Payment Orchestration Platform Market Outlook:

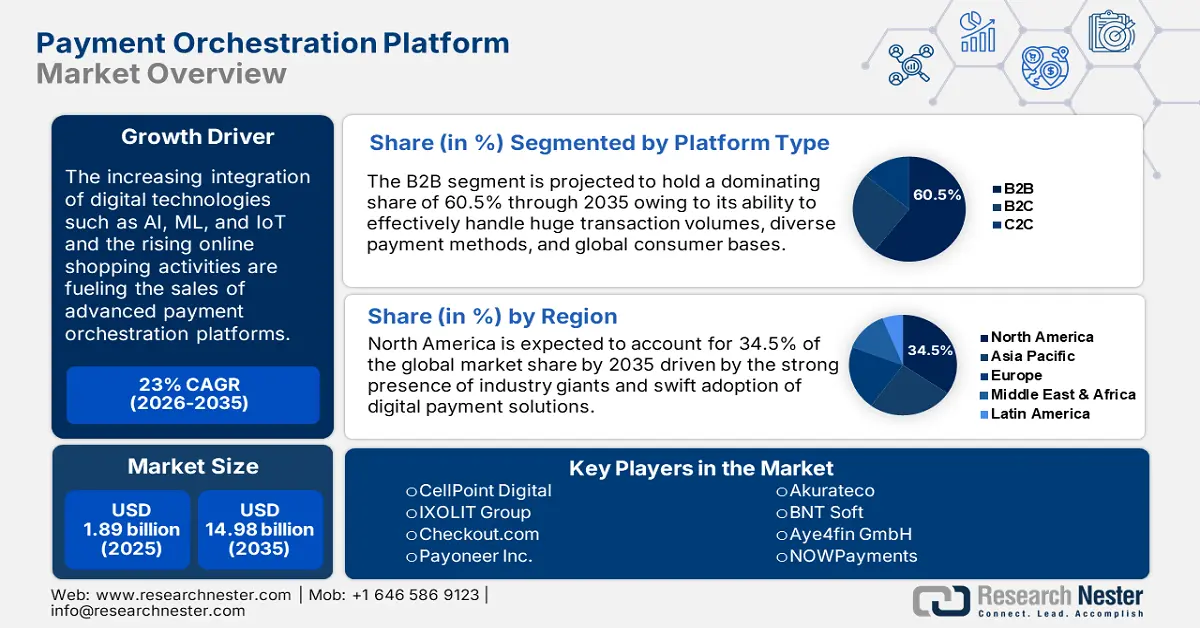

Payment Orchestration Platform Market size was valued at USD 1.89 billion in 2025 and is expected to reach USD 14.98 billion by 2035, expanding at around 23% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of payment orchestration platform is assessed at USD 2.28 billion.

In developing regions such as Latin America, Asia Pacific, and Africa payment orchestration platform developers are finding profitable opportunities owing to the increasing online shopping activities driven by the rising adoption of smartphones and easy accessibility to the internet. Consumers in these regions are adopting various payment methods such as mobile payments, UPI transactions, and smart card payments to buy products, which is directly fueling the demand for payment orchestration platforms. Payment orchestration platforms play a vital role in helping businesses navigate these developing marketplaces by offering integrated, flexible payment solutions that support a wide range of local payment methods and emerging technologies.

Payment orchestration platforms are cost-effective and flexible solutions for businesses to accept digital payments as they mitigate the need to invest in complex hardware systems. QR codes are highly used for peer-to-peer payments, bill payments, and merchant transactions. QR-based transactions are anticipated to increase rapidly across the world in the coming years, offering high-earning opportunities to payment orchestration platform providers.