Payment Orchestration Platform Market Outlook:

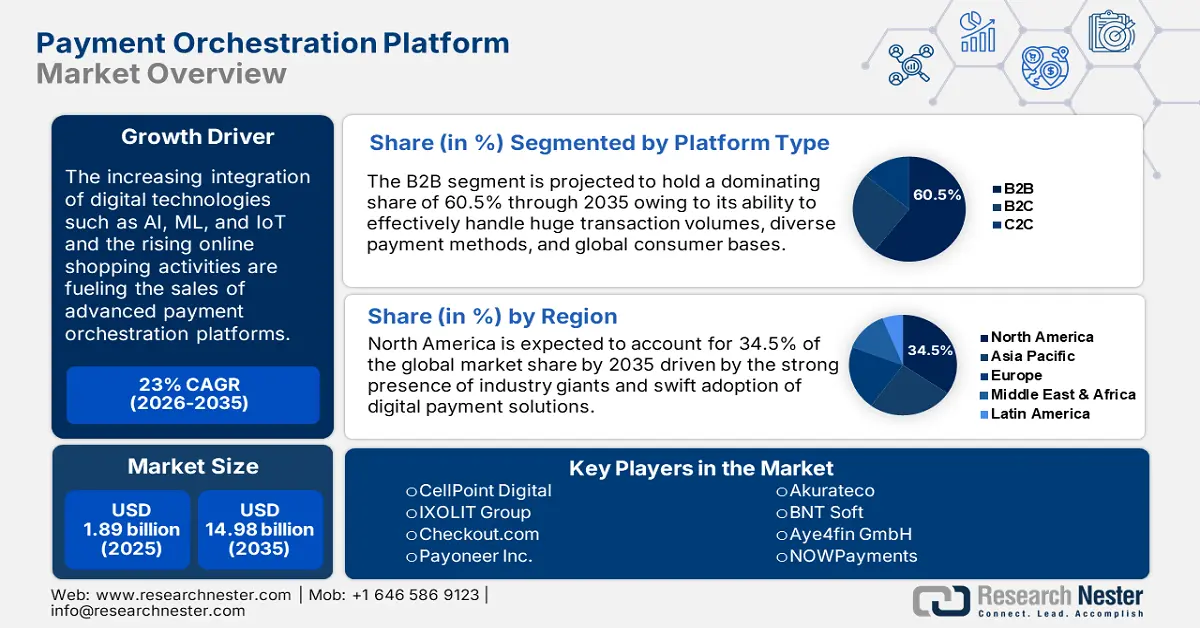

Payment Orchestration Platform Market size was valued at USD 1.89 billion in 2025 and is expected to reach USD 14.98 billion by 2035, expanding at around 23% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of payment orchestration platform is assessed at USD 2.28 billion.

In developing regions such as Latin America, Asia Pacific, and Africa payment orchestration platform developers are finding profitable opportunities owing to the increasing online shopping activities driven by the rising adoption of smartphones and easy accessibility to the internet. Consumers in these regions are adopting various payment methods such as mobile payments, UPI transactions, and smart card payments to buy products, which is directly fueling the demand for payment orchestration platforms. Payment orchestration platforms play a vital role in helping businesses navigate these developing marketplaces by offering integrated, flexible payment solutions that support a wide range of local payment methods and emerging technologies.

Payment orchestration platforms are cost-effective and flexible solutions for businesses to accept digital payments as they mitigate the need to invest in complex hardware systems. QR codes are highly used for peer-to-peer payments, bill payments, and merchant transactions. QR-based transactions are anticipated to increase rapidly across the world in the coming years, offering high-earning opportunities to payment orchestration platform providers.

Key Payment Orchestration Platform Market Insights Summary:

Regional Highlights:

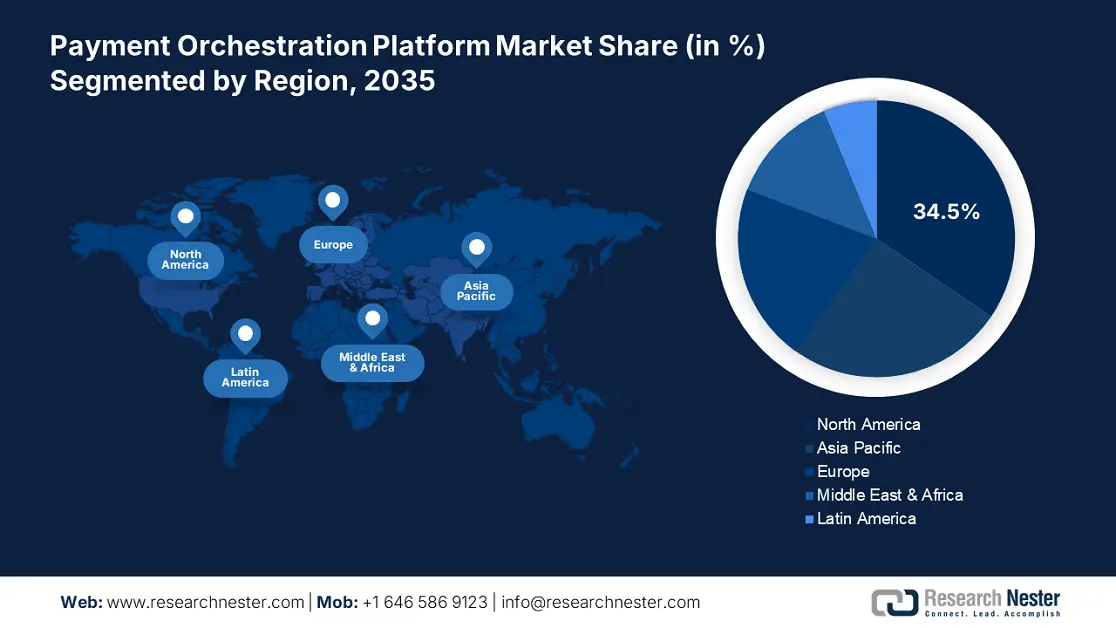

- North America leads the Payment Orchestration Platform Market with a 34.5% share, driven by the presence of leading market players, swift adoption of digital payment technologies, and stringent regulations for secure payment methods, ensuring strong growth by 2035.

- Asia Pacific's payment orchestration platform market anticipates rapid growth by 2035, attributed to swift digital payment adoption, rising e-commerce activities, SME digital transformation, and supportive government initiatives for fintech growth.

Segment Insights:

- The Retail & E-commerce segment is forecasted to capture a substantial share by 2035, propelled by rising global online shopping and demand for integrated payment systems.

- By 2035, the B2B payment platform segment is projected to hold a 60.5% share, driven by firms seeking operational efficiency and seamless transaction handling.

Key Growth Trends:

- Integration of AI and ML technologies

- Increasing subscription-based services

Major Challenges:

- Diverse regulations

- High installation and maintenance costs

- Key Players: Akurateco, BlueSnap, CellPoint Digital, IXOLIT Group, Checkout.com, Payoneer Inc., PayPal (Braintree), and Paysafe.

Global Payment Orchestration Platform Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.89 billion

- 2026 Market Size: USD 2.28 billion

- Projected Market Size: USD 14.98 billion by 2035

- Growth Forecasts: 23% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Payment Orchestration Platform Market Growth Drivers and Challenges:

Growth Drivers

- Integration of AI and ML technologies: The integration of artificial intelligence and machine learning technologies is leading to the development of advanced payment orchestration platforms that enhance the optimization of payment processes and success rates. Conventional payment processing systems route the payments through a default gateway or processor but the advanced AI and ML-based payment orchestration platforms facilitate dynamic routing. Each transaction is analyzed in real-time based on multiple factors such as geographical location, the type of product being purchased, and the specific payment method used.

Also, AI and ML algorithms drive informed decisions in milliseconds, confirming that the transaction is performed in the optimal gateway. Furthermore, minimized payment failures, great transaction success rates, faster transactions, and scalability are some of the other aspects of AI and ML-based payment orchestration platforms, contributing to their sales growth. - Increasing subscription-based services: The rising demand for subscription-based services such as media streaming and e-commerce is creating complex and dynamic payment environments. To simplify payment methods businesses involved in these sectors use secure and reliable payment orchestration platforms. Payment orchestration platforms offer advanced tools to streamline recurring billion, enhance payment success rates, manage complex pricing models, and reduce churn.

By offering flexibility in payment methods, automating billing cycles, and leveraging advanced features such as retry logic and fraud prevention, these platforms are gaining traction among subscription companies looking for seamless transactions and retaining customers over time. Some of the top payment orchestration platforms in 2025 are BlueSnap, Sila, Meld, Gr4vy, Payoneer, Razorpay, and Rapyd.

Challenges

-

Diverse regulations: Each country or region has its own set of regulations governing payment processes, which are often influenced by economic, cultural, and political factors. Global regulatory standards are creating major challenges for producers of payment orchestration platforms. Also, as businesses are expanding globally, ensuring compliance with a complex array of regulatory standards is becoming more challenging, driving up investments in legal, compliance, and operational resources for payment orchestration platform market players.

-

High installation and maintenance costs: The integration of existing payment infrastructure with advanced payment orchestration platforms is a complex process and requires extensive investments. This is particularly true in payment orchestration platform markets with legacy infrastructure, where outdated technology, regulatory constraints, and fragmented payment systems make integration even more difficult. Also, the regular maintenance and upgradation of payment orchestration platforms are costly, which limits their adoption rates among small-scale enterprises.

Payment Orchestration Platform Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

23% |

|

Base Year Market Size (2025) |

USD 1.89 billion |

|

Forecast Year Market Size (2035) |

USD 14.98 billion |

|

Regional Scope |

|

Payment Orchestration Platform Market Segmentation:

Platform Type (B2B, B2C, C2C)

B2B payment orchestration platform segment is projected to account for payment orchestration platform market share of around 60.5% by 2035 owing to the B2B companies increasing demands for operational efficiency, automation, and cost reduction. To simplify complex payment processes such as invoicing, payments, and reconciliation B2B companies are employing payment orchestration platforms. These platforms also successfully handle large transaction volumes and diverse payment methods contributing to their sales growth. Such characteristics of payment orchestration platforms are aiding payment orchestration platform market players in earning high revenue shares. For instance, in April 2024, Emagia announced the launch of GiaPay AI-powered B2B customer payments platform for small to large scale enterprises. GiaPay is a faster, frictionless, and cost-effective B2B customer payments orchestration platform.

End use (BFSI, Retail & E-commerce, Healthcare, Travel & Hospitality)

In payment orchestration platform market, retail and e-commerce segment is anticipated to hold revenue share of more than 40.5% by 2035. The retail and e-commerce sectors are expanding rapidly across the globe owing to a boom in the adoption of online shopping activities. The businesses in these sectors are widely investing in modern payment systems such as payment orchestration platforms to manage complex transactions across multiple payment methods and regions. Also, as payment orchestration platforms offer seamless integration with multiple payment gateways, processors, and methods, businesses can improve conversion rates and customer satisfaction.

Our in-depth analysis of the global payment orchestration platform market includes the following segments:

|

Platform Type |

|

|

Enterprise Size |

|

|

Functionality |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Payment Orchestration Platform Market Regional Analysis:

North America Market Forecast

North America industry is estimated to dominate majority revenue share of 34.5% by 2035. The presence of leading market players, an extensive network of end use organizations, and the swift adoption of digital payment technologies are augmenting the sales of payment orchestration platforms. The stringent regulations for secure payment methods are also pushing the demand for advanced and secure payment orchestration platforms in the region.

In the U.S., high online shopping activities are driving the sales of seamless and efficient payment systems such as payment orchestration platforms. These platforms effectively manage multi-channel payment flows, enhance user experience, and support various payment methods, crucial for e-commerce businesses. For instance, according to the U.S. Census Bureau, on a not-adjusted basis, the estimated U.S. retail e-commerce sales for the second quarter of 2024 totaled USD 282.3 billion, a rise of 5.3% (±0.7) from the first quarter of 2023. Thus, the rising e-commerce activities are anticipated to boost the revenues of payment orchestration platform producers in the coming years.

In Canada, the government is actively promoting the digital economy through initiatives such as the 2021 Canada Digital Government Strategy and the 2022 Digital Ambition Plan. Such initiatives are boosting the adoption of smart technologies such as payment orchestration platforms to improve payment security, reduce operation costs, and streamline business operations.

Asia Pacific Market Statistics

The Asia Pacific payment orchestration platform market is projected to increase at a rapid pace during the study period. The swift digital payment adoption, rising e-commerce activities, SME digital transformation, and supportive government initiatives for fintech growth are pushing the sales of payment orchestration platforms in the region.

India is witnessing rapid growth in digital payment systems such as the unified payment interface (UPI), which enables millions of payments in a secure, reliable, and real-time manner. For instance, according to the Ministry of Finance, India, the digital payments in the country rose from USD 24.51 billion (2,071 crore INR) in FY 2017-18 to USD 221.79 billion (18,737 crore INR) in FY 2023-2024 at a CAGR of 44%. Thus, the government’s push for a cashless economy coupled with the rise in QR code-based payments are fuelling the adoption of payment orchestration platforms.

China is one of the largest markets for e-commerce due to the strong presence of companies such as Alibaba Group Holding Limited, Temu, JD.com, Inc. For instance, according to the International Trade Administration, China’s online retail transactions are anticipated to increase from USD 2.29 trillion in 2020 to USD 3.56 trillion by 2024. Thus, the sheer volume of online transactions is pushing a high demand for payment orchestration platforms to handle complex and multichannel transactions.

Key Payment Orchestration Platform Market Players:

- Akurateco

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BlueSnap

- CellPoint Digital

- IXOLIT Group

- Checkout.com

- Payoneer Inc.

- PayPal (Braintree)

- Paysafe

- Recurly

- APEXX Fintech Limited

- Rebilly

- Spreedly

- ACI Worldwide Inc.

- Modo Payments

- BNT Soft

- Aye4fin GmbH

- NOWPayments

- BKN301 Group

- Cashfree Payments

- Adyen

Key players in the payment orchestration platform market are concentrating on enhancing technological innovations, building strategic partnerships, and expanding the global reach. Continuous investments in research and development activities are leading to the introduction of advanced payment orchestration platforms. Leading companies are collaborating with other players to boost their product folios and cater to a wider consumer base. Furthermore, industry giants are also employing merger and acquisition tactics to earn high profits. Acquisitions of smaller companies with advanced technology mitigate the research investment and aid in maximizing revenue streams.

Some of the key players include:

Recent Developments

- In March 2024, BKN301 Group announced the launch of the BaaS Orchestrator solution to radically transform the MENA (Middle East & North Africa) region's financial landscape. The banks and fintech companies are estimated to be prime customers of the BKN301 Group’s payment orchestration platform solution.

- In December 2023, Cashfree Payments revealed the launch of India’s first self-hosted payments orchestration platform ‘FlowWise’. This secure and advanced payment orchestration platform is empowering Indian businesses to seamlessly use multiple payment aggregators with just one integration.

- Report ID: 6744

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.