Photodiode Sensors Market Outlook:

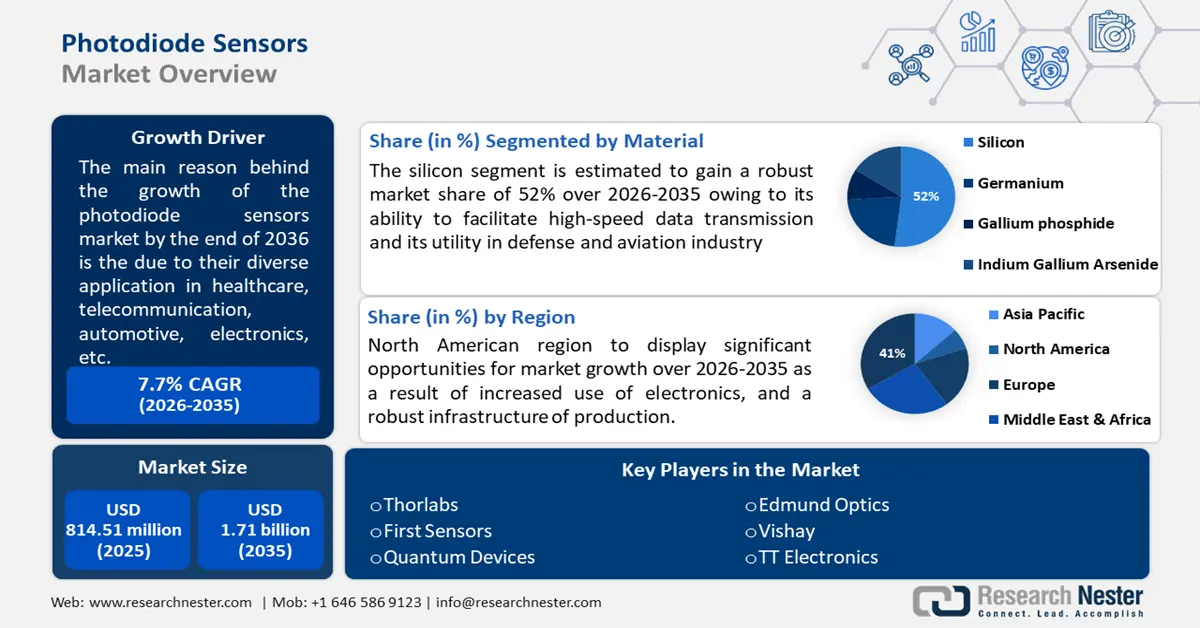

Photodiode Sensors Market size was over USD 814.51 million in 2025 and is projected to reach USD 1.71 billion by 2035, witnessing around 7.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of photodiode sensors is evaluated at USD 870.96 million.

The driver behind the fueling of the photodiode sensors market is the photodiode’s diverse applications due to properties such as high sensitivity, fast rise time with low capacitance, and high gain at a low bias voltage. The responsivity of the photodiode ranges between 0.08 amp per A/W for 400 nm and 0.48 A/W for 700 nm, thus enabling the absorption of maximum photos.

Key Photodiode Sensors Market Insights Summary:

Regional Highlights:

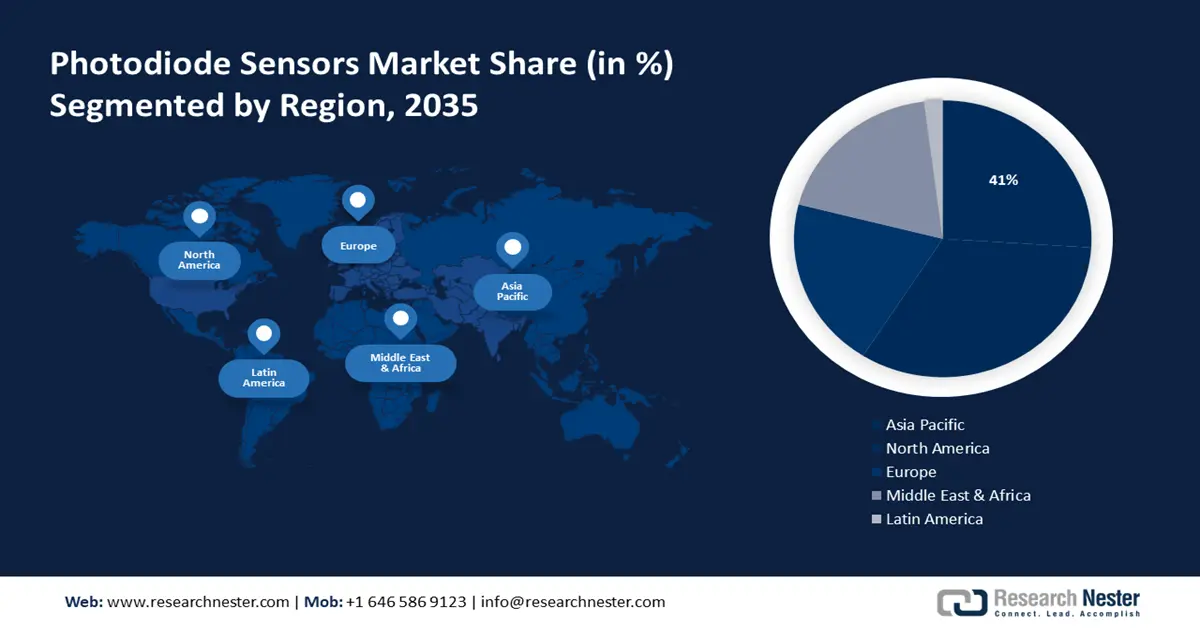

- North America photodiode sensors market will secure over 41% share by 2035, driven by growth in telecommunications, electronics, and retail sectors.

- Asia Pacific market will account for 26% share by 2035, driven by the concentration of telecom and electronics manufacturing companies.

Segment Insights:

- The silicon segment in the photodiode sensors market is expected to achieve a 52% share by 2035, driven by silicon photodiodes’ high-speed application and use in energy-efficient systems.

- The uv spectrum segment in the photodiode sensors market is expected to achieve a 33% share by 2035, fueled by quick spectrum scanning ability with diode array UV sensors.

Key Growth Trends:

- Increased use of avalanche photodiodes

- Rising demands for photodiode sensors in electronics

Major Challenges:

- Interruptions in the supply chain

- High costs

Key Players: Hamamatsu, Vishay, Edmund Optics, First Sensors, TT Electronics, ROHM Semiconductors, Quantum Devices.

Global Photodiode Sensors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 814.51 million

- 2026 Market Size: USD 870.96 million

- Projected Market Size: USD 1.71 billion by 2035

- Growth Forecasts: 7.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, China, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

Photodiode Sensors Market Growth Drivers and Challenges:

Growth Drivers

-

Increased use of avalanche photodiodes - IT and telecom have become an integral part of our modern lives and continue to be so. Avalanche photodiodes find their application in optic fiber which is the core of faster data connectivity. The 28,000 km long optic fiber cable is the cornerstone of connectivity and has the capacity to function even in extreme climatic conditions of -40℃ to 70℃. Avalanche photodiode in optical communications brings the advantage of its high power handling capacity, amplifying the weak signals, sensitivity, and a 90% quantum speed. Avalanche photodiodes also find their applications in laser microscopy like electron microscopes, optic-time domain reflectometers, etc. as an alternative to photomultiplier tubes, which is expected to fuel the growth of the photodiode sensors market globally.

-

Rising demands for photodiode sensors in electronics - Photodiode sensors find their application in a plethora of gadgets like mobile phones, digital cameras, laptops, tablets, etc. This factor is expected to boost the photodiode sensors market in the upcoming times. The consumer electronics market has a CAGR of 2.99%, with a projection of their volume touching 9014.0 pieces in 2028. Photodiode sensors, also known as photodetectors or photosensors, find their applications in medical equipment as well. They facilitate the calibration of heart rate and blood pressure, computed tomography, and sample analysis devices.

- Applications in the automotive industry - Photodiode sensors are fundamental to automobiles in both electric as well as hybrid cars. The latest cars are much more focused on sensor sensitivity, alongside improved laser technology. These allow for automatic display light adjustment per the light availability outside and also deploy wiper action post sensing the presence of water droplets. Since the automotive industry is well on its way to gaining a market size of USD 3.2 Trillion, it creates opportunities for the photodiode sensors market to strengthen its position and generate more revenue.

Challenges

-

Interruptions in the supply chain - Any disturbance in the global supply of the photodiode sensors market puts a pause on the production of medical devices, automobiles, or electronics since they are an integral part of these machines. Time and again, there have been incidents of slowing down the operations in the photodiode sensors business due to the overburden on the assembling department. Any delay in the photodiode’s supply jeopardizes the clients’ businesses.

-

High costs - High costs associated with photodiode sensors, preventing their applications in more industries may serve as a hindrance in the market. The manufacturing process of photodiode sensors is intricate, and elaborate which requires high initial investments. The addition of materials like silicon to amplify their quality further adds to the overall price.

Photodiode Sensors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.7% |

|

Base Year Market Size (2025) |

USD 814.51 million |

|

Forecast Year Market Size (2035) |

USD 1.71 billion |

|

Regional Scope |

|

Photodiode Sensors Market Segmentation:

Material

Silicon segment is poised to account for photodiode sensors market share of around 52% by 2035. Silicon photodiodes facilitate high-speed applications. The theory behind their function is that the electrical properties of this change seem to be modified upon the interference of light particles. They allow for the free flow of current in one direction and prevent its flow in the opposite direction. With a reverse breakdown voltage following a range of 70-100 V, silicon photodiodes can be modified via doping with impurities to control their conductivity. These are finding their high utilization in energy-efficient lighting systems, as well as in defense and aerospace for target detection. Augmented reality is on its way to pick up, which also depends on silicon photodiodes, which can act as a driver for this market.

Application

In photodiode sensors market, healthcare segment is estimated to hold revenue share of more than 28% by 2035. The pandemic witnessed increased use of oximeters, which work on the principle that light is absorbed by oxygen. Photodiode sensors aid in measuring the wavelengths of light absorbed by the blood, thereby producing the result. The use of sensors in medical industries, by banking on smart devices stands at USD 143.6 billion, which clearly opens up new avenues for the utilization of photodiode sensors in the healthcare industry, thereby expanding their market. The selling points of photodiodes are their low noise, reasonable costs, and the least consumption of power, consequently becoming a preferred sensor in the healthcare industry, including health-related smart gadgets.

Wavelength

By 2035, UV spectrum segment is expected to dominate photodiode sensors market share of over 33%. The diode array UV sensors help in quickly scanning the whole spectrum in milliseconds. Faster data acquisition allows for quicker scanning, with the support of modern computers. A spectrum of up to 600nm can be scanned in under 10 milliseconds with the help of the diode array UV sensors, leading to a quick retrieval of sample data.

Our in-depth analysis of the global market includes the following segments:

|

Materials |

|

|

Application |

|

|

Wavelength |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Photodiode Sensors Market Regional Analysis:

North America Market Insights

North America industry is poised to dominate majority revenue share of 41% by 2035. The market growth in the region is also expected on account of the rapidly developing telecommunications and electronics sector, alongside heavy investments in infrastructures and R&D. Photodiode sensors display high reliability in their application, finding their purpose even in the retail industry by simplifying the billing procedure via barcode scanners. The retail industry is witnessing immense growth in this region, which will drive up the demand for photodiode sensors.

In the U.S., the photodiode sensors industry has a huge opportunity for market growth. With healthcare monitoring systems seeping into every aspect of the daily lives of individuals here, there is more than ever reliance on photodiode sensors owing to the increased utilization of digital blood pressure monitors, smartwatches, etc to keep a record of health data. The healthcare industry in this country is growing at a CAGR of 7%. Under these circumstances, the photodiode sensors market is also set to grow due to the increased focus on healthcare, and the application of these sensors in the various diagnostic tools like mobile computed tomography, to diagnose health issues and prevent worsening of conditions. Another aspect is the increasing need for quicker data transmission, wherein photodiode sensors play a key role. Canada, too, is expected to witness a surge in demand for photodiode sensors due to their applications in various industries like burglary alarms, street lights, solar cell panels, etc, whose demand is only bound to increase with the increasing population.

APAC Market Insights

By 2035, Asia Pacific photodiode sensors market is poised to dominate over 26% share. Dozens of telecommunications, automobiles, and electronics manufacturing companies are concentrating in this region which will work as a driving force in expanding the photodiode sensors industry.

Globally, China stands as the market leader in the manufacture of consumer electronics, at a massive industry size of USD 218.6 Billion. The rapid acceptance of the Internet of Things, investments in the automation of factories, and focus on the expansion of fiber optics in the Asia-Pacific areas are the key propellors of the photodiode sensors market in this region. This country is also witnessing the emergence of new players in the electronics and communications industry, to provide mapping, scanning, and inspecting cloud technology, big data, artificial intelligence, etc, that rely on the performance of photodiode sensors. The expansion of the automotive sector in this country, and the presence of many automakers, with ongoing research on perfecting the LiDAR system, also are expected to back up the photodiode sensors market in the coming times. South Korea follows China in the next global position in the production of electronic goods, and also their consumption. This factor is also expected to push the market on an upward trajectory in the coming decade.

Photodiode Sensors Market Players:

- Hamamatsu

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Thorlabs

- Edmund Optics

- Excelitas Technologies

- First Sensors

- TT Electronics

- ROHM Semiconductor

- Vishay

- Quantum Devices

- Everlight Americas

Industry players are working closely to understand the constantly modifying requirements of the customers and develop sensors that promise nothing but optimized performance and accuracy. Their specialties are geared toward maintaining a consistent supply chain.

Recent Developments

- Hamamatsu - Hamamatsu has joined hands with NKT Photonics to expand its range of light sources, detectors, and lasers to another level, and accelerate business growth in the semiconductor field.

- Thorlabs - Thorlabs has completed the formalities of JMP optical acquisition, thereby further expanding its optical components. This is expected to set a new benchmark in the photonics industry.

- Report ID: 6192

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Photodiode Sensors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.