Passive Optical LAN Market Outlook:

Passive Optical LAN Market size was valued at USD 38.95 billion in 2025 and is set to exceed USD 156.21 billion by 2035, expanding at over 14.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of passive optical LAN is estimated at USD 44.17 billion.

Investments in digital infrastructure, smart city projects, and the push for sustainable networking solutions is driving the passive optical LAN market significantly. For instance, in January 2022, Government of Canada announced successful investments of more than USD 6.9 million to provide high-speed internet to over 3,455 households in Ontario. Through this, the government made further progress in the continuity of making high-speed internet accessible to the 98% of the citizens by 2026. Need for secure and scalable networks in enterprises, and growing broadband penetration in developing regions is pushing for further growth of the market.

Advancements in fiber-optic technology, rapid growth of data centers, and the expansion of fiber-to-the home (FTTH) networks are also key contributors offering opportunities for POL deployment in bot residential and commercial settings. In July 2022, Nokia deployed a passive optical LAN (POL) solution for Orange, over 20 sites in France, intending to replace the existing copper-based LAN with the POL solution, linking over 5,000 end points including Wi-Fi and hard-wired terminals. These developments are boosting the passive optical market growth significantly, predicting a considerable expansion during the forecast period.

Key Passive Optical LAN Market Insights Summary:

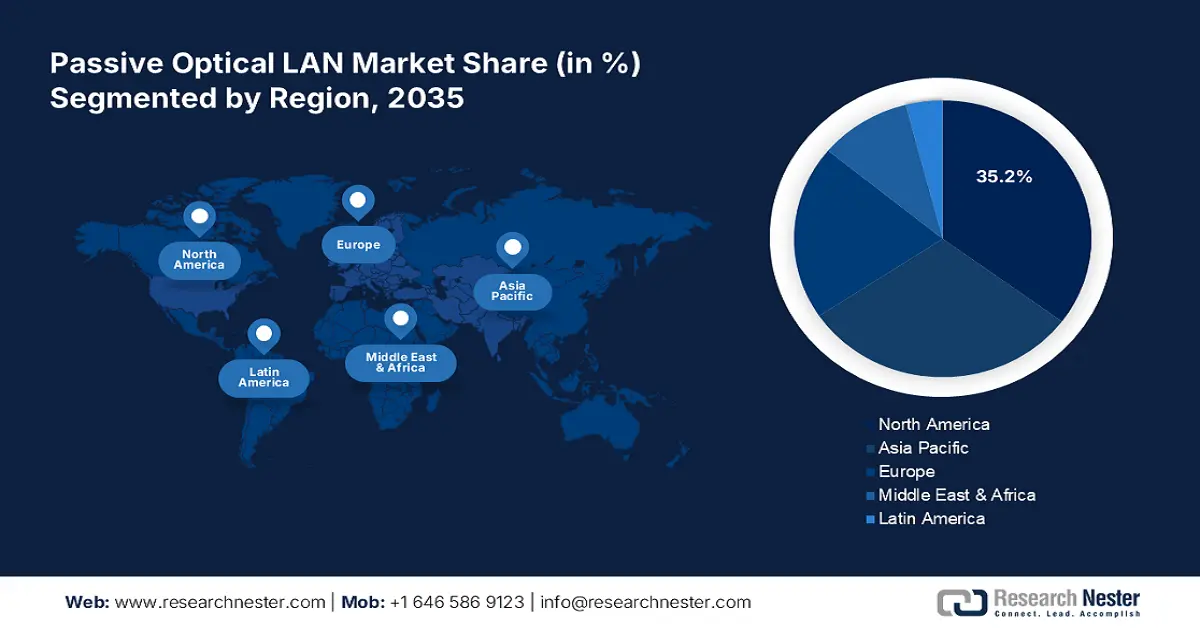

Regional Highlights:

- North America holds a 35.2% share in the Passive Optical LAN Market, strengthened by adoption in healthcare, education, government sectors, and investments in fiber-optic technologies, driving growth through 2035.

Segment Insights:

- The BFSI segment is set to achieve notable growth from 2026 to 2035, driven by the sector's need for secure and high-speed network infrastructure.

- The GPON segment of the Passive Optical LAN Market is projected to dominate by 2035, driven by its cost-efficiency and ability to support multiple services.

Key Growth Trends:

- Expanding demand for rapid data transmission

- Technological advancements

Major Challenges:

- Compatibility issue

- High initial deployment costs

- Key Players: ADTRAN, Inc., AFL, ALE International, Alpha Technologies, Calix Inc..

Global Passive Optical LAN Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 38.95 billion

- 2026 Market Size: USD 44.17 billion

- Projected Market Size: USD 156.21 billion by 2035

- Growth Forecasts: 14.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Malaysia

Last updated on : 13 August, 2025

Passive Optical LAN Market Growth Drivers and Challenges:

Growth Drivers

- Expanding demand for rapid data transmission: The increasing reliance on bandwidth-intensive applications such as video streaming, online gaming, and cloud computing is driving the passive optical LAN market. Businesses and consumers alike require faster and more reliable networks, majorly for real-time data processing, and the growing adoption of IoT devices. The surge in demand is pushing organizations to upgrade their network infrastructure with advanced fiber-optic solutions. For instance, in August 2021, ADTRAN, Inc. and ADVA announced a new agreement to create a leading scaled provider of end-to-end fiber networking solutions for communications service providers, enterprises, and government customers, by combining the two companies.

- Technological advancements: Adoption of 10G PON, XGS-PON, and NG-PON2 technologies, are significantly enhancing network performance and capacity. These innovations enable higher bandwidth, low latency, and seamless support for emerging applications including 5G backhaul, IoT, and cloud-based services. In April 2024, Tellabs announced that FlexSym Optical Line Terminal 2, FlexSym OLT2, along with System Release 32.0 was initiated for customer deployment. It has optically linked distributed endpoints that can be GPON or symmetrical 10G XGS-PON. Moreover, it provides multiple point-to-point 10G interfaces. In addition, integration of SDN and NFV improves network flexibility, and management, driving widespread adoption.

Challenges

- Compatibility issue: This issue in the passive optical LAN market arises when integrating with legacy systems, requiring additional equipment such as media converters to bridge the gap between technologies, increasing costs and causing potential inefficiencies. This complexity and cost can delay adoption, particularly in organizations with existing infrastructure. Furthermore, mismatched protocols or standards can lead to inefficiencies and reduced performance.

- High initial deployment costs: The passive optical LAN market faces deployment price challenges with the expenses of fiber installation, specialized equipment, and infrastructure upgrades. These upfront costs, combined with the need for skilled labor, can deter the adoption of the passive optical LAN despite long-term savings in maintenance and operations. Furthermore, these costs are particularly burdensome for SMEs with underdeveloped infrastructure.

Passive Optical LAN Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.9% |

|

Base Year Market Size (2025) |

USD 38.95 billion |

|

Forecast Year Market Size (2035) |

USD 156.21 billion |

|

Regional Scope |

|

Passive Optical LAN Market Segmentation:

End user (BFSI, Manufacturing, Healthcare, Government, Education)

Based on end user, the BFSI segment is poised to account for passive optical LAN market share of more than 33.2% by the end of 2035. The Banking, Financial Services, and Insurance (BFSI) sector dominates because of the need for secure, high-speed, and reliable network infrastructure to support data-intensive applications, ensure cybersecurity, and enable seamless digital banking services. In 2021, banks invested nearly USD 124 billion globally in new IT which is a 24% increase compared to that of 2019. Such investments for advancements and developments demand high-speed and secure networking, promoting the expansion of the global market significantly.

Application (GPON, EPON, Others)

Based on application, the GPON segment is projected to dominate the passive optical LAN market during the forecast period. GPON offers high bandwidth, cost efficiency, and the ability to support multiple services such as voice, data, and video over a single fiber. This makes it ideal for enterprises and large-scale deployments. In October 2024, GX Group launched the first Wi-Fi routers and GPON ONTs using recycled and biodegradable materials, through the company's Ecoverse initiative, which aligns perfectly with India's ambitious climate goals and contributes to a cleaner, greener planet. Developments such as this are anticipated to boost the segment’s growth further in the coming years.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Application |

|

|

End user |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Passive Optical LAN Market Regional Analysis:

North America Market Analysis

North America passive optical LAN market is predicted to capture revenue share of over 35.2% by 2035. Key industries, including healthcare, education, and government, are adopting POL to support large-scale data transmission and improve operational efficiency. The region benefits from a robust digital infrastructure and a focus on sustainable, cost-effective networking solutions. In September 2024, FS launched an XG(S)-PON OLT and two XG-PON ONUs, intending to enhance its product lineup and solutions for PON that meets consumer demands for developed bandwidth and quicker data transmission rates.

In the U.S., the passive optical LAN market is expanding due to increased adoption in enterprise settings and government facilities. Initiatives to modernize IT infrastucture and implement smart building technologies are further fueling demand. The presence of leading market players and significant investment in advanced fiber-optic technologies strengthen the market’s growth prospects in the United States.

Canada is also embracing the passive optical LAN technology, particularly in sectors including education and hospitality, where reliable and scalable networks are crucial. The government’s push for enhanced broadband access in rural and remote areas contributes to the market’s growth. However, challenges such as high deployment costs and limited awareness in less urbanized regions persist.

APAC Market Statistics

The APAC passive optical LAN market is expected to be the fastest growing region from 2025 to 2035. The rapid growth is driven by increasing investments in digital infrastructure, smart city projects, and rising internet penetration. Governments across the region are promoting fiber-optic deployments to support high-speed connectivity, particularly in urban areas. The growing adoption of IoT, cloud computing, and 5G networks further fuels the demand for POL solutions.

India passive optical LAN market is expanding owing to government initiatives including Digital India and BharatNet, which aim to enhance broadband connectivity across urban and rural areas. Expansion of the IT and telecom sectors are also supporting the market growth in the region. For instance, the Union Budget 2024-25, the allocation for IT and telecom sector is estimated at USD 13.98 billion. Furthermore, the country’s IT and business services market is projected to reach USD 19.93 billion by 2025, leading to expansion of the market.

China leads the passive optical LAN market in APAC, supported by its massive investments in fiber-optic infrastructure and smart city initiatives. With a strong focus on 5G deployment and data center expansion, the country it witnessing widespread adoption of POL across industries. For instance, in 2021, China installed over 1.4 million 5G base stations, accounting for 60% of the world’s total. Government-backed projects and the presence of major players further accelerates the market growth.

Key Passive Optical LAN Market Players:

- 3M Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ADTRAN, Inc.

- AFL

- ALE International

- Alpha Technologies

- Calix Inc.

- Cisco Systems, Inc

- CommScope Inc.

- Nexans

Dominating companies in the passive optical LAN market are focusing on strategies such as developing cost-effective and energy-efficient solutions, enhancing network scalability, and integrating advanced technologies such as 10G PON. The players also emphasize partnerships with telecom operators and government collaborations to support global digitalization initiatives, ensuring robust infrastructure for high-speed connectivity. Furthermore, players such as the GX Group are emphasizing sustainability and green planet concepts. For instance, in 2024, GX Group announced incorporating 60% reusable materials in the company’s products by 2026.

Recent Developments

- In October 2024, ZTE Corporation unveiled two new optical access products: the 50G PON integrated optical business gateway ZXA10 P910 and the lightweight outdoor PON OLT product ZXA10 C604Z, designed to enable enterprise networks to achieve all-optical ultra-high bandwidth access.

- In September 2023, Alcatel-Lucent Enterprise (ALE) and Nokia announced a partnership intending to offer compelling hybrid network solution blueprints for industry verticals.

- Report ID: 6918

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Passive Optical LAN Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.