Pharmaceutical Packaging Market Outlook:

Pharmaceutical Packaging Market size was over USD 150.7 billion in 2025 and is projected to reach USD 447.57 billion by 2035, growing at around 11.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of pharmaceutical packaging is evaluated at USD 166.3 billion.

This can be attributed to the growing health concerns and the increased use of medicines worldwide. Further there has been rise in adoption of generic drugs which is also estimated to boost the growth of the market over the forecast period. Currently, 90% (9 out of 10) of all prescriptions written in the United States are for generic medications. Since it is necessary to pack and safeguard medications during storage and transportation, this packaging plays a significant part in the manufacturing of generic medications. Consequently, the use of pharmaceutical packaging would increase as the demand for generic medications rises.

Additionally, the manufacturing of novel drugs is also estimated to drive the market growth. The novel medicine packaging method has prefilled inhalers and syringes, which are single-dose vaccination units. The prefilled inhalers and syringes are made to prevent the packed medications from coming into direct touch with the patient or the environment, preventing contamination. By allowing for a self-administered metered dosage, it also decreases waste and increases patient compliance. Also, large number of pharmaceutical companies are shifting towards sustainable packaging owing to the growing concern for environment. They are extensively using recyclable materials and biodegradable packaging for packaging. One of the most extensively used material is polyethylene terephthalate by pharmaceutical companies. Hence owing to the rising adoption of sustainable packaging the market is estimated to boost further.

Key Pharmaceutical Packaging Market Insights Summary:

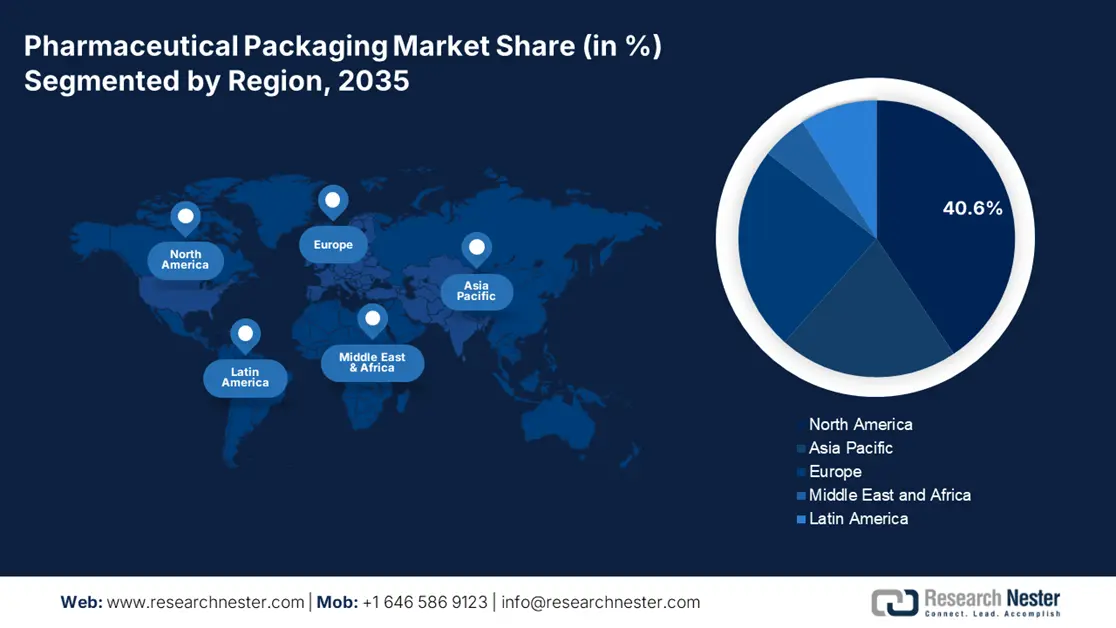

Regional Highlights:

- North America pharmaceutical packaging market will secure around 40.6% share by 2035, driven by reshoring of pharmaceutical manufacturing, increased production facilities, and rising government spending on medicines.

- Asia Pacific market will experience the fastest growth during the forecast timeline, driven by rising healthcare spending and growing awareness of zero waste packaging.

Segment Insights:

- The plastic segment in the pharmaceutical packaging market is anticipated to hold the largest share by 2035, driven by its growing preference for packaging of tablets, capsules, and liquid doses like syrups.

- The primary segment in the pharmaceutical packaging market will command the largest share, fueled by its role in protecting products and providing consumer information over the forecast period 2026-2035.

Key Growth Trends:

- Increasing World Medical Expenditure

- Increased Government Spending on Healthcare

Major Challenges:

- Growth in Counterfeit Pharmaceutical Drugs

- Breakages, Spillage and Improper Handling

Key Players: Becton, Dickinson, and Company, Amcor plc, AptarGroup, Inc., Drug Plastics Group, Gerresheimer AG, Schott AG, Owens Illinois, Inc., West Pharmaceutical Services, Inc., Berry Global, Inc., WestRock Company, SGD S.A.

Global Pharmaceutical Packaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 150.7 billion

- 2026 Market Size: USD 166.3 billion

- Projected Market Size: USD 447.57 billion by 2035

- Growth Forecasts: 11.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 10 September, 2025

Pharmaceutical Packaging Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing World Medical Expenditure – People are spending more money than ever on healthcare to prevent sickness as modern healthcare facilities and better diagnostics evolve. In the United States, health spending and funding (per capita, current prices) grew from USD 11859.2 in 2020 to USD 12318.1 in 2021, according to the OECD.

-

Increased Government Spending on Healthcare – The figures for the U.S. showed that government spending on healthcare increased by nearly 35% in 2020, a major increase from the 6% growth in 2019. This expansion was more rapid in part because of the COVID-19 epidemic.

-

A Marked Rise in the Frequency of Chronic Diseases – Diseases which often require a long, undergoing treatment and are generally incurable are called chronic diseases. They often require regular medication to manage symptoms. According to the CDC, 6 out of 10 people in the U.S. have at least one chronic disease, such as heart disease, diabetes, stroke or cancer.

-

Better and Safer Supply Chains – Better supply chains will reduce costs, and enhance the reach and use of pharmaceutical products, directly benefitting the pharmaceutical packaging market. Furthermore, pharma products need a proper cold chain logistics to cover a long distance, and it is expected to drive the growth of the market. Post-pandemic, the world has realized the importance of better supply chains, and over 60% of businesses feel they have a competitive advantage thanks to supply chain management.

-

Increased Use of Pharma Products Post-Pandemic – According to Our World in Data, 67.9% of the total people in the world have received at least the first dose of the COVID vaccine. Over 12.71 billion doses have been used all over the world, and 3.5 million doses are being used per day. Each vaccine is contained inside a glass vial, and the pharmaceutical packaging market is benefitting from it.

Challenges

-

Growth in Counterfeit Pharmaceutical Drugs - A counterfeit pharmaceutical medication is purposefully and illegally mislabeled in terms of its identity. Pharmaceutical products that are phoney may have the proper components, the incorrect ingredients, no active ingredients, the incorrect ingredients with an incorrect amount of an active ingredient, or fraudulent packaging. With the prevalence of fake goods increasing, the market for pharmaceutical packaging is facing a significant obstacle.

-

Breakages, Spillage and Improper Handling

-

Maintaining Sustainability and Preventing Environmental Harm

Pharmaceutical Packaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.5% |

|

Base Year Market Size (2025) |

USD 150.7 billion |

|

Forecast Year Market Size (2035) |

USD 447.57 billion |

|

Regional Scope |

|

Pharmaceutical Packaging Market Segmentation:

Material

The global pharmaceutical packaging market is segmented and analyzed for demand and supply by material into plastic, glass, metal, paper, and others. Out of which the plastic segment is anticipated to hold the largest market share over the forecast period. The growth of this segment can be attributed to its growing preference for packaging of tablets and capsules. Further, they also extensively used for packing liquid dose like syrups, and nasal. Approximately 19% of the weight of all pharmaceutical packaging is currently made up of plastic. Plastics are a diverse set of rigid composite materials that are primarily organic and that could be cast, molded, or directly polymerized into form, typically by applying pressure and heat separately or in combination. They benefit from being light in weight, simple to process, break resistant, tamper proof, pilfer proof, and corrosion resistant. Hence their demand in pharmaceutical companies for packaging is estimated to boost.

Type

The global pharmaceutical packaging market is also segmented and analyzed for demand and supply by type into primary and secondary. Amongst these segments, the primary segment is anticipated to generate the largest revenue in the market. Primary packaging, often known as retail packaging or POS (Point-of-Sale) packaging, is the package that comes into direct touch with the product. Primary packaging's major goals are product preservation and consumer education. In order to shield the product from the environment, it is typically composed of materials that are impermeable to air, light, and moisture. It is foremost procedure in packaging of medicine and hence can’t be avoided. Therefore, owing to the growth of the segment is anticipated to increase.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Material |

|

|

By Product Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pharmaceutical Packaging Market Regional Analysis:

North American Market Insights

North America region is poised to dominate around 40.6% market share by 2035, driven by reshoring of pharmaceutical manufacturing, increased production facilities, and rising government spending on medicines. However, the market in Asia Pacific region is to grow faster over the forecast period. This is anticipated by growing spending on healthcare in this region. For instance, the APAC region's average healthcare benefit cost trend increased from about 5% in 2020 to approximately 10% in 2021 before falling to about 4% in 2022. Costs are anticipated to increase by an estimated 11% in 2023.Furthermore, the surging awareness related to the zero waste packaging in the pharma industry is further predicted to boost the market’s growth in the region.

Pharmaceutical Packaging Market Players:

- Becton, Dickinson, and Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amcor plc

- AptarGroup, Inc.

- Drug Plastics Group

- Gerresheimer AG

- Schott AG

- Owens Illinois, Inc.

- West Pharmaceutical Services, Inc.

- Berry Global, Inc.

- WestRock Company

- SGD S.A.

Recent Developments

-

Gerrsheimer AG has greatly increased the amount of glass and plastic it can produce in India. In the Kosamba location, a new cutting-edge facility was constructed to manufacture high quality plastic containers and closures, with cutting-edge, environmentally friendly furnace technology.

-

SGD S.A. launches of 100ml Ready-to-Use (RTU) Type I molded glass vials for aseptic fill/finish of parenteral medicinal formulations. It is the first product of its sort in an EZ-fill tray arrangement from a renowned glass packaging supplier.

- Report ID: 4616

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pharmaceutical Packaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.