Pharmaceutical Contract Manufacturing and Research Services Market Outlook:

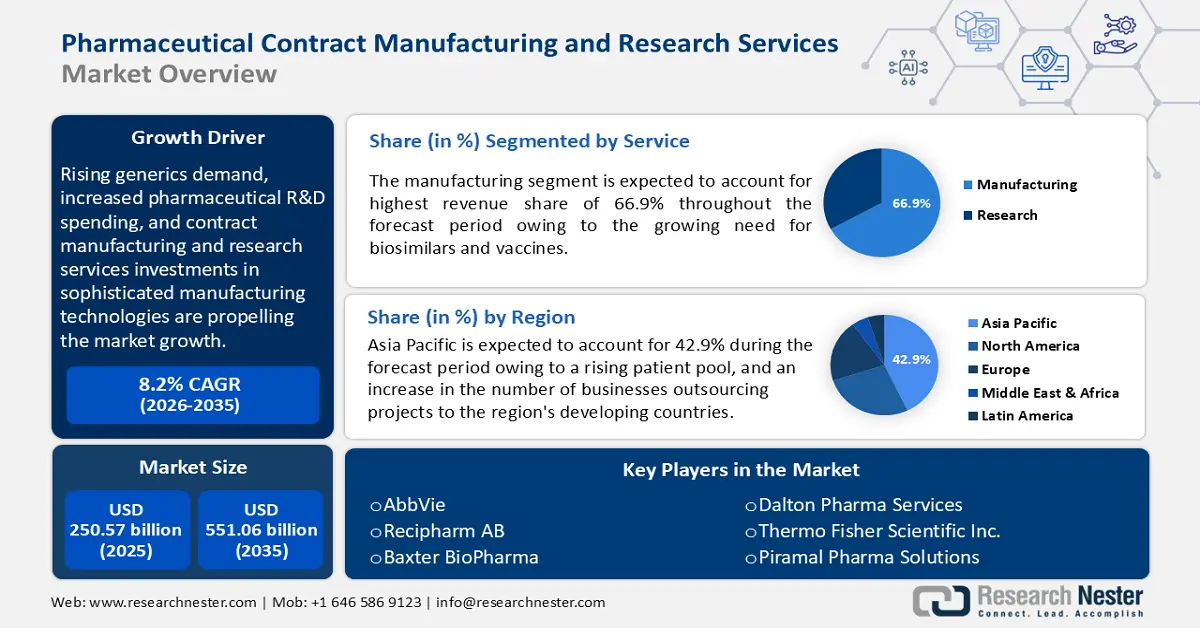

Pharmaceutical Contract Manufacturing and Research Services Market size was valued at USD 250.57 billion in 2025 and is set to exceed USD 551.06 billion by 2035, expanding at over 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of pharmaceutical contract manufacturing and research services is estimated at USD 269.06 billion.

Rising generics demand, increased pharmaceutical R&D spending, and contract manufacturing and research services investments in sophisticated manufacturing technologies are propelling the market forward. According to a report by Research Nester, in 2023, more than 5,500 pharmaceutical businesses had active R&D pipelines. Growing demand for biological therapies, a greater emphasis on specialty medicines, nuclear medicine sector expansion, and advances in cell and gene therapies are all expected to drive pharmaceutical contract manufacturing and research services market growth in the coming years.

Active Pharmaceutical Ingredient (API) CMOs are focused on navigating value chain challenges and ensuring best quality practices including Current Good Manufacturing Practice (CGMP) using corrective and preventative action (CAPA) by the FDA. In October 2023, Farmabios gained AIFA's current Good Manufacturing Practices (cGMP) approval to extend its production of Highly Potent APIs (HPAPIs), steroids, generics, and CDMO services.

Key Pharmaceutical Contract Manufacturing and Research Services Market Market Insights Summary:

Regional Highlights:

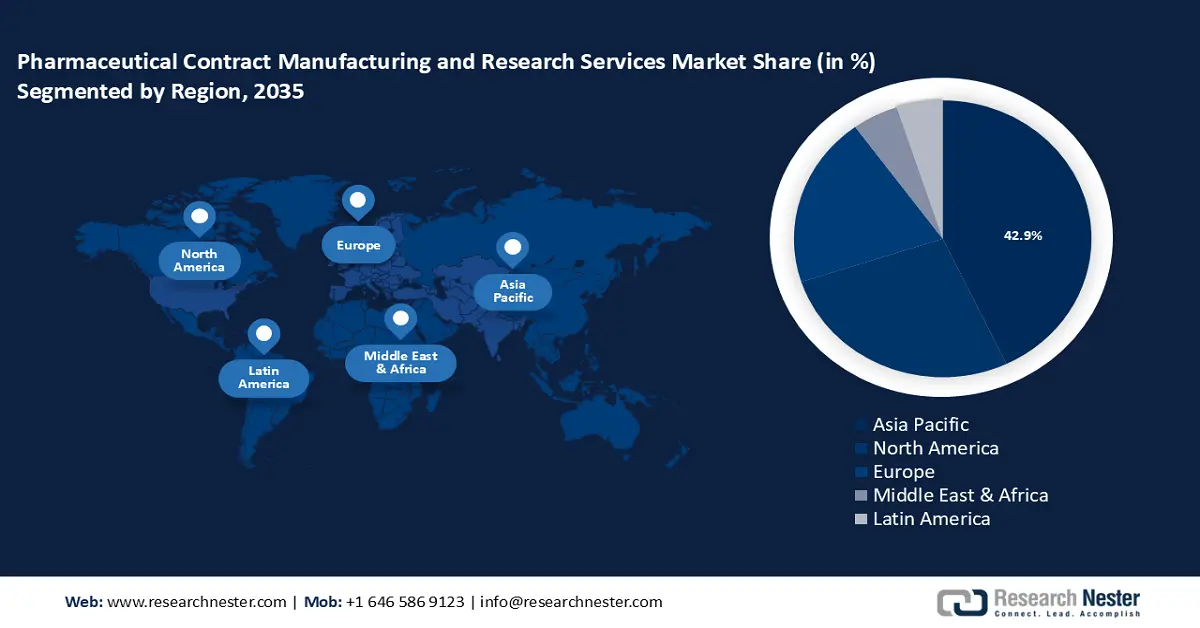

- Asia Pacific pharmaceutical contract manufacturing and research services market will account for 42.90% share by 2035, driven by increased outsourcing and growing production capacity in the region.

Segment Insights:

- The manufacturing segment in the pharmaceutical contract manufacturing and research services market is forecasted to maintain a 66.90% share by 2035, driven by outsourcing trends in biosimilars and vaccine production.

- The big pharma segment in the pharmaceutical contract manufacturing and research services market is set to maintain a significant share by 2035, driven by demand for end-to-end outsourcing services and cost optimization.

Key Growth Trends:

- Increasing investments in diverse drug modalities and advanced technologies

- Patent expiration of various drugs

Major Challenges:

- Restricted contracting chosen by large pharmaceutical firms

- Strict government regulatory frameworks

Key Players: AbbVie, Recipharm AB, Baxter BioPharma, Dalton Pharma Services, Thermo Fisher Scientific Inc., Piramal Pharma Solutions, Jubilant Pharmova Limited, Samsung Biologics.

Global Pharmaceutical Contract Manufacturing and Research Services Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 250.57 billion

- 2026 Market Size: USD 269.06 billion

- Projected Market Size: USD 551.06 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Pharmaceutical Contract Manufacturing and Research Services Market Growth Drivers and Challenges:

Growth Drivers:

- Increasing investments in diverse drug modalities and advanced technologies: The pharmaceutical industry is keen on investing in new modalities to strengthen its presence in drug development and manufacturing. Heterobifunctional protein degraders, oligomers, peptides, and polymers are some complex synthetic modalities that are now routinely used as new drug candidates. Furthermore, traditional small molecules are gaining high demand in drug development. These shifts in the complexity and type of chemical matter used in pharma have implored the industry players to seek investments in CDMOs and facilitate the development of novel investigational drugs.

CordenPharma in July 2024 made a record investment of approximately USD 1.0 billion for developing its peptide production platform in the U.S. and Europe to cater to surging GLP-1 peptides demand and facilitating long-term U.S.-based manufacturing contracts totaling over USD 3.3 billion, with other potential upsides. The Peptide Platform willntegrate small to large-scale services from injectable and oral peptide APIs to drug products. In July 2024, Samsung Biologics announced a new manufacturing accord of USD 1.05 billion from an undisclosed U.S. drugmaker and the deal accounts for over 39% of Samsung Biologics' total sales haul of USD 2.7 billion. Meanwhile, Samsung Biologics in June this year, retooled its Baxter Healthcare deal and Baxter will now fund USD 223.0 million to Samsung Biologics for pharmaceutical contract manufacturing services.

Since such pipeline expansions are majorly driven by large-cap players with smaller in-house capabilities, CDMOs have amped up their investment capabilities to strengthen their innovation and commercial capacity. As funding inflow to fruition, contract manufacturers are ready for new projects to ensure developers have access to capacity. Collaborative partnerships between CDMOs and innovators, where both parties share the risk associated with commercializing new technologies are likely to facilitate success. In July 2020, Sparta Systems partnered with Quartic.ai to launch TrackWise and TrackWise Digital to ensure supply chain continuity of drug and medical device manufacturing. - Patent expiration of various drugs: The patent expiration of many pharmaceuticals drives growth in the pharmaceutical contract manufacturing and research services market. Although patent expiration has resulted in significant income and volume losses for the branded pharmaceutical industry, it also allows for the entry of many new, lower-cost generic alternatives into the markets. Generic firms outsourcing their production to contract manufacturing and research services is a positive sign for the market's growth over the forecast period.

For instance, a collaboration with Moderna, Inc. was announced in June 2020 by Catalent Inc., a prominent supplier of cutting-edge delivery technologies, development, and manufacturing solutions for pharmaceuticals, biologics, cell and gene therapies, and consumer health products. The development of a large-scale, commercial fill-finish manufacturing method for Moderna's COVID-19 vaccine candidate, which is based on mRNA, is the aim of this partnership. - Commercial success of biologicals for clinical applications: The emergence of biological medications has helped to alleviate concerns regarding the usage of traditional synthetic drugs. These synthetic medications are made from synthetic compounds that are not naturally found in the human body, resulting in negative side effects. As a result, biopharmaceutical companies are using a biological approach to generate biologics that target more than 100 ailments. These biopharmaceuticals include monoclonal antibodies, vaccinations, as well as gene and cell therapies.

- SMEs' budgetary restrictions: The financial limitations that small and developing firms in the pharmaceutical sector confront represent one of the major market possibilities in the field of global pharmaceutical contract manufacturing research. Financial constraints frequently impede the ability of small and developing pharmaceutical enterprises to invest in costly production equipment and capabilities. These businesses don't have to make large upfront investments to meet their needs, thanks to contract manufacturing services.

Small and startup pharmaceutical businesses can obtain specialized manufacturing facilities, cutting-edge machinery, and skilled workers through contract manufacturing without having to invest a significant amount of capital. These businesses can concentrate their limited financial resources on other vital areas like marketing, regulatory compliance, and research and development by contracting out their production needs to manufacturers.

Challenges

- Restricted contracting chosen by large pharmaceutical firms: The biggest obstacle to the market progress is the existence of large pharmaceutical companies that possess the ability to manufacture drugs internally. These businesses create their candidate medications, conduct in-house research, and carry out clinical trials. Several businesses, including Novartis, have declared plans to increase their internal manufacturing capacity and stop depending on outside services to fulfill the demand for pharmaceuticals around the world. This is mainly to keep their product development process entirely under control and to keep it secret.

- Strict government regulatory frameworks: The pharmaceutical contract manufacturing and research services market's growth is hampered by stringent government regulatory frameworks and their limits and ongoing improvement in the strict laws enforced by governments in emerging countries. Furthermore, because gene and cell therapies are highly individualized, they can address unmet medical needs in the treatment of a wide range of diseases or disorders. Due of their high therapeutic potential, many pharmaceutical companies and investors have invested much in the development and commercialization of these drugs.

Pharmaceutical Contract Manufacturing and Research Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 250.57 billion |

|

Forecast Year Market Size (2035) |

USD 551.06 billion |

|

Regional Scope |

|

Pharmaceutical Contract Manufacturing and Research Services Market Segmentation:

Service Segment Analysis

Manufacturing segment is set to account for pharmaceutical contract manufacturing and research services market share of around 66.9% by 2035. One of the key factors propelling the segment's expansion in the market is the growing need for biosimilars and vaccines. The profitable growth rate is explained by a rise in the number of businesses choosing to outsource the production of pharmaceutical finished products, clinical trial materials, and active pharmaceutical ingredients (APIs).

This is expected to lead to higher pharmaceutical spending and, consequently, a larger budget for drug development outsourcing. Given their extensive service offering to the pharmaceutical industry, contract manufacturers are thought of as a temporary fix for production capacity issues. creation of dose and formulation, regulatory support, analytical assay creation, release and stability testing, and safety assessment services are all included in manufacturing outsourcing.

End user Segment Analysis

Based on the end user, the big pharma segment in pharmaceutical contract manufacturing and research services market is likely to hold a significant share during the forecast period. The large proportion of this end user group may be attributed to factors including the growing demand for end-to-end services by large pharmaceutical companies, increasing pressure on prices due to channel problems and rising prices, and the increasing need to optimize execution costs as the patents on blockbuster medications expire.

Our in-depth analysis of the global market includes the following segments:

|

Service |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pharmaceutical Contract Manufacturing and Research Services Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific pharmaceutical contract manufacturing and research services market is set to capture revenue share of over 42.9% by 2035. An increase in the number of businesses outsourcing projects to the region's developing countries is fueling this market. Because of their increasing capacity for production, nations like Singapore, China, and India have emerged as significant participants in the pharmaceutical sector in recent years. The pharmaceutical industry in Asia-Pacific was expected to increase by 4.2% between 2022 and 2027, with China, India, and Japan leading the way in market share.

The dominant country in the Asia Pacific market is China due to low labor and production costs that draw big investors from pharmaceutical corporations in the country.

India is coming into prominence within the pharmaceutical contract manufacturing and research services market, driven by factors including enhanced social insurance programs, advantageous economic conditions, growing manufacturing capabilities, and the availability of a large patient population. The area has emerged as a top outsourcing location for pharmaceutical manufacturing due to its cost benefits. In addition to facilitating the conduct of clinical trials and studies, a varied patient pool also helps the pharmaceutical business in the country flourish. For example, the nation had the largest number of malaria cases in the Asia-Pacific region in 2020.

North America Market Insights

North America is expected to experience stable growth during the forecast period due to several factors, including the high number of clinical trials, a wide base of production for active pharmaceutical ingredients, modern manufacturing capabilities, the presence of leading pharmaceutical companies, and the expansion of the generics industry. Additionally, several market participants carry out strategic efforts, which support pharmaceutical contract manufacturing and research services market expansion.

For example, in January 2022, Recro Pharma Inc., a contract development and manufacturing organization (CDMO) focused on resolving complex formulation and manufacturing challenges, mostly in small molecule therapeutic development, announced that it had been awarded a new contract from a major US government department for formulation development and cGMP manufacturing.

The U.S. has maintained the largest market share in North America. It can be linked to important regional actors, particularly in the U.S., and the rising burden of chronic diseases. For example, the American Cancer Society estimates that in 2022 there will be 609,360 cancer-related deaths and 1.9 million new cancer cases identified in the country. Due to the growing incidence of cancer, there is a greater need for pharmaceuticals to treat the disease. To meet this demand, pharmaceutical companies are forming collaborations with providers of contract manufacturing and research services, which is driving up market expansion.

Pharmaceutical Contract Manufacturing and Research Services Market Players:

- Catalent, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Boehringer Ingelheim Biopharmaceuticals GmbH,

- AbbVie

- Recipharm AB

- Baxter BioPharma

- Dalton Pharma Services

- Thermo Fisher Scientific Inc.

- Piramal Pharma Solutions

- Jubilant Pharmova Limited

- Samsung Biologics

There are many national and international competitors in the pharmaceutical contract manufacturing and research services market. The major competitors are implementing a variety of growth tactics, including alliances, partnerships, joint ventures, product launches, geographic expansions, mergers, and acquisitions, to increase their market share. Boehringer Ingelheim Biopharmaceuticals GmbH, AbbVie, Baxter BioPharma, Dalton Pharma Services, and Thermo Fisher Scientific (PPD, Inc.) are some of the major companies in the market.

To bolster their position in the market, market participants are concentrating on partnerships, acquisitions, agreements, and other tactics. For example, Boehringer Ingelheim and Enara Bio signed a planned collaboration and licensing deal in January 2021 for the latter's Dark Antigen discovery platform to be used in the research and development of innovative targeted cancer immunotherapies. Comparably, Charles River Laboratories International, Inc. declared in February 2021 that it had agreed to pay approximately USD 875 million to buy Cognate BioServices, Inc., a CDMO for cell and gene therapy.

Here are some leading players in the pharmaceutical contract manufacturing and research services market:

Recent Developments

- In July 2024, Catalent, Inc., a global leader in facilitating the development and provision of improved medicines for patients, has completed the expansion of its clinical supply facility located in Schorndorf, Germany. Catalent's flagship location in Europe, Schorndorf, offers a full range of clinical supply services, including distribution, packaging, and storage.

- In April 2024, Kühne Holding AG acquired CDMO, Aenova from BC Partners, and closed the deal in August 2024. This M&A aims at innovating Aenova’s CDMO capabilities and strengthening its competitive advantage in the manufacturing of conventional dosage forms.

- In February 2022, Recipharm AB, leading contract development and manufacturing company announced the purchase of Arranta Bio. The acquisition of Arranta Bio is intended to provide cutting-edge drug developers in the biologics industry with contract development and manufacturing services for advanced therapeutic medications that are characterized by science.

- Report ID: 6455

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pharmaceutical Contract Manufacturing and Research Services Market Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.