Phased Array Ultrasonic Testing Market Outlook:

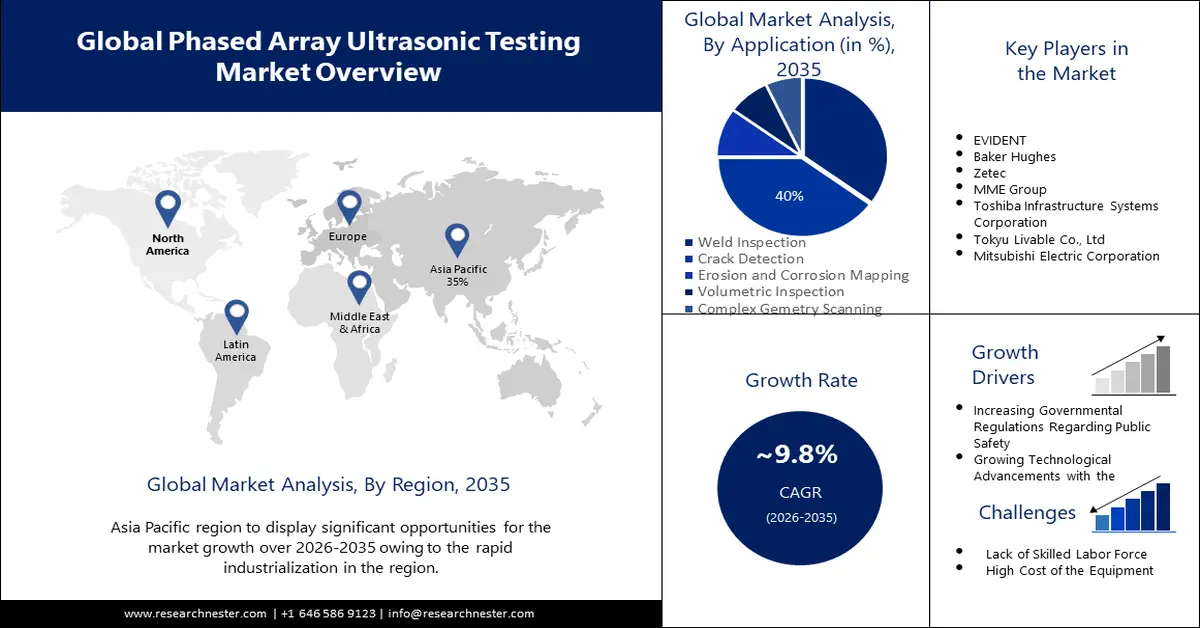

Phased Array Ultrasonic Testing Market size was over USD 970.56 million in 2025 and is projected to reach USD 2.47 billion by 2035, growing at around 9.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of phased array ultrasonic testing is evaluated at USD 1.06 billion.

The growing demand for quality control and assurance in aerospace industry is also fueling the growth of the market. Also, the expansion of aerospace industry is also fueling the growth of the market. The industry for aerospace was projected to be worth USD 255.6 Billion in 2021. In this industry, Northrop, Grumman, Lockheed, and Boeing are top key players. Companies in this industry are under constant pressure to ensure the integrity of their product and infrastructure. PAUT offers a highly effective and reliable solution for detecting defects and ensuring compliance with industry standards.

In addition, PAUT provides improved inspection capabilities over conventional ultrasonic testing techniques. Inspectors can better regulate and focus the inspection process with PAUT's electrical manipulation of the ultrasonic beam. As a result, lesser flaws are detected with greater accuracy. It is a unique non-destructive technology that uses a set of (UT) ultrasonic testing prepared of many small components, individually throbbed independently computed timing with the computer. Therefore, these factors are propelling the growth of the market.

Key Phased Array Ultrasonic Testing Market Insights Summary:

Regional Highlights:

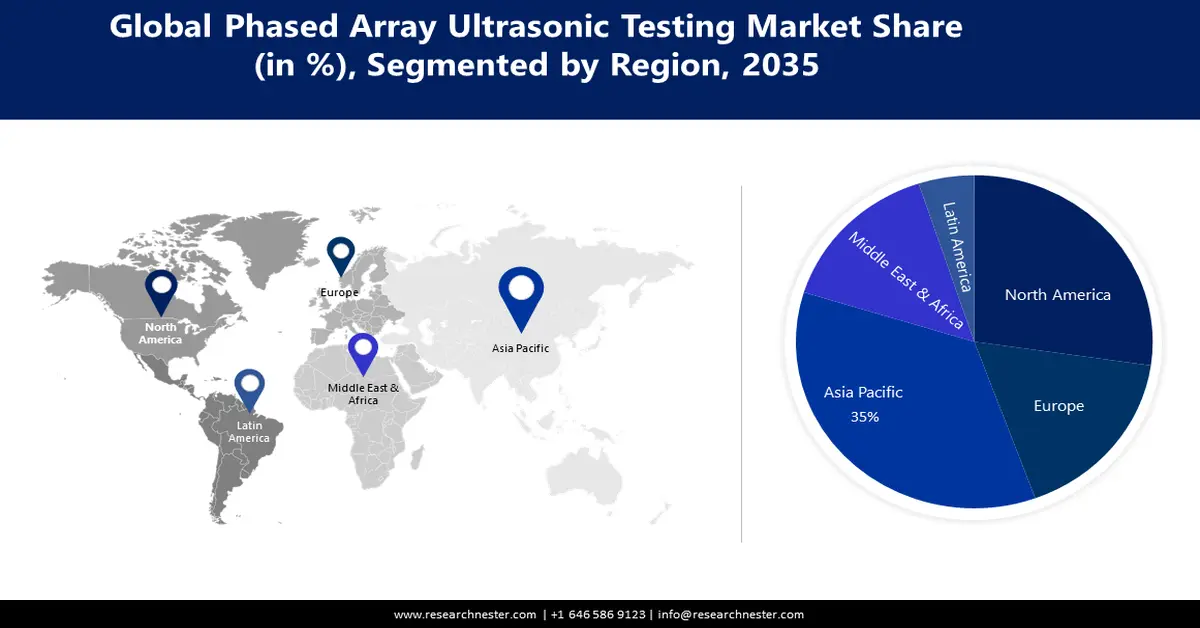

- Asia Pacific phased array ultrasonic testing market achieves a 35% share by 2035, driven by industrial and infrastructure expansion.

- North America market will attain a 27% share by 2035, attributed to increased demand for advanced inspection techniques.

Segment Insights:

- The crack detection segment in the phased array ultrasonic testing market is expected to hold a 40% share by 2035, fueled by the need for precise and effective fracture detection techniques.

- The oil & gas segment in the phased array ultrasonic testing market is projected to achieve a 34% share by 2035, attributed to the increasing importance of ultrasonic testing for preventative maintenance.

Key Growth Trends:

- Increasing Governmental Regulations Regarding Public Safety

- Growing Technological Advancements with the Integration of AI and Machine Learning

Major Challenges:

- Lack of Skilled Labor force

- High Cost of the Equipment may Hinder the Growth of the Market

Key Players: Vermon NDT, LLC, EVIDENT, Baker Hughes, Zetec, MME Group, Toshiba Infrastructure Systems Corporation, Tokyu Livable Co., Ltd, Mitsubishi Electric Corporation, Hitachi Power Solutions Co., Ltd., NIHON SEALAKE CO., LTD.

Global Phased Array Ultrasonic Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 970.56 million

- 2026 Market Size: USD 1.06 billion

- Projected Market Size: USD 2.47 billion by 2035

- Growth Forecasts: 9.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 16 September, 2025

Phased Array Ultrasonic Testing Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Governmental Regulations Regarding Public Safety - The main drivers of the market's expansion are the expanding complexity of machinery, the need for ever-stricter product usage criteria, the ongoing enforcement of government laws ensuring worker safety, and the growing demands for quality control. Governments around the world have imposed strict safety standards in response to past instances of infrastructure failures, such as nuclear refinery leaks, pipeline explosions, and refinery blasts. This has increased demand for phased array ultrasonic testing and services.

-

Growing Technological Advancements with the Integration of AI and Machine Learning - The phased array ultrasonic testing market is expanding as a result of PAUT systems' use of AI and machine learning (ML). Additionally, the greatest segment of the AI industry is machine learning. By 2030, this industry is projected to increase from about 140 billion dollars to almost two trillion dollars. Large volumes of data may be analyzed by AI and ML, which can then be used to learn and improve inspection efficiency and accuracy. Additionally, the market is growing faster thanks to the creation of sophisticated imaging algorithms. These algorithms aid in producing precise and in-depth pictures of the things under inspection. By evaluating the ultrasonic waveforms, these algorithms can provide exact images that identify faults, fissures, or other irregularities.

-

Increased Efficiency Provided by PAUT - The enhanced effectiveness and expedited inspection durations given by PAUT. Inspectors can scan bigger areas faster since the ultrasonic beams can be electrically controlled. This increases productivity and saves time, enabling the completion of more inspections in less time. Phased array ultrasonic testing will also become more and more popular worldwide due to the growth of the petrochemical and oil and gas industries. In 2021, the global petrochemical production capacity was close to 2.3 billion metric tons. It is anticipated to increase dramatically by 2030, with Iran, China, and India having the biggest stated or planned petrochemical capacity expansions. It is projected that the market for phased array ultrasonic testing will be driven by reducing damage generation.

Challenges

-

Lack of Skilled Labor force - More and more people are in need of ultrasonic testing services than ultrasonic testing equipment. It has also become critical for players to expand their worldwide reach while simultaneously developing a highly skilled labor force capable of delivering efficient ultrasonic testing and inspection services. Thus, having personnel that is qualified and equipped with the necessary ultrasonic testing and inspection skills is a strategic concern for businesses. The need for skilled labor is growing as a result of strict government restrictions and the complexity of ultrasonic testing methods. As a result, this element could impede market expansion.

-

High Cost of the Equipment may Hinder the Growth of the Market

-

Complex Nature of the Technology may become Hindrance for the Growth of the market.

Phased Array Ultrasonic Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.8% |

|

Base Year Market Size (2025) |

USD 970.56 million |

|

Forecast Year Market Size (2035) |

USD 2.47 billion |

|

Regional Scope |

|

Phased Array Ultrasonic Testing Market Segmentation:

Application Segment Analysis

Crack detection segment for phased array ultrasonic testing market is expected to hold the largest share of 40% by the end of 2035. Because fractures can seriously affect the performance and safety of materials and structures, the market in crack detection segment is expanding. Early crack detection is essential to avert failures and guarantee the integrity of important components. Phased array ultrasonic testing is also a major tool used in the power generating, automobile, and aerospace industries for fracture identification. The need for high-performance, lightweight materials has grown, which has increased the requirement for precise and effective fracture detection techniques. Phased array ultrasonic testing offers a trustworthy method for identifying and assessing data. As a result, this element is driving the segment's expansion. Therefore, these factors are propelling the growth of the segment.

End-use Segment Analysis

Phased array ultrasonic testing market from the oil & gas segment is expected to hold a share of 34% during the forecast period. In the oil & gas sector, ultrasonic testing is becoming more and more significant. It emphasizes frequent and thorough inspections more because of the vast network of pipelines, storage facilities, and other vital facilities; additionally, because of the industry's high stakes and inherent dangers. The oil and gas sector works in harsh environments, like rural areas and offshore platforms, where it may be expensive or difficult to apply conventional inspection techniques. Faster inspection times and better flaw detection are made possible by the more effective and efficient solution offered by phased array ultrasonic testing. In the oil and gas sector, preventative maintenance and asset integrity management are also becoming more and more important. Phased array ultrasonic testing is essential for spotting possible concerns before they become more serious ones, which helps to save downtime and guarantee operational effectiveness.

Our in-depth analysis of the global phased array ultrasonic testing market includes the following segments:

|

Technology |

|

|

Application |

|

|

End-use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Phased Array Ultrasonic Testing Market Regional Analysis:

APAC Market Insights

Phased array ultrasonic testing market for Asia Pacific is expected to hold the largest share of 35% during the projected period. The growth can be attributed to the rapid industrialization and infrastructure development ongoing in countries like China, India, and Japan. These countries have a significant presence in industries such as manufacturing, automotive, aerospace, and energy, which require reliable and efficient inspection techniques. As these industries strive for higher quality control and safety standards, there is an increasing demand for advanced inspection technologies like phased array ultrasonic testing. Additionally, the growing importance of non-destructive testing methods in ensuring the integrity and reliability of materials and structures has contributed to the market growth in the region.

North American Market Insights

North American phased array ultrasonic testing market is poised to hold a share of 27% during the foreseen period. The region's stronghold in industries including manufacturing, aerospace, automotive, and energy is the main contributing element. For the infrastructure and goods in these industries to be safe and of high quality, sophisticated inspection methods are needed. Additionally, phased array ultrasonic testing has a lot of advantages over conventional inspection techniques. It makes it possible to inspect complex geometric shapes more quickly and with greater accuracy. Because of this, businesses in North America are using this technology more frequently to improve their inspection procedures and uphold strict standards.

Phased Array Ultrasonic Testing Market Players:

- Vermon NDT, LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- EVIDENT

- Baker Hughes

- Zetec

- MME Group

- Toshiba Infrastructure Systems Corporation

Recent Developments

- The brand-new online store, www.pautprobes.com, has been launched by Vermon NDT, a prominent producer of Phased Array Ultrasonic Testing (PAUT) probes. Through quicker and simpler access to a large selection of premium PAUT probes, this cutting-edge website is redefining the way nondestructive testing (NDT) experts acquire their equipment worldwide.

- The field-proven phased array ultrasonic testing (PAUT) product line from Olympus gains enhanced power and performance with the introduction of the OmniScanTM X3 64 fault detector. This 64-channel instrument has the pulser capacity to drive phased array (PA) probes with a larger number of elements, boosting the data gathering speed for total focusing method (TFM) imaging. Its enhanced capabilities can be used by users to broaden and diversify the applications they use.

- Report ID: 5586

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.