Global PFAS Testing Market

- Introduction

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- SPSS Methodology

- Data Triangulation

- Executive Summary

- Competitive Landscape

- Competitive Intelligence

- Outcome: Actionable Insights

- Global Industry Overview

- Market Overview

- Market Segmentation

- Regional Synopsis

- Industry Supply Chain Analysis

- DROT

- Driver

- Restraint

- Opportunities

- Trends

- Government Regulation

- Competitive Landscape

- Agilent Technologies Inc.

- Thermo Fisher Scientific Inc.

- Eurofins Scientific

- SGS S.A.

- Merck KGaA

- LGC Limited

- Danaher Corporation

- Waters Corporation

- Biotage, PerkinElmer Inc.

- Shimadzu Corporation

- MACHEREY-NAGEL GmbH & Co. KG

- Avantor Inc.

- AccuStandard Inc.

- Restek Corporation.

- Ongoing Technological Advancements

- Price Benchmarking

- Technique Type Scenario

- Key End-User

- PFAS Testing Market Analysis By Analyte Type

- SWOT Analysis

- Case Study Analysis

- Unmet Need Analysis

- Disruption Impacting Customers' Business

- Emerging Alternative Testing Methods For PFAS Detection

- Recent Developments

- Root Cause Analysis (RCA)

- Porter Five Forces Analysis

- PFAS Remediation Market Growth

- Adoption Of PFAS Remediation Technologies Across Different Sectors

- Different PFAS Remediation

- PFAS Value Chain Flow

- PFAS Detection – Player Analysis

- PFAS Removal – Player Analysis

- PFAS Decomposition – Player Analysis

- PFAS Disposal – Player Analysis

- PFAS Value Chain – Market Research & Business Opportunity Analysis

- Industry Risk Assessment

- Global Outlook and Projections

- Global Overview

- Market Value (USD Thousands), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Global Segmentation (USD Thousands), 2026-2036, By

- Analyte, Value (USD Thousands)

- Perfluorooctanoic Acid (PFOA)

- Perfluorooctane Sulfonic Acid (PFOS)

- Perfluorononanoic Acid (PFNA)

- Perfluorohexane Sulfonate (PFHxS)

- Perfluorobutanesulfonic Acid (PFBS)

- Perfluorobutanoic Acid (PFBA)

- Perfluorohexanoic Acid (PFHxA)

- Fluorotelomer Sulfonic Acids (FTS)

- Others

- Sample Tested, Value (USD Thousands)

- Water

- Soil

- Food & Beverages

- Air

- Animal Feed

- Others

- Testing services offered, Value (USD Thousands)

- Quantification

- Screening

- Extraction

- End use, Value (USD Thousands)

- Pharma companies

- Environmental Testing & Regulatory Agencies

- Research Institutes

- Water Treatment Facilities

- Industrial Manufacturing

- Others

- Regional Synopsis, Value (USD Thousands), 2026-2036

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- Analyte, Value (USD Thousands)

- Cross Analysis of Product Type w.r.t End User, 2026-2036 (USD Thousands)

- Global Overview

- North America Market

- Overview

- Market Value (USD Thousands), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Thousands), 2026-2036 , By

- Analyte, Value (USD Thousands)

- Perfluorooctanoic Acid (PFOA)

- Perfluorooctane Sulfonic Acid (PFOS)

- Perfluorononanoic Acid (PFNA)

- Perfluorohexane Sulfonate (PFHxS)

- Perfluorobutanesulfonic Acid (PFBS)

- Perfluorobutanoic Acid (PFBA)

- Perfluorohexanoic Acid (PFHxA)

- Fluorotelomer Sulfonic Acids (FTS)

- Others

- Sample Tested, Value (USD Thousands)

- Water

- Soil

- Food & Beverages

- Air

- Animal Feed

- Others

- Testing services offered, Value (USD Thousands)

- Quantification

- Screening

- Extraction

- End use, Value (USD Thousands)

- Pharma companies

- Environmental Testing & Regulatory Agencies

- Research Institutes

- Water Treatment Facilities

- Industrial Manufacturing

- Others

- Country Level Analysis, Value (USD Thousands)

- U.S.

- Canada

- Analyte, Value (USD Thousands)

- Cross Analysis of Product Type w.r.t End User, 2026-2036 (USD Thousands)

- Overview

- Europe Market

- Overview

- Market Value (USD Thousands), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Thousands), 2026-2036, By

- Analyte, Value (USD Thousands)

- Perfluorooctanoic Acid (PFOA)

- Perfluorooctane Sulfonic Acid (PFOS)

- Perfluorononanoic Acid (PFNA)

- Perfluorohexane Sulfonate (PFHxS)

- Perfluorobutanesulfonic Acid (PFBS)

- Perfluorobutanoic Acid (PFBA)

- Perfluorohexanoic Acid (PFHxA)

- Fluorotelomer Sulfonic Acids (FTS)

- Others

- Sample Tested, Value (USD Thousands)

- Water

- Soil

- Food & Beverages

- Air

- Animal Feed

- Others

- Testing services offered, Value (USD Thousands)

- Quantification

- Screening

- Extraction

- End use, Value (USD Thousands)

- Pharma companies

- Environmental Testing & Regulatory Agencies

- Research Institutes

- Water Treatment Facilities

- Industrial Manufacturing

- Others

- Country Level Analysis, Value (USD Thousands)

- UK

- Germany

- France

- Italy

- Spain

- Netherlands

- Russia

- Switzerland

- Poland

- Belgium

- Rest of Europe

- Analyte, Value (USD Thousands)

- Cross Analysis of Product Type w.r.t End User, 2026-2036 (USD Thousands)

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Thousands), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Thousands), 2026-2036, By

- Analyte, Value (USD Thousands)

- Perfluorooctanoic Acid (PFOA)

- Perfluorooctane Sulfonic Acid (PFOS)

- Perfluorononanoic Acid (PFNA)

- Perfluorohexane Sulfonate (PFHxS)

- Perfluorobutanesulfonic Acid (PFBS)

- Perfluorobutanoic Acid (PFBA)

- Perfluorohexanoic Acid (PFHxA)

- Fluorotelomer Sulfonic Acids (FTS)

- Others

- Sample Tested, Value (USD Thousands)

- Water

- Soil

- Food & Beverages

- Air

- Animal Feed

- Others

- Testing services offered, Value (USD Thousands)

- Quantification

- Screening

- Extraction

- End use, Value (USD Thousands)

- Pharma companies

- Environmental Testing & Regulatory Agencies

- Research Institutes

- Water Treatment Facilities

- Industrial Manufacturing

- Others

- Country Level Analysis, Value (USD Thousands)

- China

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Thailand

- Singapore

- New Zeeland

- Rest of Asia Pacific Excluding Japan

- Analyte, Value (USD Thousands)

- Cross Analysis of Product Type w.r.t End User, 2026-2036 (USD Thousands)

- Overview

- Latin America Market

- Overview

- Market Value (USD Thousands), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Thousands), 2026-2036, By

- Analyte, Value (USD Thousands)

- Perfluorooctanoic Acid (PFOA)

- Perfluorooctane Sulfonic Acid (PFOS)

- Perfluorononanoic Acid (PFNA)

- Perfluorohexane Sulfonate (PFHxS)

- Perfluorobutanesulfonic Acid (PFBS)

- Perfluorobutanoic Acid (PFBA)

- Perfluorohexanoic Acid (PFHxA)

- Fluorotelomer Sulfonic Acids (FTS)

- Others

- Sample Tested, Value (USD Thousands)

- Water

- Soil

- Food & Beverages

- Air

- Animal Feed

- Others

- Testing services offered, Value (USD Thousands)

- Quantification

- Screening

- Extraction

- End use, Value (USD Thousands)

- Pharma companies

- Environmental Testing & Regulatory Agencies

- Research Institutes

- Water Treatment Facilities

- Industrial Manufacturing

- Others

- Country Level Analysis, Value (USD Thousands)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Analyte, Value (USD Thousands)

- Cross Analysis of Product Type w.r.t End User, 2026-2036 (USD Thousands)

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Thousands), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Thousands), 2026-2036, By

- Analyte, Value (USD Thousands)

- Perfluorooctanoic Acid (PFOA)

- Perfluorooctane Sulfonic Acid (PFOS)

- Perfluorononanoic Acid (PFNA)

- Perfluorohexane Sulfonate (PFHxS)

- Perfluorobutanesulfonic Acid (PFBS)

- Perfluorobutanoic Acid (PFBA)

- Perfluorohexanoic Acid (PFHxA)

- Fluorotelomer Sulfonic Acids (FTS)

- Others

- Sample Tested, Value (USD Thousands)

- Water

- Soil

- Food & Beverages

- Air

- Animal Feed

- Others

- Testing services offered, Value (USD Thousands)

- Quantification

- Screening

- Extraction

- End use, Value (USD Thousands)

- Pharma companies

- Environmental Testing & Regulatory Agencies

- Research Institutes

- Water Treatment Facilities

- Industrial Manufacturing

- Others

- Country Level Analysis, Value (USD Thousands)

- Saudi Arabia

- UAE

- Israel

- Qatar

- Kuwait

- Oman

- South Africa

- Rest of Middle East & Africa

- Analyte, Value (USD Thousands)

- Cross Analysis of Product Type w.r.t End User, 2026-2036 (USD Thousands)

- Overview

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

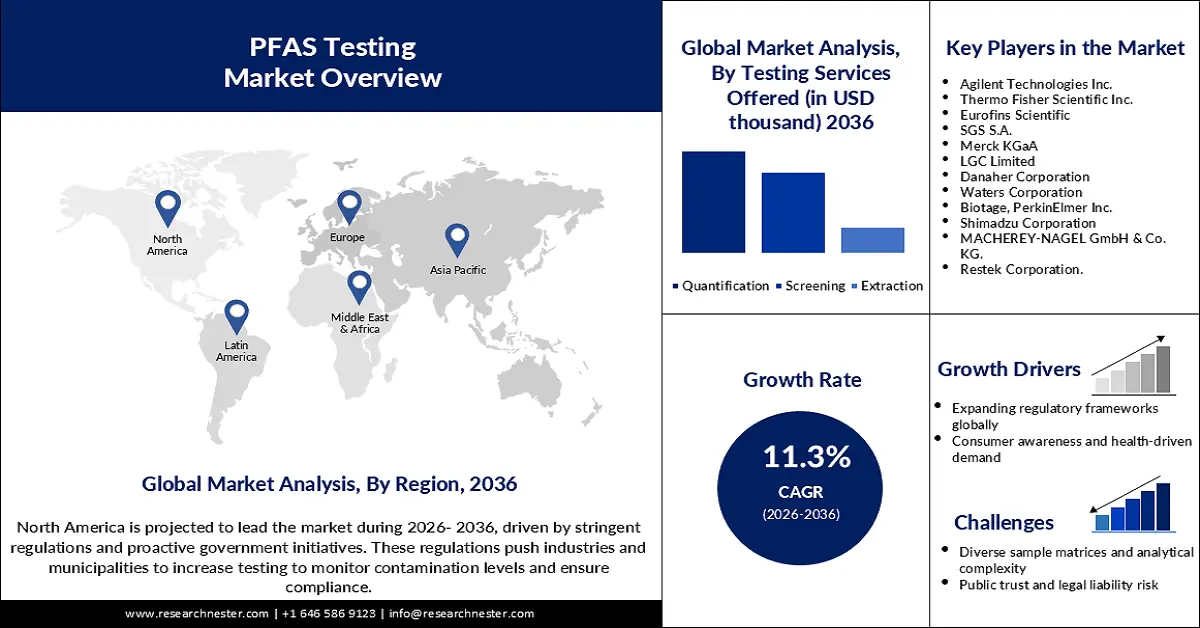

PFAS Testing Market Outlook:

PFAS Testing Market size was valued at USD 10.2 billion in 2025 and is projected to reach a valuation of USD 29.7 billion by the end of 2036, rising at a CAGR of 11.3% during the forecast period, i.e., 2026-2036. In 2026, the industry size of PFAS testing is assessed at USD 11.3 billion.

The PFAS testing market is experiencing significant growth due to a rising number of regulatory requirements and the widespread implementation of national standards. In April 2024, the U.S. put in place its first-ever national drinking water regulation for Perfluoroalkyl and Polyfluoroalkyl Substances (PFAS), which led to a sharp increase in demand for better testing solutions. It has further amplified the need to enhance the detection, tracing, and removal of the chemical. In addition, the public blood screening program that Japan started in November 2024, following contaminated water leakage, reflects the rising demand for diagnostics. Due to increased consumer awareness and legal actions against false and misleading information, the market participants are increasing their capacity and accuracy. Governments are also investing in population-level tracking of PFAS, ensuring a steady growth trajectory.

The PFAS testing ecosystem is constantly evolving by expanding its technological advances and collaborations with various industries. For example, in June 2025, ESP unveiled its partnership with Pro Aqua, initiated with the motive of revolutionizing the technologies used in wastewater treatment. The collaboration led to the development of PFASER, a uniquely effective solution for rapid, on-site elimination of PFAS. These trends indicate a change towards comprehensive management of PFAS involving both diagnosis and therapy. Testing coverage is also extending to non-conventional sectors such as supplements and cosmetic products. State-level bans and new FDA mandates under MoCRA further strengthen demand across the consumer health segment. Altogether, these trends indicate the increased cross-sector adoption of PFAS testing, ranging from water treatment plants to the wellness sector.

Key PFAS Testing Market Insights Summary:

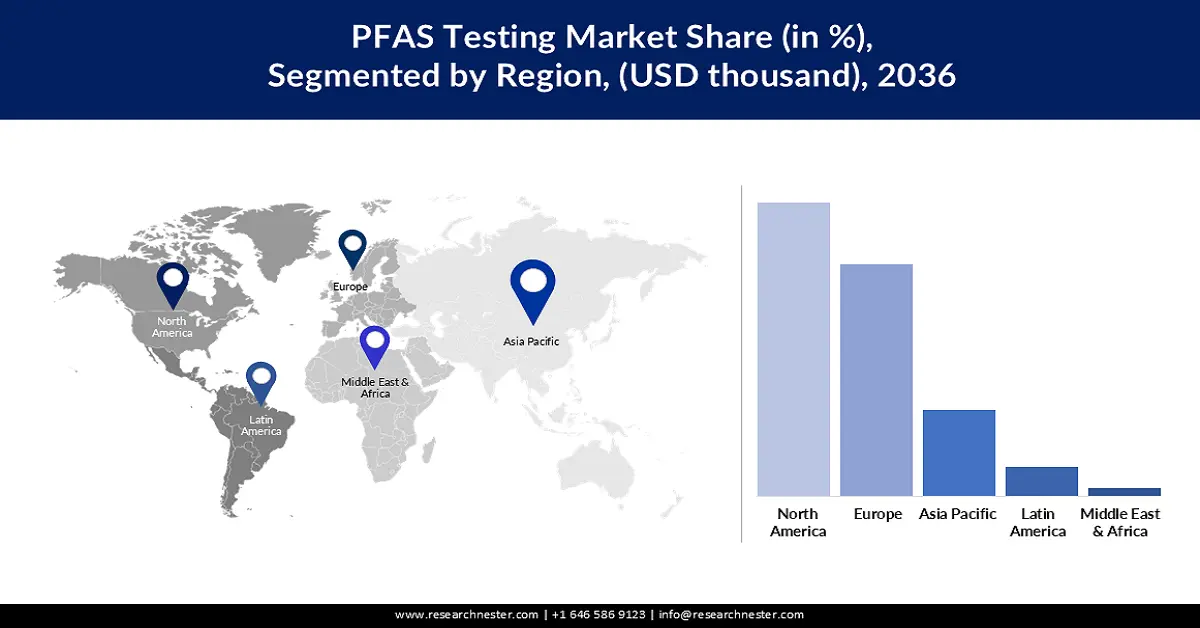

Regional Highlights:

-

The North America market is projected to hold a 46.2% share by 2036, owing to a well-established laboratory network, stringent regulatory requirements, and advanced testing platforms.

- The Europe market is expected to expand steadily by 2036, driven by tightened regulations such as the Packaging and Packaging Waste Regulation (PPWR) restricting PFAS use in packaging.

-

Segment Insights:

- The water sub-segment is projected to hold 43.8% share by 2036, driven by the global demand for safe water, technological advancements in detection, and stringent water safety regulations.

- The Perfluorooctanoic Acid (PFOA) sub-segment is expected to capture a significant share by 2036, impelled by rising awareness of PFOA-related health risks and government-imposed maximum contaminant levels.

Key Growth Trends:

- Expanding regulatory frameworks globally

- Consumer awareness and health-driven demand

Major Challenges:

- Diverse sample matrices and analytical complexity

- Public trust and legal liability risk

Key Players: Thermo Fisher Scientific Inc., Danaher Corporation, SGS S.A., Merck KGaA, LGC Limited, Eurofins Scientific, Waters Corporation, Biotage, PerkinElmer Inc., Shimadzu Corporation, MACHEREY-NAGEL GmbH & Co. KG, Avantor Inc., AccuStandard Inc., Restek Corporation

Global PFAS Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.2 billion

- 2026 Market Size: USD 11.3 billion

- Projected Market Size: USD 29.7 billion by 2036

- Growth Forecasts: 11.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.2% Share by 2036)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Canada, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, South Korea, Mexico

Last updated on : 29 September, 2025

PFAS Testing Market - Growth Drivers and Challenges

Growth Drivers

- Expanding regulatory frameworks globally: Governments around the globe are increasing the stringency of environmental regulations to track PFAS concerns more effectively. In Brazil, Bill No. 2726/2023 was presented in May 2023 and created the National PFAS Control Policy to increase the demand for testing. In the U.S., the declaration of PFAS as hazardous under CERCLA and the introduction of national testing thresholds have spurred compliance-driven investments. Europe and Japan are no exception to this, with more stringent testing being conducted at the ports and other common areas. These advancements are pushing laboratories toward the use of more delicate detection methods. The increased regulatory action is extending testing across municipal, industrial, and consumer industries. This is driving innovation and growth across the global PFAS testing market.

- Consumer awareness and health-driven demand: Consumer awareness about health issues is influencing their choice in favor of PFAS-free products and information about possible exposure. Recent research shows that 97% of Americans have PFAS in their bodies, which has led to increased awareness among the population. In October 2024, the Kibichuo Town in Japan started mass blood testing of PFAS after detecting high water contamination levels. This shows that there is a growing trend toward early detection of diseases. Furthermore, the direct-to-consumer PFAS blood test that Quest Diagnostics launched in February 2024 also helped to expand access to screening. These developments represent a shift from a focus on the environment to individual testing. Higher public awareness is likely to further drive the demand for PFAS detection in wellness and clinical settings.

- Technological advancements enhancing detection precision: Recent advancements in analytical techniques and instrumentation are enhancing the capacity and precision of PFAS identification. The announcement of a new workflow for targeted PFAS, synchronized with the launch of the Agilent 6495 Triple Quadrupole LC/MS (LC/TQ), and other PFAS consumables by Agilent Technologies Inc. in June 2025, is a significant example of technological advancements in enhancing detection precision. The solution was developed based on Method 1633 of the Environmental Protection Agency (EPA). These tools manage contamination factors and guarantee compliance with the corresponding regulatory requirements. The application of the enhanced LC-MS/MS systems and cartridge-based sample preparation systems is increasing lab productivity. These improvements are crucial as testing increases in terms of matrices involving water, soil, and products that people use in their daily lives.

Challenges

- Diverse sample matrices and analytical complexity: The diversity of the sample matrix, from water and soil to cosmetic products and blood, also contributes to the difficulty in standardizing PFAS testing. However, achieving high accuracy at low detection thresholds for multiple compounds in the PFAS family is technically demanding. International differences also affect the comparability of results across countries due to variations in the methods used. Due to the dynamic nature of the market, laboratories need to adapt to new rules and regulations by upgrading their equipment. This puts operational pressure, especially on small-scale theatres. These limitations will have to be addressed through the ongoing process of standardization of global standards and the enhancement of workflow solutions.

- Public trust and legal liability risk: The increasing number of PFAS-related litigation cases and the focus on media coverage are increasing the pressure on test accuracy and data. In February 2025, Santa Clara County initiated one of the largest lawsuits against manufacturers such as 3M and DuPont for PFAS contamination. In such scenarios, both the labs and the product companies are exposed to reputational and legal risks whenever testing is substandard or partial. A lack of accurate results might result in penalties for non-compliance and loss of trust from consumers. This has led to a heightened requirement for validated and certified testing solutions, thus increasing the legal admissibility of data.

PFAS Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2036 |

|

CAGR |

11.3% |

|

Base Year Market Size (2025) |

USD 10.2 billion |

|

Forecast Year Market Size (2036) |

USD 29.7 billion |

|

Regional Scope |

|

PFAS Testing Market Segmentation:

Sample Tested Segment Analysis

The water segment is expected to account for a market share of 43.8% by the end of 2036, owing to growing demand for safe water globally, driving the demand for PFAS testing. As reported by the WHO in September 2022, around 73% of the global population, which is equivalent to 6 billion people, drank safely managed water in 2022. Relevant technological advancements are also allowing for increasing appropriate, sensitive, and fast-paced PFAS detection even at lower levels in water samples, driving the sustainability of the market. Stringent regulations related to water safety are also pushing the PFAS testing laboratories to adopt more sophisticated methods, contributing to increasing market flexibility.

Analyte Segment Analysis

The Perfluorooctanoic Acid (PFOA) is anticipated to account for a significant market share by the end of 2036, owing to the growing awareness of the PFOA-caused health risks, such as tumors of the testicles, liver, mammary glands, and others among people, increasing the demand for PFAS testing. The domination of this segment is also likely to be driven by the stringent regulations of governments. For example, in April 2024, the U.S. Environmental Protection Agency (EPA) established enforceable Maximum Contaminant Levels (MCLs) at 4.0 parts per trillion for PFOA. This type of restriction increases the demand for appropriate and more sensitive testing, driving the PFAs testing market growth.

End Use Segment Analysis

By 2036, the industrial manufacturing segment is poised to acquire a high revenue share, due to growing regulatory pressure for manufacturing companies to track PFAS in their finished products and the wastewater caused by manufacturing. Companies associated with the manufacturing sector are increasingly adopting advanced PFAS testing methods to comply with the set regulatory standards. For instance, a leading manufacturer of air conditioning systems and producer of fluorochemical products, Daikin, revealed in August 2024 that it is investing drastically in research and development of PFAS. The motive of the business is to enable safe utilization of unique properties of fluorinated materials across industries, including security, health, safety, comfort, and environmental conservation.

Our in-depth analysis of the PFAS testing market includes the following segments:

|

Segments |

Subsegments |

|

Analyte |

|

|

Sample Tested |

|

|

Testing Services |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

PFAS Testing Market - Regional Analysis

North America Market Insights

North America is expected to continue to dominate the market with a share of 46.2% by 2036, owing to the well-established laboratory network and regulatory requirements. In October 2024, SGS enhanced its comprehensive PFAS testing suite to address industries’ needs and strengthen regional leadership. Labs in the U.S. and Canada are more privileged to use sophisticated platforms and EPA assistance. For instance, in May 2025, the EPA unveiled its plans for the extension of the PFOA and PFOS Maximum Contaminant Level compliance deadlines and the establishment of a federal exemption framework. This is increasing the demand for precise PFAS testing methods.

Legal liability and insurance claims have also contributed to the increased use of high-resolution instruments in the private sector. There has been an increase in municipal testing capacity after the regulation due to state and federal funding. Canada’s new frameworks are integrating with those of the U.S., which is increasing regional coherence. This synergy ensures that North America maintains its leadership in PFAS testing development and application.

The U.S. stands as a leader in PFAS monitoring, based on the multi-agency approach and active consumer protection. In April 2024, the U.S. EPA issued national PFAS drinking water standards, which prompted utilities to ramp up their test purchases. U.S. firms are still increasing accessibility through new workflows and blood testing services. For example, in February 2024, a leading company in diagnostic information services, Quest Diagnostics, launched the first consumer-initiated, physician-ordered blood-draw test for PFAS chemicals. The test helps detect and measure PFAS identified by the National Academies of Sciences, Engineering, and Medicine. State laws also contribute to the demand side by raising localized thresholds that require more sampling and remediation. As EPA funding and legal settlements increase, U.S. labs are rapidly increasing their capacity to meet growing demand.

The testing market for PFAS in Canada is set to grow with the help of academic collaborations and health-related projects. In June 2024, UDS Health and Relentless Health embarked on providing PFAS screening to fire departments, which is a high-risk population group. This is a clear indication of the increasing focus of the Canadian government and health officials on occupational exposure and tracking of the public. The Ministries of Health are harmonizing national standards of water quality with international ones.

Europe Market Insights

Europe is set to emerge as an expanding PFAS testing market during the forecast period, owing to the tightened regulatory environment. One such example is the entry into force of the Packaging and Packaging Waste Regulation (PPWR) in February 2025. The regulation restricted the use of intentionally added PFAS in packaging for food items. As a result, the demand for precise PFAS testing methods is likely to increase in the coming years.

The PFAS testing market in Germany is set to witness exponential growth due to the stringent EU regulations, obligating different industries in Germany to strengthen their PFAS testing. The rising prevalence of high-profile contamination cases is also accelerating the demand for precise PFAS testing in Germany. Strategic partnerships are also initiated in Germany to enable further advancement of PFAS testing methods. As revealed by the Federal Ministry of Research, Technology, and Space (BMFTR) in April 2025, the PROMISCES project undertaken in adherence to the European Green Deal brought 27 partners from 9 nations in a time span of 3 and a half years for the development of innovative approaches suitable to monitor and reduce the PFAS pollution. This type of initiative is expected to increase the sustainability of the PFAS testing market.

The UK PFAS testing market is projected to expand at a rapid CAGR, on account of growing awareness of the health and environmental risks of PFAS chemicals. Such an awareness has influenced the transformation of PFAS testing from a niche service to a critical element of health and environmental risk management. Involvement of organizations in the development of different analytical techniques is helping to increase the efficiency and precision of PFAS testing. One such example is the collaboration of Puraffinity with the U.S. Army Corps of Engineers in July 2025 for a Cooperative Research and Development Agreement.

Asia Pacific Market Insights

Asia Pacific market for PFAS testing is projected to increase at a high CAGR, attributed to the increasing industrialization and environmental concerns across the region. The expansion of the firms headquartered within the region also fuels the market growth. In March 2024, Synergen Met signed a strategic collaboration with Yokogawa for the implementation of PFAS remediation technologies in North America, with production from the Asia Pacific. Regional labs are increasing capacities and sophistication as contamination in large cities like Shenzhen is revealed. Strategic collaborations are expanding access to high-throughput testing technologies across the various sectors. The governments are now extending their efforts to monitor PFAS in water, cosmetics, and food chains. As is evident in Kibichuo Town, Japan’s national response to PFAS demonstrates the public sector’s engagement. The region is moving from being a PFAS producer to becoming a regulator and a tester.

China remains the largest contributor of PFAS testing in Asia due to higher pollution control measures and its position as the largest manufacturer of PFAS. In October 2024, studies on bottled and tap water from various cities, such as Shenzhen, found that they contained PFAS levels beyond what is acceptable in the U.S. These revelations have prompted demands for new regulation and preventive measures. Analytical laboratories and state organizations are improving the identification methods for food products, cosmetics, and industrial emissions. There is public funding for method development and public release of findings by the government. China’s increasing export sector is also exerting pressure on manufacturers to meet global PFAS standards of safety standards. This dual pressure will support the growth of the market.

The testing market of PFAS in India is gradually emerging owing to the increasing awareness of food safety and environmental policies. Strategic collaborations are also initiated in the country for the advancement of PFAS testing. In May 2024, Agilent collaborated with the National Research Centre for Grapes in India to co-create analytical workflows for PFAS in food. This is a shift towards residue monitoring in agriculture and consumer products. Growing concerns about the presence of PFAS in water and other products are now forcing local laboratories to use EPA standard protocols. The institutional buying of water quality and clean cosmetics is being propelled by government funding. While India continues to strive for export accreditation along with its domestic policies for PFAS testing, the testing environment is only getting more complex and capable.

Key PFAS Testing Market Players:

- Thermo Fisher Scientific Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Danaher Corporation

- SGS S.A.

- Merck KGaA

- LGC Limited

- Eurofins Scientific

- Waters Corporation

- Biotage

- PerkinElmer Inc.

- Shimadzu Corporation

- MACHEREY-NAGEL GmbH & Co. KG

- Avantor Inc.

- AccuStandard Inc.

- Restek Corporation

The PFAS testing market is a relatively fragmented industry with intense competition and continuous innovation, with the major players being Agilent Technologies, Bruker, PerkinElmer, SCIEX, Shimadzu Corporation, Thermo Fisher Scientific, and Waters Corporation. These companies provide products and services ranging from instruments, reagents, and consumables all the way to software and automation. The market also has regional players targeting matrix-specific and low-cost testing. Collaborations between the labs and the regulatory authorities have made the detection services more accessible and accurate. From environmental, pharmaceutical, and personal care applications, differentiation is now based on throughput speed, sensitivity, and readiness for regulation. The continuous method validation and accreditation are crucial for sustaining a competitive advantage.

Below is the list of key players operating in the PFAS testing market:

Recent Developments

- In August 2025, Thermo Fisher Scientific launched its Heratherm Environmental Chamber. The product offers a vast temperature and stability range. Repeatable and consistent performance that is supported by the data acquisition is offered by the technology. The use of the technology in laboratories is likely to help in complying with 21 CFR Part 11.

- In March 2025, TÜV Rheinland revealed that it was expanding its global testing capabilities to meet the year-on-year increased demand for PFAS testing services by 30%. The motive of the company was to help laboratories comply with regulations like EU Regulation 2024/2462.

- In October 2024, Lummus Technology launched advanced analytical services to detect PFAS compounds in water and wastewater systems. The new services help utilities identify contamination sources and assess treatment effectiveness. This capability strengthens PFAS surveillance in municipal and industrial settings. Lummus enters the testing segment with a strong focus on infrastructure support.

- In October 2024, Claros Technologies raised USD 22 million to advance its PFAS elimination technologies. The company combines testing services with sustainable solutions like PFAS destruction, metal recovery, and smart textiles. This funding accelerates commercialization across industries such as water treatment and functional materials. Claros positions itself at the forefront of holistic PFAS management.

- Report ID: 7543

- Published Date: Sep 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

PFAS Testing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.