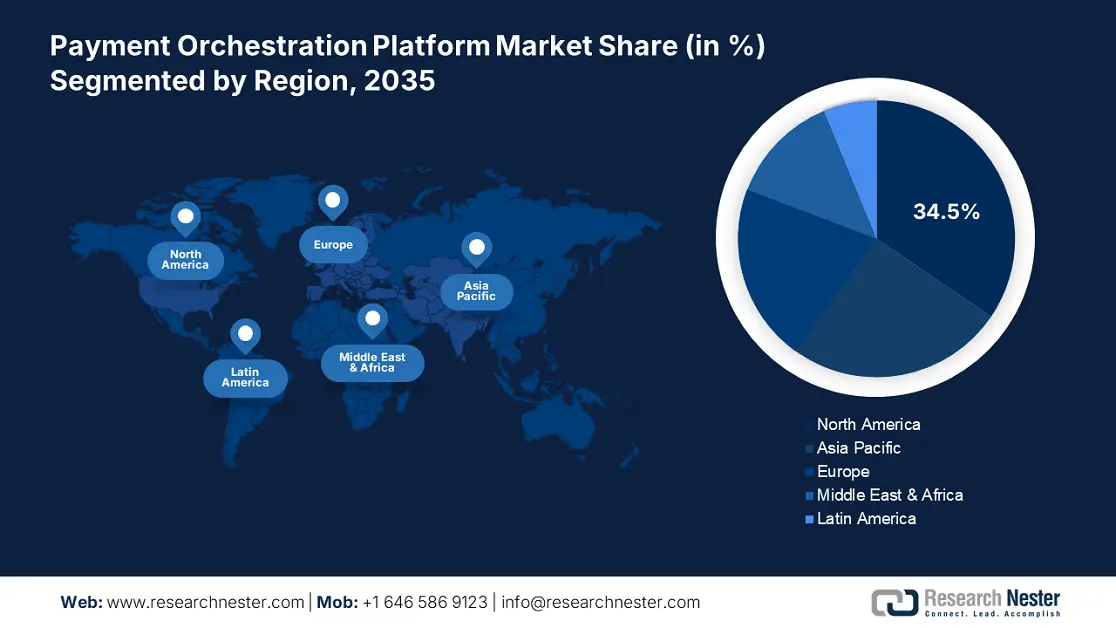

Payment Orchestration Platform Market Regional Analysis:

North America Market Forecast

North America industry is estimated to dominate majority revenue share of 34.5% by 2035. The presence of leading market players, an extensive network of end use organizations, and the swift adoption of digital payment technologies are augmenting the sales of payment orchestration platforms. The stringent regulations for secure payment methods are also pushing the demand for advanced and secure payment orchestration platforms in the region.

In the U.S., high online shopping activities are driving the sales of seamless and efficient payment systems such as payment orchestration platforms. These platforms effectively manage multi-channel payment flows, enhance user experience, and support various payment methods, crucial for e-commerce businesses. For instance, according to the U.S. Census Bureau, on a not-adjusted basis, the estimated U.S. retail e-commerce sales for the second quarter of 2024 totaled USD 282.3 billion, a rise of 5.3% (±0.7) from the first quarter of 2023. Thus, the rising e-commerce activities are anticipated to boost the revenues of payment orchestration platform producers in the coming years.

In Canada, the government is actively promoting the digital economy through initiatives such as the 2021 Canada Digital Government Strategy and the 2022 Digital Ambition Plan. Such initiatives are boosting the adoption of smart technologies such as payment orchestration platforms to improve payment security, reduce operation costs, and streamline business operations.

Asia Pacific Market Statistics

The Asia Pacific payment orchestration platform market is projected to increase at a rapid pace during the study period. The swift digital payment adoption, rising e-commerce activities, SME digital transformation, and supportive government initiatives for fintech growth are pushing the sales of payment orchestration platforms in the region.

India is witnessing rapid growth in digital payment systems such as the unified payment interface (UPI), which enables millions of payments in a secure, reliable, and real-time manner. For instance, according to the Ministry of Finance, India, the digital payments in the country rose from USD 24.51 billion (2,071 crore INR) in FY 2017-18 to USD 221.79 billion (18,737 crore INR) in FY 2023-2024 at a CAGR of 44%. Thus, the government’s push for a cashless economy coupled with the rise in QR code-based payments are fuelling the adoption of payment orchestration platforms.

China is one of the largest markets for e-commerce due to the strong presence of companies such as Alibaba Group Holding Limited, Temu, JD.com, Inc. For instance, according to the International Trade Administration, China’s online retail transactions are anticipated to increase from USD 2.29 trillion in 2020 to USD 3.56 trillion by 2024. Thus, the sheer volume of online transactions is pushing a high demand for payment orchestration platforms to handle complex and multichannel transactions.