Parenteral Nutrition Market Outlook:

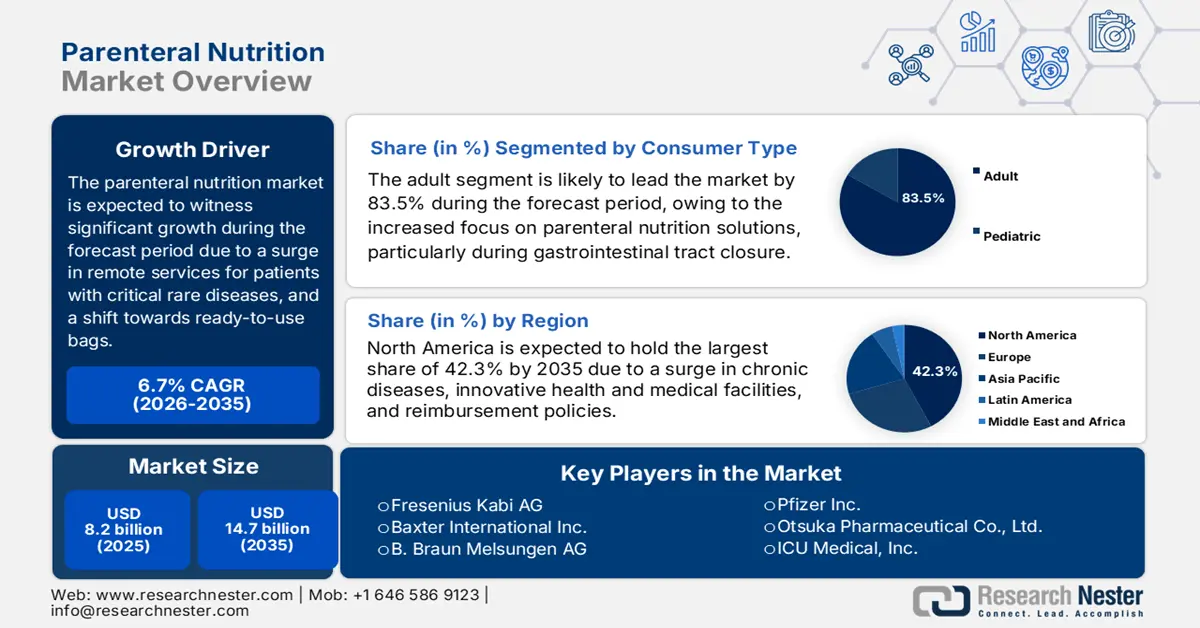

Parenteral Nutrition Market size was over USD 8.2 billion in 2025 and is estimated to reach USD 14.7 billion by the end of 2035, expanding at a CAGR of 6.7% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of the parenteral nutrition is estimated at USD 8.7 billion.

The dominating trends for the international market include the paradigm-based transition to multi-chamber and ready-to-use bags, along with a rise in home parenteral nutrition (HPN). According to an article published by NLM in June 2022, an estimated 25,011 patients receive HPN, along with 437,882 receiving home enteral nutrition, particularly in the U.S. In addition, within a short-term HPN duration, which is almost 6 to 12 weeks, inserting a peripheral central venous catheter is one of the options. Besides, as stated in the August 2025 PIB data report, the government of India surged the utilization modification for gunny bags by almost 40% to ensure seamless operation and support sustainable packaging.

Furthermore, the aspect of advancement in lipid emulsions, along with pharmaconutrition and personalization, is also bolstering the market globally. According to an article published by NLM in February 2024, an estimated 20% of IV lipid emulsion preparations are easily available globally, with the most prevalent formulations constituting 100% long-chain fatty acids readily derived from soybean oil. Besides, other emulsions account for 50% of medium-chain fatty acids, mainly from coconut oil, and the remaining 50% from soybean oil. Meanwhile, the one-size-fits-all concept is increasingly becoming obsolete, with the current focus on personalized formulations, suitable for boosting the market’s exposure.

Key Parenteral Nutrition Market Insights Summary:

Regional Highlights:

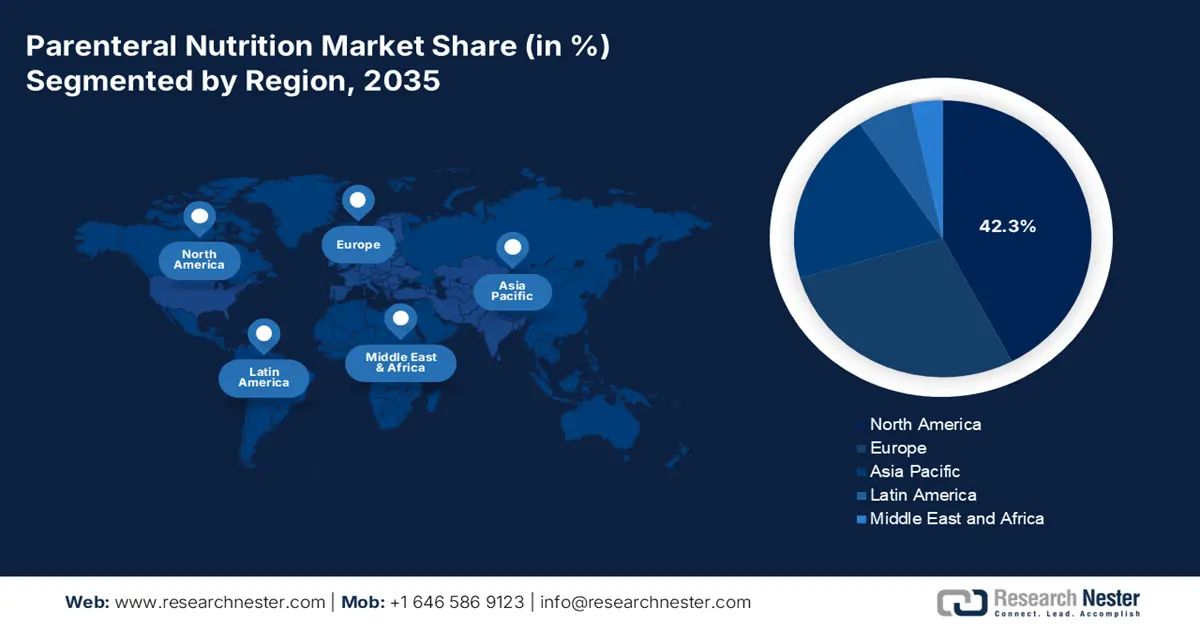

- By 2035, North America is anticipated to secure a 42.3% share of the Parenteral Nutrition Market, uplifted by the rising prevalence of chronic disorders and the growing transition from inpatient to remote parenteral nutrition.

- By 2035, the Asia Pacific region is set to expand at the fastest pace, supported by rapid population aging, rising disposable incomes, and escalating government investments in healthcare infrastructure.

Segment Insights:

- By 2035, the adult segment is projected to hold 83.5% of the Parenteral Nutrition Market, amplified by the critical need for nutritional support when the gastrointestinal tract cannot be utilized due to conditions such as high-output fistulas and intestinal failure.

- By 2035, the hospital and clinics segment is expected to capture the second-largest share, strengthened by its central role in acute care initiation where parenteral nutrition requires close clinical monitoring and metabolic management

Key Growth Trends:

- An increase in cancer burden

- Advancements in pump and catheter design

Major Challenges:

- Complexity in supply chain and logistics

- Strict compliance and regulatory scrutiny

Key Players: Fresenius Kabi AG (Germany), Baxter International Inc. (U.S.), B. Braun Melsungen AG (Germany), Pfizer Inc. (U.S.), Otsuka Pharmaceutical Co., Ltd. (Japan), ICU Medical, Inc. (U.S.), Vifor Pharma Management Ltd. (Switzerland), Grifols, S.A. (Spain), Sichuan Kelun Pharmaceutical Co., Ltd. (China), Hospira, Inc. (U.S.), Ajinomoto Co., Inc. (Japan), Fresenius SE & Co. KGaA (Germany), B. Braun of America (U.S.), JW Life Science (South Korea), Baxter Healthcare (U.S.), Lupin Ltd. (India), Cadila Healthcare Ltd. (Zydus) (India), CSL Limited (Australia), Hikma Pharmaceuticals PLC (Jordan), DuPont Nutrition & Biosciences (U.S.).

Global Parenteral Nutrition Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.2 billion

- 2026 Market Size: USD 8.7 billion

- Projected Market Size: USD 14.7 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Australia, Indonesia

Last updated on : 20 October, 2025

Parenteral Nutrition Market - Growth Drivers and Challenges

Growth Drivers

- An increase in cancer burden: The component of cachexia and malnutrition is increasingly available among cancer patients, which is positively driving the market’s demand. As per an article published by NLM in October 2022, malnutrition significantly affects 75% of overall cancer patients. In addition, an estimated 15% to 50% of cancer patients are affected with nutritional deficiencies, while 43% and 9% are impacted with overt malnutrition. This incidence readily increases during treatment procedures, reaching nearly 80% of patients, and can account for 20% of cancer deaths, depending on which there is a huge growth opportunity for the market.

- Advancements in pump and catheter design: The efficiency and safety of home parenteral nutrition are hugely dependent on vascular accessibility devices. The aspect of innovations in catheters and pumps has successfully made the global market manageable, leading to expanded adoption. According to the October 2022 NLM article, the utilization of in-line filters in pediatric-based parenteral nutrition constitutes a 1.2-micron in-line filter, suitable for lipid-containing admixture. Most importantly, a 0.22-micron filter is recommended to be readily utilized for non-lipid-containing admixtures, thus denoting an optimistic outlook for the overall market.

- Surge in the aging population: This is the single-most non-cyclical and robust driver for the market internationally. As stated in the October 2025 World Health Organization (WHO) article, the world’s population proportion is predicted to increase to 22% by the end of 2050, an increase from 12% as of 2015. Additionally, approximately 80% of older people will be residing across low- and middle-income nations by the end of the same year. Therefore, this increase in aging demographics denotes an upsurge in chronic conditions for which there is a huge demand for parenteral nutrition.

Long and Medium-Chain Formulation Differentiation Uplifting the Market (2024)

|

Long-Chain Fatty Acids |

Medium-Chain Triglycerides |

||

|

Acid Formulation |

% |

Acid Formulation |

% |

|

Linoleic |

53 |

Caprylic |

28.5 |

|

Oleic |

24 |

Capric |

20 |

|

Palmitic |

11 |

Lauric |

1 |

|

Alpha-Linoleic |

8 |

Caproic |

0.5 |

|

Stearic |

4 |

- |

- |

Source: NLM

Needles, Catheters, and Cannulae 2023 Export and Import Driving the Parenteral Nutrition Market

|

Countries/Components |

Export |

Import |

|

U.S. |

USD 6.9 billion |

USD 7.6 billion |

|

Ireland |

USD 4.4 billion |

- |

|

Mexico |

USD 4.3 billion |

- |

|

Netherlands |

- |

USD 4.9 billion |

|

Germany |

- |

USD 2.7 billion |

|

Global Trade Valuation |

USD 35.8 billion |

|

|

Global Trade Share |

0.1% |

|

|

Product Complexity |

0.1 |

|

|

Export Growth |

5.9% |

|

Source: OEC

Challenges

- Complexity in supply chain and logistics: The products in the market, particularly those comprising complex multi-vitamin cocktails and lipid emulsions, are frequently photosensitive and thermolabile. These need stringent protection from light and a cold-chain logistics system. Therefore, ensuring an end-to-end integrity from the manufacturing process to the patient's bedside is a massive challenge. This is extremely critical for home parenteral nutrition, wherein patients are required to administer storage and handling by themselves. Moreover, the worldwide supply chain fragility results in a severe shortage of necessary vitamins or amino acids, which jeopardizes patient care.

- Strict compliance and regulatory scrutiny: As complex and biologic drug-nutrient combinations, parenteral nutrition-based formulations witness intensified administrative oversight from bodies such as the EMA and FDA. Any modification in composition, raw materials sourcing, and manufacturing process demands suitable regulatory clearance and extended validation. This eventually slows down the entry and innovation in the market. Therefore, this transition towards formulations denotes an increased compliance burden on manufacturers, needing to cater to good manufacturing practice (GMP).

Parenteral Nutrition Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 8.2 billion |

|

Forecast Year Market Size (2035) |

USD 14.7 billion |

|

Regional Scope |

|

Parenteral Nutrition Market Segmentation:

Consumer Type Segment Analysis

Based on the consumer type, the adult segment is projected to account for the highest share of 83.5% by the end of 2035. The segment’s exposure is uplifted by the importance of parenteral nutrition, especially when the gastrointestinal tract is unable to be utilized, owing to conditions such as high-output fistulas and intestinal failure. According to an article published by the WA Country Health Service in February 2025, total parenteral nutrition should be provided to stable adult patients who are unable to receive 50% of nutritional requirements. In addition, this is essential for adult populations with low nutrition within 3 to 5 days, thus suitable for the overall market’s growth.

Distribution Channel Segment Analysis

Based on the distribution channel, the hospital and clinics segment is predicted to constitute the second-highest share during the projected timeline. The segment’s growth is fueled by its pivotal role as the usual facility for undertaking acute care initiation. Besides, severely ill patients’ complex comorbidities and post-operative cases are initially stabilized in hospital settings, wherein parenteral nutrition is essential for metabolic support. Additionally, the segment’s supremacy is also reinforced by the requirement for clinical oversight, especially during parenteral nutrition, which demands effective monitoring and maintaining metabolic status.

Bag Type Segment Analysis

Based on the bag type, the multi-chamber bags segment is catered to garner the third-highest share by the end of the forecast duration. The segment’s development is propelled by its ability to enhance efficacy, convenience, and safety by diminishing the risk of compounding contamination and errors. As per an article published by NLM in November 2024, a clinical study was conducted on 87,727 adults, wherein 20,192 received parenteral nutrition from multi-chambered bags, and the overall hospitalization expense was EUR 23,495, which is considered to be less in comparison to individually compounded bags, thus denoting an optimistic outlook for the overall segment.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Consumer Type |

|

|

Distribution Channel |

|

|

Bag Type |

|

|

Nutrient |

|

|

Application |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Parenteral Nutrition Market - Regional Analysis

North America Market Insights

North America in the parenteral nutrition market is anticipated to garner the largest share of 42.3% by the end of 2035. The market’s growth in the overall region is propelled by a rise in chronic disorders, increased shift from inpatient to remote parenteral nutrition, the presence of CMS reimbursement policies, and the aspect of reduced health and medical expenses. According to an article published by NLM in January 2024, the approximate expense of chronic disease is over USD 1 trillion in the regional medical system. Besides, these diseases cater to an overwhelming disability and death percentage in the U.S., which is positively impacting the market.

The parenteral nutrition market in the U.S. is significantly growing, owing to an increase in remote services, which is readily driven by the existence of CMS policies that focus on affordable site-of-care transitions. In addition, the support provision by Medicare coverage for nutrients and infusion pumps is also driving the market in the country. As stated in the June 2025 Office of Inspector General article, as of 2022 and 2023, Medicare paid over USD 487 million for parenteral nutrition under the Social Security Act of 1861 (s)(8), as well as 1862 (a)(1)(A). Besides, the NIH has highlighted in-depth research to support SMOFlipid-based emulsions in the country to diminish PNALD, thus suitable for the market’s development.

The parenteral nutrition market in Canada is also growing due to the presence of provincial health and medical systems, which are readily focused on expanding accessibility and standardizing care outside acute environments. In addition, the implementation and development of provincial HPN programs, suitable to optimize patient life quality and manage expenses, is also boosting the market in the country. Besides, the Nutritional International Organization, in one of its February 2025 articles, noted that the Government of Canada initiated an investment of USD 360.6 million. The purpose is to significantly provide support to high and impactful nutrition programming for the upcoming 6 years, and improve health, generate economic and educational outcomes, and save lives in more than 60 nations.

Chronic Disease Prevalence in North America (2024)

|

Components |

Rate |

|

Total people affected in the U.S. |

129 million (1 major chronic condition) |

|

Death |

5 in 10 |

|

Proportion of people in America |

42% having two or more |

|

Yearly healthcare spending |

USD 4.1 trillion |

|

Least prevalence |

8,576 people |

|

Moderate prevalence |

14,670 |

Source: CDC

APAC Market Insights

The Asia Pacific in the parenteral nutrition market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly driven by an upsurge in the aging population, especially in South Korea and Japan, an increase in disposable income, and huge government investments in health facilities, particularly in India and China. According to an article published by the UNESCAP Organization in 2022, 1 in 7 people in Asia and the Asia Pacific are aged more than 60 years, and by the end of 2050, 1 in 4 people is predicted to belong to this particular age category. Therefore, there is a massive chance for this particular group to be affected by rare diseases, hence denoting a growth opportunity for the market.

The parenteral nutrition market in China is gaining increased traction, owing to the existence and generous contributions by the National Medical Products Administration (NMPA), and an upsurge in patients aided with parenteral nutrition-based treatments. This is highly fueled by an increase in gastric cancer incidence, along with optimization in accessibility across tier-2/3 cities. According to an article published by NLM in April 2025, the country caters to 70% of cardia and 50% of non-cardia gastric cancer. In addition, the disease in the country originates from a convergence of behavioral and biological drivers, thus uplifting the market’s demand.

The parenteral nutrition market in India is also developing due to the presence of immense support, which is provided through government healthcare strategies. In this regard, Ayushman Bharat has successfully facilitated a surge in patients effectively accessing parenteral nutrition, with the majority of patients receiving standard treatment. As per the July 2024 PIB article, the Central Pool in the country accounts for 608.7 lakh metric tons of food grains, which significantly surpasses the 411.2 lakh metric ton stocking norm. Besides, the National Food Security Act has entitled almost 75% of the rural population, as well as 50% of the urban population, thus creating an optimistic outlook for the overall market.

Living Arrangements for the Older Population in Asia and the Asia Pacific (2022)

|

Countries |

One Person |

Couple Only |

Parents with children |

Extended Family |

Others |

|

China |

8.3 |

24.9 |

9.2 |

- |

0.4 |

|

Japan |

17.2 |

36.6 |

- |

- |

- |

|

Malaysia |

6.9 |

14.0 |

25.0 |

51.0 |

3.1 |

|

India |

4.0 |

14.0 |

11.3 |

66.9 |

3.9 |

|

Australia |

21.7 |

46.7 |

- |

- |

- |

Source: UNESCAP Organization

Europe Market Insights

Europe in the parenteral nutrition market is projected to grow steadily by the end of the forecast period. The market’s growth in the region is highly determined by high standards of clinical care, an increase in the elderly population, strong public healthcare and medical systems, and strict administrative oversight by the EMA. Additionally, the tactical shift from hospital-based compounded bags to standardized and ready-to-use multi-chamber bags is also bolstering the market by reducing medication errors and healthcare expenses. Moreover, there is a strong push for incorporating advanced lipid emulsions, including SMOFlipid to combat parenteral nutrition-associated liver disease, thus denoting a positive impact for the overall market in the region.

The parenteral nutrition market in Germany is gaining increased exposure, owing to a surge in medical spending, with the Federal Ministry of Health reporting a growth in demand. This is effectively attributed to wide-ranging insurance coverage, as well as healthcare infrastructure. According to the 2025 Germany Visa Organization data report, the healthcare expenditure in the country accounted for 474.1 billion euros, with life expectancy in the country catering to 83.3 years for women and 78.5 years for men, thereby suitable for uplifting the overall market.

The parenteral nutrition market in France is also growing, due to tactical governmental strategies to enhance efficacy in its national health system. In addition, the French National Authority for Health (HAS) has integrated reforms that strongly focus on ready-to-use parenteral formulations, along with home-based care to diminish hospital admission rates and related expenses. Besides, the Ministry of Solidarity and Health has displayed a continuous yearly increase in HPN patients, readily backed by the presence of a standard reimbursement system that can facilitate accessibility to innovative nutrition support.

Key Parenteral Nutrition Market Players:

- Fresenius Kabi AG (Germany)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Baxter International Inc. (U.S.)

- B. Braun Melsungen AG (Germany)

- Pfizer Inc. (U.S.)

- Otsuka Pharmaceutical Co., Ltd. (Japan)

- ICU Medical, Inc. (U.S.)

- Vifor Pharma Management Ltd. (Switzerland)

- Grifols, S.A. (Spain)

- Sichuan Kelun Pharmaceutical Co., Ltd. (China)

- Hospira, Inc. (U.S.)

- Ajinomoto Co., Inc. (Japan)

- Fresenius SE & Co. KGaA (Germany)

- B. Braun of America (U.S.)

- JW Life Science (South Korea)

- Baxter Healthcare (U.S.)

- Lupin Ltd. (India)

- Cadila Healthcare Ltd. (Zydus) (India)

- CSL Limited (Australia)

- Hikma Pharmaceuticals PLC (Jordan)

- DuPont Nutrition & Biosciences (U.S.)

- Fresenius Kabi AG is one of the global leaders that offers a wide-ranging parenteral nutrition products portfolio, which includes advanced ready-to-use multi-chamber bags, as well as innovative clinical lipid emulsions. Besides, the 2024 annual report has stated the revenue and earnings amounting to EUR 21,526 million, along with EUR 3,614 million for revenue, EUR 1,749 million for net income, and EUR 3.1 million as earnings per share.

- Baxter International Inc. is considered a dominant force in the market, providing a comprehensive range of suitable solutions from single-nutrient injections to complicated compounded bags. In addition, the organization holds a robust positive outlook in the increasing home parenteral nutrition field, which is backed by delivery systems and integrated infusion pumps.

- B. Braun Melsungen AG is one of the key players in Europe, specializing in efficient and safe parenteral nutrition delivery systems. This includes its proprietary all-in-one admixture solutions. Meanwhile, the firm has emphasized product safety and quality, offering effective systems that successfully cover the overall processes. In its 2024 annual report, the company's sales surged by 6.8%, and readily maintained a long-lasting growth strategy within a range of 5% to 7%.

- Pfizer Inc. is regarded as the international supplier of sterile injectables, which include necessary single-dose vials of electrolytes, vitamins, and other required components, which are utilized in compounding parenteral formulations. Additionally, the organization’s massive production capacity has ensured a suitable supply of these building blocks, particularly for clinical nutrition.

- Otsuka Pharmaceutical Co., Ltd. is one of the major leaders in the Asia-based market, commonly well-known for its research and development in disease-specific and amino acid science nutritional therapies. The firm also generously contributes with personalized formulations that are tailored for patients with distinct metabolic requirements, including patients with renal or hepatic impairment.

Here is a list of key players operating in the global market:

The international market is extremely consolidated and dominated by certain giant firms, such as B. Braun, Baxter, and Fresenius Kabi. Their approach has focused on providing wide-ranging product portfolios, as well as incorporating extended international distribution networks. Besides, notable tactical strategies include a robust focus on research and development to develop ready-to-use, affordable, and clinically superior formulations. For instance, in November 2024, Otsuka Pharmaceutical Factory, Inc. launched KIDPAREN Injection, which is an amino acid multivitamin, glucose, and electrolyte injection for high-calorie parenteral nutrition of patients. There is also an effective demand for vertical integration to control the supply chain, thus suitable for uplifting the market.

Corporate Landscape of the Parenteral Nutrition Market:

Recent Developments

- In October 2025, Roquette unveiled its newest novel pharmaceutical exicipient, KLEPTOSE Crysmeb methyl-beta-cyclodextrin to effectively harness the compressing performance of precisely improved MßCD to augment the stability and solubility of a wide range of active pharmaceutical ingredients (APIs).

- In September 2024, Nutricia, which is part of Danone, notified the introduction of its reformulated Nutrison core range tube feeds to successfully tackle malnutrition among patients who are unable to drink or consume food in a normal way.

- In July 2024, AvevoRex, has declared the creation of a regional Total Parenteral Nutrition (TPN) program, with the intention of supporting patients with complicated gastrointestinal diseases.

- Report ID: 2775

- Published Date: Oct 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Parenteral Nutrition Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.