PC-based Automation Market Outlook:

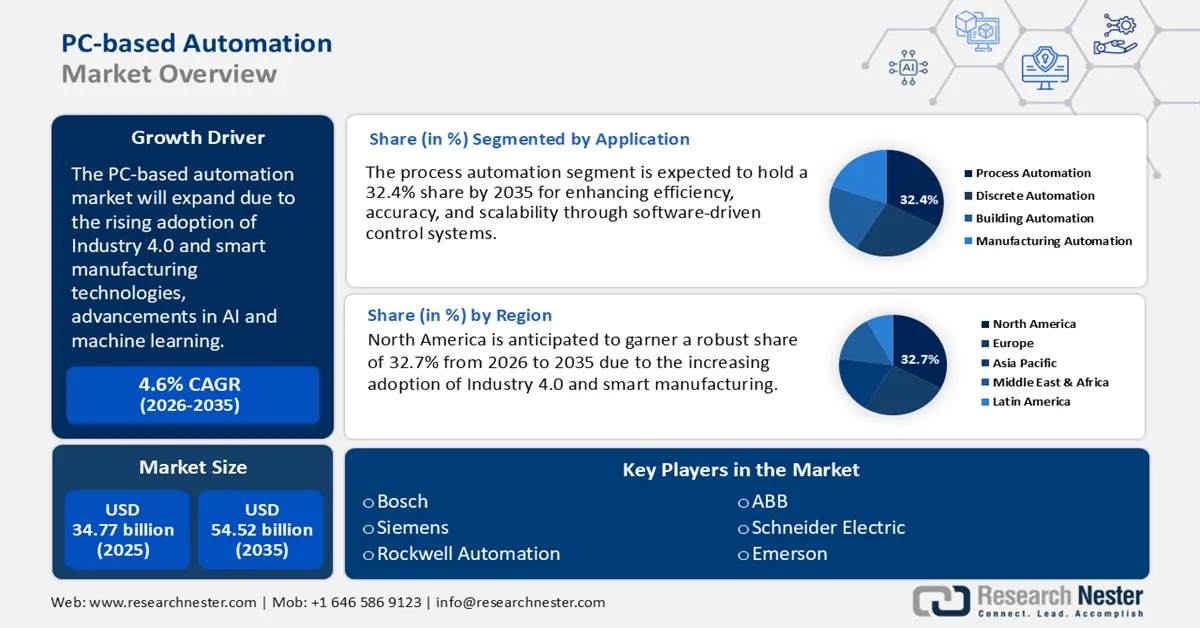

PC-based Automation Market size was over USD 34.77 billion in 2025 and is poised to exceed USD 54.52 billion by 2035, growing at over 4.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of PC-based automation is estimated at USD 36.21 billion.

The primary driver of the market is the rising adoption of Industry 4.0 and smart manufacturing technologies. The shift toward Industry 4.0 and smart factories is fueling the demand for intelligent, connected automation systems. The PC-based automation supports real-time data analytics, remote monitoring, and seamless integration with industrial IoT devices. For instance, a recent development in the realm of Industry 4.0 and smart manufacturing is Nielsoft’s launch of comprehensive Industry 4.0 solutions in India in August 2024. These solutions aim to accelerate digital transformation in manufacturing and automation by providing manufacturing and building automation and digital factory solutions at the shop floor, factory, and enterprise levels.

Moreover, the demand for highly adaptive automation solutions in the automotive, electronics, food & beverage, and pharmaceutical industries is accelerating the adoption of PC-based automation systems as part of the Industry 4.0 revolution. As manufacturers seek greater efficiency, cost-effectiveness, and sustainability, PC-based automation continues to be a key factor in smart manufacturing. PC-based automation reduces hardware costs by consolidating multiple control functions into a single system. High-speed processors enable faster computations, better automation control, and improved system reliability.

Key PC-based Automation Market Insights Summary:

Regional Highlights:

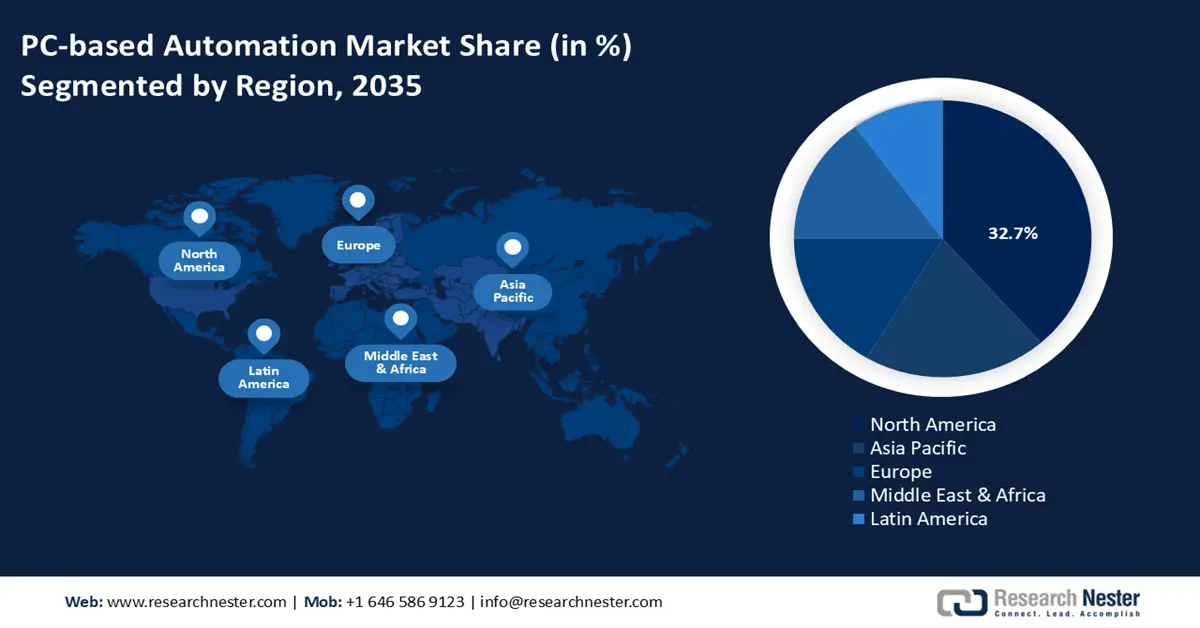

- North America PC-based automation market will account for 32.70% share by 2035, attributed to the increasing adoption of Industry 4.0, smart manufacturing, and advanced automation technologies.

Segment Insights:

- The process automation segment in the pc-based automation market is anticipated to hold a 32.40% share by 2035, driven by enhanced efficiency, AI, IoT integration, and demand for smart factories.

- The programmable logic controller segment in the pc-based automation market is expected to achieve significant share by 2035, attributed to integration with PC-based systems enhancing flexibility and data processing.

Key Growth Trends:

- Advancements in AI and ML

- Increasing demand for industrial efficiency and flexibility

Major Challenges:

- High initial investment and implementation cost

- Cybersecurity risks and data vulnerability

Key Players: Honeywell International Inc., Rockwell Automation, Ge Fanuc, Advantech, Schneider Electric, Siemens, ABB, Yokogawa Electric.

Global PC-based Automation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 34.77 billion

- 2026 Market Size: USD 36.21 billion

- Projected Market Size: USD 54.52 billion by 2035

- Growth Forecasts: 4.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 18 September, 2025

PC-based Automation Market Growth Drivers and Challenges:

Growth Drivers

-

Advancements in AI and ML: AI-driven automation enhances predictive maintenance, process optimization, and adaptive control in industries. Machine learning allows real-time decision-making, improving efficiency and reducing downtime. For instance, in March 2024, Rockwell Automation introduced a new software, FactoryTalk Analytics Guardian AI, that provides insights on predictive maintenance via continuous condition-based monitoring. The software helps maintenance engineers track the right information at the proper time to optimize maintenance activities and reduce unplanned downtime.

-

Increasing demand for industrial efficiency and flexibility: Industries need high-performance, flexible, and cost-effective automation solutions. A recent development exemplifying the increasing demand for industrial efficiency and flexibility through PC-based automation is Beckhoff Automation’s TwinCAT automation software program. This platform enables seamless integration of machine learning, vision edge computing and cloud connectivity, opening new opportunities for automation applications. It combines IT and OT technologies, allowing for code development, building, and debugging without the need for hardware thereby enhancing scalability and flexibility in industrial automation. PC-based automation offers better scalability, software-driven upgrades, and open system architecture compared to traditional PLCs.

Challenges

-

High initial investment and implementation cost: Setting up a PC-based automation system requires significant capital investment in hardware, software, and integration with existing industrial systems. Small and medium enterprises often find it challenging to justify the upfront costs despite long-term benefits.

-

Cybersecurity risks and data vulnerability: As PC-based automation systems rely on IoT, cloud computing, and remote monitoring, they become more vulnerable to cyberattacks, hacking, and data breaches. Industries must invest in advanced cybersecurity solutions to protect sensitive operational data.

PC-based Automation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 34.77 billion |

|

Forecast Year Market Size (2035) |

USD 54.52 billion |

|

Regional Scope |

|

PC-based Automation Market Segmentation:

Application Segment Analysis

Process automation segment is likely to capture PC-based automation market share of over 32.4% by 2035. Process automation in the PC-based automation market is transforming industries by enhancing efficiency, accuracy, and scalability through software-driven control systems. Unlike traditional PLC-based automation, PC-based solutions provide greater flexibility, real-time data processing AI, IoT, and cloud computing integration. Industries such as manufacturing, pharmaceuticals, oil & gas, and food processing leverage PC-based automation for monitoring tasks, production lines, predictive maintenance, quality control, and supply chain optimization. For instance, in January 2024, ABB introduced a new automation solution for the cold block stage of beer production to improve efficiency and optimization. The ABB Ability BeerMaker system is designed for breweries to enhance safety, quality, and productivity. It ensures better connectivity across the brewing process, promoting sustainable water and energy use.

These systems enable seamless communication between machines, remote monitoring, and adaptive control allowing businesses to reduce downtime, improve product consistency, and lower operational costs. As the demand for smart factories and Industry 4.0 solutions grows, PC-based process automation drives higher productivity, data-driven decision-making, and enhanced system reliability across industrial applications.

System Type Segment Analysis

The programmable logic controller is expected to hold a significant PC-based automation market share through 2035. Programmable logic controllers (PLCs) serve as a reliable controller for real-time industrial processes. While traditional PLCs are stand-alone systems designed for deterministic control, modern PC-based automation integrates PLC functionality with industrial PCs, allowing for enhanced flexibility, scalability, and data processing. For instance, in 2024, Ckylop, a leader in packaging automation, revolutionized its operations by integrating PLCs with PC-based systems. This integration enhanced flexibility and data processing capabilities by using AI-driven analytics and cloud integration.

Our in-depth analysis of the global PC-based automation market includes the following segments:

|

Application |

|

|

System Type |

|

|

End use |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

PC-based Automation Market Regional Analysis:

North America Market Insights

North America in PC-based automation market is set to capture over 32.7% revenue share by 2035, due to the increasing adoption of Industry 4.0 and smart manufacturing. AI, IoT, and cloud integration are driving demand for advanced automation solutions in industries such as automotive, healthcare, and energy. Leading companies such as Rockwell Automation, Siemens, and Beckhoff are expanding their presence in the region. Moreover, government initiatives and investments in industrial automation and digital transformation are fueling market growth.

The PC-based automation market in the U.S. is fueled by the rising need for high-performance, software-driven industrial control systems. The country’s focus on manufacturing automation, robotics, and AI-powered analytics is accelerating adoption across various sectors. Tech giants and industrial automation leaders are investing heavily in innovation and R&D to enhance automation capabilities. In 2024, OnLogic, a U.S.-based industrial PC manufacturer, expanded its operations by opening a new 160,000 sq. ft. global headquarters in South Burlington, Vermont. This expansion reflects the increasing demand for PC-based automation systems in the U.S industrial sector.

The PC-based automation market in Canada is expanding due to the country’s emphasis on smart factories and energy-efficient industrial solutions. Strong investments in AI-driven automation and industrial IoT are transforming the manufacturing and logistics sectors. The rise of automation startups and collaborations with global tech firms is accelerating innovation. For instance, in June 2024, Cyklop International, a leading supplier of systems for securing products, acquired Polaris Systems Inc. for packaging solutions.

Europe Market Insights

Europe is anticipated to report a significant PC-based automation market share through 2035, driven by the region’s focus on advanced manufacturing, robotics, and digital twin technology. Strict regulations on energy efficiency and sustainability are pushing industries towards smart automation solutions. Leading firms in Europe such as Siemens, Schneider Electric, and Bosch are pioneering innovations in industrial automation. The rapid adoption of 5G and edge computing is further expected to enhance automation capabilities across various sectors.

The PC-based automation market in Germany is thriving due to the country’s leadership in precision engineering and industrial digitalization. The strong presence of automotive and machinery manufacturing industries is accelerating the adoption of advanced automation. Additionally, Germany’s Industry 4.0 initiative is driving innovation in AI-powered, software-driven automation. Top companies such as Siemens, Beckhoff, and Festo are developing next-generation automation solutions for smart factories.

The PC-based automation market in the UK is expanding due to the rising adoption of AI-driven robotics and smart manufacturing solutions. The country’s strong focus on digital transformation in industries such as pharmaceuticals, aerospace, and food processing is driving demand. Moreover, government-backed initiatives and investments in automation R&D are accelerating technological advancements.

PC-based Automation Market Players:

- Siemens

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bosch Rexroth

- Rockwell Automation

- Advantech

- Schneider Electric

- ABB

- Yokogawa Electric

- Emerson

- National Instruments

- Phoenix Contact

- Honeywell

- TE Connectivity

- Cognex

The PC-based automation market is led by several key players driving industrial innovation and digital transformation. Siemens dominates with its SIMATIC Industrial PCs and Xcelerator platforms enabling smart automation. Beckhoff Automation specializes in PC based control systems involving technologies like TwinCAT software for real-time automation. Rockwell Automation integrates industrial PCs with IoT and AI enhancing efficiency in manufacturing and process industries. Schneider Electric leads in sustainable automation with its EcoStruxure platform optimizing energy and industrial operations. Here are some leading players in the PC-based automation market:

Recent Developments

- In February 2025, Ranpak partnered with Rabot to expand AI-driven packaging solutions. Rabot’s vision AI platform provides real-time visibility and insights through video recordings and AI models during packing, return, inbound, and other operations.

- In January 2025, Addverb Technologies deployed many robotics-based production systems in companies to automate their manufacturing systems in the pharmaceuticals, consumer goods, and automotive sectors. The assembly lines in industries adopt flexible robotics to meet rising consumer expectations.

- In November 2024, Rockwell Automation, Inc., the world’s largest industrial automation and digital transformation company, introduced FactoryTalk Vision AI, an inspection solution that uses AI and ML to enhance quality control in manufacturing.

- Report ID: 7249

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

PC-based Automation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.