Personal Care Ingredients Market Outlook:

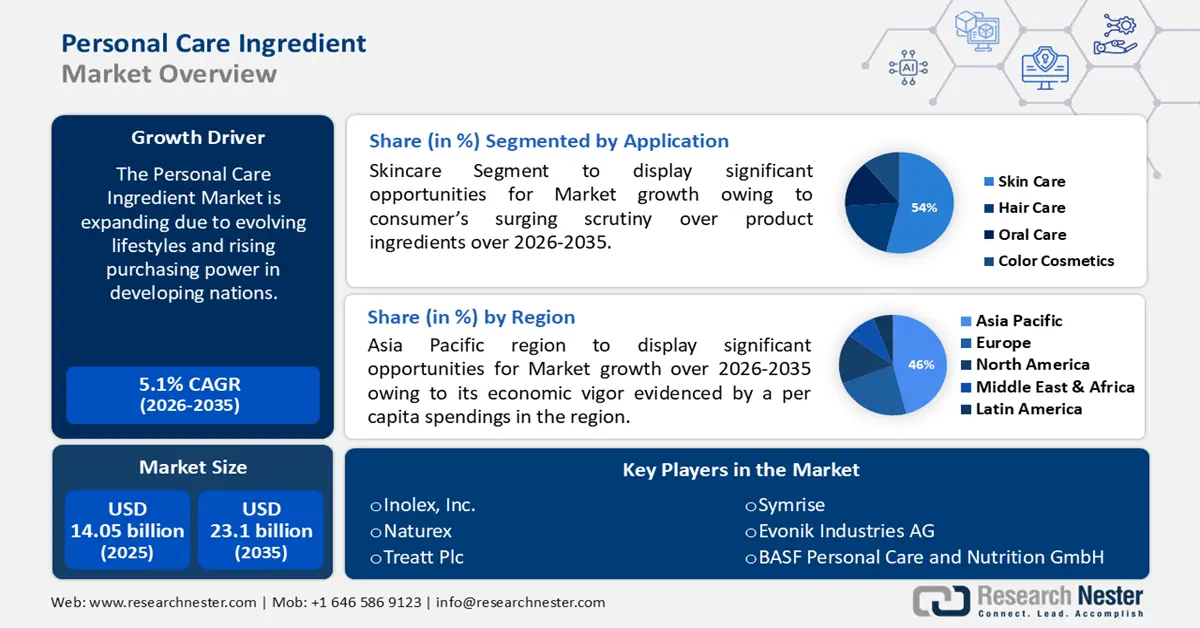

Personal Care Ingredients Market size was over USD 14.05 billion in 2025 and is projected to reach USD 23.1 billion by 2035, witnessing around 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of personal care ingredients is evaluated at USD 14.69 billion.

The market growth can be attributed to evolving lifestyles and rising purchasing power in developing nations. For instance, the active ingredients sector is worth over USD 2 billion globally. Moreover, the dominance is seen in the United States and Europe, claiming nearly 60% of the industry, while Asia holds about one-third, with China alone taking a 60% share within the region.

In addition to these, factors that are believed to fuel the sectoral growth of the market include their diverse applications as anti-fungal, anti-aging, and skin conditioning agents. Active components like UV protectants and exfoliants, along with inactive elements such as surfactants and preservatives, serve as secondary keywords, underlining their extensive use in skincare product manufacturing.

Key Personal Care Ingredients Market Insights Summary:

Regional Highlights:

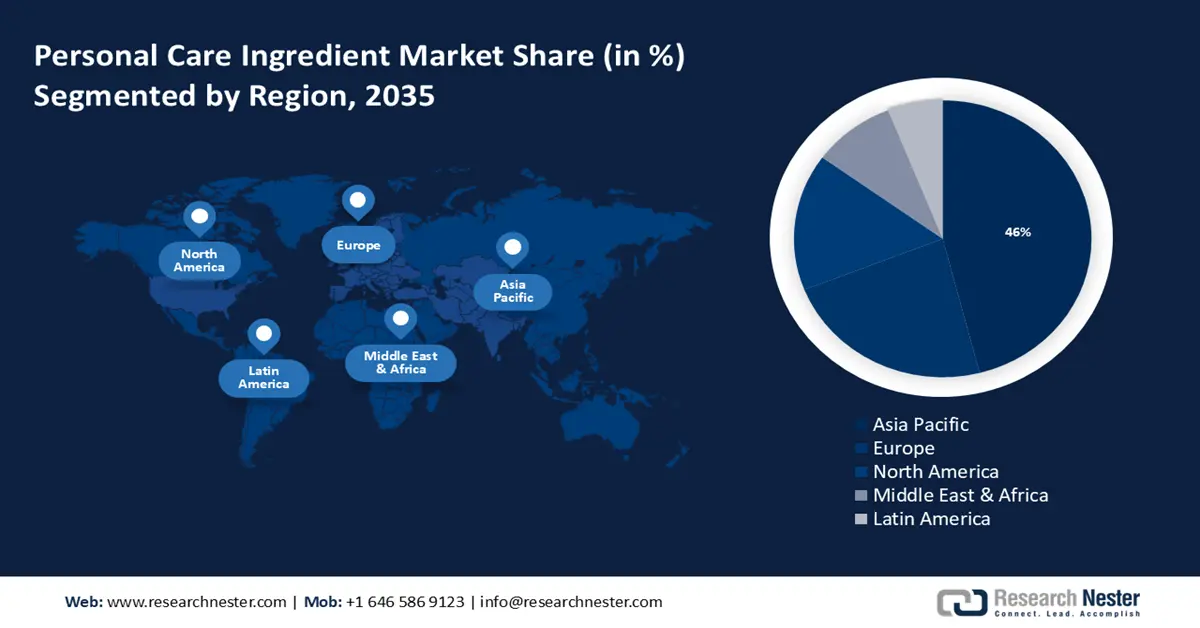

- Asia Pacific personal care ingredients market will dominate around 46% share by 2035, driven by increasing consumer investment in personal care, rising incomes, and demand for natural and organic products.

- Europe market will secure 23% share by 2035, fueled by robust industrial demand, a shift toward digital commerce, and preference for natural and organic personal care options.

Segment Insights:

- The skincare segment segment in the personal care ingredients market is projected to hold a 54% share by 2035, driven by rising consumer awareness of skincare's role in health and environmental damage protection.

- The skincare segment in the personal care ingredients market is expected to achieve significant growth through 2035, driven by rising consumer awareness of skincare's role in health and environmental damage protection.

Key Growth Trends:

- Economic Indicators Boosting the Personal Care Ingredients Market

- Consumer Trends Catalyzing Growth in Personal Care Ingredients

Major Challenges:

- Economic Indicators Boosting the Personal Care Ingredients Market

- Consumer Trends Catalyzing Growth in Personal Care Ingredients

Key Players: BASF Personal Care and Nutrition GmbH, Inolex Inc., Vantage Specialty Chemicals, Naturex, Treatt Plc, Evonik Industries AG, Dow, Akott Evolution S.r.l., Symrise, Avenir Ingredients Pty Ltd.

Global Personal Care Ingredients Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.05 billion

- 2026 Market Size: USD 14.69 billion

- Projected Market Size: USD 23.1 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 16 September, 2025

Personal Care Ingredients Market Growth Drivers and Challenges:

Growth Drivers

-

Economic Indicators Boosting the Personal Care Ingredients Market: The market is on an upward trend, leveraging the purchasing power that remained strong in 2022, with a dollar retaining 92.6 percent of its 2021 value. Women, who are more than half of the U.S. population and influence 85% of consumer spending, are pivotal to this sector’s dynamics. Concurrently, India’s consumer spending has skyrocketed to over 25.6 trillion rupees by late 2023, reflecting a massive potential customer base. These factors, alongside a demand shift towards multifunctional personal care ingredients, indicate a promising growth trajectory for the industry despite regulatory challenges and concerns regarding chemical constituents.

-

Consumer Trends Catalyzing Growth in Personal Care Ingredients: The market is witnessing a surge, propelled by consumer gravitation towards ‘natural’ and ‘botanical’ product claims. Retail insights reveal that such products are experiencing a robust year-on-year growth of 20-25%. Significantly, 71% of consumers have shown a preference for ‘natural’ face creams and lotions, while 38% are inclined to buy shampoos or hail oils labeled with ‘botanical’ ingredients. This trend underscores the growing personal care ingredients market potential, as more consumers seek authenticity and health-conscious solutions in their personal care choices, indicating a promising horizon for the industry and spotlighting consumer health awareness as a key sectoral driver.

- Innovation and An Overall Rise in Health Awareness: Innovation in skincare and an overall rise in health awareness are carving out sustainable opportunities within the personal care ingredients industry. Developments in product formulation that cater to a more informed and health-oriented consumer base are expected to foster growth. The Asia-Pacific region, particularly China with its considerable sectoral share, is emerging as a dynamic arena for such advancements. With the integration of natural and eco-friendly components, the industry is adapting to not only meet but anticipate consumer needs, driving forward the sector’s evolution.

Challenges

-

The volatility of raw material prices, particularly crude oil and natural gas, presents a significant hurdle for manufactures in market.

-

As personal care ingredients often come from petrochemicals, which require chemical processes that can release harmful wastes, regulatory bodies impose tight control. Agencies like the USEPA and REACH enforce rules that limit the growth of the sector, especially since synthetic ingredients form a significant portion.

- Another constraint is the environmental and health impact of the chemical processes used to derive personal care ingredients.

Personal Care Ingredients Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 14.05 billion |

|

Forecast Year Market Size (2035) |

USD 23.1 billion |

|

Regional Scope |

|

Personal Care Ingredients Market Segmentation:

Application Segment Analysis

The skincare segment in personal care ingredients market is estimated to gain the largest industry share of about 54% in the year 2035. Dominating 40% of the 2019 global cosmetics arena, its trajectory is bolstered by consumers’ surging scrutiny over product ingredients -47% in the U.S. prioritize this knowledge. The drive for growth is twofold: an escalating awareness of skin care’s crucial role in overall health and an eagerness to offset the damaging effects of urban living, pollution, UV exposure, and modern lifestyle shifts. This dual awareness has sparked a robust demand for products designed to neutralize these diverse environmental challenges.

Product Segment Analysis

The inactive segment in personal care ingredients market is estimated to gain a significant share of about 52% in the year 2035. The global cosmetics industry, boasting a revenue of USD 103.8 billion, is witnessing the inactive segment’s ascension due to its role in magnifying the efficacy of cosmetic components and its versatile compatibility with numerous formulations. This specialized segment’s influence has surged, becoming increasingly prevalent in hair and skin care products, as recent trends underscore a consumer shift towards products that significantly enhance the overall efficacy of their cosmetic routines.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Application |

|

|

Consumer |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Personal Care Ingredients Market Regional Analysis:

APAC Market Insights

Personal care ingredients market in the Asia Pacific, is anticipated to hold the largest with a share of about 46% by the end of 2035. The sectoral growth in the region is expected on account of its economic vigor evidenced by per capita spending is anticipated to reach USD 55.70, reflecting the increasing consumer investment in personal care. Notably, online sales are forecasted to make up 18.8% of the total sectoral revenue, underscoring the digital shift in consumer buying patterns. The region’s large and varied population, coupled with rising incomes and changing lifestyles, continues to drive the demand for a diverse range of personal care ingredients. The evolving industry landscape is characterized by robust demand for natural and organic products as well as innovative offers from a growing number of small and medium-sized enterprises, with China, Japan, and India being key contributors to this dynamic sector’s expansion.

European Market Insights

The Europe personal care ingredients market is estimated to be the second largest, registering a share of about 23% by the end of 2035. The industrial growth in the region is also expected on account of a projected revenue generation of USD 144.60 billion in 2024, indicating a robust industrial demand. Additionally, with online sales poised to represent 23.3% of the total beauty & personal care market revenue by the same year, there is a discernible shift towards digital commerce, as consumers increasingly opt for the convenience of online shopping for their beauty and persona care purchases. This digital trend, combined with the European consumer’s growing preference for natural and organic personal care options, is set to fuel the sectoral’s growth trajectory. In France, the demand for organic and natural beauty products is on the rise, with consumers seeking sustainable and eco-friendly options.

Personal Care Ingredients Market Players:

- BASF Personal Care and Nutrition GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Inolex Inc.

- Vantage Specialty Chemicals

- Naturex

- Treatt Plc

- Evonik Industries AG

- Dow

- Akott Evolution S.r.l.

- Symrise

- Avenir Ingredients Pty Ltd.

Recent Developments

- May 9, 2023; To access a larger consumer base, Evonik Industries AG partnered with Safic-Alcan, a reputable distributor of specialized chemicals, to broaden the appeal of its nutraceutical products. With this alliance, Evonik reached consumers in Europe, Turkey, and Egypt with its extensive line of nutraceutical goods, which includes AvailOm, Healthberry, and IN VIVO BIOTICS. Through a vast network of regional sales offices, Evonik was able to service a wider range of clients by utilizing Safic-Alcan's distribution capabilities.

- March 1, 2022; The acquisition of JEEN International Corporation by Vantage Specialty Chemicals, a well-known and vertically integrated provider of components sourced from natural sources, was completed with success. Vantage Personal Care further improved its wide array of naturally derived ingredients, which includes active compounds, natural oils, and bio-based chassis ingredients, thanks to this calculated decision. The addition of JEEN International Corporation to Vantage Personal Care's portfolio offers skills and products that compliment each other well.

- Report ID: 5989

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Personal Care Ingredients Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.