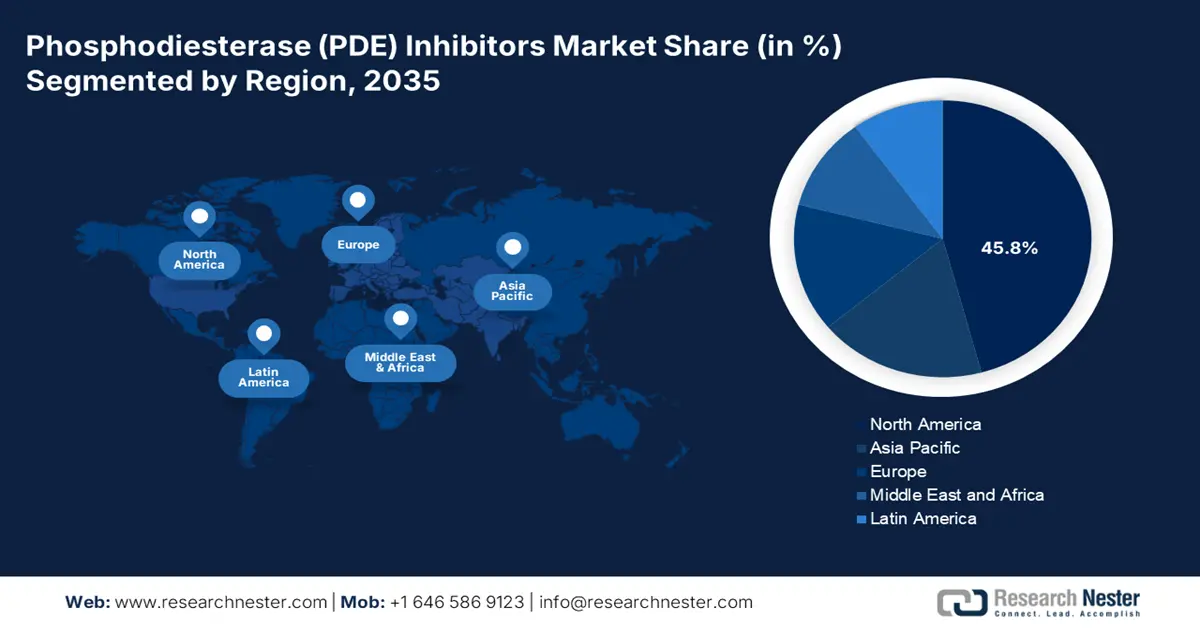

Phosphodiesterase (PDE) Inhibitors Market - Regional Analysis

North America Market Insights

The North America phosphodiesterase (PDE) inhibitors market is projected to register the highest share of 45.8% during the forecast period. The region benefits from a well-established healthcare industry and a robust government medical expenditure. The U.S. dominates the North America market owing to the high prevalence of cardiovascular diseases. According to the NLM report published in November 2022, 35 PDE inhibitors approved and authorized for marketing by the FDA or other regulatory authorities. These drugs mainly target cardiovascular diseases, respiratory diseases like COPD, inflammatory conditions, and erectile dysfunction.

The phosphodiesterase (PDE) inhibitors market in Canada is backed by strong government health care funding and increasing demand among the aging male population. As per the Canadian Urological Association, erectile dysfunction (ED) rises significantly. Increasing prevalence is fueling demand for PDE-5 inhibitors throughout the country. On the other hand, the CMA report in 2025 states that the total healthcare expenditure reached CAD 344 billion in 2023 and 12.1% of GDP is reflecting sustained federal and provincial investment in healthcare services, which, indirectly, facilitates access to ED treatments.

Asia Pacific Market Insights

Asia Pacific phosphodiesterase (PDE) inhibitors market is experiencing the fastest growth with a share of 20.2%, fueled by the advancements in the healthcare sector. Countries such as India, China, Japan, South Korea, and Malaysia are at the forefront of this growth, with rising healthcare investments and expanding access to therapeutic measures. Besides the ongoing developments in PDE inhibitors with enhanced efficacy, reduced side effects are remarkably contributing to market progression. Furthermore, the widespread availability of OTC solutions is improving patient access.

China is a key leader in the phosphodiesterase (PDE) inhibitors market with tremendous government support and an increased patient population. It is reported that the prevalence of erectile dysfunction (ED) among men aged 40 to 70 is estimated to be around 26%, based on the Frontiers article in January 2025. Numerous factors, such as urbanization, dietary changes, and increased stress levels, contribute to the disease development, further fostering a positive business environment.

Europe Market Insights

Europe is the second-largest phosphodiesterase (PDE) inhibitors market and will share a significant proportion by 2035. In 2023, the FDA, EMA, or MHRA approved 70 new medicines, including PDE Inhibitors, according to the British Journal of Pharmacology in January 2024. Most were first approved by the FDA, creating gaps between approvals because of the different regulatory processes and company strategies. One of the major trends is the adoption of generic drugs, which increases access and puts pressure on price, with innovation concentrated on next-generation, subtype-specific inhibitors.

Germany is the largest phosphodiesterase (PDE) inhibitors market in Europe. The Federal Joint Committee (G-BA) is responsible for reimbursement, and expenditure is high because of early market access to innovation. Although a dedicated budget for a PDE inhibitor is not segregated, the total market for these products is forecast to be in the hundreds of millions of euros, buoyed by Germany's robust statutory health insurance system that universally covers approved therapy, with high patient availability and stimulating phosphodiesterase (PDE) inhibitors market growth.