Paroxysmal Nocturnal Hemoglobinuria Treatment Market Outlook:

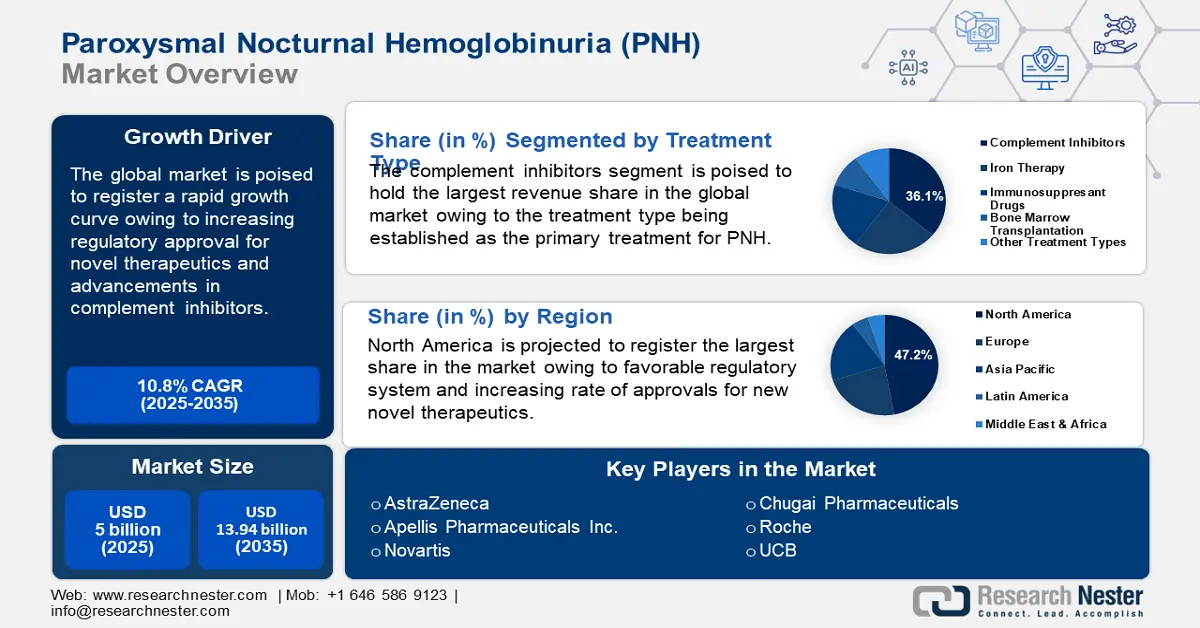

Paroxysmal Nocturnal Hemoglobinuria Treatment Market size was valued at USD 5 billion in 2025 and is expected to reach USD 13.94 billion by 2035, registering around 10.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of paroxysmal nocturnal hemoglobinuria treatment is assessed at USD 5.49 billion.

The market’s robust growth is attributed to the rising prevalence of rare blood disorders and advancements in therapeutic interventions, favoring companies in the healthcare sector to invest in developing, distributing, and selling advanced therapeutics for treatment. A paper published in the National Library of Medicine on inherited diseases of hemoglobin as an emerging global health burden predicted diseases such as paroxysmal nocturnal hemoglobinuria would cause a severe global health burden, especially in emerging economies.

PNH is a complement-mediated disease and requires targeted treatment. The global paroxysmal nocturnal hemoglobinuria (PNH) treatment market benefits from innovations in C5 inhibitors. For instance, in March 2020, a paper published in the National Library of Medicine stated that Crovalimab, a sequential monoclonal antibody recycling technology antibody was administered in small volumes once every 4 weeks and found complete terminal complement pathway inhibitions in patients with PNH, warranting the next phase of clinical development. An increasing rate of clinical approval for PNH treatment drugs such as Solaris (eculizumab), Ultomiris (ravulizumab), and Empaveli (pegcetacoplan) boosts the market’s growth. Market players are set to benefit from the increasing adoption of advanced diagnostic techniques assisting the early detection of PNH.

Rapid advancements in DNA sequencing assist early identification of PNH boosting the growth of the global paroxysmal nocturnal hemoglobinuria (PNH) treatment market as the demand for novel therapeutics rises. Additionally, industry stakeholders are focusing on strategic partnerships to improve distribution channels in emerging markets. A rising demand for PNH treatment has led to pharmaceutical companies pushing for regulatory approvals on novel therapies. New treatments receiving regulatory approvals boost the market’s growth as manufacturers, distributors, and end-users benefit from a positive treatment approval trend. For instance, in September 2024, Roche’s PIASKY received approval from the Food and Drug Administration (FDA) of the U.S. As global healthcare increases investment in gene therapy and precision medicine, new avenues are positioned to open in the paroxysmal nocturnal hemoglobinuria (PNH) treatment market driving the robust growth curve by the end of the forecast period.

Key Paroxysmal Nocturnal Hemoglobinuria (PNH) Treatment Market Insights Summary:

Regional Highlights:

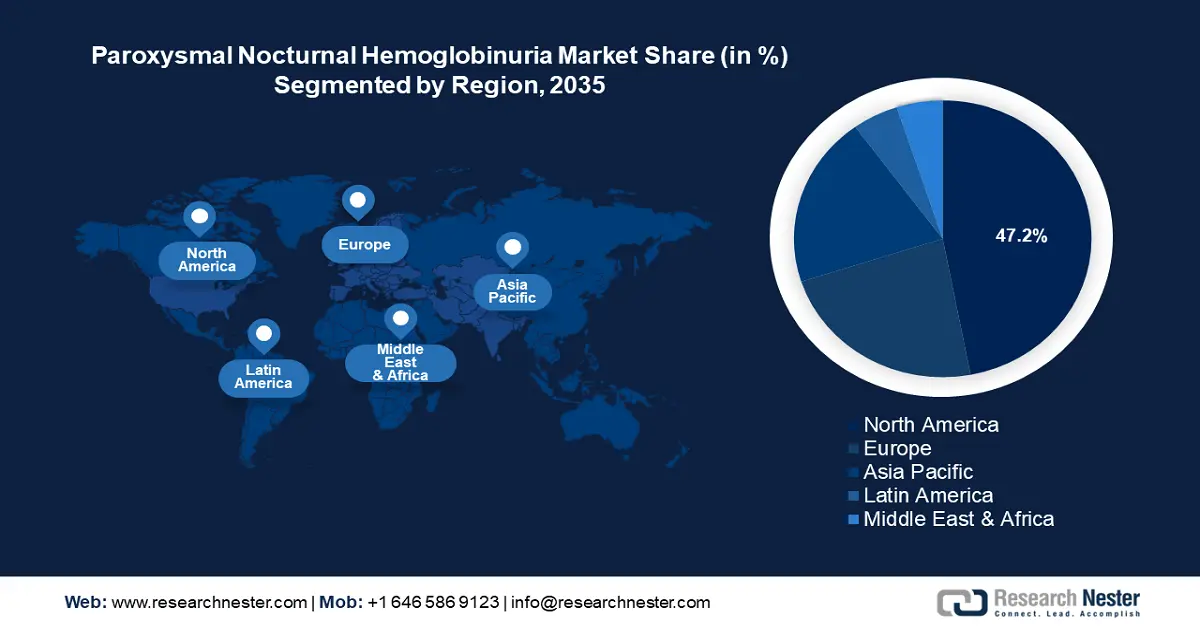

- North America commands a 47.2% share in the Paroxysmal Nocturnal Hemoglobinuria Treatment Market, driven by high adoption rate of advanced therapies and a robust regulatory framework, ensuring growth through 2035.

- Europe's Paroxysmal Nocturnal Hemoglobinuria Treatment Market is forecasted to grow rapidly by 2035, driven by a strong regulatory framework and push for rare disease research.

Segment Insights:

- The Complement Inhibitors segment is expected to capture around 36.1% market share by 2035, attributed to its effectiveness in reducing transfusion needs and improving life quality in PNH patients.

- Iron Therapy segment is anticipated to experience robust growth from 2026-2035, driven by its application in treating chronic hemolysis and anemia in PNH patients.

Key Growth Trends:

- Increasing regulatory approvals for novel therapies

- Advancements in complement inhibitors

Major Challenges:

- Limited awareness and diagnosis

- High cost of treatment

- Key Players: AstraZeneca, Apellis Pharmaceuticals Inc., Novartis, Chugai Pharmaceuticals, Roche, UCB, Regeneron Pharmaceuticals.

Global Paroxysmal Nocturnal Hemoglobinuria (PNH) Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5 billion

- 2026 Market Size: USD 5.49 billion

- Projected Market Size: USD 13.94 billion by 2035

- Growth Forecasts: 10.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, France, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Turkey

Last updated on : 14 August, 2025

Paroxysmal Nocturnal Hemoglobinuria Treatment Market Growth Drivers and Challenges:

Growth Drivers

- Increasing regulatory approvals for novel therapies: The paroxysmal nocturnal hemoglobinuria treatment sector is experiencing a surge in approvals for therapies boosted by the rising demands for treatments. PNH is classified as a rare disease and Rare Disease Advisor estimates PNH cases in the U.S. to be around 0.6 to 6.1 cases per million people. Growing research and awareness of the rare blood disorder has hastened clinical trials and approval rates by regulatory bodies, allowing pharmaceutical companies to distribute treatment options in the markets. Fast-track approval of new biologics and gene therapies usher in advanced treatments such as complement inhibitors to the paroxysmal nocturnal hemoglobinuria (PNH) treatment market swiftly. For instance, in February 2024, Chugai Pharmaceuticals reported China to be the first country to approve Crovalimab for PNH treatment, and the drug is poised to improve patient convenience by allowing self-injection every four weeks.

- Advancements in complement inhibitors: The growing research and development of complement inhibitors such as C5 inhibitors ravulizumab and eculizumab benefit the global paroxysmal nocturnal hemoglobinuria treatment sector. These biologics target the root cause of PNH patients. Additionally, therapeutic breakthroughs improving patient outcomes and convenience assist the paroxysmal nocturnal hemoglobinuria (PNH) treatment market’s growth. For instance, in October 2023, the FDA approved the complement C5 inhibitor Zilucoplan under the market name Zilbrysq. As investments in research increase, it is positioned to boost studies on next-generation complement inhibitors that can improve the efficacy of treatments.

- Expansion of precision medicine and gene therapy: Global healthcare trends are witnessing a favorable push for precision medicine to benefit the paroxysmal nocturnal hemoglobinuria (PNH) treatment market. Advancements in CRISPR gene editing can address the genetic mutations responsible for PNH. For instance, in January 2021 the creation of animal models for PNH using CRISPR gene editing advanced the understanding of the mechanism of pathogenesis of PNH. Additionally, emerging therapies have the potential to provide curative solutions that can reduce lifelong dependency on medication. For instance, in December 2023, Novartis presented 48-week research results from the Phase 3 APPLY-PNH trial that long-term efficacy of Fabhalta (Iptacopan) in adults suffering from PNH.

Challenges

- Limited awareness and diagnosis: The awareness of PNH remains limited owing to the rarity of the disorder. Emerging paroxysmal nocturnal hemoglobinuria (PNH) treatment markets are facing barriers in the growth of the paroxysmal nocturnal hemoglobinuria treatment sector owing to a lack of awareness, lesser diagnosis, and volatile healthcare infrastructure. Delayed diagnosis can prevent patients from being administered timely treatment and also reduce applications of novel therapeutics. Additionally, complications of PNH overlap with other conditions such as anemia that can add to challenges in diagnosis.

- High cost of treatment: The high cost of treatment associated with PNH can hinder the paroxysmal nocturnal hemoglobinuria (PNH) treatment market’s growth curve. Patients diagnosed with PNH often develop anemia which adds to treatment costs. Additionally, the complicated treatment procedures require specialists and a medical team that can add to the costs. The difficulties in marrow transplantation add to the challenges in treatment. The high price can deter patients from seeking treatment and put a strain on healthcare systems. As cost containment pressures rise globally, pharmaceutical companies face the issue of balancing affordability with profits.

Paroxysmal Nocturnal Hemoglobinuria Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.8% |

|

Base Year Market Size (2025) |

USD 5 billion |

|

Forecast Year Market Size (2035) |

USD 13.94 billion |

|

Regional Scope |

|

Paroxysmal Nocturnal Hemoglobinuria Treatment Market Segmentation:

Treatment Type (Complement Inhibitors, Iron Therapy, Immunosuppressant Drugs, Bone Marrow Transplantation, Other Treatment Types)

By treatment type, the complement inhibitors segment is likely to account for around 36.1% paroxysmal nocturnal hemoglobinuria (PNH) treatment market share by 2035. The segment’s growth is attributed to the primary treatment type for PNH. Complement inhibitor therapies allow patients to improve their quality and life and reduce the need for blood transfusions, contributing to the rapid growth of the segment. Ongoing approval of add-on therapies along with complement inhibitors like ravulizumab is positioned to maintain the growth curve of the segment. For instance, in April 2024, Voydeya (Danicopan) was approved in the U.S. as an add-on therapy to ravulizumab or eculizumab for the treatment of adults diagnosed with PNH.

The iron therapy treatment type segment of the global paroxysmal nocturnal hemoglobinuria treatment sector is poised to register a robust growth curve during the forecast period owing to increasing application to treat patients experiencing chronic hemolysis leading to iron deficiency. Iron supplementation can be essential in addressing anemia caused due to the breakdown of red blood cells in patients diagnosed with PNH. For instance, as per the American Society of Hematology, pregnant women diagnosed with PNH have a greater need for iron supplementation owing to intravascular hemolysis, and in certain cases, PNH patients may require intravenous iron during pregnancy. The rising awareness of PNH treatments and early diagnosis is poised to boost the application of iron therapy to support additional complications in patients suffering from PNH.

Route of Administration (Parenteral, Oral)

By route of administration, the parenteral segment of the global paroxysmal nocturnal hemoglobinuria (PNH) treatment market is projected to increase its revenue share by the end of the forecast period. The growth of the segment is owed to applications in complement inhibitors such as ravulizumab and eculizumab. The parenteral route of administration ensures effective absorption providing immediate benefits in managing life-threatening complications. Additionally, pharmaceutical companies are seeking to improve patient convenience by releasing novel therapeutics such as crovalimab that patients can self-administer. For instance, in October 2023, the FDA approved pegcetacoplan (Empaveli) on-body injector for self -administration in PNH treatment. Trends indicate developments in subcutaneous formulations that are positioned to continue the robust growth of this segment.

Our in-depth analysis of the global paroxysmal nocturnal hemoglobinuria (PNH) treatment market includes the following segments:

|

Treatment Type |

|

|

Route of Administration |

|

|

Age Group |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Paroxysmal Nocturnal Hemoglobinuria Treatment Market Regional Analysis:

North America Market Forecast

North America industry is anticipated to hold largest revenue share of 47.2% by 2035, owing to a high adoption rate of advanced therapies and a robust regulatory framework benefiting clinical trials and approvals of new treatments. North America is the home of major pharmaceutical companies such as Alexion Pharmaceuticals, which developed Soliris, and Ultomiris benefits the adoption in North America. Additionally, supportive regulatory programs such as the RareCare Patient Assistance Program by the National Organization for Rare Disorders reimburse registration costs for workshops, conferences, and educational programs related to rare diseases, boosting awareness of PNH treatments. The favorable trends in North America are poised to continue the robust growth of the paroxysmal nocturnal hemoglobinuria (PNH) treatment market.

The U.S. holds the largest share in the paroxysmal nocturnal hemoglobinuria treatment sector. The market’s growth in the country is owed to a robust regulatory ecosystem in the country ensuring timely approval of new therapeutics. For instance, in December 2023, McKesson Corporation announced the availability of Fabhalta (Iptacopan) by Novartis after Fabhalta was approved by the FDA in the same month. Additionally, government support of precision medicine research with programs such as the Precision Medicine Initiative creates a supportive ecosystem for advanced research on PNH. As academic institutions and pharmaceutical companies collaborate to develop gene therapies, the market is poised to maintain its profitable growth.

Canada exhibits rapid growth in the paroxysmal nocturnal hemoglobinuria (PNH) treatment market of North America. The market’s growth is attributed to growing awareness of PNH treatment and better access to advanced therapies. Canada has a publicly funded healthcare system called Medicare that makes high treatment costs of PNH affordable to patients, improving access to wide demographics. Additionally, the regulatory ecosystem in the country has been proactive in approving novel therapeutics for PNH treatment which boosts the sector in Canada. For instance, in August 2024, Voydeya was approved by Health Canada as an add-on to Ultomiris and Soliris in adults diagnosed with PNH.

Europe Market Analysis

Europe is poised to register the fastest growth in the paroxysmal nocturnal hemoglobinuria (PNH) treatment market by the end of the forecast period. The market growth is due to a strong regulatory framework and push for rare disease research benefiting the market. The European Medicines Agency (EMA) has been at the forefront by approving leading therapies for PNH treatment, ensuring availability across the region, and boosting patient access to new and advanced therapeutics. For instance, in November 2020, the European Commission provided marketing authorization to Alexion for a new formulation of Ultomiris with reduced infusion time for the treatment of paroxysmal nocturnal hemoglobinuria (PNH) and atypical hemolytic uremic syndrome (aHUS). France and Germany are leading the paroxysmal nocturnal hemoglobinuria (PNH) treatment market in Europe.

Germany has a large share of the paroxysmal nocturnal hemoglobinuria sector in Europe. The market in Germany benefits from its advanced healthcare infrastructure and presence of research institutions and biotech companies advancing research on rare diseases. The favorable framework for research benefits the domestic paroxysmal nocturnal hemoglobinuria (PNH) treatment market evident by a growing number of clinical trials. For instance, in April 2023, data from phase 3 APPOINT-PNH trial was presented at the 2023 annual meeting of the European Society for Blood and Marrow Transplantation (EBMT) highlighting oral iptacopan enabling an estimated 92.2% of complement inhibitor in PNH patients and achieving 2g/dl or more hemoglobin increase without the requirement of blood transfusions.

France is positioned to register rapid growth in the paroxysmal nocturnal hemoglobinuria sector in Europe. The paroxysmal nocturnal hemoglobinuria (PNH) treatment market’s growth is owed to favorable healthcare frameworks, such as the French National Plan for Rare Diseases. The next National Plan for Rare Diseases in France will focus on research & development as per the government that is set to benefit the growth of the PNH treatment sector. Additionally, the French Registry of Marrow Failure Syndrome helps research institutions such as the American Society of Hematology to research molecular profiling for next-generation sequencing that can benefit the market’s growth. In May 2024, Aspaveli (Pegcetacoplan) was approved in Europe for the treatment of adult patients diagnosed with PNH who have hemolytic anemia. As research on PNH ramps up and a strong regulatory framework in Europe benefits the domestic paroxysmal nocturnal hemoglobinuria (PNH) treatment market in France, the PNH treatment sector is projected to continue its growth.

Key Paroxysmal Nocturnal Hemoglobinuria Treatment Market Players:

- AstraZeneca

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Apellis Pharmaceuticals Inc.

- Novartis

- Chugai Pharmaceuticals

- Roche

- UCB

- Regeneron Pharmaceuticals

The global paroxysmal nocturnal hemoglobinuria treatment market is projected for a robust growth curve during the forecast period. Key market players are tying up with local distributors to penetrate new markets and invest in research and development to increase the efficacy of treatment.

Here are some key players in the market:

Recent Developments

- In August 2024, Novartis announced accelerated approval by the FDA for Iptacopan (Fabhalta) that is the first complement inhibitor for the reduction of proteinuria in primary IgA nephropathy (IgAN). The accelerated approval was granted based on the pre-specified interim analysis of the Phase III APPLAUSE-IgAN study.

- In July 2024, the Food and Drug Administration (FDA) of U.S. approved Epysqli to treat PNH. Epysqli is a biosimilar to Soliris and can prevent red blood cell destruction in PNH patients.

- Report ID: 6655

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Paroxysmal Nocturnal Hemoglobinuria (PNH) Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.