PC Accessories Market Outlook:

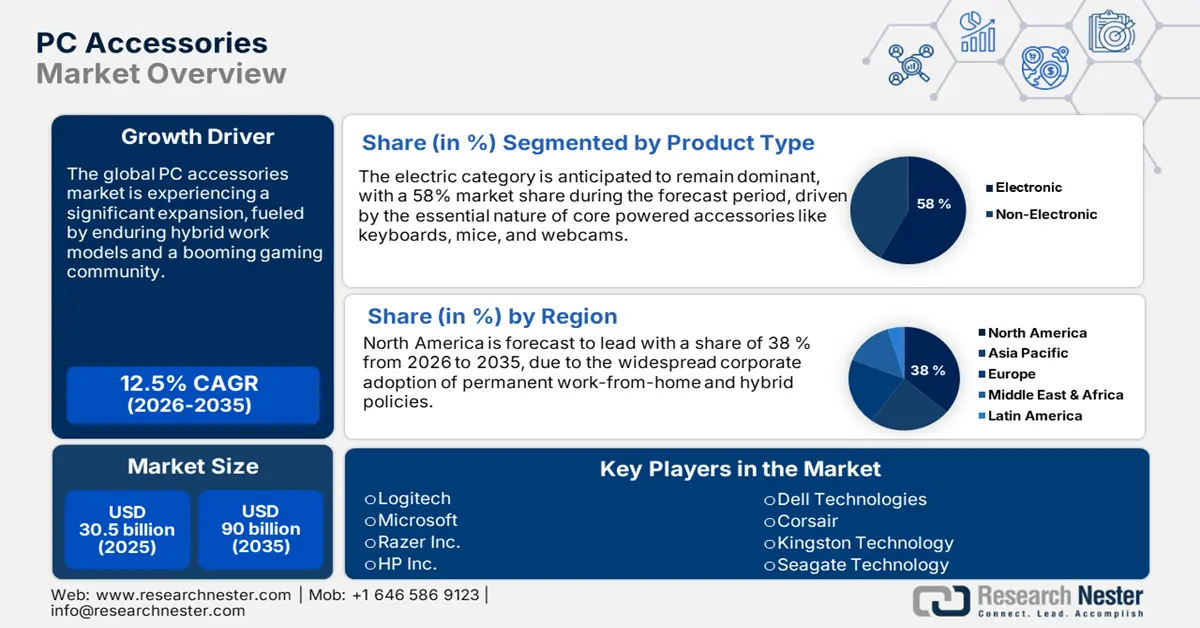

Pc Accessories Market size is valued at USD 30.5 billion in 2025 and is projected to reach a valuation of USD 90 billion by the end of 2035, rising at a CAGR of 12.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of pc accessories is assessed at USD 34.3 billion.

The global market is experiencing a significant expansion, driven by a highly developed gaming culture and the worldwide spread of hybrid work models. This has transformed accessories from mere peripherals to must-have tools of productivity, entertainment, and self-expression. There is innovation galore in the market, with players vying to provide better performance, greater customization, and improved ergonomics. For instance, Corsair launched its K65 Plus Wireless keyboard in February 2024, a compact 75% model with hot-swappable switches, and it is squarely targeted at the growing demand for bespoke and high-performance peripherals among both consumers and professionals.

The market trend is also driven by government initiatives to encourage domestic technology sectors and enable digital infrastructure. In March 2025, the UK government backed the next generation of semiconductor start-ups under its ChipStart incubator programme as part of a £1 billion National Semiconductor Strategy. While not necessarily peripheral-focused, these applications support the underlying technologies and supply chains that enable the development of next-generation PC peripherals, from advanced sensors in gaming mice to the silicon that powers fast-growing connectivity, fueling a vibrant and healthy future for the industry.

Key PC Accessories Market Insights Summary:

Regional Highlights:

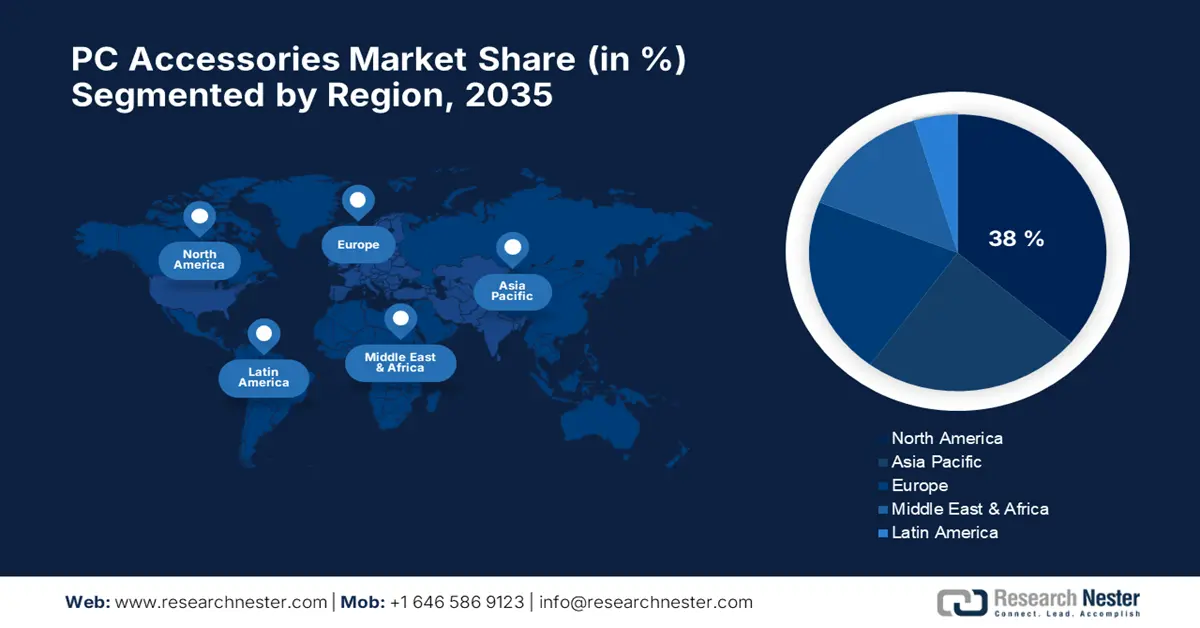

- North America is anticipated to command a 38% share of the pc accessories market by 2035, attributable to its vast and wealthier consumer base, deeply rooted PC gaming culture, and widespread adoption of remote and hybrid work patterns.

- Europe is expected to experience substantial expansion through 2035, supported by robust gaming culture, elevated remote work adoption, and rising requirements for product quality and ergonomics.

Segment Insights:

- The electronic segment of the pc accessories market is projected to secure a 58% share by 2035, sustained by rising demand for powered accessories offering better performance, functionality, and connectivity.

- The consumer segment is forecast to hold a 65% share by 2035, strengthened as the distinctions between work, entertainment, and personal activities continue to break down and the personal computer becomes the center of daily life.

Key Growth Trends:

- Sharp growth of PC gaming and Esports

- Growing inclination towards hybrid work models

Major Challenges:

- Navigating through a complex global supply chain

- Long-term threat of quantum computing

Key Players: Logitech, Microsoft, Razer Inc., HP Inc., Dell Technologies, Corsair, Kingston Technology, Seagate Technology, Anker Innovations, Samsung Electronics, Lenovo, ASUSTeK Computer Inc.

Global PC Accessories Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 30.5 billion

- 2026 Market Size: USD 34.3 billion

- Projected Market Size: USD 90 billion by 2035

- Growth Forecasts: 12% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Indonesia, Mexico

Last updated on : 19 August, 2025

PC Accessories Market - Growth Drivers and Challenges

Growth Drivers

- Sharp growth of PC gaming and Esports: The global PC gaming and esports market is a leading growth factor, with a large and avid user base continually seeking to gain an edge through high-performance peripherals. This drives a self-reinforcing cycle of innovation in mice, keyboards, and headsets that yield lower latency, higher accuracy, and increased comfort. In June 2025, ASUS ROG launched the Keris II Origin gaming mouse, a device specially created for elite esports professionals with a 42,000-dpi optical sensor and ultra-low-latency wireless connection, directly illustrating the trend's shift in the sector to meet the high standards of professional players.

- Growing inclination towards hybrid work models: The remote and hybrid work trend has made home offices a necessity in professional workspaces, triggering a strong demand for high-performance accessories that enhance productivity and comfort. This encompasses a wide range of products from ergonomic keyboards and high-resolution webcams to sophisticated docking stations. In June 2025, Ugreen launched the multi-functional 9-in-1 Revodok Pro docking station, a compact hub designed to boost productivity in office and hybrid workspaces by providing a wide range of connection features via a single, easy-to-use USB-C cable.

- Demand for customization and personalization: PC consumers in general, but particularly gamers and professionals in creative industries, often opt for accessories that can be customized to their specific needs, taste, and preferences. This has resulted in a wave of products that offer extensive customization, such as swappable components and programmable RGB lighting. For example, HP's HyperX gaming division introduced the Pulsefire Saga Pro mouse in January 2025, a groundbreaking product featuring a variety of interchangeable components for extensive ergonomic customization to fit any hand. This is an apparent response to the growing call for a greater personalized user experience.

Challenges

- Navigating through a complex global supply chain: One of the greatest challenges for the PC accessories market is managing the sophisticated and often fragile global supply chains for semiconductors and other electronic components. Disruptions lead to product delays, component availability shortages, and increased costs, impacting manufacturers' ability to fulfill customers.

- Long-term threat of quantum computing: A long-term strategic threat to the whole technology sector, including PC accessories, is the development of quantum computers with the ability to break current encryption schemes. This future threat compels forward-looking investment in the development and deployment of new quantum-resistant cryptographic solutions to offer long-term security and integrity to digital products. Early deployment of these advanced security protocols is necessary to avoid potential vulnerabilities from becoming exploitable.

PC Accessories Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.5% |

|

Base Year Market Size (2025) |

USD 30.5 billion |

|

Forecast Year Market Size (2035) |

USD 90 billion |

|

Regional Scope |

|

PC Accessories Market Segmentation:

Product Type Segment Analysis

The electronic segment is anticipated to remain dominant, with a 58% market share during the forecast period, driven by demand for powered accessories offering better performance, functionality, and connectivity. The group encompasses a wide range of products, from premium gaming mice and mechanical keyboards to active noise-canceling headphones and next-generation docking stations. For instance, HP showcased this trend in July 2025 by launching a new generation of premium Thunderbolt 4 docks, one of which is a flagship model that can drive up to four external monitors and deliver a massive 280 watts of power to charge the most power-hungry laptops. The segment is also fueled by continued innovation in wireless technology and battery life, the primary drivers of purchase for those who seek a clean and uncluttered desk environment.

End user Segment Analysis

The consumer segment is forecast to account for a 65.0% market share by 2035, as the distinctions between work, entertainment, and personal activities continue to break down, and the personal computer becomes the center of daily life. The segment's dominance is also evidenced by the industry's focus on crafting products that are centered around individual consumers' interests and lifestyles. In January 2025, Razer launched an advanced and functional monitor stand that seamlessly incorporates its signature Chroma RGB lighting system. This item serves not only ergonomic and organizational purposes but also provides personalized, vibrant ambient light for a user's battle station, thereby revealing how vendors are directly addressing the appearance and personalization needs of the large and lucrative consumer gaming demographic.

Distribution Channel Segment Analysis

The online channel segment is expected to dominate the industry through 2035, owing to the convenience, broad selection, and competitive pricing offered by online shopping websites. The strength of the online channel is also fortified by direct-to-consumer business models of major brands, which prefer to launch their more advanced products directly from their websites. For instance, Lemokey introduced its G1 wireless gaming mouse with an ultralight design and a high polling rate in June 2024 and marketed it directly to competitive gamers through digital channels. This direct involvement model allows brands to build a strong community and control the entire customer experience, further cementing the priority of online distribution.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

End user |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

PC Accessories Market - Regional Analysis

North America Market Insights

The pc accessories market in North America is anticipated to hold a 38% market share during the forecast period. It is driven by a vast and wealthier consumer base, a deeply embedded PC gaming culture, and the widespread adoption of remote and hybrid work patterns. The region is home to some of the globe's most iconic brands and is among the hubs for innovation, with an uninterrupted abundance of new product releases addressing the mainstream and enthusiast segments of the marketplace.

The U.S. market is expanding, with an emphasis on high-performance gaming and cutting-edge technology. The country is a serious esports center and boasts an enormous population of PC fanatics hungry for the latest and greatest accessories. This was exemplified at CES in January 2025, when Nvidia launched its much-hyped GeForce RTX 50 Series GPUs. The presence of such powerful core chips always creates a massive ripple effect, causing a new cycle of upgrades in high-refresh-rate monitors, high-speed solid-state drives, and other peripherals needed to take full advantage of the new technology.

US Export Data for Computer Accessories

|

Metric |

June 2025 Value (USD Billion) |

Change from May 2025 |

Year-to-Date (Jan-Jun 2025) Value (USD Billion) |

Change from Jan-Jun 2024 |

|

Exports |

4.127 |

-1.2 |

26.503 |

+7.939 |

|

Imports |

10.589 |

+0.063 |

70.029 |

+26.515 |

Source: U.S. Census Bureau

Canada PC accessories market is also rising steadily with the support of a healthy local technology sector and government initiatives towards promoting innovation and backing the country's local supply base for important components. In a significant move, the Government of Canada invested heavily in Teledyne in March 2025 through its Strategic Innovation Fund. The investment is intended to help Teledyne develop the next generation of PC enhancement image sensors and expand its semiconductor manufacturing capabilities, further entrenching Canada's leadership in providing the underlying technologies that support a wide range of PC peripherals.

Europe Market Insights

Europe is anticipated to account for substantial growth throughout the forecast period, driven by robust gaming culture, elevated remote work adoption rates, and rising requirements for product quality and ergonomics. Europe market features a diversified consumer base with varied demands and needs, opening opportunities for a wide range of products, from high-performance gaming peripherals to professional-grade accessories for the modern workplace. Government support for innovation and technology also contributes to the positive outlook of the market.

Germany is a significant market with a strong economy and a technologically savvy consumer base. The government encourages innovation in areas of core technology by supporting policies and funding mechanisms. In March 2024, the German government guaranteed support for the photonics sector through its Research Allowance Act. The new legislation, which increases R&D expenditure for small and medium-sized enterprises, aims to accelerate innovation in cutting-edge technologies such as semiconductors and optics, thereby playing a key role in future PC accessory innovation.

The UK market is vibrant, with a focus on building a robust local technology ecosystem and developing innovative firms. The government is actively involved in the same through strategic investment and targeted programs. In March 2025, the UK backed the next-generation semiconductor start-ups by funding its ChipStart incubator program. This project, under a £1 billion National Semiconductor Strategy, will create a domestic semiconductor industry, an advancement that will make the supply chain of advanced components more robust for the high-performance PC accessories utilized in a wide range of products.

APAC Market Insights

Asia Pacific PC accessories market is projected to record a 10% CAGR from 2026 to 2035. This sustained growth is fueled by the region's enormous and youthful population, a vibrant gaming phenomenon, rising disposable incomes, and the rapid expansion of digital infrastructure. The sizeable consumer base in markets like China and India, coupled with an industry-wide manufacturing ecosystem, makes APAC a lucrative market for both consumption and manufacturing of PC peripherals.

China is a significant market for pc accessories and follows a country-wide strategy of becoming self-sufficient in the core technology of the country to reduce dependence on foreign goods. The government, in August 2023, published the China Optoelectronic Device Industry Technology Development Roadmap. The national policy, which is part of the broader Made in China 2025, aims to enhance the domestic production of high-end optical components and chips, a move that will directly impact the supply chain of a broad range of PC accessories from mouse sensors to webcam components.

India PC accessories market is anticipated to see rapid growth due to an expanding digital economy and a government initiative towards promoting domestic R&D for emerging technologies. In April 2023, the Indian Government approved the National Quantum Mission, a comprehensive, long-term initiative with an over USD 60 billion budget. While focused on quantum science, the mission goal of developing high-sensitivity quantum sensors and future-generation computing will have a spillover effect in the long term, yielding a high-tech ecosystem that gives rise to more advanced PC peripherals.

Key PC Accessories Market Players:

- Logitech

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft

- Razer Inc.

- HP Inc.

- Dell Technologies

- Corsair

- Kingston Technology

- Seagate Technology

- Anker Innovations

- Samsung Electronics

- Lenovo

- ASUSTeK Computer Inc.

The global market is an extremely competitive market filled with a mix of established technology powerhouses, niche gaming brands, and frugal newcomers. Large players include Logitech, Microsoft, Razer, HP, Dell, and Corsair, who are all vying for market share with a constant stream of new products that offer more performance, improved ergonomics, and greater customization. In the highly lucrative gaming sector, competition is intense. Brand recognition and technological superiority are key factors that set companies apart.

One important milestone in competitive gaming is the January 2025 release of Razer's thinnest and most powerful Blade 16 gaming laptop to date. For its maiden such effort, this premium model features an AMD Ryzen AI 9 HX 370 processor with a high-end NVIDIA GeForce RTX 5090 graphics processor. This action by a leading peripheral and systems vendor to adopt the competition's CPU technology signifies a significant shift in the industry's direction toward AI-hardware acceleration, where even the most renowned brand alliances face intense competition for ultimate performance.

Here are some leading companies in the market:

Recent Developments

- In January 2025, Cherry unveiled the XTRFY MX 8.3 TKL at CES, a tenkeyless gaming keyboard designed for high performance and longevity. Built with a durable aluminum housing, it incorporates the new CHERRY MX2A switches, which provide a superior feel and faster actuation for competitive and enthusiast gamers alike.

- In March 2024, MSI launched the MPG 341CQPX monitor, a display that stands out for its exceptionally high refresh rate and excellent HDR performance. It provides a wide array of connectivity options for various devices and is engineered to offer a deeply immersive and visually stunning experience for gamers and content consumers.

- Report ID: 83

- Published Date: Aug 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

PC Accessories Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.