Personal Mobility Devices Market Outlook:

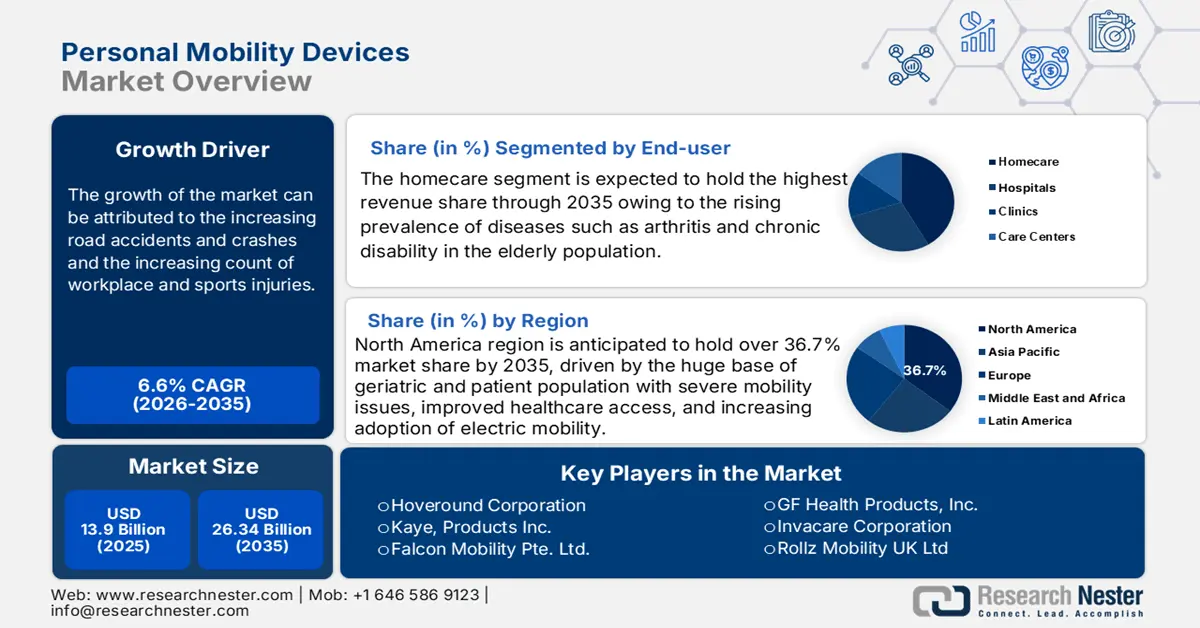

Personal Mobility Devices Market size was valued at USD 13.9 Billion in 2025 and is likely to cross USD 26.34 Billion by 2035, registering more than 6.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of personal mobility devices is assessed at USD 14.73 Billion.

The growth of the market can be attributed to the increasing road accidents and crashes worldwide, along with the increasing count of workplace and sports injuries. According to the World Health Organization (WHO), approximately 1.3 million lives are lost each year as a result of road traffic accidents. The number of non-fatal injuries is between 20 and 50 million, with many of them resulting in a disability. In addition, it was stated that more than 4,37,000 road accident cases were reported in 2019 in India. A rise in traffic accidents has resulted in a higher number of people with severe disabilities as a result. Thus, the demand for personal mobility devices is predicted to grow rapidly over the forecast period.

Designed for a single user, the personal mobility devices include one or more wheels and an electric motor, along with a stopping system controlled either by brakes, gears, or other controls, and can only travel at modest speeds. Moreover, rising disposable income, followed by the increased awareness of self-care, high spending on healthcare, initiatives by the government to expand healthcare access, as well as the development of advanced innovative products are anticipated to expand global personal mobility devices market size during the forecast period. For instance, in January 2022, Falcon Mobility Pte. Ltd. launched its 2nd-generation Ultra-Lite 2 electric wheelchair, which provides lightweight mobility and is simple to operate.

Key Personal Mobility Devices Market Insights Summary:

Regional Highlights:

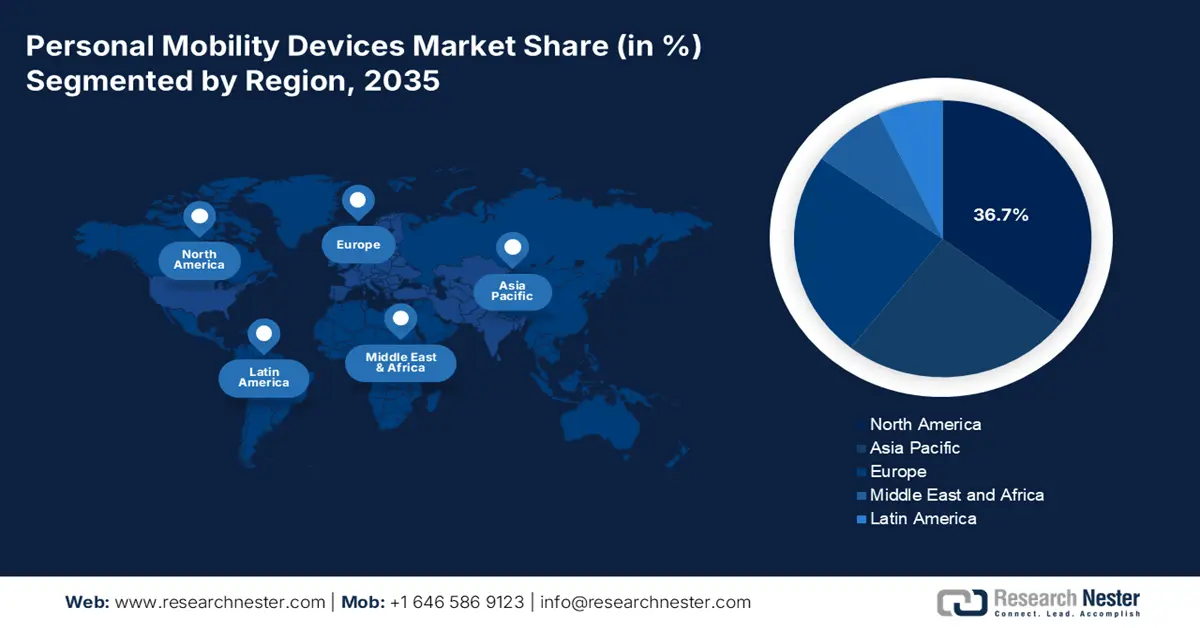

- North America’s personal mobility devices market will secure around 36.7% share by 2035, driven by the huge base of geriatric and patient population with severe mobility issues, improved healthcare access, and increasing adoption of electric mobility.

Segment Insights:

- The homecare segment in the personal mobility devices market is anticipated to achieve the largest share by 2035, driven by the rising prevalence of diseases and disabilities in the elderly.

- The wheelchairs segment in the personal mobility devices market is anticipated to achieve a significant share by 2035, influenced by the escalating global number of people with disabilities.

Key Growth Trends:

- Growing Numbers of Geriatric Population Around the World

- Rise in Prevalence of Musculoskeletal Conditions Among the Population

Major Challenges:

- Growing Numbers of Geriatric Population Around the World

- Rise in Prevalence of Musculoskeletal Conditions Among the Population

Key Players: Drive DeVilbiss Healthcare Ltd, Falcon Mobility Pte. Ltd., Rollz Mobility UK Ltd, GF Health Products, Inc., Invacare Corporation, Carex Health Brands, Inc., Kaye Products, Inc, Medline International B.V., Ottobock SE & Co. KGaA, Hoveround Corporation.

Global Personal Mobility Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 13.9 Billion

- 2026 Market Size: USD 14.73 Billion

- Projected Market Size: USD 26.34 Billion by 2035

- Growth Forecasts: 6.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 September, 2025

Personal Mobility Devices Market Growth Drivers and Challenges:

Growth Drivers

- Growing Numbers of Geriatric Population Around the World- According to the World Bank, there were 747,238,580 people over the age of 60 years in the world in 2021. Across the globe, the number of seniors over 65 is rapidly increasing.

- There is a reduction in the ability to do physical chores as people age. Mobile device usage among the geriatric population is expected to increase significantly as a result of chronic illness, fear of falling, and difficulty walking. This factor is expected to fuel the demand for personal mobility devices during the forecast period.

- Rise in Prevalence of Musculoskeletal Conditions Among the Population – According to the World Health Organization, worldwide, 1.71 billion people suffer from musculoskeletal conditions. These conditions are responsible for the majority of disability, with back pain being the most prevalent cause.

- Increasing Incidence of Disabilities Worldwide- For Instance, there are more than 1 billion people living with disabilities. A total of about 15% of the world's population is affected by this problem, with 190 million (3.8%) people over the age of 15 experiencing significant difficulties.

- Surge in Exports of Mobility Carriages for Disabled Persons- According to the statistics by the International Trade Center (Trademap), the value of exports of mobility Carriages in China in the year 2021 was recorded to be USD 255,613 thousand, which was an increase from USD 183,661 thousand in the previous year.

- Globally Increasing Spending on Healthcare Services- The Centers for Medicare & Medicaid Services released a report showing that in 2020, the United States spent USD 4.1 trillion on healthcare services in the form of healthcare services, which represented 19.7% of the country's GDP.

Challenges

- Disruption in Sales of Product as of COVID-19 Pandemic - Owing to the COVID-19 pandemic's detrimental effects on production and decreased demand for personal mobility devices, the market for these devices have been declined globally. This factor is projected to hinder the market growth over the forecast period.

- High Production Costs for The Product

- Difficulties Associated with The Use of Personal Mobility Devices

Personal Mobility Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.6% |

|

Base Year Market Size (2025) |

USD 13.9 Billion |

|

Forecast Year Market Size (2035) |

USD 26.34 Billion |

|

Regional Scope |

|

Personal Mobility Devices Market Segmentation:

End-user Segment Analysis

The global personal mobility devices market is segmented and analyzed for demand and supply by end user into hospitals, clinics, care centers, homecare, and others. Out of these types of segments, homecare segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the rising prevalence of diseases such as arthritis and chronic disability in the elderly population. It was observed that a staggering 45% of older persons aged 60 and older are living with a disability, and more than 245 million older people suffer from mild to severe levels of disability. Older people are less capable of walking and need mobility aids at home. Therefore, the acceptance of personal mobility devices among the elderly population is expected to augment segment growth during the forecast period.

Product Segment Analysis

The global personal mobility devices market is also segmented and analyzed for demand and supply by product into wheelchairs, mobility scooters, medical beds, crutches, walking aids, and others. Amongst these segments, the wheelchairs segment is expected to garner a significant share. Wheelchairs used by people living with mobility disability for locomotion. Wheelchairs can be both power-driven and manually operated. The benefits of a wheelchair are reduction in the physical problems such as. Progression of deformities, pressure sores, and digestion. The segment is estimated to grow on the back of escalating number of people across the globe with disabilities every day. For instance, it was observed that the need for wheelchairs rises by nearly 3000 every day worldwide while around 600 million people are living with some sort of disabilities across the globe.

Our in-depth analysis of the global personal mobility devices market includes the following segments

|

By Product |

|

|

By Sales Channel |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Personal Mobility Devices Market Regional Analysis:

North America Market Insights

North America region is anticipated to hold over 36.7% market share by 2035. The growth of the market can be attributed majorly to the huge base of geriatric and patient population with severe mobility issues and also triggering the demand for hospitalization owing to several chronic and acute diseases. Well-structured homecare services in the region also expected to hike the market growth over the forecast period. For instance, in United States, Medicare patients with chronic diseases account 80% of hospitalizations, 90% of medication prescriptions, and 77% of healthcare home visits. Additionally, more than 6 million Americans are anticipated to use assistive devices for mobility. Moreover, the availability of personal mobility devices, improved access to healthcare, the prevalence of age-related diseases such as cancer, diabetes, seizures, and others, and favorable hospital reimbursement policies are some other factors anticipated to propel the demand for personal mobility devices in the region during the forecast period. In addition to this, an upsurge in the adoption of electric mobility is also a crucial factor that is anticipated to further boost the personal mobility devices market in the region in the coming years. For instance, currently, around 150,000 people uses electric powered wheelchair and scooters in USA. Moreover, as of 2021, approximately 2 million people were diagnosed with cancer while this disease accounted for around 600,000 deaths in the United States. Therefore, all these factors are projected to enlarge the market size in the region over the forecast period.

Personal Mobility Devices Market Players:

- Drive DeVilbiss Healthcare Ltd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Falcon Mobility Pte. Ltd.

- Rollz Mobility UK Ltd

- GF Health Products, Inc.

- Invacare Corporation

- Carex Health Brands, Inc.

- Kaye Products, Inc

- Medline International B.V.

- Ottobock SE & Co. KGaA

- Hoveround Corporation

Recent Developments

-

Drive DeVilbiss Healthcare Ltd introduced a lightweight powerchair called the NEW Carbon Fibre AirFold Powerchair. Despite being compact and lightweight, it weighs only 15.8kg and has an integral grab handle to make carrying and lifting easier.

-

Rollz Mobility UK Ltd has announced that 80% of the Parkinson’s participants benefited from using Rollz’s Parkinson’s walker with different cues. In addition to being able to adjust the cues, it also facilitates an active lifestyle for people with neurological disorders, such as Parkinson's and MS.

- Report ID: 4389

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Personal Mobility Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.