Patient-controlled Analgesia Pumps Market Outlook:

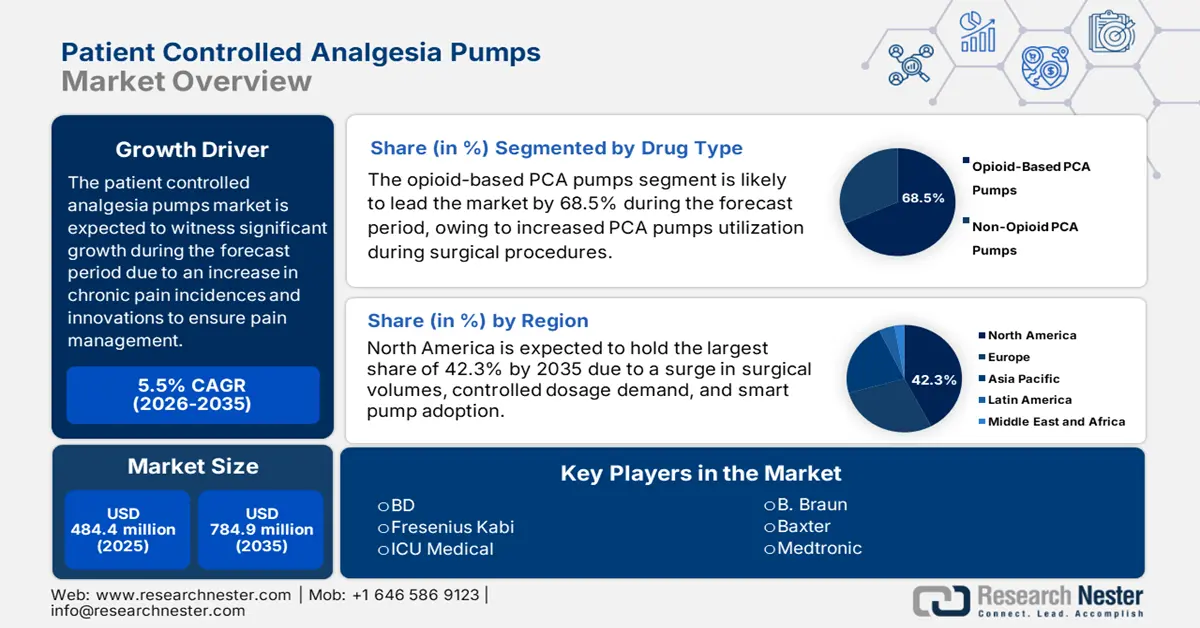

Patient-controlled Analgesia Pumps Market size was USD 484.4 million in 2025 and is projected to reach USD 784.9 million by the end of 2035, increasing at a CAGR of 5.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of patient-controlled analgesia pumps is evaluated at USD 511.4 million.

The market is gaining increased traction, owing to PCA pumps that are increasingly utilized to aid labor, postoperative, chronic, and acute pain. For instance, according to an article published by the International Journal of Emergency Medicine in March 2024, 26.5% of 85% of overall patients in Hospital Kuala Lumpur suffered from moderate and severe pain, and in turn, received analgesia in the Emergency Department. Different types of drugs used for PSA are deliberately administered intravenously (IV) through a peripheral or epidural nerve catheter. Therefore, this activity has readily outlined the role of the interprofessional team to manage patients undergoing PSA.

Moreover, the utilization of PSA through a Continuous Ambulatory Delivery Device (CADD) has become a common and effective source of symptom and pain management, particularly for hospitalized patients affected with malignancy. Regarding this, the June 2024 Pain Management Nursing report stated that an estimated 20% of patients demand a shift to a separate unit in hospitals to accommodate the CADD. In addition, the average length of accommodation for such patients is 13 days, with an additional average length of half a day for the pump to commence during surgeries. Therefore, CADD is an effective symptom management for malignancy, which is positively impacting the market’s demand globally.

Key Patient Controlled Analgesia Pumps Market Insights Summary:

Regional Highlights:

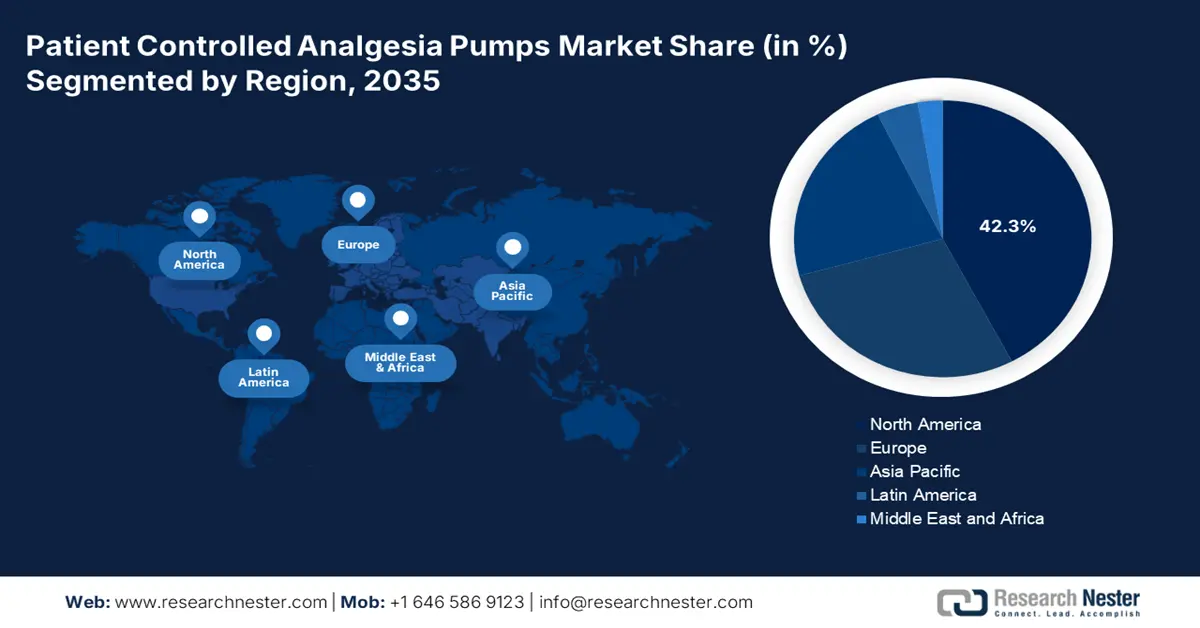

- North America is projected to command a 42.3% share by 2035 in the patient-controlled analgesia pumps market, underpinned by rising surgical procedures, the need for controlled opioid dosing, and expanding smart pump adoption.

- Asia Pacific is anticipated to secure a 22.1% share during 2026–2035, supported by healthcare modernization, a growing elderly population, and increasing surgical interventions.

Segment Insights:

- The opioid-based PCA pumps segment is forecasted to hold a 68.5% share by 2035 in the patient-controlled analgesia pumps market, propelled by rising post-operative PCA utilization to curb opioid consumption and enhance patient–nurse satisfaction.

- The electronic PCA pumps segment is projected to reach a 62.5% share by 2035, owing to precision dosing benefits, administrative compliance requirements, and accelerating hospital digital transformation.

Key Growth Trends:

- Rise in surgical procedures

- Increased cases of chronic conditions

Major Challenges:

- Delay in regulations

- Increased out-of-pocket expenses for patients

Key Players: Becton Dickinson (BD) (U.S.), Fresenius Kabi (Germany), Smiths Medical (ICU Medical) (UK), B. Braun (Germany), Baxter International (U.S.), Medtronic (Ireland), Mindray (China), Micrel Medical Devices (Greece), Trivitron Healthcare (India), BPL Medical Technologies (India), Ace Medical (South Korea), Medline Industries (U.S.), Teleflex Medical (U.S.), Shenzhen Mindray Bio-Medical (China), Ambu A/S (Denmark).

Global Patient Controlled Analgesia Pumps Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 484.4 million

- 2026 Market Size: USD 511.4 million

- Projected Market Size: USD 784.9 million by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Mexico, Indonesia

Last updated on : 14 August, 2025

Patient-controlled Analgesia Pumps Market - Growth Drivers and Challenges

Growth Drivers

- Rise in surgical procedures: The aspect of surgery plays a pivotal role in the overall healthcare system, especially for certain conditions that are unbale to be managed by drugs or other standard therapies. Conditions, such as cardiovascular diseases and cancer demand surgeries, which is a huge growth opportunity for the patient-controlled analgesia pumps market. According to an international survey conducted by the ISAPS Organization as of 2023, aesthetic procedures account for 35 million, while overall surgical and non-surgical procedures surged to 3.4%, accounting for USD 34.9 million, thereby suitable for uplifting the market demand across different nations.

- Increased cases of chronic conditions: An increase in chronic incidence is an essential public health concern, especially among the older population and developing nations, which is deliberately increasing the demand for the market internationally. According to a report published by the NLM in January 2024, the approximate expense of this disease is projected to increase by USD 47 trillion globally by the end of 2030. Besides, for the past 7 years, approximately 27% of adults in the U.S. have been suffering from severe chronic conditions, which is an optimistic opportunity for the market’s growth.

- Technical innovation in smart PCA pumps: The aspect of technical innovation in the market has readily focused on connectivity, usability, and safety, which denotes a positive growth. In this regard, the March 2023 NLM article indicated that 89.5% of hospitals in the U.S. have been readily implementing smart pump technology for more than 7 years. However, the smart pump utilization varies, depending on hospital bed size, accounting for more than 600 beds. Besides, smart pump infusion technology demonstrated an 80% reduction in infusion-related drug errors, therefore denoting its suitability.

Centrifugal Pumps Utilization in Market

Centrifugal Pumps Import and Export Data

|

Components/Countries |

Import |

Export |

|

China |

USD 759 million |

USD 4.0 billion |

|

Germany |

USD 1.0 billion |

USD 1.9 billion |

|

Italy |

- |

USD 1.3 billion |

|

U.S. |

USD 1.8 billion |

- |

Source: OEC, 2023

Pain Statistics in the Market

Chronic Pain Incidences and Costs

|

Description |

Value |

|

Percentage of U.S. adults with chronic pain |

1 in 5 (20%) |

|

Percentage of U.S. adults with high-impact chronic pain |

1 in 14 (7.1%) |

|

Duration threshold for acute pain |

Less than 1 month |

|

Duration threshold for subacute pain |

1 to 3 months |

|

Duration threshold for chronic pain |

More than 3 months |

|

Estimated economic cost of chronic pain |

USD 560 to USD 635 billion annually |

|

Percentage of suicide decedents with chronic pain |

9% |

Source: CDC, November 2022

Challenges

- Delay in regulations: The aspect of strict regulatory and administrative requirements is negatively impacting the market globally. Based on this, product launches in Europe and Japan have been halted, mainly owing to the implementation of innovative PCA pumps. Besides, the presence of administrative policies has also exacerbated challenges by requiring manufacturers to resubmit technological files, which has increased the cost aspect for each device. However, to combat this, organizations have designed clinical trials to cater to simultaneous regional standards to avoid the surged expense of PCA pump devices.

- Increased out-of-pocket expenses for patients: The market is facing hindrance in growth since PCA pumps are overall unaffordable for the majority, owing to limitations in insurance coverage and upsurged expenses. Despite the presence of suitable reimbursement policies, patients need to make the majority of the payment for each pump. In addition, middle-class patients, particularly in developing nations continue to depend on outdated and traditional mechanical pumps, which are creating a gap in the market expansion internationally and restricting the overall development internationally.

Patient-controlled Analgesia Pumps Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2025-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 484.4 million |

|

Forecast Year Market Size (2035) |

USD 784.9 million |

|

Regional Scope |

|

Patient-controlled Analgesia Pumps Market Segmentation:

Drug Type Segment Analysis

Based on the drug type, the opioid-based PCA pumps segment is projected to account for the highest share of 68.5% in the patient-controlled analgesia pumps market by the end of 2035. The segment’s growth is determined by an increase in the use of PCA pumps, particularly during post-operative settings to diminish overall opioid consumption and enhance nurse and patient satisfaction. According to a clinical study conducted on 842 patients by the American Journal of Emergency Medicine in January 2022, it has been demonstrated that 60% of patients suffering from pain comprised a pain intensity score of more than 4. These particular patients received analgesics, and 74% of them were discharged with moderate to severe pain. Therefore, PCA-based pumps play an essential role in effectively reducing opioids among patients, thus suitable for the segment’s growth.

Product Type Segment Analysis

Based on the product type, the electronic PCA pumps segment in the patient-controlled analgesia pumps market is predicted to garner the second-highest share of 62.5% by the end of the projected timeline. The segment’s growth is highly attributed to precision dosing, administrative mandates, digitalization in hospitals, and market modernization. According to an article published by the NLM in April 2025, CADD-Solis, which is an electronic-based infusion pump, has demonstrated continuous flow rates, with minor modifications, owing to -5.0% of epidural catheter placement and 4.2% of motion conditions. Besides, the Rakurakufuser and Balloonjector exhibited variations in the flow rate due to an increase in time and temperature, and gradually increased by 24.3%, thereby inhibiting a growth opportunity for the segment.

Modality Segment Analysis

Based on the modality, the portable PCA pumps segment in the patient-controlled analgesia pumps market is expected to hold the third-highest share of 58.7% during the forecast period. The segment’s upliftment is highly driven by a rise in the need for ambulatory care solutions, as well as home-based pain management strategies. This particular pump is a battery-operated and lightweight device that ensures continuous pain and mobility relief outside of hospital facilities, thus effectively aligning with the global transition to decentralized healthcare. Besides, the aspects of cost-efficiency, technological innovations, and aging demographics are other notable factors that are fueling the segment.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Drug Type |

|

|

Product Type |

|

|

Modality |

|

|

End user |

|

|

Application |

|

|

Connectivity |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Patient-controlled Analgesia Pumps Market - Regional Analysis

North America Market Insights

North America in the market is projected to hold a share of 42.3% by the end of 2035. The market’s growth in the region is propelled by an increase in surgical volumes, the opioid crisis driving the need for controlled dosage, and smart pump integration. In addition, a surge in home healthcare services and the existence of Medicare and Medicaid coverage are also driving the market in the overall region. As per the June 2024 Annals of Thoracic Surgery organizational report, 271.5 cardiac-based surgical volumes have been conducted in the U.S., along with 55.2 valve-based surgeries. Additionally, the CABG volume was 64.5, thereby determining the increased demand for PCA pumps in the region to administer post-operative pain for patients.

The patient-controlled analgesia pumps market in the U.S. is significantly growing, owing to administrative support, an increase in healthcare expenditure, and Medicare reimbursement facilities. As per an article published by the AMA in April 2025, the healthcare expenditure in the country increased by 7.5% as of 2023 to USD 4.9 trillion. This growth rate is effectively higher than the 4.6% surge as of 2022, and this escalation is highly attributed to an upsurge in the utilization of healthcare services, along with the 92.5% insured share provision. Besides, the November 2023 NLM article demonstrated that 25% of Part B spending is covered by beneficiary premiums, with an increase in the expense for seniors.

The market in Canada is also growing, which is fueled by universal healthcare coverage, as well as government initiatives. For instance, according to the November 2022 Health Canada report, the country’s government declared a funding of USD 5 million to augment support for patients affected with chronic pain and enhance the Pain Canada network. In addition, the federal government made an investment of more than USD 184 million for pain-based research through Institutes of Health Research, and vigorously supported 17 pain-specific projects, with a valuation of more than USD 22.5 million through Health Canada’s SUAP. Therefore, this denotes a huge opportunity for the market to expand in the country, and cater to patients suffering from any form of pain.

Healthcare Spending Comparison Between the U.S. and Canada

|

Components/Countries |

U.S. |

Canada |

|

Medicare Spending |

USD 12,914 per person |

USD 250 billion (2022)- USD 6,500 per person |

|

Publicly Funded Healthcare |

91% have health insurance |

2 of 3 patients comprise private health insurance (90% received through employers) |

|

GDP |

18.3% |

11.2% |

Sources: Ross University, May 2021; World Bank Group, 2025

APAC Market Insights

Asia Pacific in the patient-controlled analgesia pumps market is expected to emerge as the fastest-growing region, with a share of 22.1% during the forecast period. The market’s development in the region is highly attributed to modernization in healthcare, aging population, and a rise in surgical conduction. In this regard, as per an article published by the NLM in August 2024, the development of strong health systems is driven by an increase in out-of-pocket (OOP) payments, ranging from 44% to 73%, particularly in South Asia, with Sri Lanka comprising the lowest at 44%. Besides, the region is subject to an increase in the non-communicable diseases (NCDs) burden, modifiable risk factor levels, and high mortality, ranging between 66% to 83%, thus suitable for the market’s exposure.

The market in China is gaining increasing traction due to an increase in the patient pool and the presence of administrative bodies to approve healthcare products and services. According to a report published by the International Trade Administration in April 2023, the comprised 36,570 hospitals, which provided more than 7.4 million beds and achieved 3.88 billion patient visits. Of all these, public facilities offered 70.2% of hospital beds received 84.2% of patient visits. Besides, the medical device market in the country is expected to gradually increase at a growth rate of 8.3%, which denotes a huge opportunity for the market’s flourishment.

The patient-controlled analgesia pumps market in India is also growing, which is driven by expansion in administrative beneficiaries. According to the August 2025 Ministry of Health and Family Welfare report, 4.5 crore (45 million) families are to benefit, with 6 crore (60 million) senior citizens with 5 Lakh rupees (approximately USD 5,715) free health insurance cover on a family basis. Therefore, based on this approval, senior citizens of more than 70 years of age are eligible to receive the AB PM-JAY benefit. Hence, with such provisions from the regional government, there is a huge opportunity for the market to gain increased exposure in the country.

Europe Market Insights

Europe in the patient-controlled analgesia pumps market is expected to garner a considerable share of 28.4% by the end of the projected timeline. The market’s development in the region is highly attributed to digital health strategies, an increase in aging demographics, and stringent pain management protocols. Besides, healthcare systems in the region have effectively focused on quality and affordability for both patients and the overall society. Additionally, advancements in PCA pumps, initiatives undertaken by government subsidies, telemedicine-integrated PCA pumps, along with opioid-sparing protocols, are other factors that are deliberately driving the market demand in the overall region.

The market in Germany is gaining increased exposure, owing to the existence of rigorous pain management standards. According to a report published by the NLM in January 2024, commonly utilized non-opioid medications for pain management in the country’s hospitals include metamizole, accounting for 98% of the management, which is followed by ibuprofen with 81.6%, paracetamol with 56.5%, diclofenac with 55.1%, coxibe with 51.7%, and ASS with 16.3%. Besides, the most common medication for opioid-based pain management in the country is hydropmorphon, constituting 98.6% of the management, thus increasing the patient-controlled analgesia pumps market’s demand.

The market in the UK is steadily growing due to the presence of NHS policies and surgical backlog clearance. In this regard, suitable explanations should be provided to patients regarding the nursing staff before undertaking any surgical procedure that includes the use of PCA pumps. According to the April 2025 Royal Cornwall Hospital report, there is an exception for clear IV fluids, including 0.9% of sodium chloride, while administering PCA pumps through a separate cannula. Therefore, with the presence of such policies, the market is expected to effectively grow in the country.

Europe’s Healthcare Expenditure Breakdown as of 2022

|

Financing Sources |

Expenditure by Function |

Expenditure by Provider |

|

Compulsory schemes & savings accounts- 51.3% |

Curative & rehabilitative care- 51.9% |

Hospitals- 36.4% |

|

Government schemes- 30.0% |

Medical goods- 17.8% |

Ambulatory care providers- 25.0% |

|

Other financing agents- 18.7% |

Other functions- 30.3% |

Retailers & medical goods providers- 16.6% |

|

- |

- |

Other providers- 22.0% |

Source: Eurostat, November 2024

Key Cognitive Patient-controlled Analgesia Pumps Market Players:

- Becton Dickinson (BD) (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Fresenius Kabi (Germany)

- Smiths Medical (ICU Medical) (UK)

- B. Braun (Germany)

- Baxter International (U.S.)

- Medtronic (Ireland)

- Mindray (China)

- Micrel Medical Devices (Greece)

- Trivitron Healthcare (India)

- BPL Medical Technologies (India)

- Ace Medical (South Korea)

- Medline Industries (U.S.)

- Teleflex Medical (U.S.)

- Shenzhen Mindray Bio-Medical (China)

- Ambu A/S (Denmark)

The international market is extremely competitive, owing to the presence of key players, such as Smiths Medical, Fresenius Kabi, and BD, collectively holding a considerable share in the market. Besides, mergers and acquisitions activities, expansion in emerging economies, and smart pumps advancements are a few strategies that these organizations have implemented to generously contribute to the market globally. For instance, BD successfully implemented IoT-based devices to ensure the smooth functioning of PCA pumps, while B. Braun readily made an expansion in India and Mindray in China. Additionally, ICU Medical successfully acquired Smiths Medical, thus denoting an optimistic outlook for the overall market across different nations.

Here is a list of key players operating in the global market:

Recent Developments

- In July 2024, Boston Scientific Corporation notified the 5-year pooled results for the Intracept Intraosseous Nerve Ablation System, that has the ability to measure results from three clinical trials for the ailment of vertebrogenic low back pain.

- In July 2023, BD declared that the updated BD Alaris Infusion System has successfully achieved the 510(k) clearance from the U.S. FDA, which can enable both return and remediation to complete commercial operations.

- Report ID: 8005

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Patient Controlled Analgesia Pumps Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.