Perfume Ingredient Chemicals Market Outlook:

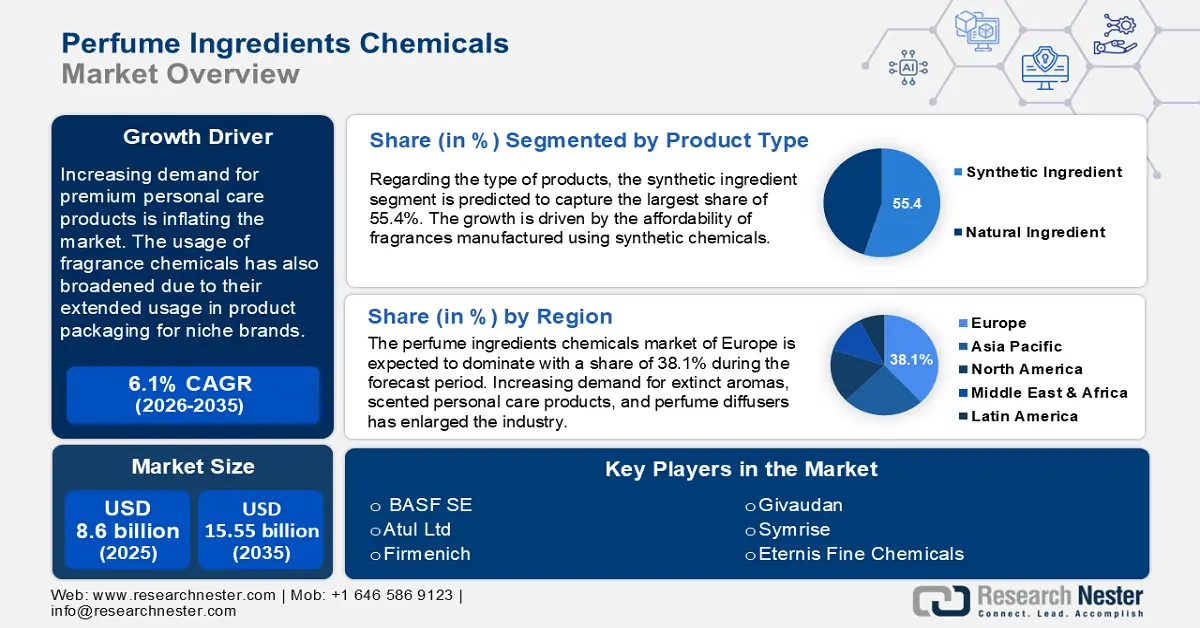

Perfume Ingredient Chemicals Market size was over USD 8.6 billion in 2025 and is projected to reach USD 15.55 billion by 2035, witnessing around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of perfume ingredient chemicals is evaluated at USD 9.07 billion.

Increasing demand for premium personal care products is inflating the perfume ingredient chemicals market. Online consumer engagement through e-commerce platforms and digital marketing is multiplying product sales. The usage of fragrance chemicals has also broadened due to their extended usage in product packaging for niche brands. Consumer preference for clean and organic products is changing the market dynamics, contributing to industry evolution.

Increasing disposable income in emerging markets is expanding the consumer base for fragrance chemicals. The growth in expenditure for luxury grooming products also includes an enlarged appetite for fragrances. According to a report published by the U.S. BEA, in August 2024, personal income rose by 0.2% monthly rate, and disposable personal income (DPI) minus taxes also increased by 0.2% (USD 34.3 billion). This implies that wealthier consumers are seeking personalized fragrances, inspiring manufacturers to develop custom formulations. Innovations in the fragrance chemical sector encourage the production of unique blends, addressing specific needs. Various applications in cosmetics, toiletries, food, and other sectors are also driving demand for innovative perfume chemicals.

Key Perfume Ingredient Chemicals Market Insights Summary:

Regional Highlights:

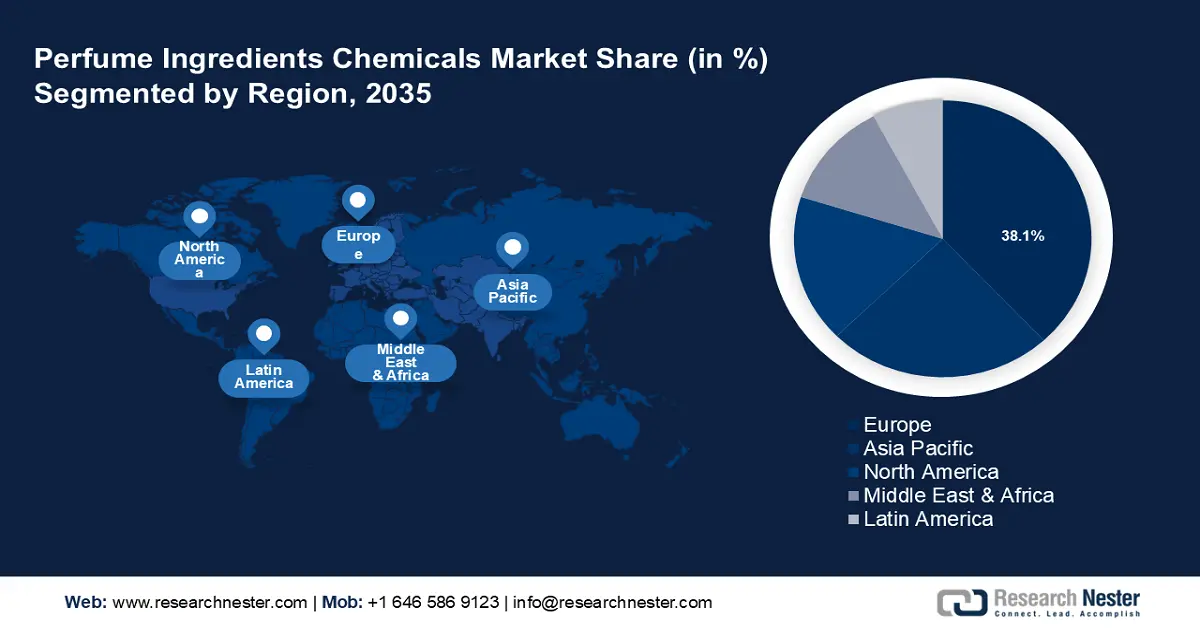

- Europe's 38.1% share in the Perfume Ingredient Chemicals Market is driven by luxury fragrance innovation, consumer demand for natural ingredients, and investments in botanical formulas, solidifying its dominance through 2035.

Segment Insights:

- Synthetic Ingredients segment are anticipated to capture a 55.4% share by 2035, driven by the affordability of synthetic fragrances and their ability to mimic natural ingredients.

Key Growth Trends:

- Innovative production methods

- Rising demand for sustainable products

Major Challenges:

- Lack of compliance with regulations

- Expensive manufacturing of natural ingredient

- Key Players: BASF SE, Atul Ltd, DSM, Eternis Fine Chemicals, Firmenich, Givuadan, Godavari Biorefineries Ltd., Harmony Organics Pvt. Ltd., International Flavors and Fragrances Inc, KDAC CHEM Pvt. Ltd., MANE, Sensient Technologies Corporation, Shiseido, Symrise.

Global Perfume Ingredient Chemicals Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.6 billion

- 2026 Market Size: USD 9.07 billion

- Projected Market Size: USD 15.55 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (38.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: France, United States, Germany, Switzerland, China

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 14 August, 2025

Perfume Ingredient Chemicals Market Growth Drivers and Challenges:

Growth Drivers

-

Innovative production methods: The economy is predicted to hold a mass volume of middle-class consumers, who seek affordable personal care. Companies prefer beneficial methods to reduce the production cost to expand their supply chain. Large-scale manufacturing facilities lower the cost per unit, leading to bulk purchases of perfume ingredient chemicals. Demand for long-lasting results and multifunctional properties has penetrated advanced technologies in production. AI applications are leveraging the production of affordable and customized fragrances conveniently. In June 2021, Firmenich launched Scentmate, an AI-enabled platform for entrepreneurs and brands. This innovation can offer opportunities to create new formulas according to consumer parameters, subsequently escalating the demand for new perfume chemical blends.

Nanotechnology in manufacturing high-quality perfume ingredient has helped the fragrance industry to offer affordable options for consumers. Compounds such as gold nanoparticles can reduce toxicity from chemicals. Nano-delivery systems can also make the fragrance long-lasting through efficient and time-controlled release of scents. Nanotechnology is also being used in replicating the human nose to detect and absorb unwanted odors. The application of nano-emulsions contributes to the replacement of alcohol through their novel delivery system. Leading perfume and air freshener brands are adopting capsulation technology to produce water-based fragrances. Moreover, such revolutionary technologies are introducing effective and inexpensive alternatives in the perfume industry. -

Rising demand for sustainable products: Increasing awareness about origin and ingredient has ignited the popularity of natural and organic products. As a result, the perfume industry is surging for sustainable sourcing options. Manufacturing companies are reformulating their ingredient to meet these standards. Government and public authorities are also pushing this trend to obtain chemical safety. Brands are adopting circular economy principles to reduce waste through recycling and repurposing materials. The dedicated chemical industry can support such initiatives with its expertise in materials. In June 2024, IFF launched three new fragrance ingredient Ylanganate, Grapefruit, and Persian Lime Oils. Luxury product buyers are willing to pay for premium products, alternating with synthetic materials.

Research and development are taking place to profound new alternatives for synthetic ingredient. The industry is incorporating biotechnology to produce high-quality perfume materials. Plant-based biotechnical methods are being induced in manufacturing environmentally viable fragrances. In June 2021, Givaudan launched PlanetCaps, a biodegradable fragrance capsule, which can perform well for fabric softeners. Advancements in biotechnology also promote the production of natural aroma compounds through endurable methods, including fermentation. Development in synthetic materials is also a captivating interest due to their alignment with sustainability standards. Companies are formulating new natural isolates with enhanced stability and longevity.

Challenges

-

Lack of compliance with regulations: The stringent regulatory framework can hinder the process of new product launches. Concerns about consumer safety and the environmental impact of chemicals can lead to ingredient unavailability. Government agencies including the EU’s REACH demand a detailed listing of all chemical substances. This governing body has the authority to order the elimination of certain chemicals, which further restricts production. Often replacing particular ingredient costs the manufacturer extensive expenditure. The use of synthetic elements in perfumes can violate environmental laws such as governing VOC emissions. Regional restrictions on the import and export of selected chemicals can also affect the product cost.

-

Expensive manufacturing of natural ingredient: Rising demand for sustainable products is pressurizing manufacturers to adopt natural methods. Such sourcing practices can be way more expensive than synthetic chemicals, refraining companies from investing. Supply of raw materials can be disrupted due to natural disasters or pandemics, leading to unavailability of raw materials. Fluctuating prices of essential oils and other ingredient can bring uncertainty in production budgets and profit margins. Navigating patent laws can be complex to understand and compile benefits. The ever-changing market dynamics require manufacturers to be up-to-date with innovations. The lack of advanced extraction and synthesis methods can fail companies in competition.

Perfume Ingredient Chemicals Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 8.6 billion |

|

Forecast Year Market Size (2035) |

USD 15.55 billion |

|

Regional Scope |

|

Perfume Ingredient Chemicals Market Segmentation:

Product type (Synthetic Ingredient, Natural Ingredient)

Regarding the type of products, the synthetic ingredient segment in the perfume ingredient chemicals market is predicted to capture the largest share of 55.4% by 2035. The affordability of fragrances manufactured using synthetic chemicals has positioned this segment on top. These ingredient are being developed to mimic natural ingredient to align with rising consumer demand. In May 2023, Lanxess doubled the production of benzyl alcohol. This chemical has multi-application including deodorants, scented candles, and solvents for perfumes. Innovation in formulation allows manufacturers to create unique product offerings.

Synthetic chemicals are also supporting sustainability trends by reducing pressure on natural resources. Expansion in the cosmetics sector is contributing to the remarkable growth of the perfume chemicals market. Upgradation in ingredient quality and safety has collected approvals from established regulations. Synthetic, natural, and bioengineered materials are now blending to produce multifunctional ingredient. In March 2024, Givaudan launched Nympheal, which is a blend of muguet aldehydes and a hint of linden blossom. This hybrid ingredient can offer exceptional olfactive performance while complying with chemical safety regulations.

Our in-depth analysis of the perfume ingredient chemicals market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Perfume Ingredient Chemicals Market Regional Analysis:

Europe Market Statistics

Europe industry is set to account for largest revenue share of 38.1% by 2035. Being the inventory of luxury fragrance manufacturers, Europe entrenched steady growth in this sector. The broader range of perfumery availed both synthetic and natural ingredient. Increasing demand for extinct aromas, scented personal care products, and perfume diffusers has enlarged the industry. Preference for essential oil and botanical extracts has inflated due to consumer awareness. Market leaders are investing in developing new formulas and chemicals for sufficient supply. In September 2024, Givaudan launched [N.A.S.] to infuse botanical extracts in hybrid makeup products. The vegan ingredient consists of benefits from three skin-friendly powders. With such innovations, market players are leading the competition in quality and sustainability.

Germany is emerging to be a major market share holder in Europe perfume ingredient chemicals market. A strong industrial base and innovation in formulation have elevated the growth. Massive investment in research and development has emphasized the scope of innovation in the sector. Many companies are now focusing on maintaining eco-friendly practices to supply consumer-specific needs. With a large number of prominent perfumers, the country contributes to both the national and international landscape. In June 2024, Symrise launched its Iconoclast series at the World Perfumery Congress. The debut includes the introduction of FROSTWOOD and AMBRONOVA, showcasing their novelty in innovation. Compliance with EU regulations is also shaping production strategies.

France has garnered an exceptional reputation for delivering high-quality fragrance ingredient. Its historical heritage as an iconic perfume supplier in the global fashion industry has driven significant growth. Their craftsmanship with modern technologies is fostering greater investment opportunities. Government policies including the Gender Equality Index have empowered every citizen to invest in personal care. Further, helping the country to concur in premium aromatic products for both men and women. Their unique scent profiles have inspired the companies to penetrate for new formulations. Domestic fine fragrances have set standards of luxury through worldwide consumer preferences. In June 2021, Corda acquired 96.6% equity of Parfex, a fine fragrance manufacturer. Such events are captivating more investments in the ingredient chemicals for fine perfumes.

APAC Market Analysis

The rapid growth in the middle-class population and urbanization has influenced the Asia Pacific perfume ingredient chemicals market. Large resources of natural elements in this region are inspiring companies to invest in perfumery. The rising popularity of premium and luxurious personal care products is enlarging the market scope. Regional celebrity endorsements with international perfume brands are propelling consumer demand. International and domestic players are now showing interest in capturing such a large consumer base. Countries including China are emerging with changes in lifestyle preferences. Manufacturers are now developing new extraction methods to produce affordable and sustainable products. Global exposure through internet penetration is encouraging local companies to invest in this sector.

India is slowly but steadily introducing their portfolio in exporting raw materials for the perfume ingredient chemicals market. The country is also participating in the global market as a reservoir for plant-based raw materials for perfumes. According to a 2022 OEC report, India exported USD 0.5 billion worth of perfume plants in the U.S., Germany, China, Italy, and the UK. With the growing numbers, India has become the 2nd largest exporter of perfume plants. Many global leaders are now supplying perfume chemicals in this country to expand their market reach. Local aroma chemical manufacturing companies are also marking their presence overseas. According to the annual investment report of Privi Speciality Chemicals, in April 2024, their turnover crossed USD 0.2 billion in 2023. The exceptional growth is driven by international collaboration, partnerships, and production expansion for external supply.

China is portraying noticeable growth in the perfume chemicals industry due to their large production facilities and labor power. The country has a sufficient resource of raw materials to supply for both domestic and international chemical manufacturing. Being a major manufacturing hub, China shows potential to offer cost-effective solutions for the fragrance market. With access to a variety of resources of essential oils and organic extracts, it has become one of the largest natural ingredient exporters. According to the 2022 OEC report, China exported USD 7.5 billion worth of perfumery and cosmetics worldwide. Some of its target consumers include the U.S., Hong Kong, Japan, the UK, and Malaysia.

Key Perfume Ingredient Chemicals Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Atul Ltd

- DSM

- Eternis Fine Chemicals

- Firmenich

- Givuadan

- Godavari Biorefineries Ltd.

- Harmony Organics Pvt. Ltd.

- International Flavors and Fragrances Inc

- KDAC CHEM Pvt. Ltd.

- MANE

- Sensient Technologies Corporation

- Symrise

The perfume ingredient chemicals market is highly competitive, and companies maintain continuous innovation to align with its changing dynamics. They are focusing on acquiring sustainable sources of raw materials. While the demand for organic personal products is increasing, these key players are adopting natural ingredient. Further, meeting the consumer demand for eco-friendly products. In November 2023, L’Oréal Groupe partnered with Cosmo International Fragrances to offer 100% natural and pure scent extracts. The collaboration aimed to utilize the patent-pending green sciences-based extraction process to create fine fragrances.

Recent Developments

- In April 2024, Clariant announced a 100% acquisition of Lucas Meyer Cosmetics for USD 0.8 billion. This investment is allocated to offer the consumer high-value personal care products, strengthening the market reach of Clariant.

- In March 2024, BASF Aroma launched new natural-flavored products in their Isobionics portfolio. The upgraded product line will supply according to the market trend of developing natural ingredient. Additionally, BASF consolidated its leading position through this launch.

- Report ID: 6560

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Perfume Ingredient Chemicals Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.