Pay TV Market Outlook:

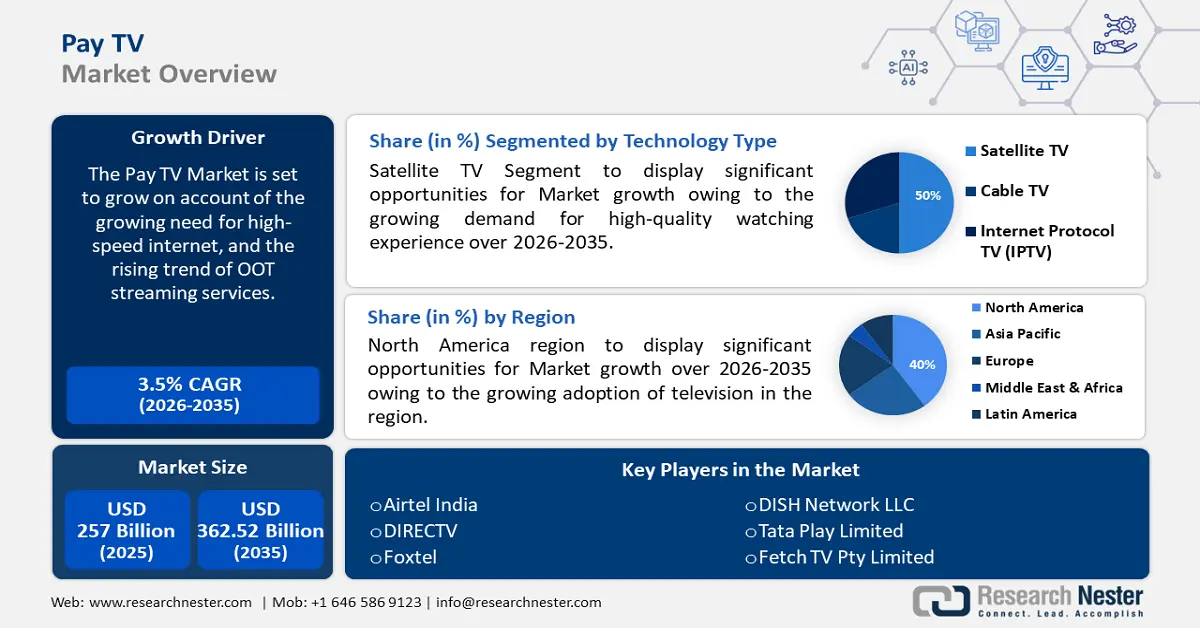

Pay TV Market size was over USD 257 billion in 2025 and is poised to exceed USD 362.52 billion by 2035, witnessing over 3.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of pay TV is estimated at USD 265.1 billion.

This Pay TV market expansion is poised to be influenced by the growing availability of high-speed internet. This has been made possible with several government programs. For instance, in the case of America in 2022 National Telecommunications and Information Administration launched BEAD program which was further allocated USD 42.45 billion of funds to expand the presence of high-speed internet around the nation.

Key Pay TV Market Insights Summary:

Regional Highlights:

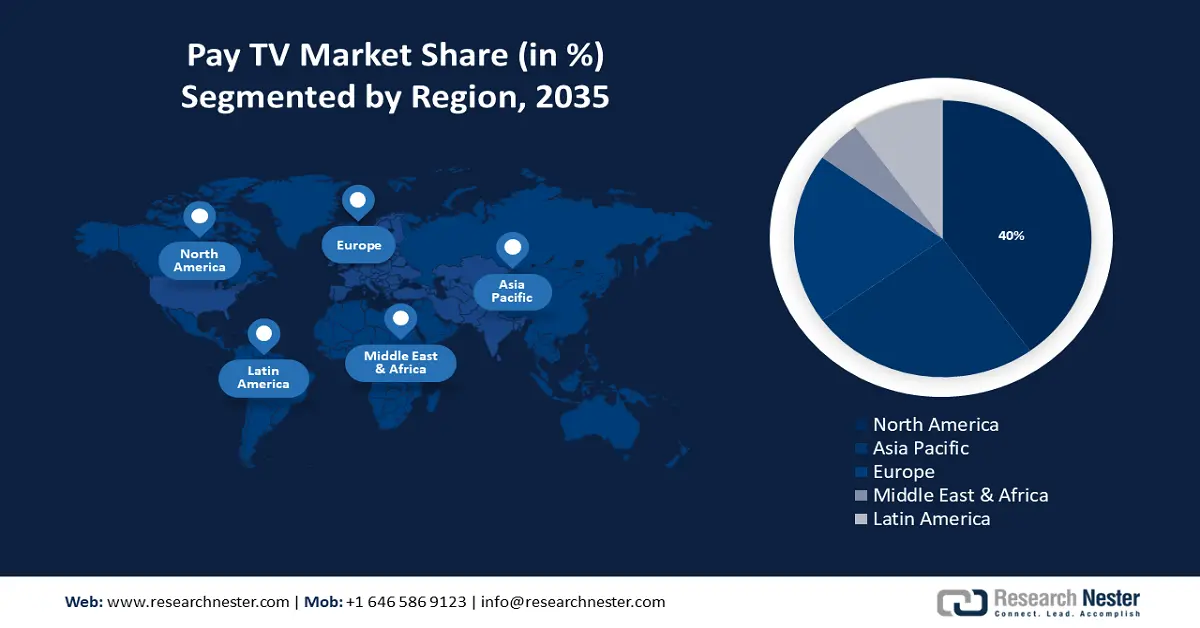

- North America pay tv market is anticipated to capture 40% share by 2035, driven by growing adoption of television and abundance of excellent content creators.

Segment Insights:

- The residential segment in the pay tv market is projected to achieve significant growth till 2035, driven by the rise in residential complexes and disposable income.

- The satellite tv segment in the pay tv market is projected to achieve significant growth till 2035, fueled by increased consumer demand for UHD/4K viewing and added content offerings.

Key Growth Trends:

- Surging trend of OOT streaming services

- Growing evolution of multiscreen view

Major Challenges:

- Growing concern over content security

- High Price of pay TV

Key Players: Airtel India, DIRECTV, Carter Communications, Foxtel, Rostelecom, Comcast Corporation, DISH Network LLC.

Global Pay TV Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 257 billion

- 2026 Market Size: USD 265.1 billion

- Projected Market Size: USD 362.52 billion by 2035

- Growth Forecasts: 3.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Japan, Germany

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 17 September, 2025

Pay TV Market Growth Drivers and Challenges:

Growth Drivers

- Surging trend of OOT streaming services - The digital era has brought about a huge shift in customer behavior, with consumers progressively preferring on-demand entertainment to scheduled programs. OTT platforms serve an important part of catering to this need by rendering a wide range of material available at the viewer's convenience. For instance, it is predicted that by 2028, over 4 billion users are anticipated to stream OTT videos.

This is because, in the recent world, the demand for traditional TV has been significantly declining, which might also affect the Pay TV market. Due to this, pay TV companies are collaborating with OTT services platforms to satisfy the customer's changing needs and provide them with new content. - Growing evolution of multiscreen view - With growing knowledge regarding the use of technology the preference for the multiscreen view is also expanding. Also, owing to the growing need to flexibly access content from several screens in the form of computers, television, and more the evolution of multiscreen viewing is expected to observe a boost.

- Rising deployment of AI - The importance of AI and data analytics is growing in various sectors. Furthermore, according to the World Economic Forum, different countries are initiating the adoption of AI for instance, Saudi Arabia has recently stated to be aligning a USD 40 billion AI strategy, for chipmaking to data centers and more. Hence, the deployment of AI is also projected to rise in pay TV.

This is because as pay TV advances beyond cable-based set-top boxes and towards utilizing the internet to distribute programming. Moreover, it becomes more vital than ever to make use of AI-powered video compression technology for distribution.

Challenges

- Growing concern over content security - Due to the potential of content piracy, the primary factor impeding the expansion and utilization of pay TV is content security concerns.

The unsafe nature of pay TV material constitutes one of the significant obstacles to its growth. Copyrighted work might be illegally reproduced and offered for sale on the grey market for a significantly lower price. - High Price of pay TV

- Surging cord-cutting trend - The increasing number of online video platforms and streaming platforms has led to cord-cutting. Also, customers abandon traditional pay TV subscriptions in favor of cheaper and more adaptable streaming options. This trend represents a significant challenge to the pay-TV business.

Pay TV Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.5% |

|

Base Year Market Size (2025) |

USD 257 billion |

|

Forecast Year Market Size (2035) |

USD 362.52 billion |

|

Regional Scope |

|

Pay TV Market Segmentation:

Technology Type Segment Analysis

Satellite TV segment is predicted to hold pay TV market share of more than 50% by 2035. Satellite TV service providers are constantly broadening their range of offers by incorporating bonus features, newer networks, and more current channels. Consequently, the expansion of this market is mainly fueled by increased consumer demand for such products.

Satellite TV service providers, on the other hand, can meet the growing demand for high-quality watching experiences in the form of Ultra HD (UHD) and 4K picture quality among viewers without concern for bandwidth constraints. Furthermore, the internet protocol TV (IPTV) segment is also estimated to surge between the years 2024 to 2035. This segment expansion is anticipated to be encouraged by rising IPTV subscribers.

Application Segment Analysis

In pay TV market, residential segment is estimated to hold revenue share of over 60% by the end of 2035. This growth of the market can be influenced by a growing number of residential complexes. Additionally, the disposable income of the people is also predicted to rise.

As per the predictions of Euromonitor, in 2022, the disposable incomes and expenditure of the globe observed rise of 2.6%. This is because normal TV watching including the morning news and nightly prime-time entertainment is high in residents.

Type Segment Analysis

The prepaid segment in pay TV market is projected to have notable growth in the revenue over the years to come. Prepaid plans allow customers to control their expenses with greater effectiveness and provide clear upfront fees, thus preventing long-term financial commitments. Furthermore, they demand less strict credit checks and documents, facilitating a wider spectrum of consumers to obtain pay-TV services.

Our in-depth analysis of the global Pay TV market includes the following segments:

|

Technology Type |

|

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pay TV Market Regional Analysis:

North American Market Insights

North America industry is estimated to dominate majority revenue share of 40% by 2035. This growth of the market in this region is foreseen to be dominated by the growing adoption of television. For instance, in 2022 over 124 million households were having a TV in the US.

Aside from that, North America has an abundance of excellent content creators, making it a hotspot for premium shows, films, and athletic competitions that drive subscriptions.

Additionally, the Pay TV market in the US for pay TV is estimated to have notable growth in the market over the coming years. This growth is poised to be encouraged by the growing number of service providers.

Furthermore, the Canadian market is also projected to expand in this region on account of the surging launch of supportive policies to boost the media & entertainment industry.

APAC Market Insights

The Asia Pacific pay TV market is set to have notable growth in the revenue during the forecast period. The market growth in this region can be encouraged by growing investment in digital transformation. According to the DFAT, the Digital Business Plan invests USD 796.5 million in vital digital infrastructure and skills, suitable regulatory frameworks, SME support and competence, and digital business relations with the government. This has further encouraged growth in the usage of IPTV.

Moreover, the market in China for pay TV will observe the highest growth as compared to other nations in this region owing to the growing adoption of tablets.

Furthermore, the Indian Pay TV market is also expected to rise over the forecast period on account of the reduced cost of the internet.

Moreover, with the surging 5G users in Japan, the market in this nation is to experience growth in its revenue over the year to come.

Pay TV Market Players:

- Airtel India

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DIRECTV

- Carter Communications

- Foxtel

- DISH Network LLC

- Comcast Corporation

- Dish TV India Limited

- Tata Play Limited

- Rostelecom

- Fetch TV Pty Limited

The pay TV market is projected to have great influence from the key players owing to surging competition among them which is further encouraging them to advance their services. Some of the major key players include:

Recent Developments

- Bharti Airtel and CuriosityStream announced that they have expanded their trailblazing content connection to deliver premium CuriosityStream content to Indian television homes.

- DIRECTV and Newsmax Media, Inc. announced that they have reached an agreement for a multi-year distribution contract which will make the Newsmax channel return to DIRECTV, DIRECTV STREAM, and U-verse on March 23, 2023.

- Report ID: 6218

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pay TV Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.