Palm Payment Technology Market Outlook:

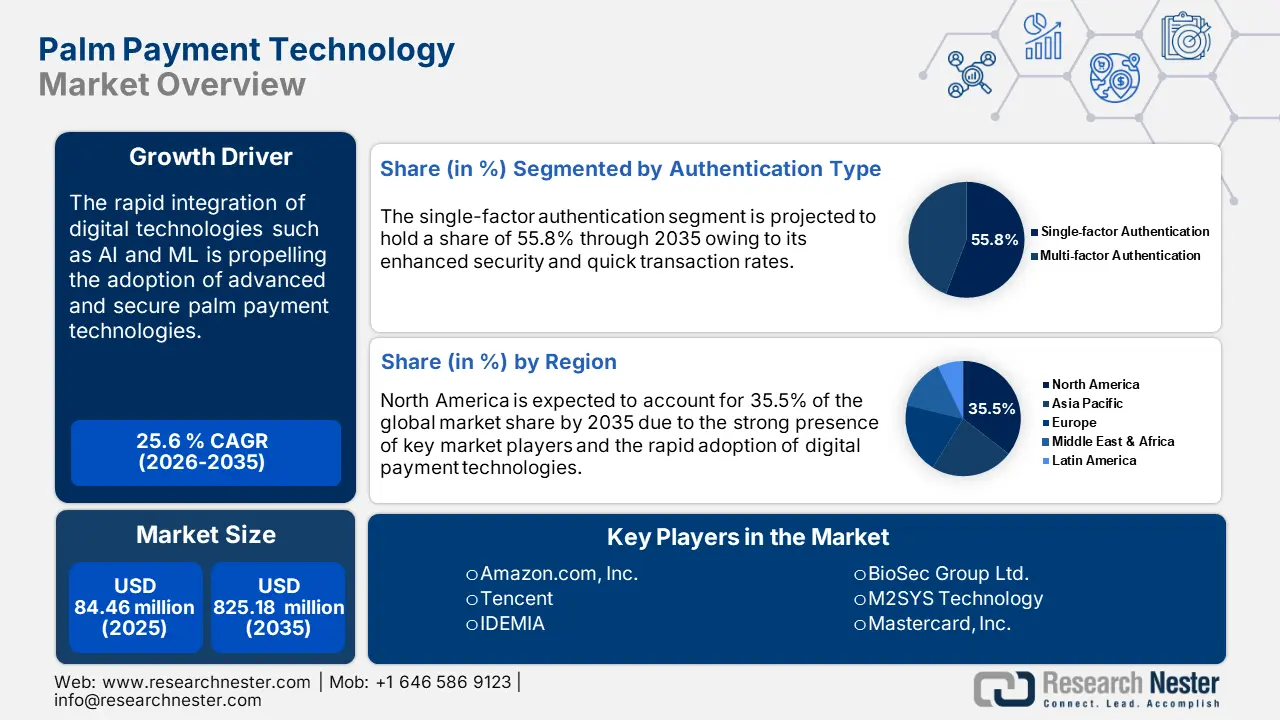

Palm Payment Technology Market size was over USD 84.46 million in 2025 and is poised to exceed USD 825.18 million by 2035, growing at over 25.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of palm payment technology is estimated at USD 103.92 million.

The majority of countries across the world are focusing on strongly expanding their digital economy. The rising shift towards cashless transactions is driving a high demand for secure and efficient ways to process payments including palm payment technologies. For instance, the World Bank revealed that the information technology sector, which involves software development and services expanded twice as fast as the global economy in 2022. The top economies that captured 70% of the value added to global IT services were China, the U.S., the U.K., Germany, Japan, and India. Furthermore, digitalization is generating jobs at 6 times the rate of the global economy. In 2021, almost all adult citizens in high-income countries made use of digital payment methods, whereas the low-income countries accounted for around 37.0%.

Key Palm Payment Technology Market Insights Summary:

Regional Highlights:

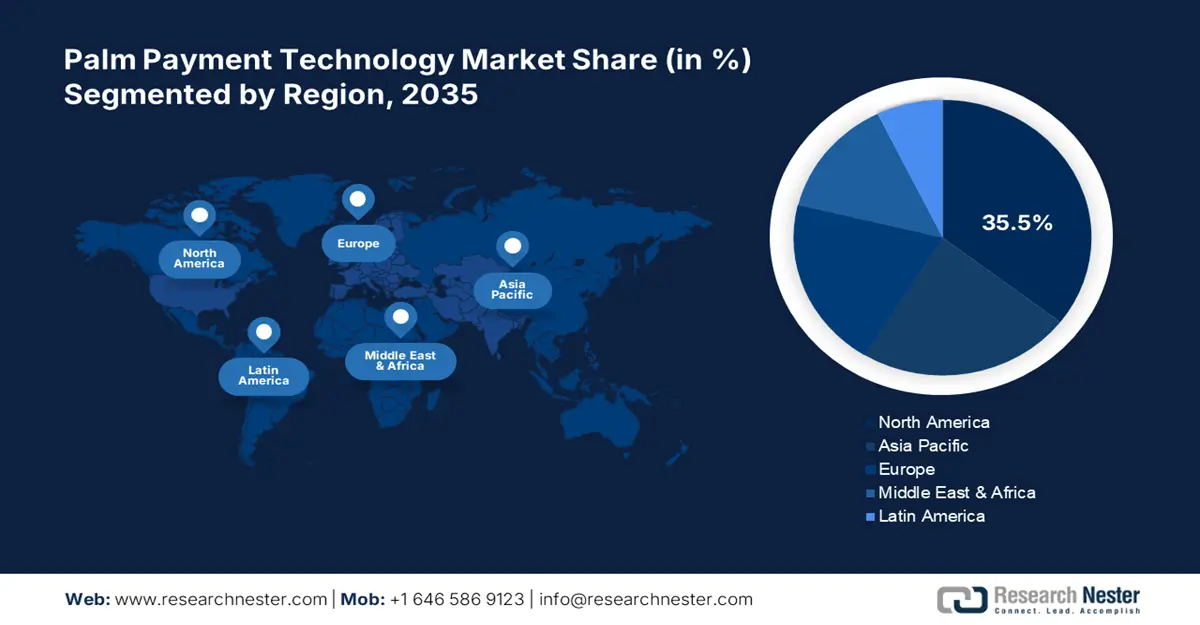

- North America's 35.5% share in the palm payment technology market is driven by fintech innovation and strong digital adoption, positioning it for significant growth through 2035.

- The Palm Payment Technology Market in Asia Pacific is set for the fastest growth by 2035, driven by the expanding IT sector, fintech advancements, and digital payment adoption.

Segment Insights:

- The Software segment of the Palm Payment Technology Market is projected to maintain a dominant share through 2035, fueled by enhanced security, data encryption, and integration capabilities.

- The Single-factor Authentication segment is anticipated to achieve over 55.8% share by 2035, fueled by its seamless user experience and cost-effective implementation.

Key Growth Trends:

- AI and ML integration

- Increasing use by retail and financial sectors

Major Challenges:

- Data and privacy concerns

- Complex regulations

Key Players: Amazon.com, Inc., Tencent, IDEMIA, BioSec Group Ltd., and M2SYS Technology.

Global Palm Payment Technology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 84.46 million

- 2026 Market Size: USD 103.92 million

- Projected Market Size: USD 825.18 million by 2035

- Growth Forecasts: 25.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, United Kingdom, Germany

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Palm Payment Technology Market Growth Drivers and Challenges:

Growth Drivers

- AI and ML integration: The increasing integration of artificial intelligence (AI) and machine learning (ML) algorithms is enhancing the capabilities of palm payment technologies. These technologies are also improving the accuracy and speed of the biometric recognition algorithms, making palm-based systems more reliable and capable of handling complex real-world scenarios such as varying lighting conditions or hand orientations. For instance, the revenues from artificial intelligence software market are forecast to reach USD 126 billion by the end of 2025.

Manufacturers are continuously investing in research and development activities to drive innovations in palm payment technologies. Microsoft Corporation, Google, Inc., IBM, and Samsung are some of the top companies that strongly invest in AI software start-ups and have high AI patent applications. For instance, in May 2024, the Society for Worldwide Interbank Financial Telecommunication (SWIFT) revealed that it introduced 2 pilots to test the practical application of AI to enhance fraud detection in payments. Thus, continuous innovations in AI are expected to lead to the development of advanced and secure palm payment technologies in the foreseeable years. - Increasing use by retail and financial sectors: The retail and financial sectors are prime end users of palm payment solutions, potentially influencing the revenue shares of key players. The increasing international trade and travel activities are also anticipated to augment the adoption of palm payment technologies, worldwide. Retailers, banks, and payment processors are widely exploring palm payment technologies to enhance customer experiences, improve security, and streamline transaction processes. Amazon with Amazon One has already rolled out a palm payment system in selective stores in the U.S. Fintech companies worldwide are investing in artificial intelligence to enhance cashless payment transactions. For instance, the artificial intelligence in fintech market is set to surpass USD 50 billion by 2029. Thus, technological advancements are set to drive the use of palm payment technologies in the coming years.

Challenges

- Data and privacy concerns: The collection and storage of biometric data raise significant concerns related to privacy and data protection. Even though some palm payment solutions store data locally or use encryption, any potential breach or misuse of biometric data undermines consumer confidence and hinders the adoption rates of palm payment technologies.

- Complex regulations: The use of biometric data is subject to a complex regulatory environment, particularly in Europe, where strict laws are protecting data usage. Companies deploying palm payment technology have to navigate these regulations carefully, which slows the market growth and leads to legal challenges. Despite these, the lack of awareness in undeveloped and developing regions is expected to limit the use of palm payment technologies.

Palm Payment Technology Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

25.6% |

|

Base Year Market Size (2025) |

USD 84.46 million |

|

Forecast Year Market Size (2035) |

USD 825.18 million |

|

Regional Scope |

|

Palm Payment Technology Market Segmentation:

Authentication Type (Single-factor Authentication, Multi-factor Authentication)

The single-factor authentication segment is expected to account for palm payment technology market share of more than 55.8% by the end of 2035. Single-factor authentication with palm print technology offers a seamless and frictionless user experience. Users don’t need to remember passwords, carry tokens, or perform additional steps as a quick palm scan is sufficient for authentication, leading to faster transactions. For instance, in October 2023, the World Bank revealed that around 100 economies are using faster payment systems. Furthermore, single-factor biometric authentication systems are less costly to implement compared to multi-factor systems. The incorporation of additional layers of security such as voice recognition, PIN, or token-based authentication increases the complexity and costs of deployment.

Component (Hardware, Software, Services)

The software segment is anticipated to capture a dominant palm payment technology market share throughout the forecast period. The software is further bifurcated into palm recognition algorithms, payment processing software, and security software. Palm payment technologies rely on biometric authentication systems to recognize unique features in a person’s palm such as vein patterns and the palm shape. This biometric data is processed using sophisticated software algorithms including machine learning and image processing technologies. Thus, the demand for software components is high due to their enhanced security levels, data encryption, and privacy compliance. The advanced software solutions also easily integrate with other digital payment infrastructures such as payment gateways and point-of-sale (POS) systems. The wider advancement scope is anticipated to lead to the development of innovative palm payment software.

Our in-depth analysis of the global palm payment technology market includes the following segments

|

Component |

|

|

Authentication Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Palm Payment Technology Market Regional Analysis:

North America Market Forecast

In palm payment technology market, North America region is predicted to hold over 35.5% revenue share by the end of 2035. The strong presence of industry giants, continuous innovations in cashless payment solutions, and the rapidly expanding fintech sector are positively influencing the palm payment technology market growth in the region. Both, the U.S. and Canada are the most profitable marketplaces for palm payment technology producers.

In the U.S., the strong presence of tech-savvy consumers and quick adoption of advanced technologies is set to augment the palm payment technology market growth in the coming years. The fintech and retail companies in the country are playing a vital role in the development and commercialization of palm payment technologies. Collaborations between technology companies and financial institutions are anticipated to accelerate the U.S. palm payment technology market growth.

In Canada, the supportive government policies and regulatory approvals for the use of digital payment technologies including palm payment are estimated to offer lucrative opportunities to key market players. The International Trade Administration (ITA) reveals that the country has the presence of over 670 AI start-ups and GenAI companies driving the AI market to reach USD 4.13 billion in 2024. The country’s strong focus on advancing its digital economy is forecast to boost the use of palm payment technologies.

Asia Pacific Market Statistics

The Asia Pacific market is expected to expand at the fastest pace during the anticipated period. The rapid expansion of the IT sector, continuous innovations in the fintech sector, and high adoption of digital payment methods are collectively set to uplift the regional market growth in the foreseeable period. India, China, Japan, South Korea, and Australia are some of the swiftly expanding marketplaces for palm payment technology producers.

In India, the government’s active move promoting cashless transactions is set to drive quick adoption of payment technologies. Initiatives such as Digital India and Unified Payment Interface (UPI) have strongly increased the usage and awareness of digital payment technologies among the public at large. For instance, in December 2023, the Ministry of Finance, India revealed that the digital payment transactions volume increased at a CAGR of 45.5% from 2017 to 2023.

China has been at the forefront of integrating biometric technologies into everyday life, and the strong presence of tech giants is anticipated to positively influence the palm payment technology market growth in the coming years. Similar to other countries the high focus on expanding the digital economy is expected to augment the adoption of palm payment methods. In 2022, the country’s digital economy was evaluated at USD 6.9 trillion.

Key Palm Payment Technology Market Players:

- Tencent

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- IDEMIA

- Amazon.com, Inc.

- BioSec Group Ltd.

- M2SYS Technology

- Mastercard, Inc.

- Fulcrum Biometrics, Inc.

- Ingenico

The palm technology market is characterized by the presence of industry giants and the increasing emergence of start-ups. The new companies are standing out in the crowd by introducing advanced solutions. For this, they are investing heavily in research and development activities. Industry giants are more focused on mergers and acquisition strategies to increase their product offerings. The big companies often acquire smaller or new companies with advanced technologies rather than directly investing in R&D. This move is highly cost-effective compared to investing huge capital in R&D.

The leading companies are also forming strategic collaborations with other players and fintech companies to maximize their market reach. The global expansion strategies are further aiding companies to enter into the untapped markets and earn high profits.

Some of the key players include:

Amazon.com, Inc.

Recent Developments

- In November 2024, Tencent collaborated with Visa to launch palm payment technology in Singapore. This move was announced at the Singapore Fintech Festival (SFF) where Visa cardholders from participating banks, including DBS, OCBC, and UOB, were set to be part of the pilot program.

- In June 2023, Amazon.com, Inc. announced that its new one palm payment technology is widely available in 500+ whole food stores in the U.S. This technology has emerged as an easy payment solution for Amazon consumers

- Report ID: 6847

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Palm Payment Technology Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.