Photoelectric Sensors Market Outlook:

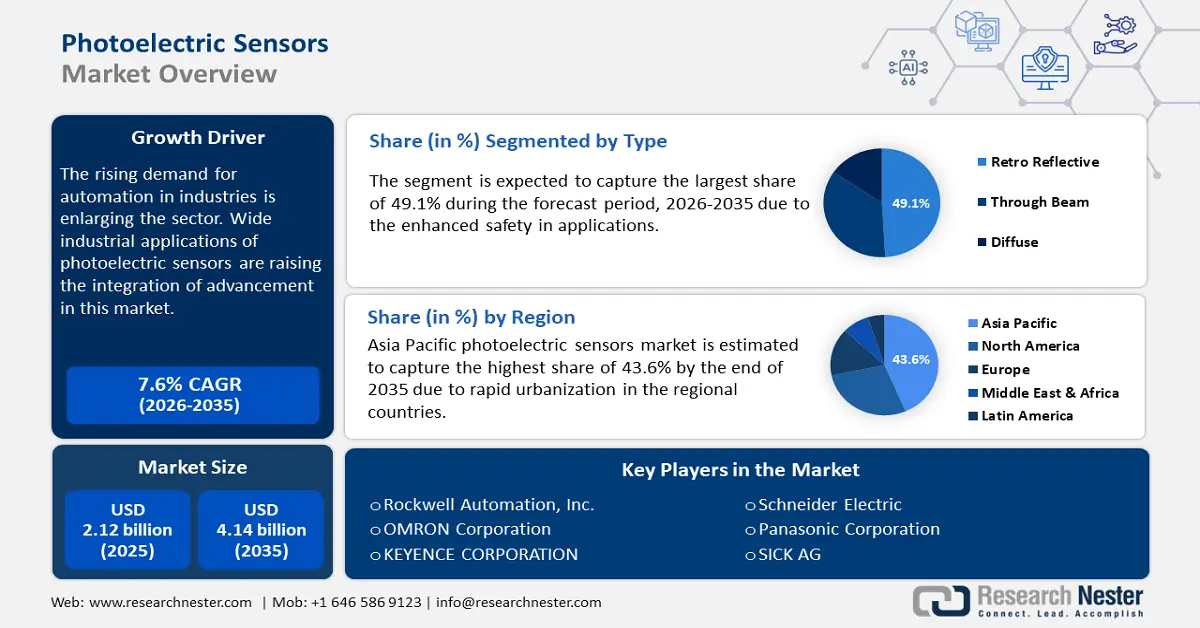

Photoelectric Sensors Market size was valued at USD 2.12 billion in 2025 and is likely to cross USD 4.41 billion by 2035, registering more than 7.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of photoelectric sensors is assessed at USD 2.27 billion.

The rising demand for automation in industries is enlarging the sector. Robust processing in manufacturing, logistics, and packaging allows accurate object detection and positioning. Such improvisation in production is boosting the demand for photoelectric sensors. Wide industrial applications are raising the integration of advancement in product development.

The popularity of smart manufacturing facilities has increased the demand in the market. Manufacturers are rigorously seeking a method for cost reduction. Mass production has proven to be one of the most effective techniques to reduce expenses. Adopting photoelectric sensors can effectively support the concept. For instance, in 2022, Keyence launched the IL series of photoelectric sensors, allowing stable analog detection in smart factories. The multi-function CMOS laser sensor can be integrated seamlessly with IoT systems for remote monitoring. Such advancement in this sector will encourage more industrialists to incorporate these sensing technologies.

Key Photoelectric Sensors Market Insights Summary:

Regional Highlights:

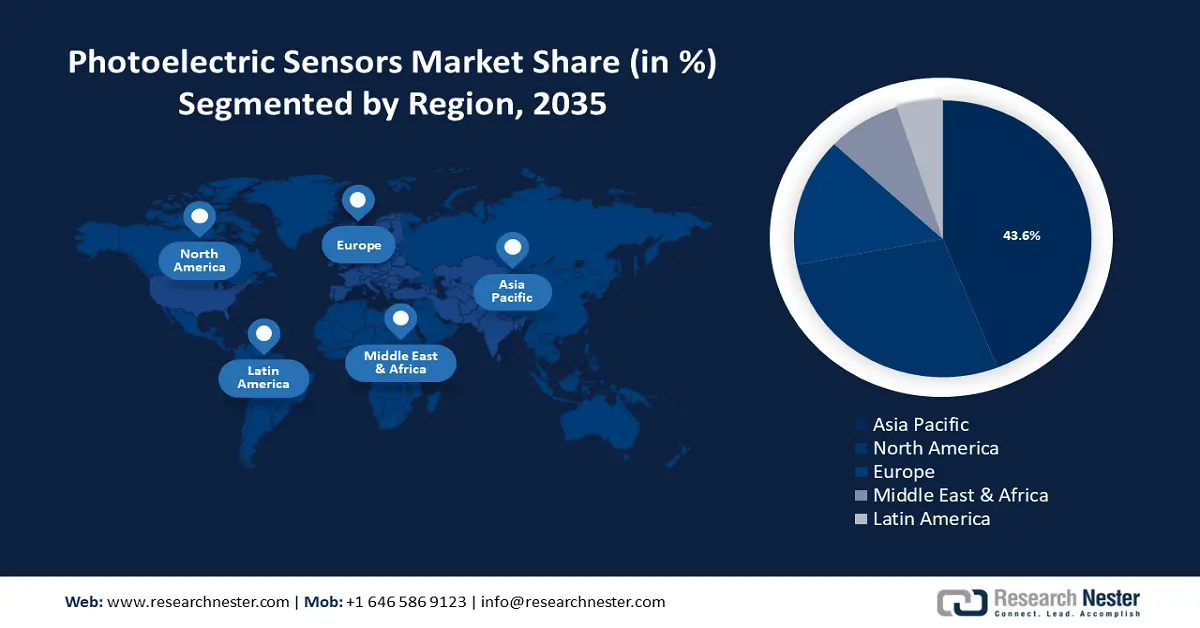

- Asia Pacific dominates the photoelectric sensors market with a 43.6% share, propelled by increased industrial automation, ensuring strong growth through 2026–2035.

- The Photoelectric Sensors Market in North America is witnessing significant growth by 2035, driven by technological advancements and shift toward automation.

Segment Insights:

- The Industrial Manufacturing segment is poised for rapid growth by 2035, propelled by increased efficiency and demand for IoT-integrated solutions.

- The Retro Reflective segment is projected to capture over 49.1% market share by 2035, driven by enhanced safety and precise object detection in industrial applications.

Key Growth Trends:

- Advancement in technology for efficient production

- Optimized safety and security

Major Challenges:

- Expensive production

- Environmental impact

- Key Players: Rockwell Automation, Inc., OMRON Corporation, KEYENCE CORPORATION, Schneider Electric, Eaton, Panasonic Corporation, SICK AG.

Global Photoelectric Sensors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.12 billion

- 2026 Market Size: USD 2.27 billion

- Projected Market Size: USD 4.41 billion by 2035

- Growth Forecasts: 7.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 14 August, 2025

Photoelectric Sensors Market Growth Drivers and Challenges:

Growth Drivers

- Advancement in technology for efficient production: Rapid industrialization is pushing the need for smart manufacturing. Industry 4.0 initiatives fuel the concept of smart factories with sufficient and quality production. Advanced photoelectric sensors are enabled in these facilities for real-time monitoring and data collection. Technology innovation improves sensitivity, miniaturization, and integration with IoT devices, further allowing enhanced performance in such mass manufacturing units. In March 2024, Pepperl+Fuchs launched the VMT series. The product aims to enable advanced diagnostics and communication protocols in smart factories, such as battery manufacturing facilities.

- Optimized safety and security: The need for enhanced security systems in residencies, public spaces, and industrial facilities is increasing. Compact photoelectric sensors can facilitate safety with motion detection and monitoring in such environments. Further, driving developmental scope in the photoelectric sensors market. In 2023, Banner Engineering launched long-range photoelectric sensors, the QS30 series. This device is designed to deliver high-performance security applications with adjustable sensing ranges. The sensors are also helping to meet stringent safety standards for machines. Precise detection and easy access control influence a large consumer base for greater investments.

Challenges

- Expensive production: Manufacturing high-quality sensors involves precise and specialized equipment. Such complex manufacturing adds higher production costs in the market. Used raw materials including semiconductors and optics can also increase the production expense. Continued innovation is needed to stand out in the competition. Thus, companies are pushed to invest in research and development to improve product performance and inflate adoption. The process of rigorous testing to ensure reliability and quality can be time-consuming and expensive.

- Environmental impact: Extraction of raw materials to manufacture sensors can result in natural resource depletion. Energy consumption during production is high and can contribute to greenhouse gas emissions. The manufacturing process often involves harmful chemicals, posing environmental risks. Thus, environment-sensitive regulations can hinder the process of product launches in the market. On the other hand, the sensors can get hampered by extreme conditions such as dust, moisture, and temperature. Further, affecting consumer trust in product durability.

Photoelectric Sensors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.6% |

|

Base Year Market Size (2025) |

USD 2.12 billion |

|

Forecast Year Market Size (2035) |

USD 4.41 billion |

|

Regional Scope |

|

Photoelectric Sensors Market Segmentation:

Type (Retro Reflective, Through Beam, Diffuse)

Retro reflective segment is poised to hold more than 49.1% photoelectric sensors market share by 2035. The enhanced safety in applications made retro-reflective sensors dominate the industry. Precise object detection for conveyor systems and robotics has inflated the demand for these sensors. Its ability to integrate with IoT facilities allows advanced monitoring and control access. The sophisticated operations of these sensors also play a vital role in inspection and quality assurance. In May 2024, Banner Engineering launched Q2X miniature photoelectric sensors. The compact design with a long detection range is suitable for limited industrial space or precise machinery.

Application (Industrial Manufacturing, Automotive and Transportation, Building Automation, Food and Beverages, Pharmaceuticals and Medical, Packaging & Logistics)

Based on the application, industrial manufacturing is one of the fastest-growing segments in the photoelectric sensors market. The efficiency of reducing labor costs has increased the adoption of such sensory technology. Enhanced operational performance is growing the number of industrial end users. Governmental pressure to maintain regulatory standards to increase safety and quality in the workplace. Introducing innovations to participate in mass production has become a trend in various industries. Manufacturers are demanding reliable sensing solutions to maintain product quality while producing in huge volumes. Improved detection capability and integration with IoT devices have made photoelectric sensors the most suitable option for industries.

Our in-depth analysis of the market includes the following segments:

|

Type |

|

|

Product |

|

|

Range |

|

|

Source |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Photoelectric Sensors Market Regional Analysis:

APAC Market Statistics

Asia Pacific industry is set to dominate majority revenue share of 43.6% by 2035 due to increased industrial automation. The sensors are integrated into automated manufacturing units, offering accurate object detection and positioning. Further, boosting demand for these photoelectric sensors. The technology of sensing is being developed to deliver extensive applications. In September 2022, Omoron Corporation launched E3Z, a compact photoelectric sensor for usage in manufacturing facilities, and cold-storage warehouses. With a built-in amplifier, this sensor is capable of operating efficiently in long-range distances.

India is expected to witness remarkable growth in the market by the end of 2035. Government initiatives including Make in India are encouraging consumers to invest in these sensors to increase productivity. They are also integrating photo sensors to ensure public safety through issuing regulations. According to an article published by the Time of India, in March 2024, the road transport and highway ministry of Delhi has mandated sensors for bridges. The authorities also issued guidelines for identification and implementation to supervise the bridge’s health. The robust growth in industrialization has broadened the trend of photoelectric sensors.

China is also estimated to generate remarkable revenue in the photoelectric sensors market. The penetration of electric vehicles into the country’s transportation is inflating to meet their zero-emission target. They are emphasizing the production of EV batteries to support the complete electrification. Implementation of evolved sensory systems can efficiently handle data of large manufacturing units, with enhanced quality control. Photoelectric sensors are also being used for smart battery management in EVs. Its safety monitoring features have the potential to optimize China patented battery-swapping technology, additionally, occupying an enlarged consumer base and application fields in the country.

North America Market Analysis

The North America photoelectric sensors market is presenting significant growth opportunities. Technological advancement and a shift toward automation are fueling the industry with the scope of investment. The utilization of sensory devices in conveyor systems, packaging machinery, robotics, and personal safety modules is inflating their demand. Integration with consumer electronics has broadened access to direct connectivity. Smart devices can perform with enhanced functionality with the usage of upgraded sensors. The application of sensing technology has outstretched to healthcare sector. The advanced systems allow precise measurements and operations in operating medical devices.

The U.S. is augmenting with innovation to consolidate its position in the market. Market leaders are introducing auto-adjusting solutions to implement in varied applications. Multispectral photoelectric sensors are offering detection on color and material type for factory manufacturers. Some production houses are incorporating AI to enhance sensor capabilities. Industries are opting for compact designs to fit narrow spaces. In May 2023, IDEC launched SA2E miniature photoelectric sensors. With a standardized ASIC design, the sensor can deliver faster response and better detection, while capturing minimal space.

Canada is showing promising growth in the market. The push towards energy efficiency is leading to sensor implementation in lighting and HVAC systems. Improvement in accuracy and functionality is driving investments for future innovation in sensor technology. Industries including automotive, packaging, food, and pharmaceuticals are required for advanced sensing systems for better quality control. Investment in research and development in this sector has multiplied due to consumer demand. These factors are collectively shaping the country’s sensor market with a lucrative growth trajectory.

Key Photoelectric Sensors Market Players:

- Rockwell Automation, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Schneider Electric

- Eaton

- SICK AG

- IFM

- Balluff

- Pepperl+Fuchs

- Wenglor

Widening application range is one of the major beneficial trends in the photoelectric sensors market. Following the smart manufacturing strategies of individual regions, companies are developing personalized solutions. Many are partnering with or acquiring tech-driven competitors to align with industry standards. For instance, in January 2024, ABB acquired Real Tech to utilize its optical sensor technology. This acquisition was aimed at expanding ABB's portfolio to smart water management. Such key players in the market includes:

Recent Developments

- In October 2024, Lynred acquired NIT (New Imaging Technologies) to consolidate its leadership in infrared sensors. This acquisition will allow Lynred to access the SWIR technology of NIT, expanding its product portfolio.

- In May 2024, Hikrobot introduced a series of machine vision photoelectric sensors. The range includes an area scan camera, 3D laser profile sensor, XoF 8K Line Scan Camera, SC6000 Smart Camera, and IDH Handheld Code Reader.

- Report ID: 6580

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Photoelectric Sensors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.