Pharmacy Market Outlook:

Pharmacy Market was valued at USD 1.7 trillion in 2025 and is projected to reach USD 3.4 trillion by the end of 2035, rising at a CAGR of 7.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of pharmacy is assessed at USD 1.8 trillion.

The growing demand for prescription drugs, over-the-counter medications, and the increasing prevalence of chronic diseases are readily driving business in the global market. This can be testified by the report from the World Health Organization, which was published in December 2024, that states that noncommunicable diseases (NCDs) caused 43 million deaths in 2021, which represents 75% of global non-pandemic deaths. It also highlighted that premature NCD deaths before the age of 70 reached 18 million, out of which 82% occur in low and middle-income countries. Further cardiovascular diseases, cancers, and respiratory conditions are also on the rise, creating a sustained market demand for long-term medications.

Furthermore, there has been a rising pharmaceutical access, which is highly essential for the availability of timely medication and healthcare support across all nations. Therefore, a study was conducted by the Journal of American Pharmacists Association in December 2022 that found that in the U.S., there are 61,715 pharmacies, out of which 61.5% i.e., 37,954, are chains and 38.1% (23,521) are regional franchises or independently owned. It further observed that a small fraction, i.e., 0.4% i.e., 240, is government operated. Also, 48.1% of individuals dwell within 1 mile of a pharmacy, reflecting greater opportunities for market expansion through enhanced pharmacy networks.

Key Pharmacy Market Insights Summary:

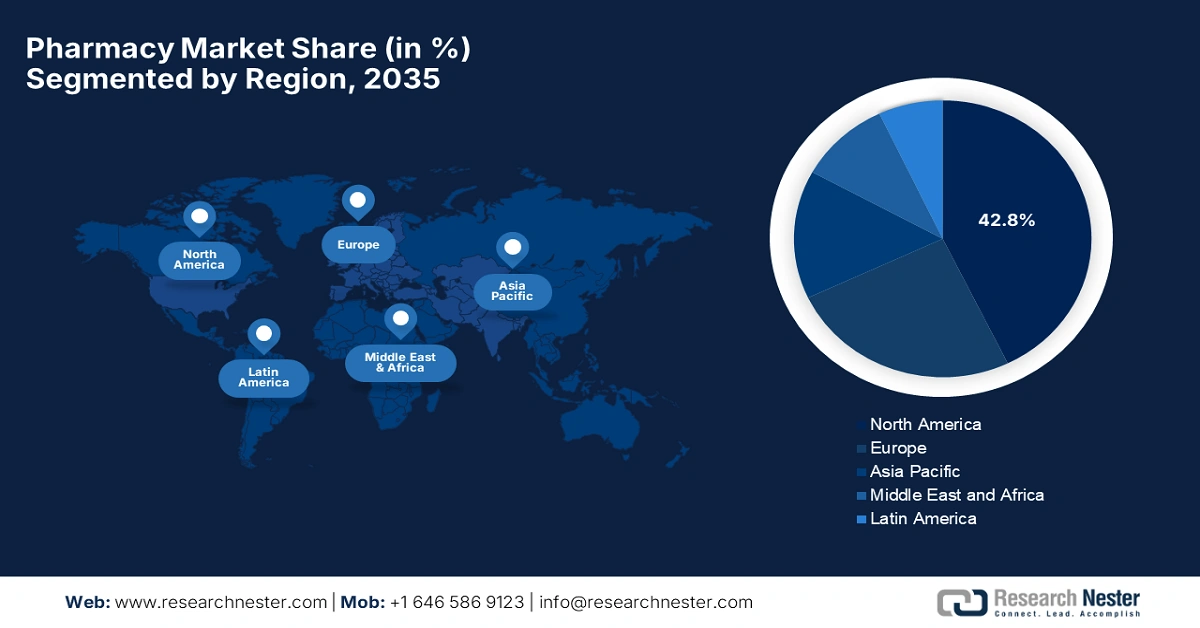

Regional Insights:

- By 2035, North America is anticipated to command a 42.8% share of the Pharmacy Market, owing to its advanced healthcare infrastructure and steady demand for pharmacy services.

- Asia Pacific is projected to witness the fastest expansion from 2026–2035, as a result of growing aging populations, rising chronic disease burdens, and improving healthcare infrastructure.

Segment Insights:

- The prescription drugs segment is projected to secure a 63.5% share by 2035 in the Pharmacy Market, propelled by rising disease prevalence and increasing demand for specialty therapies.

- The retail pharmacy segment is set to achieve notable growth by 2035, supported by its extensive physical presence, expanded consultation services, and strengthened staffing through strategic collaborations.

Key Growth Trends:

- Expansion of e-pharmacy and emergence of digital health platforms

- Rising aging demographics

Major Challenges:

- Continuously exacerbating drug costs

- Lack of skilled workforce

Key Players: Pfizer Inc., Novartis AG, Merck & Co., Inc., Johnson & Johnson, Roche Holding AG, AbbVie Inc., Sanofi, Bristol Myers Squibb, AstraZeneca PLC, GlaxoSmithKline plc, Gilead Sciences, Inc., Eli Lilly and Company, Amgen Inc., Novo Nordisk A/S, Teva Pharmaceutical Industries Ltd.

Global Pharmacy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.7 trillion

- 2026 Market Size: USD 1.8 billion

- Projected Market Size: USD 3.4 billion by 2035

- Growth Forecasts: 7.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Indonesia, Mexico

Last updated on : 17 September, 2025

Pharmacy Market - Growth Drivers and Challenges

Growth Drivers

-

Expansion of e-pharmacy and emergence of digital health platforms: The rapid adoption of e-pharmacies influenced by the consumer demand for convenience is reshaping the foundation of the global market. For instance, in February 2024 WHO announced the launch of the Global Initiative on Digital Health (GIDH) with a key focus on national transformation with a network of governments, institutions, and technical agencies aimed at advancing digital health systems worldwide. The effort marks a significant step toward more inclusive, sustainable, and technology-driven global health systems.

-

Rising aging demographics: The global market is readily expanding on account of a rising aging demographics. There has been a consistent surge in age-related health conditions that has drawn the interest of nationwide leaders to make investments in this sector. For instance, as per a December 2023 Research in Social and Administrative Pharmacy article, over 55% of aged adults demonstrated satisfaction with pharmacist and doctor-led medication services. The study also highlighted the rising demand for pharmacist-led support in aging populations, hence reflecting a strong potential for pharmacies to capitalize on this sector.

- Integration of pharmacists into primary healthcare teams: This has been a principal driver for the pharmacy market, which drives a steady cash influx into the sector. In this context, the study by the National Institute of Health in September 2024, which combined four focus groups and nine interviews, identified six key themes around pharmacy integration. Stakeholders primarily associated integration with collaboration, communication, and cooperation. While community pharmacies were viewed positively, reinforcing their value within healthcare systems.

Medicare Part D Prescription Drug Spending from 2012 to 2021

|

Year |

Total gross spending (USD billions) |

Total prescription claims (USD millions) |

Average cost per prescription claim USD (95% CI) |

|

2012 |

106.0 |

1,125.4 |

962.94 (794.76-1,131.12) |

|

2013 |

124.1 |

1,308.7 |

1,248.09 (1,042.42-1,453.77) |

|

2014 |

146.0 |

1,400.3 |

1,370.86 (1,168.77-1,572.95) |

|

2015 |

162.2 |

1,446.7 |

1,676.25 (1,450.29-1,902.21) |

|

2016 |

162.6 |

1,444.7 |

1,742.16 (1,513.21-1,971.11) |

|

2017 |

165.8 |

1,394.9 |

2,241.67 (1,923.41-2,559.92) |

|

2018 |

180.0 |

1,455.8 |

2,600.91 (2,241.06-2,960.76) |

|

2019 |

194.5 |

1,493.1 |

2,983.55 (2,540.41-3,426.70) |

|

2020 |

202.4 |

1,496.6 |

3,170.71 (2,741.27-3,600.15) |

|

2021 |

215.7 |

1,500.4 |

3,327.63 (2,906.91-3,748.35) |

|

Change 2012-2021, % |

103.5 |

33.3 |

245.6 |

|

CAGR, % |

8.2 |

3.2 |

14.8 |

Source: NLM, December 2024

Challenges

-

Continuously exacerbating drug costs: Despite the existence of heightened demand, the pharmacy market still faces disparities in terms of exacerbated drug expenses. This makes it challenging for both consumers and service providers since it can limit adoption among patients from price-sensitive regions. Therefore, pharmaceutical firms witness significant disparities in operations, making it inaccessible. In the U.S., 23.8% of prescribed patients lack access due to the aspect of huge medical expenses.

-

Lack of skilled workforce: The market is expanding at a rapid pace, resulting in a shortage of qualified pharmacists and pharmacy technicians. The existence of this obstacle can significantly disrupt the workflow by reducing service quality, thereby negatively influencing patient safety as well. Therefore, these workforce shortages need to be addressed in order to maintain efficient pharmacy operations and support expanding healthcare roles. Hence, the challenge underscores the need for improved training and retention strategies.

Pharmacy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.6% |

|

Base Year Market Size (2025) |

USD 1.7 trillion |

|

Forecast Year Market Size (2035) |

USD 3.4 trillion |

|

Regional Scope |

|

Pharmacy Market Segmentation:

Type Segment Analysis

Prescription drugs segment is predicted to garner the largest share of 63.5% in the pharmacy market during the forecast timeline. The rising disease prevalence and growing demand for specialty therapies are the key factors reinforcing the segment’s dominance in this field. This can be testified by the CDC survey of National Health Statistics Reports published in September 2024 that observed that in the U.S., 88.6% of adults who are aged above 65 took prescription drugs from 2021 to 2022, with higher use among those with chronic conditions, hence denoting a wider segment scope.

Distribution Channel Segment Analysis

Retail pharmacy segment is projected to experience a lucrative growth in the market by the end of 2035. The segment’s growth is subject to extensive physical presence, expanded consultation services, and immediate access. Also, the profitable collaborations between organizations are blooming growth in the segment. In February 2025, CVS Pharmacy, in collaboration with Duquesne University, declared the launch of a Tuition Advantage program to address the national pharmacist shortage. It also underscored that the initiative offers reduced-cost Pharm.D. education to CVS employees, strengthening the retail pharmacy segment by improving staffing and service accessibility.

Therapeutic Area Segment Analysis

Cardiovascular segment is expected to grow with a significant share in the pharmacy market during the discussed timeline. The growth in the segment originates from increasing disease occurrence, personalized interventions, and medication adherence programs. Therefore, the study published by WHO in July 2025 outlined that increased access to essential medications such as aspirin, beta-blockers, ACE inhibitors, statins, and others is highly essential for management of timely and efficient management of cardiovascular diseases, hence denoting a positive market outlook.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Distribution Channel |

|

|

Therapeutic Area |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pharmacy Market - Regional Analysis

North America Market Insights

North America market holds a dominant position with the largest share of 42.8% by the end of 2035. The region’s leadership in this field is attributed to its advanced healthcare infrastructure and consistent demand for pharmacy services. The region is also paving the way towards enhancing pharmacy accessibility, wherein in January 2025, Walmart Inc. notified the launch of Same-Day Pharmacy Delivery service across 49 states in the U.S. in a single online order, which is powered by AI, geospatial tools, and cloud-based platforms. The company received support from over 15,000 pharmacists, thereby creating an optimistic market opportunity.

U.S. is augmenting its leadership in the regional market on account of growing demand for long-term prescriptions and robust research infrastructure. Besides, the country hosts substantial technological advances with the emergence of AI, automation, and home delivery options. Therefore, in June 2025, Walgreens Boots Alliance, Inc. celebrated its major milestone in the U.S. retail pharmacy, productively marking three years of its clinical trials initiative, which is the longest-standing clinical research commitment by any retail pharmacy in the country. Such instances transform pharmacies into community research hubs, thereby enhancing accessibility, supporting innovation in drug development.

There is a huge opportunity for the market in Canada, extensively facilitated by the expansion of retail and clinic-based pharmacy models. The country also benefits from supportive administrative bodies facilitating suitable reimbursements. For instance, in June 2025, Astellas Pharma Canada, Inc. declared that its XTANDI (enzalutamide), an androgen receptor pathway inhibitor, is reimbursed and is currently funded under the Ontario Drug Benefit Program’s Exceptional Access Program. Hence, these enhanced reimbursements and faster patient access to efficacious treatments will foster a favorable business environment in Canada.

Pharmaceutical and Prescription Drug Expenditure Data in 2023

|

Category |

U.S. (2023) |

Canada (2023) |

|

Total Expenditure |

USD 722.5 billion (↑13.6% vs. 2022) |

Prescription drug expenditures ↑12.9% (return to pre-pandemic trend) |

|

Drivers of Growth |

• Utilization ↑6.5% |

• Higher-cost medicines (drug-mix effect) avg. 6.3% (2018–2023), peaked at 9.2% in 2023 |

|

Top Drugs |

1. Semaglutide |

Not specified (but growth driven by high-cost drugs) |

|

Hospital & Clinic Expenditures |

• Nonfederal hospitals: USD 37.1B (↓1.1%) |

Not applicable (focus on private plans only) |

Source: Government of Canada, February 2025, NLM July 2024

APAC Market Insights

Asia Pacific market is likely to exhibit the fastest growth from 2026 to 2035. The region’s progress in this field is highly attributed to the growing aging populations, rising chronic disease prevalence, and improving healthcare infrastructure. Besides the prominent countries, China, India, and Japan each contribute uniquely to this robust expansion. The region also benefits from increasing demand for prescription medications, OTC products, and expanding retail pharmacy networks, thereby positioning Asia Pacific as the critical leader in the pharmacy industry.

China has become the prime focus for investors around the global pharmacy market due to its evolving healthcare ecosystem. Besides, the country hosts ample government healthcare reforms and expanded insurance coverage, thereby benefiting both service providers and consumers. In this regard, Lupin Limited in June 2025 declared that it entered into a strategic alliance with Sino Universal Pharmaceuticals for the commercialization of its benchmark product called Tiotropium Dry Powder Inhaler (DPI) in China, targeting chronic obstructive pulmonary disease (COPD) treatment. Therefore, this collaboration is all set to drive the country’s market with improved access.

India is gaining enhanced traction in the regional market owing to its large population and rising healthcare awareness. The country receives mounting government support for improving medical accessibility across the nation has spurred the pharmaceutical sector. Therefore, the Pharmaceutical Industry report published in February 2025 by the India Brand Equity Foundation states that the Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP) achieved sales of Rs. 1,000 crore (USD 119 million) in October 2024, which underscores its potential in expanding affordable generic medicines. Hence, such events strengthen the country’s potential in this field, ultimately benefiting the overall market.

Europe Market Insights

Europe is the key player in the global market, readily accountable to its strong healthcare infrastructure and rising burden of chronic diseases. The region also benefits from a well-established regulatory framework and an increased adoption of exclusive pharmaceutical technologies. For instance, in January 2024, Boehringer Ingelheim announced that it is expanding its manufacturing plant in Koropi, Greece, with a total investment of EUR 120 million. The company plans to increase production capacity for both new and existing medications. Hence, such moves will productively boost the domestic economy and employment as well.

Germany stands at the forefront of growth in the regional pharmacy market due to the existence of robust R&D investments and a large export hub. The country’s focus on innovation and digital health integrations also contributes to development in this field. For instance, in February 2025, Isotopia, in partnership with DSD Pharma, notified the launch of Isoprotrace in Germany with a great focus on efficient and reliable delivery of Isoprotrace to hospitals, clinics, and diagnostic centers across the country’s vast geography, hence positively impacting the country’s healthcare sector.

France holds a strong position in Europe market, which is gaining enhanced recognition facilitated by the increasing foreign investments and a focus on sustainability. This heightened demand has encouraged players to undertake strategic initiatives, thereby fostering a profitable business environment. In February 2025, STRATACACHE declared that it acquired SNED, which is a France-based LED solutions specialist focused on pharmacy displays and signage as well. This acquisition will support STRATACACHE’s operations across France and the Benelux region, hence making it suitable for standard market development.

Pharmacy Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis AG

- Merck & Co., Inc.

- Johnson & Johnson

- Roche Holding AG

- AbbVie Inc.

- Sanofi

- Bristol Myers Squibb

- AstraZeneca PLC

- GlaxoSmithKline plc

- Gilead Sciences, Inc.

- Eli Lilly and Company

- Amgen Inc.

- Novo Nordisk A/S

- Teva Pharmaceutical Industries Ltd.

The worldwide pharmacy market is witnessing intensifying competition between the pioneers across all nations who are driving patient care through digital transformation and strategic partnerships. In response to the heightened demand, players are readily expanding into the prime regions such In July 2025, CVS Health inaugurated a new 13,000 sq. ft. CVS Pharmacy in Philadelphia with exclusive pharmaceutical services and modern amenities. Therefore, this expansion strengthens the company’s presence in urban healthcare, thereby attracting more players to make investments in this field.

Here is the list of some prominent players operating in the market:

Recent Developments

- In July 2025, Walgreens Boots Alliance declared that it had finished its investment in Sinopharm Holding GuoDa Drugstores, which is a major pharma chain in China. The company also underscored that it acquired a 40% minority stake through a capital increase of around USD 416 million.

- In December 2024, Cencora announced the launch of Accelerate Pharmacy Solutions, which is a unified portfolio designed to support hospitals and health systems. The platform productively integrates pharmacy, supply chain, and financial performance, thereby enhancing patient care.

- Report ID: 4435

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pharmacy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.