Global People Analytics Market

- An Outline of the Global People Analytics Market

- Market Definition and Market Segmentation

- Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- SPSS Methodology

- Data Triangulation

- Executive Summary

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Technological Advancements

- Growth Outlook

- Patent Analysis

- Risk Overview

- SWOT

- Regional Demand

- Pricing Benchmarking

- People Analytics Market: Software and Services in Action

- People Analytics Across Industries: Adoption, Challenges & Future Potential

- Growth Potential for End-User of People Analytics Market

- On-Premises vs. Cloud: The Ultimate Deployment Showdown in People Analytics

- Consumer Behavior Insights: What Drives People Analytics Choices

- Smarter HR with AI: How Automation is Shaping the Workforce

- The Future of People Analytics: Trends Shaping the Next Decade

- Regional Readiness for People Analytics: Market Maturity & Key Trends

- Breaking into People Analytics: Strategic Recommendations for Success

- Recent News

- Mergers and Acquisitions (M&A)

- Root Cause Analysis (RCA) for discovering problems of the People Analytics Market

- Porter Five Forces

- PESTLE

- Comparative Positioning

- Competitive Landscape

- Competitive Model

- Company Market Share

- Business Profile of Key Enterprise

- ADP, Inc.

- ChartHop, Inc.

- Crunchr

- Culture Amp Pty Ltd

- Ernst & Young Global Limited

- Humanforce Holdings Pty Ltd

- Links International

- One Model Inc.

- Qualtrics

- Splash Business Intelligence Inc.

- Visier, Inc.

- Willis Towers Watson (WTW)

- Workday, Inc.

- Global People Analytics Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Global People Analytics Market Segmentation Analysis (2024-2037)

- By Component

- Software, Market Value (USD Million), and CAGR, 2024-2037F

- Services, Market Value (USD Million), and CAGR, 2024-2037F

- By Deployment Mode

- On-Premises, Market Value (USD Million), and CAGR, 2024-2037F

- Cloud-Based, Market Value (USD Million), and CAGR, 2024-2037F

- By Organization Size

- Small and Medium-Sized Enterprises, Market Value (USD Million), and CAGR, 2024-2037F

- Large Enterprises, Value (USD Million), and CAGR, 2024-2037F

- By End User

- Telecom and IT, Market Value (USD Million), and CAGR, 2024-2037F

- BFSI, Market Value (USD Million), and CAGR, 2024-2037F

- Healthcare, Market Value (USD Million), and CAGR, 2024-2037F

- Manufacturing, Market Value (USD Million), and CAGR, 2024-2037F

- Retail and Consumer Goods, Market Value (USD Million), and CAGR, 2024-2037F

- Education, Market Value (USD Million), and CAGR, 2024-2037F

- Travel and Hospitality, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Region

- North America, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Europe, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Asia Pacific Excluding Japan, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Japan, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Latin America, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Middle East and Africa, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Component

- Cross Analysis of Deployment Mode W.R.T. End User (USD Million), 2024-2037

- North America People Analytics Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- North America People Analytics Market Segmentation Analysis (2024-2037)

- By Component

- Software, Market Value (USD Million), and CAGR, 2024-2037F

- Services, Market Value (USD Million), and CAGR, 2024-2037F

- By Deployment Mode

- On-Premises, Market Value (USD Million), and CAGR, 2024-2037F

- Cloud-Based, Market Value (USD Million), and CAGR, 2024-2037F

- By Organization Size

- Small and Medium-Sized Enterprises, Market Value (USD Million), and CAGR, 2024-2037F

- Large Enterprises, Value (USD Million), and CAGR, 2024-2037F

- By End User

- Telecom and IT, Market Value (USD Million), and CAGR, 2024-2037F

- BFSI, Market Value (USD Million), and CAGR, 2024-2037F

- Healthcare, Market Value (USD Million), and CAGR, 2024-2037F

- Manufacturing, Market Value (USD Million), and CAGR, 2024-2037F

- Retail and Consumer Goods, Market Value (USD Million), and CAGR, 2024-2037F

- Education, Market Value (USD Million), and CAGR, 2024-2037F

- Travel and Hospitality, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Country

- U.S., Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Canada, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Component

- Cross Analysis of Deployment Mode W.R.T. End User (USD Million), 2024-2037

- Europe People Analytics Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Europe People Analytics Market Segmentation Analysis (2024-2037)

- By Component

- Software, Market Value (USD Million), and CAGR, 2024-2037F

- Services, Market Value (USD Million), and CAGR, 2024-2037F

- By Deployment Mode

- On-Premises, Market Value (USD Million), and CAGR, 2024-2037F

- Cloud-Based, Market Value (USD Million), and CAGR, 2024-2037F

- By Organization Size

- Small and Medium-Sized Enterprises, Market Value (USD Million), and CAGR, 2024-2037F

- Large Enterprises, Value (USD Million), and CAGR, 2024-2037F

- By End User

- Telecom and IT, Market Value (USD Million), and CAGR, 2024-2037F

- BFSI, Market Value (USD Million), and CAGR, 2024-2037F

- Healthcare, Market Value (USD Million), and CAGR, 2024-2037F

- Manufacturing, Market Value (USD Million), and CAGR, 2024-2037F

- Retail and Consumer Goods, Market Value (USD Million), and CAGR, 2024-2037F

- Education, Market Value (USD Million), and CAGR, 2024-2037F

- Travel and Hospitality, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Country

- UK, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Germany, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- France, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Italy, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Spain, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Russia, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- BENELUX, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Poland, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Rest of Europe, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Component

- Cross Analysis of Deployment Mode W.R.T. End User (USD Million), 2024-2037

- Asia Pacific Excluding Japan People Analytics Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Asia Pacific Excluding Japan People Analytics Market Segmentation Analysis (2024-2037)

- By Component

- Software, Market Value (USD Million), and CAGR, 2024-2037F

- Services, Market Value (USD Million), and CAGR, 2024-2037F

- By Deployment Mode

- On-Premises, Market Value (USD Million), and CAGR, 2024-2037F

- Cloud-Based, Market Value (USD Million), and CAGR, 2024-2037F

- By Organization Size

- Small and Medium-Sized Enterprises, Market Value (USD Million), and CAGR, 2024-2037F

- Large Enterprises, Value (USD Million), and CAGR, 2024-2037F

- By End User

- Telecom and IT, Market Value (USD Million), and CAGR, 2024-2037F

- BFSI, Market Value (USD Million), and CAGR, 2024-2037F

- Healthcare, Market Value (USD Million), and CAGR, 2024-2037F

- Manufacturing, Market Value (USD Million), and CAGR, 2024-2037F

- Retail and Consumer Goods, Market Value (USD Million), and CAGR, 2024-2037F

- Education, Market Value (USD Million), and CAGR, 2024-2037F

- Travel and Hospitality, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Country

- China, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- India, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- South Korea, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Australia, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Indonesia, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Malaysia, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Vietnam, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Thailand, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Singapore, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- New Zealand, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Rest of APEJ, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Component

- Japan People Analytics Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Japan People Analytics Market Segmentation Analysis (2024-2037)

- By Component

- Software, Market Value (USD Million), and CAGR, 2024-2037F

- Services, Market Value (USD Million), and CAGR, 2024-2037F

- By Deployment Mode

- On-Premises, Market Value (USD Million), and CAGR, 2024-2037F

- Cloud-Based, Market Value (USD Million), and CAGR, 2024-2037F

- By Organization Size

- Small and Medium-Sized Enterprises, Market Value (USD Million), and CAGR, 2024-2037F

- Large Enterprises, Value (USD Million), and CAGR, 2024-2037F

- By End User

- Telecom and IT, Market Value (USD Million), and CAGR, 2024-2037F

- BFSI, Market Value (USD Million), and CAGR, 2024-2037F

- Healthcare, Market Value (USD Million), and CAGR, 2024-2037F

- Manufacturing, Market Value (USD Million), and CAGR, 2024-2037F

- Retail and Consumer Goods, Market Value (USD Million), and CAGR, 2024-2037F

- Education, Market Value (USD Million), and CAGR, 2024-2037F

- Travel and Hospitality, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Component

- Cross Analysis of Deployment Mode W.R.T. End User (USD Million), 2024-2037

- Latin America People Analytics Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Latin America People Analytics Market Segmentation Analysis (2024-2037)

- By Component

- Software, Market Value (USD Million), and CAGR, 2024-2037F

- Services, Market Value (USD Million), and CAGR, 2024-2037F

- By Deployment Mode

- On-Premises, Market Value (USD Million), and CAGR, 2024-2037F

- Cloud-Based, Market Value (USD Million), and CAGR, 2024-2037F

- By Organization Size

- Small and Medium-Sized Enterprises, Market Value (USD Million), and CAGR, 2024-2037F

- Large Enterprises, Value (USD Million), and CAGR, 2024-2037F

- By End User

- Telecom and IT, Market Value (USD Million), and CAGR, 2024-2037F

- BFSI, Market Value (USD Million), and CAGR, 2024-2037F

- Healthcare, Market Value (USD Million), and CAGR, 2024-2037F

- Manufacturing, Market Value (USD Million), and CAGR, 2024-2037F

- Retail and Consumer Goods, Market Value (USD Million), and CAGR, 2024-2037F

- Education, Market Value (USD Million), and CAGR, 2024-2037F

- Travel and Hospitality, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Country

- Brazil, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Argentina, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Mexico, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Rest of Latin America, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Component

- Cross Analysis of Deployment Mode W.R.T. End User (USD Million), 2024-2037

- Middle East & Africa People Analytics Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Middle East & Africa People Analytics Market Segmentation Analysis (2024-2037)

- By Component

- Software, Market Value (USD Million), and CAGR, 2024-2037F

- Services, Market Value (USD Million), and CAGR, 2024-2037F

- By Deployment Mode

- On-Premises, Market Value (USD Million), and CAGR, 2024-2037F

- Cloud-Based, Market Value (USD Million), and CAGR, 2024-2037F

- By Organization Size

- Small and Medium-Sized Enterprises, Market Value (USD Million), and CAGR, 2024-2037F

- Large Enterprises, Value (USD Million), and CAGR, 2024-2037F

- By End User

- Telecom and IT, Market Value (USD Million), and CAGR, 2024-2037F

- BFSI, Market Value (USD Million), and CAGR, 2024-2037F

- Healthcare, Market Value (USD Million), and CAGR, 2024-2037F

- Manufacturing, Market Value (USD Million), and CAGR, 2024-2037F

- Retail and Consumer Goods, Market Value (USD Million), and CAGR, 2024-2037F

- Education, Market Value (USD Million), and CAGR, 2024-2037F

- Travel and Hospitality, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Country

- GCC, Market Value (USD Million), Volume (Tons) and CAGR, 2024-2037F

- Israel, Market Value (USD Million), Volume (Tons) and CAGR, 2024-2037F

- South Africa, Market Value (USD Million), Volume (Tons) CAGR & Y-o-Y Growth Trend, 2024-2037F

- Rest of Middle East & Africa, Market Value (USD Million), Volume (Tons) and CAGR, 2024-2037F

- By Component

- About Research Nester

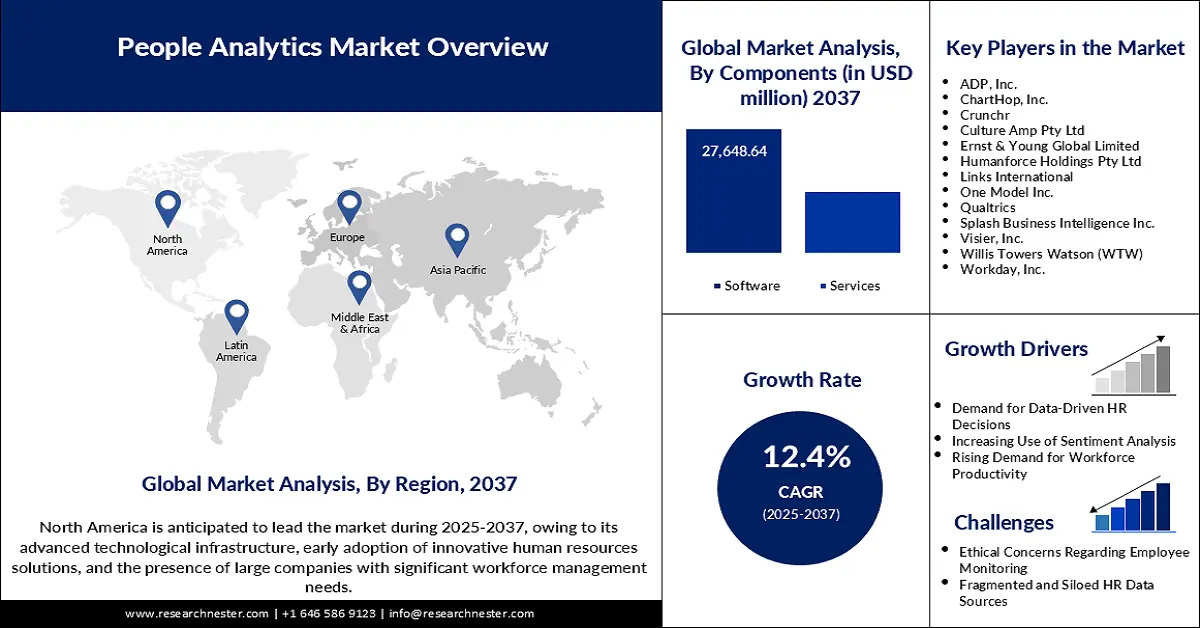

People Analytics Market Outlook:

People Analytics Market size was valued at USD 8.9 billion in 2024 and is projected to reach a valuation of USD 41.5 billion by the end of 2037, rising at a CAGR of 12.4% during the forecast period, i.e., 2025-2037. In 2025, the industry size of people analytics is assessed at USD 10.1 billion.

The people analytics market is growing rapidly, due to the need for data-driven decision-making in human resource management. Businesses are using big data to increase employee satisfaction, organizational commitment, productivity, and organizational outcomes. For example, in May 2024, Oracle introduced the new AI-powered upskilling solution within Oracle Grow, within Oracle Fusion Cloud Human Capital Management (HCM). This platform consolidates feedback, productivity, and collaboration to measure organizational culture. This trend is a part of a larger movement to incorporate AI and machine learning into HR processes to create a more dynamic and flexible work environment.

Governments around the globe are also paying attention to the benefits of people analytics in managing human capital in public sector organizations. In South Korea, the deployment of AI-powered people analytics in public hospitals is gaining traction to manage nurse staffing and turnover. These efforts demonstrate that data analytics is increasingly becoming central to the development of strong and sustainable public workforce systems.

The people analytics supply chain is rooted in AI/ML software development, and major players such as SAP SuccessFactors, Oracle, and Workday use cloud platforms (AWS, Azure) for scalability. As per the data from the US Bureau of Labor Statistics (BLS), the employment for HR analytics is expected to expand by 8% between 2023 and 2033, due to the skills gap and managing a remote workforce. In August 2024, Tulane University’s study disclosed that 25% of HR managers are engaged in AI tool use at the workplace. The global demand is set to reshape the trade of people analytics technologies in the years ahead.

Key People Analytics Market Insights Summary:

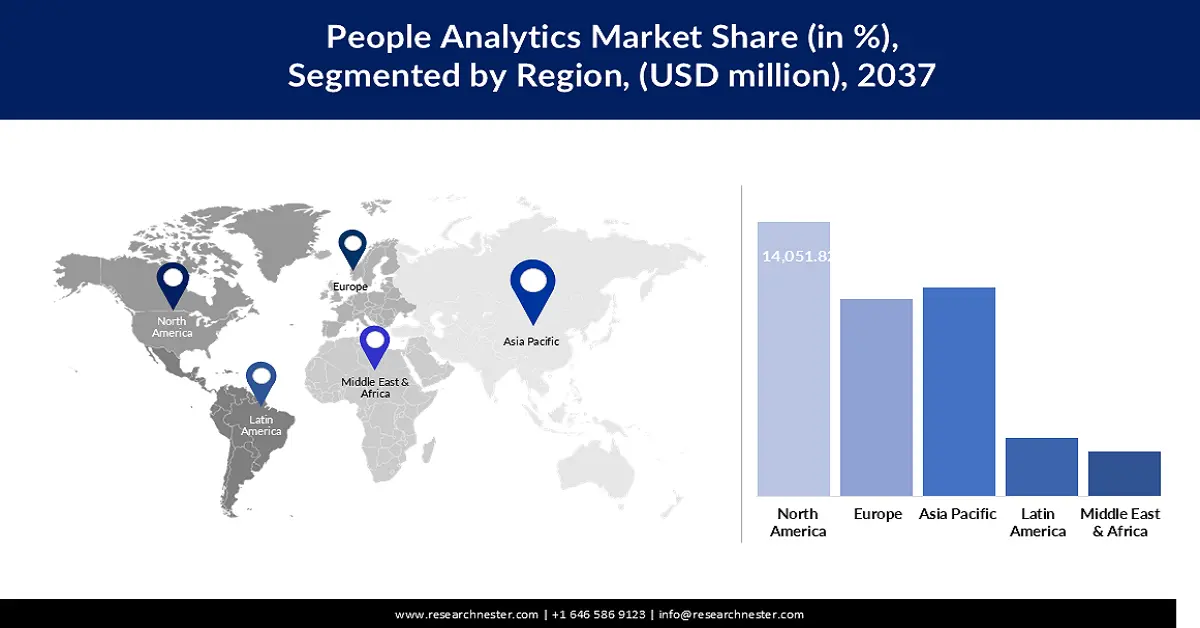

Regional Highlights:

- North America is anticipated to command a 35% share of the People Analytics Market by 2037, owing to the region’s early technological adoption and growing emphasis on evidence-based workforce decisions.

- The Asia Pacific region is projected to witness a CAGR of 13.5% from 2025 to 2037, impelled by rapid digital transformation and expanding HR technology integration.

Segment Insights:

- The software segment in the People Analytics Market is projected to account for 65.9% share during 2025–2037, propelled by the growing need for advanced analytics tools that provide real-time workforce insights.

- The on-premises segment is expected to capture a 57.4% share by 2037, sustained by the preference of enterprises with stringent data governance standards.

Key Growth Trends:

- Emphasis on Diversity, Equity, and Inclusion (DEI)

- Demand for real-time workforce insights

Major Challenges:

- Data privacy and compliance concerns

- Integration with existing systems

Key Players: Workday, Inc., Visier, Inc., Qualtrics, ADP, Inc., ChartHop, Inc., Crunchr, Culture Amp Pty Ltd, Humanforce Holdings Pty Ltd, Links International, One Model Inc., Splash Business Intelligence Inc., Willis Towers Watson (WTW), Darwinbox, Ernst & Young Global Limited, PeopleStrong.

Global People Analytics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2024 Market Size: USD 8.9 billion

- 2025 Market Size: USD 10.1 billion

- Projected Market Size: USD 41.5 billion by 2037

- Growth Forecasts: 12.4% CAGR (2025-2037)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 2 September, 2025

People Analytics Market - Growth Drivers and Challenges

Growth Drivers

-

Emphasis on Diversity, Equity, and Inclusion (DEI): Today, many organizations are leveraging people analytics to advance DEI in their organizations. In May 2025, Korn Ferry introduced a next-gen solution designed to help organizations achieve fair, consistent, and data-driven pay practices. This new product is also rewarding HR professionals to find differences in employee pay, make fair changes, and create focused plans to address them. Through hiring, promotion, and compensation data, companies are set to monitor D&I progress and address specific areas of need.

-

Demand for real-time workforce insights: The demand for real-time and usable data concerning the workforce is placing pressure on the adoption of enhanced analytics solutions. In January 2023, Crunchr launched a low-code analytics studio that empowered HR teams to create more ad hoc reports and build their own custom dashboards by including a self-service reporting feature and an option to segment data by role, years of service, and geography. This helps the HR professionals to make faster decisions based on their data analysis. Real-time data availability enables timely interventions on emerging issues while tracking important workforce trends and indices.

-

Integration of AI and ML: AI and ML are revolutionizing the fundamental structure of the people analytics market. Through the use of intelligent algorithms in recruitment, retention, and workforce planning, organizations are shifting the HR function from a tactical to a predictive, strategic business partner. For example, predictive attrition models effective in identifying potential turnover risks are becoming useful for timely interventions by HR departments. As reported by the International Journal of Research and Review, such AI-based models contribute to the decrease of employee turnover costs and enhance employees' satisfaction. The combination of AI and ML is inconsistent across applications and platforms, depending on the scope of the application and the extent of the platform’s development.

Challenges

-

Data privacy and compliance concerns: With the growing amount of employee data collected and analyzed by organizations, compliance with data protection laws is crucial. This includes GDPR, CCPA, and other regional and national laws and regulations. Non-compliance attracts hefty fines and has a negative impact on the company’s reputation among its clients and partners. Health care organizations need to develop comprehensive data governance policies and protocols that are legal and ethical. It is also important to ensure that the employees’ data is protected through strong security measures that can prevent access by unauthorized persons. Conducting frequent audits and updating privacy measures are required due to constantly emerging guidelines.

-

Integration with existing systems: The adoption of new analytics tools in the current human resource systems may cause some challenges and may require a lot of time and effort. There are cases of compatibility problems, data format incompatibility, and a need to build new integrations. In some cases, organizations may need to purchase middleware or APIs to enable effective data flow between the systems. This means that good planning and testing must be done to avert the creation of data silos and to guarantee the quality of the reports. Addressing these integration challenges is crucial to achieving the benefits that come with implementing people analytics. The integration process can be divided into several stages to minimize the risks and to control resources more efficiently.

People Analytics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

12.4% |

|

Base Year Market Size (2024) |

USD 8.9 billion |

|

Forecast Year Market Size (2037 |

USD 41.5 billion |

|

Regional Scope |

|

People Analytics Market Segmentation:

Component Segment Analysis

The software segment is anticipated to generate a people analytics market share of 65.9% during the forecast period. This has been attributed to the growing need for higher-level analytics tools that can deliver instantaneous information on workforce trends. In November 2024, Paychex released its Paychex Premium HR Analytics for SMBs, which provided real-time dashboards and predictive analytics to indicate the further trend towards the availability of enterprise-level analytics to small businesses. This trend points to an increasing use of advanced software in the decision-making process of the human resource department. The advancement of these tools signifies that the complexity of the forecasts and the analysis of workforce trends improves.

Deployment Mode Segment Analysis

The on-premises segment is expected to hold a people analytics market share of 57.4% by 2037. A large number of companies with high security standards for their data opt for on-premises solutions to ensure the security of their employees’ records. This underscores the significance of data governance for many organizations in the modern world. Thus, even though cloud solutions have become popular, on-premises solutions are likely to remain popular due to security and compliance.

Our in-depth analysis of the people analytics market includes the following segments:

|

Segments |

Subsegments |

|

Component |

|

|

Deployment Mode |

|

|

Organization Size |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

People Analytics Market - Regional Analysis

North America Market Insights

North America is expected to hold a people analytics market share of 35% during the forecast period. This dominance can be attributed to the region’s early adoption of technology and focus on evidence-based decision-making. The increasing popularity of advanced AI/ML tools and the rising demand for workforce optimization are creating a lucrative environment for people analytics companies. The end use organizations are deploying analytics to enhance employee engagement, diversity and inclusion initiatives, succession planning, and retention strategies. According to the U.S. Bureau of Labor Statistics estimates that the country is expected to register an addition of 6.7 million employment opportunities from 2023 to 2033. This is also likely to intensify the need for workforce planning tools in the years ahead.

The U.S. people analytics market leads the sales of people analytics solutions, mainly driven by a high concentration of enterprises investing in advanced HR technologies. The federal agencies are also expected to increasingly use analytics to enhance workforce diversity and streamline recruitment. This trend is also mirrored by the players in the private sector. The U.S. BLS study reveals that in July 2023, about 11.9 million people worked as independent contractors for their main or only job, making up 7.4% of all workers. This is higher than in May 2017, when 6.9% of workers were independent contractors. Thus, the growing gig economy is underscoring the need for flexible workforce data management tools.

The Canada people analytics market is anticipated to increase at the fastest CAGR from 2026 to 2035. The strong focus on workplace diversity and inclusion is propelling the sales of people analytics solutions. The need for compliance with evolving privacy laws is also accelerating the trade of advanced analytical technologies. Businesses are increasingly investing in analytics for strategic workforce planning, particularly in response to demographic shifts. The report by Statistics Canada reveals that the number of seniors is likely to reach 9.9 to 10.9 million individuals by the end of 2036. This is expected to amplify the need for succession planning and talent pipeline strategies.

Asia Pacific Market Insights

The Asia Pacific people analytics market is expected to rise at a CAGR of 13.5% between 2025-2037. The robust digital transformation and rising HR technology adoption are fueling the sales of people analytics platforms. The government-led workforce modernization programs are also contributing to the increasing sales of people analytics technologies. Many enterprises are increasingly employing AI, machine learning, and predictive analytics to address talent shortages. According to the International Labor Organization (ILO), APAC accounts for more than 55% of the global labor force, making workforce data insights critical for strategic planning. China, India, Japan, and Australia are driving the adoption of people analytics solutions, owing to large-scale digital HR investments.

The sales of people analytics solutions in China people analytics market are estimated to be driven by large-scale workforce digitization and AI adoption. The strong governmental focus on labor productivity is also fueling the trade of people analytics technologies. The National Bureau of Statistics of China discloses that the country’s urban employment reached 470.32 million in 2023, highlighting the scale of data processing needs for recruitment, engagement, and training. The manufacturing, technology, and financial services are also contributing to the increasing sales of predictive analytics, vital for skills gap identification and turnover reduction.

The India people analytics market is estimated to register robust growth, owing to its expanding digital economy, competitive labor sector, and HR technology adoption among both corporates and startups. The Digital India mission is likely to support the trade of people analytics solutions in the country. The India Brand Equity Foundation (IBEF) reveals that the Union Budget FY26 allocated nearly USD 232 million to accelerate AI adoption and infrastructure development. The supportive government policies and funding are further fueling the trade of people analytics.

Key People Analytics Market Players:

- Workday, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Visier, Inc.

- Qualtrics

- ADP, Inc.

- ChartHop, Inc.

- Crunchr

- Culture Amp Pty Ltd

- Humanforce Holdings Pty Ltd

- Links International

- One Model Inc.

- Splash Business Intelligence Inc.

- Willis Towers Watson (WTW)

- Darwinbox

- Ernst & Young Global Limited

- PeopleStrong

The people analytics market is highly competitive with key players such as Workday, Inc., Visier, Inc., Qualtrics, ADP, Inc., ChartHop, Inc., Crunchr, Culture Amp Pty Ltd, Humanforce Holdings Pty Ltd, Links International, One Model Inc., Splash Business Intelligence Inc., Willis Towers Watson (WTW), Darwinbox, Ernst & Young Global Limited, and PeopleStrong. To that end, these firms are constantly developing new and improved products and services that can adequately address the needs of today’s HR professionals. Most organizations are outsourcing their human resource analytics to various firms to upgrade their HR systems. This improves the company’s capacity to integrate HR with the business strategies, which depicts the increasing use of analytical tools in the firm.

Here are some leading companies in the people analytics market:

Recent Developments

- In January 2025, Workday, Inc. and TechWolf announced that they are set to roll out TechWolf's AI-powered skills intelligence across its global workforce. It comprises more than 20,400 employees and is expected to help augment Workday skills data, making work easier.

- In November 2024, NTT DATA unveiled the expansion of its strategic partnership with Google Cloud. These companies aim to boost the adoption of cloud-based data analytics and generative AI solutions for customers across key markets in Asia Pacific.

- In June 2024, Syndio announced the enhancements to its Workplace Equity Platform. The upgrades are set to help companies navigate the evolving, complex demands for pay equity and transparency.

- Report ID: 7689

- Published Date: Sep 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

People Analytics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.