Perception Sensors Market Outlook:

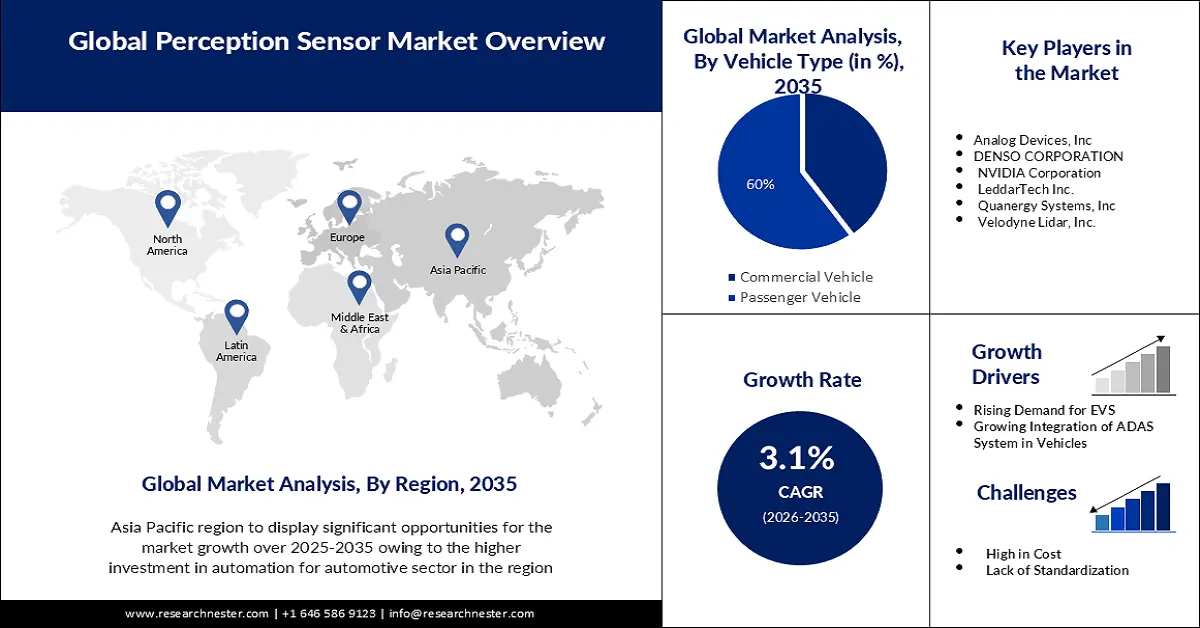

Perception Sensors Market size was over USD 26.52 billion in 2025 and is anticipated to cross USD 35.99 billion by 2035, witnessing more than 3.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of perception sensors is estimated at USD 27.26 billion.

The growth of the market can be attributed to the rising number of car accidents, and growing demand for passenger safety around the world. According to the Centers for Disease Control and Prevention, 1.35 million people are killed on the road every year. Almost 3,700 people are killed each day in crashes involving cars, buses, motorcycles, bicycles, trucks, or pedestrians.

Along with these, as a result of stringent government regulations, the autonomous capabilities of vehicles are projected to rise in the forthcoming years. This is another factor expected to drive perception sensors market growth in the future. Stringent regulations around vehicle safety are prompting automakers to adopt advanced ADAS features, further driving the market for perception sensors.

Key Perception Sensors Market Insights Summary:

Regional Insights:

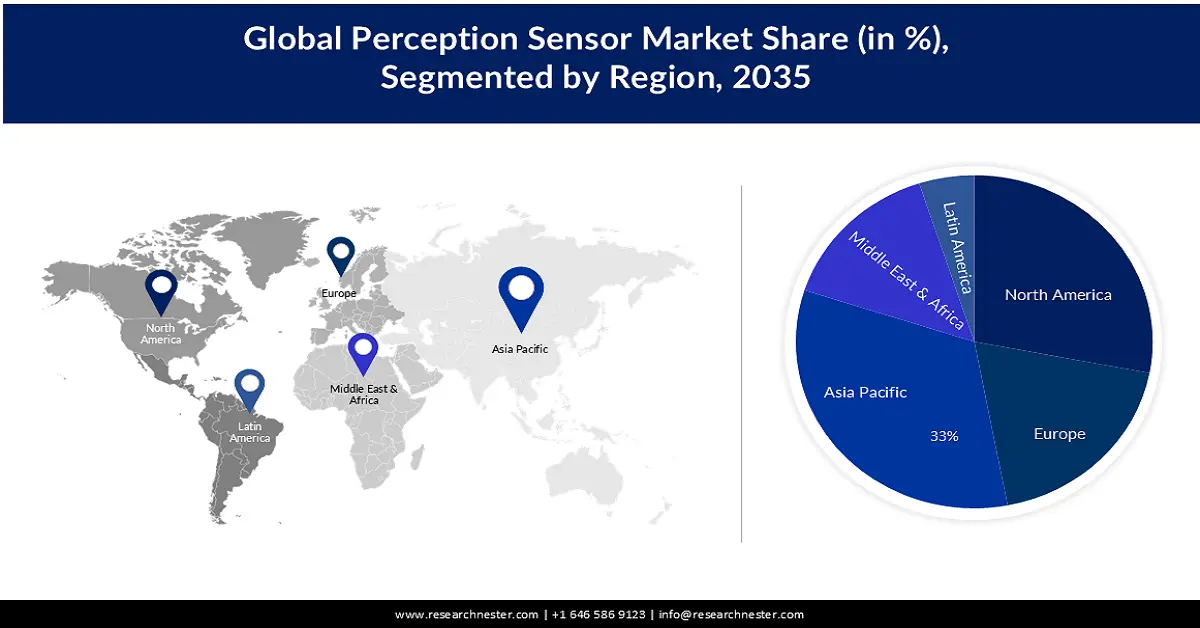

- By 2035, the Asia Pacific region is projected to command a 33% revenue share in the Perception Sensors Market, attributed to lower automotive production costs, abundant low-cost labor, and rising disposable incomes.

- During 2026–2035, the North America region is expected to expand robustly, spurred by the rising uptake of advanced driving systems and accelerating EV sales.

Segment Insights:

- By 2035, the camera segment in the Perception Sensors Market is projected to post a 25% CAGR, supported by its ability to simplify circuitry, reduce static power usage, and enhance sensitivity through advanced pixel architecture.

- By 2035, the passenger vehicle segment is poised to record 60% growth, fueled by the surging need for fuel-efficiency optimization and increasing consumer preference for eco-friendly, safety-centric vehicles.

Key Growth Trends:

- Growing Investment by Key Players

- Growing Demand for Electric Vehicles

Major Challenges:

- Accuracy and Reliability Issues

- High Cost of perception sensors

Key Players: Analog Devices, Inc, DENSO CORPORATION, NVIDIA Corporation, LeddarTech Inc., Quanergy Systems, Inc., Velodyne Lidar, Inc.

Global Perception Sensors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 26.52 billion

- 2026 Market Size: USD 27.26 billion

- Projected Market Size: USD 35.99 billion by 2035

- Growth Forecasts: 3.1%

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Brazil, Singapore, Mexico, United Arab Emirates

Last updated on : 19 November, 2025

Perception Sensors Market - Growth Drivers and Challenges

Growth Driver

- Growing Investment by Key Players - Escalating investments by key market players to develop sophisticated technologies to enhance passenger experience is assessed to provide ample growth opportunities to the perception sensors market.

- Growing Demand for Electric Vehicles - Due to continued technological advances and increasing public awareness of their benefits, the use of electric vehicles is expected to increase in the coming years. The transition to electric vehicles will increase demand for self-driving cars. Self-driving electric vehicles offer a variety of benefits such as improved safety, increased mobility, reduced environmental impact, and increased efficiency. Autonomous electric vehicles can reduce dependence on non-renewable energy sources such as fossil fuels. These two technologies will grow together, as demand for electric vehicles rapidly increases in many countries around the world, with the goal of greener and safer transportation options. Countries such as China, Germany, and the United States, among others, have enacted strict safety and environmental regulations. In three years, the share of electric cars in overall vehicle sales jumped from about 4% to 14% between 2020 and 2022. It is expected that sales of electric vehicles will continue to grow strongly in the coming years.

- Growing Technological Advancement - The increasing accessibility of these sensors to a wider range of vehicles is facilitated by developments in sensor technology, such as their greater precision and extended range with reduced costs. The perception sensors market is expected to grow over the next few years due to this trend.

Challenges

- Accuracy and Reliability Issues - Perception sensors need to be highly accurate and reliable, especially in safety-critical applications like autonomous vehicles. Environmental factors such as rain, snow, and low light can affect sensor performance, posing accuracy challenges.

- Data Processing and Integration Problem with perception sensors is Predicted to Hamper the Market Growth in the Upcoming Period

- High Cost of perception sensors is Anticipated to Pose Limitations in the Perception Sensors Market Expansion During the Forecast Period

Perception Sensors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.1% |

|

Base Year Market Size (2025) |

USD 26.52 billion |

|

Forecast Year Market Size (2035) |

USD 35.99 billion |

|

Regional Scope |

|

Perception Sensors Market Segmentation:

Type Segment Analysis

In terms of type, the camera segment is predicted to hold the highest CAGR of 25% by the end of 2035. This is predicted to grow on account of the abilities of this perception sensor to reduce the complexity of the circuit, consume very low static power, and offer higher sensitivity owing to the presence of the latest pixel architecture. Furthermore, increased resolution is going to provide even more detailed information for accurate object recognition and identification. Smaller and more compact cameras will enable integration into smaller devices and robots. Additionally, AI-powered algorithms are going to enhance the ability of cameras to handle challenging environmental conditions and extract meaningful information from the data.

Vehicle Type Segment Analysis

In terms of vehicle type, the passenger vehicle segment is predicted to dominate the perception sensors market growth with a growth rate of 60% during the estimated period. The segment for passenger vehicles is estimated to lead the market, in terms of share, ascribing to the rising need for the optimization of fuel consumption and growing demand for environment-friendly and safety-oriented vehicles. From 2017 to 2025, an analysis shows the number of green vehicle models sold by Hyundai Motor and Kia Motors in South Korea. By the year 2025, it is expected that approximately 38 eco-vehicle models will be produced by the Hyundai Motor Group. Features such as lane departure warning, blind spot detection, and automatic emergency braking rely heavily on sensors such as cameras, radar, and ultrasonic sensors, driving the demand and thus driving the segment growth in the estimated timeframe.

Our in-depth analysis of the global perception sensors market includes the following segments:

|

Type |

|

|

Vehicle Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Perception Sensors Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is expected to dominate majority revenue share of 33% by 2035. The growth can be attributed to the back of lesser automotive production costs, availability of low-cost labor, and increasing disposable income of the population. In addition, the growing number of vehicular accidents and escalating emphasis on automobile safety systems are also anticipated to boost market growth in the region. Well-known automakers like Hyundai, Toyota, and Honda are based in the Asia-Pacific area and are investing in autonomous car technology. In order to build autonomous vehicles, these OEMs have partnered with numerous international software and hardware companies. In the upcoming years, they also intend to make significant investments in the advancement of sensor technologies for driverless vehicles. The region's nations are also setting up the necessary infrastructure to use electric vehicles, which may contribute to the emergence of autonomous vehicles. For example, in October 2021, Honda and Cruise, a General Motors company, inked a deal whereby Honda will invest USD 2 billion over a 12-year period in the development of autonomous car technologies.

North American Market Insights

The North America perception sensors market is set to grow significantly during the time period between 2026-2035. The growth can be attributed to the rising adoption of advanced driving systems and increasing sales of electric vehicles. The increasing integration of smart devices in homes and wearables is also fuelling demand for miniature, low-power perception sensors for features like gesture recognition and environmental monitoring. This is predicted to drive the growth of the perception sensors market in the region during the prediction period.

Perception Sensors Market Players:

- Robert Bosch GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Analog Devices, Inc

- NVIDIA Corporation

- LeddarTech Inc.

- Quanergy Systems, Inc.

- ZF Friedrichshafen AG

- Velodyne Lidar, Inc.

- EMBARCADERO INC.

- AEye, Inc.

- Mobileye Technologies Limited

Recent Developments

- January 2020: Bosch debuted its long-range LIDAR sensor LRR4 for autonomous vehicles. The product features a detection range of 250 meters and is capable of recognizing up to 24 objects simultaneously. It is targeted for medium and close ranges in cities and on highways.

- DENSO developed the Global Safety Package 3, an active security system designed to improve the environment-sensing capabilities of automobiles and raise vehicle safety in January 2022. The Global Safety Package combines the capabilities of a vision sensor and a millimeter-wave radar sensor to assist the driver in operating the vehicle safely. The millimeter-wave radar sensor uses radar to identify the shapes of road items, such as cars and guardrails, while the vision sensor uses a camera to identify the area in front of the vehicle.

- Report ID: 3210

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Perception Sensors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.