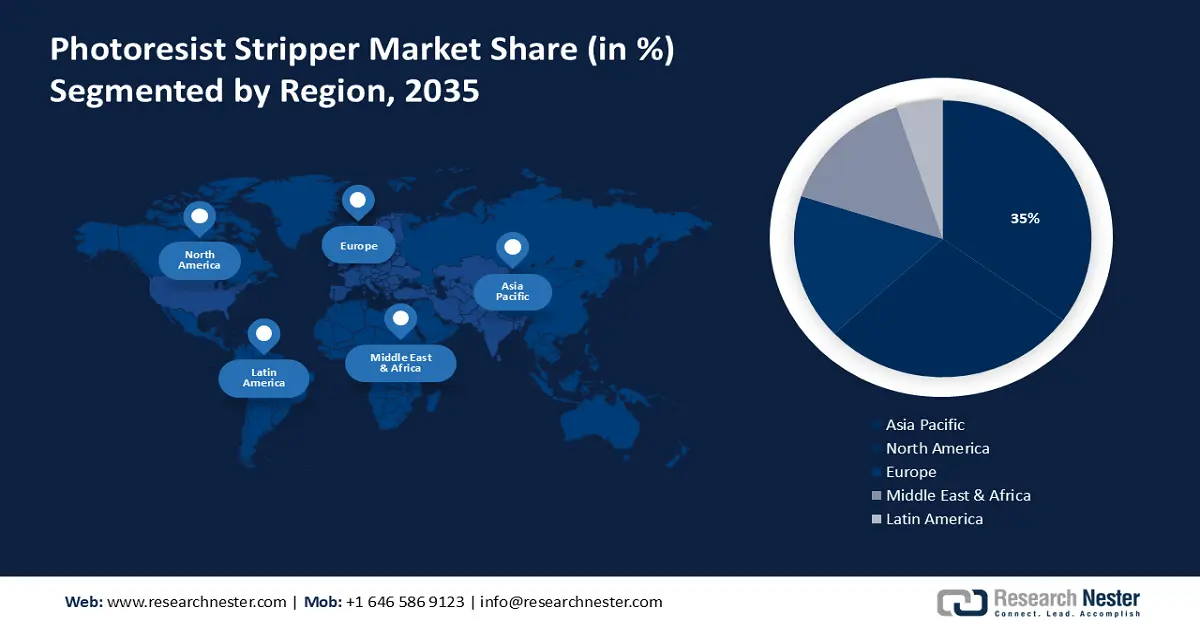

- Asia Pacific photoresist stripper market is expected to capture 35% share by 2035, driven by rapid expansion of semiconductor industry and technological advancements.

Segment Insights:

- The aqueous segment in the photoresist stripper market is projected to attain a 57% share by 2035, fueled by environmental benefits, cost-effectiveness, and preference in electronics manufacturing.

- The positive photoresist stripping segment in the photoresist stripper market is projected to hold a 53% share by 2035, driven by its effectiveness in achieving precise patterns for advanced microfabrication.

Key Growth Trends:

- Increased adoption of advanced products

- Growing technological advancements

Major Challenges:

- Intense competition in the semiconductor industry places cost pressure on manufacturers, restricting the market’s growth.

- The market is vulnerable to disruptions in the global supply chain.

Key Players: DuPont de Nemours, Inc., Ashland Inc., Air Products and Chemicals, Inc., SCREEN Semiconductor Solutions Co., Ltd., Axcelis Technologies, Inc., Merck KGaA, Entegris, Inc., Avantor, Inc., Solexir Technology, Technic Inc..

Global Photoresist Stripper Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.05 billion

- 2026 Market Size: USD 1.11 billion

- Projected Market Size: USD 2.03 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 16 September, 2025

Photoresist Stripper Market Growth Drivers and Challenges:

Growth Drivers

- Increased adoption of advanced products - The product's presentation will be further enhanced by technological advancements, which will enable it to meet a wider range of market demands. The development of technology will boost output and spur market expansion. For instance, MicroChemicals launched a new product, the ready-to-use dilution 1:4 (one-part concentration and four parts DI water) of AZ® 400K 1:4 MIC is based on buffered KOH and can be used particularly with their thicker resist types, such as AZ® 4562, AZ® 10XT, and AZ® 40XT.

Furthermore, high demand combined with technological innovation is creating more and more pressure to boost output. To satisfy customer needs and preferences, some players concentrate on improving their products. It is expected that continuous innovation in product manufacture will increase consumer demand. - Growing technological advancements - Innovation and technological progress create a special possibility for income augmentation, which will accelerate the expansion of the photoresist stripper market. Profitable prospects for the market are predicted to arise from rising investment in R&D projects and rising benefit awareness. Businesses are investing highly in R&D to create cutting-edge semiconductor devices.

For instance, the leading private investment firm Ardian announced that it is entering the semiconductor industry with the establishment of Ardian Semiconductor. With an emphasis on Europe, this cutting-edge platform will invest throughout the semiconductor value chain, empowering businesses to become industry leaders worldwide. - Increased adoption of renewable energy sources - The demand for LED lighting and the expanding adoption of renewable energy sources are driving the market for photoresist stripper. For instance, around 61% of lights worldwide were LED as of 2020.

The production of solar cells and LED lighting, which is becoming more and more popular since it is environmentally friendly and energy-efficient, uses photoresist stripping. Industry leaders never stop concentrating on tactics like new product creation, acquisitions, and successes to broaden their global presence and meet the quickly rising demands of their clientele.

Challenges

- Material compatibility - The diversity of materials used in semiconductor manufacturing creates challenges in developing photoresist strippers that effectively remove photoresist without negatively impacting underlying materials. Achieving compatibility across various substrates is a persistent challenge.

- Intense competition in the semiconductor industry places cost pressure on manufacturers, restricting the market’s growth.

- The market is vulnerable to disruptions in the global supply chain.

Photoresist Stripper Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 1.05 billion |

|

Forecast Year Market Size (2035) |

USD 2.03 billion |

|

Regional Scope |

|

Photoresist Stripper Market Segmentation:

Product Type Segment Analysis

In photoresist stripper market, aqueous segment is likely to account for more than 57% share by the end of 2035. Aqueous photoresist strippers use water as the primary solvent, offering environmental advantages and cost-effectiveness. They are favored for their ability to efficiently remove photoresist materials in semiconductor and electronics manufacturing processes.

Aqueous solutions are generally considered more sustainable and safer compared to the semi-aqueous segment the dominant choice, reflecting industry preferences for environmentally friendly and economically viable solutions in the market.

Process Segment Analysis

In photoresist stripper market, positive photoresist stripping segment is predicted to capture over 53% revenue share by 2035. Positive photoresist stripping involves removing the exposed portions of the photoresist material, leaving the desired pattern intact. This process is more widely used as it is versatile and suitable for various applications in semiconductor manufacturing.

Positive photoresists offer higher resolution and better pattern transfer capabilities, making them prevalent in advanced microfabrication processes. The market dominance of positive photoresist stripping is driven by its effectiveness in achieving precise and intricate patterns, meeting the demands of modern semiconductor and electronics industries.

Our in-depth analysis of the market includes the following segments:

|

Product Type |

|

|

Process |

|

|

Application |

|

|

End-user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Photoresist Stripper Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to dominate majority revenue share of 35% by 2035. The market growth in the region is also expected on account of the rapid expansion of the semiconductor industry and technological advancements. With a strong emphasis on electronics and a persistent desire for innovation in semiconductor technology, nations like China, South Korea, and Taiwan emerged as major participants. This created a significant need for high-performance photoresist strippers.

The main production hub for semiconductors is Asia Pacific. More than 90% of global semiconductor foundry revenues are accounted for by Taiwan, South Korea, and China which together account for more than 60 % of the market. As the needs of the semiconductor industry changed, Asia Pacific emerged as a center for semiconductor fabrication, drawing large expenditures in R&D.

There was fierce competition on the industry, with businesses vying to create innovative methods for efficient photoresist removal. As a result, the Asia Pacific market made a substantial contribution to the region's technological leadership and economic progress, as well as to the worldwide semiconductor scene.

North America Market Insights

The North America region will also witness huge growth for the photoresist stripper market during the projection period and will hold the second position owing to the growing emphasis on environmental sustainability in the region. The demand for advanced photoresist strippers was driven by the expanding semiconductor industry, particularly in the United States. Companies in North America focused on developing high-performance solutions to meet the stringent requirements of evolving semiconductor technologies.

Further, the market dynamics were influenced by a constant pursuit of efficiency of precision in semiconductor fabrication processes. The North American market marked by technological prowess and environmental consciousness, reflected the region’s commitment to maintaining a competitive edge in semiconductor manufacturing.

Photoresist Stripper Market Players:

- DuPont de Nemours, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ashland Inc.

- Air Products and Chemicals, Inc.

- SCREEN Semiconductor Solutions Co., Ltd.

- Axcelis Technologies, Inc.

- Merck KGaA

- Entegris, Inc.

- Avantor, Inc.

- Solexir Technology

- Technic Inc.

Recent Developments

- Merck, a leading scientific and technology corporation, has launched a new line of green solvents for photolithography in semiconductor manufacturing. The growing demand for electronic devices, including smartphones, 5G, gaming, home entertainment, automotive applications, Internet of Things (IoT), and Artificial Intelligence (AI), has fueled the growth of the semiconductor industry, resulting in increased demand for wafer cleaning solvents and equipment. AZ® 910 Remover is a new series of NMP-free chemicals that dissolve photoresist patterns quickly and affordably.

- Air Products stated that it has entered into an investment deal worth USD 1 billion to purchase, own, and run a natural gas-to-syngas processing facility in Qashqadaryo Province, Uzbekistan, with the Government of the Republic of Uzbekistan and Uzbekneftegaz JSC ("UNG").

- Report ID: 5553

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Photoresist Stripper Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.