Paints and Coatings Market Outlook:

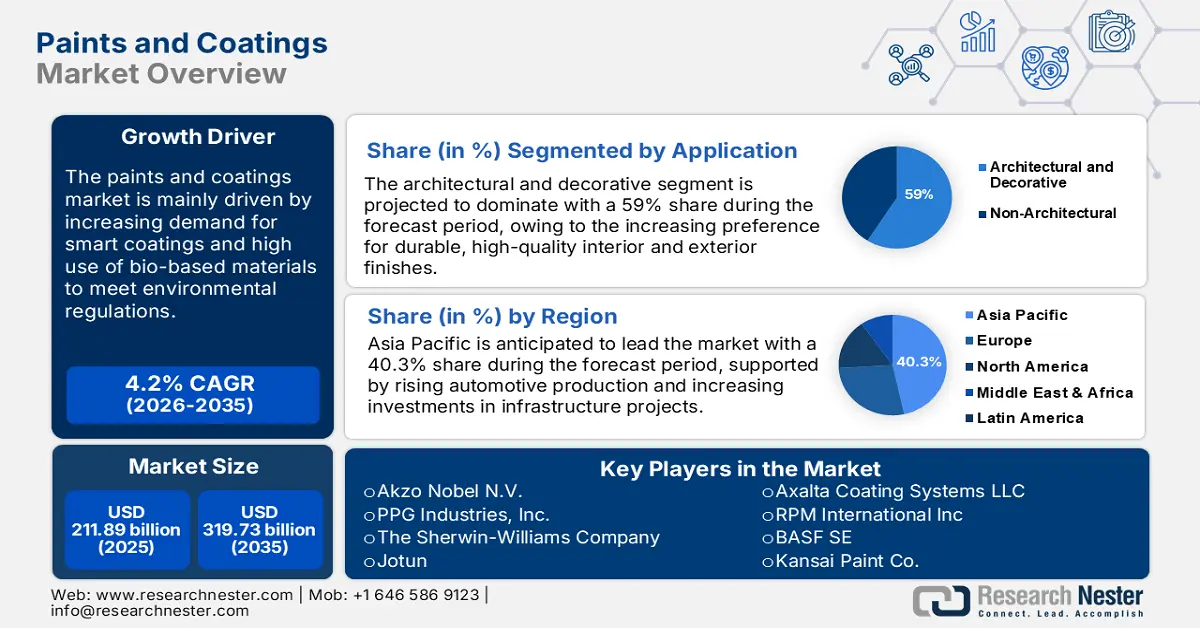

Paints and Coatings Market size was valued at USD 211.89 billion in 2025 and is set to exceed USD 319.73 billion by 2035, expanding at over 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of paints and coatings is estimated at USD 219.9 billion.

The paints and coatings industry is driven by increased development of technology and a focus on sustainability. As various industries across the globe are trying to work on aesthetic appeal and protection, the demand for value-added coatings is on an upward curve. Opportunities abound in the automotive, infrastructure development, and residential construction sectors, where high-performance coating usage is gaining significance. Also, the trend of using eco-friendly products is impelling manufacturing companies to prepare effective yet safe formulations for the environment.

Government regulations and initiatives also play an important role in boosting market growth. For instance, in February 2022, The Sherwin-Williams Company entered an agreement with the state of North Carolina to extend the manufacturing capacity in Statesville, for which the minimum investment required will be around USD 300 million. Apart from this, several regulations such as the Clean Air Act and EU legislation about volatile organic compounds (VOCs) make a sufficient number of coatings greener, which adds to the growth momentum.

Key Paints and Coatings Market Insights Summary:

Regional Highlights:

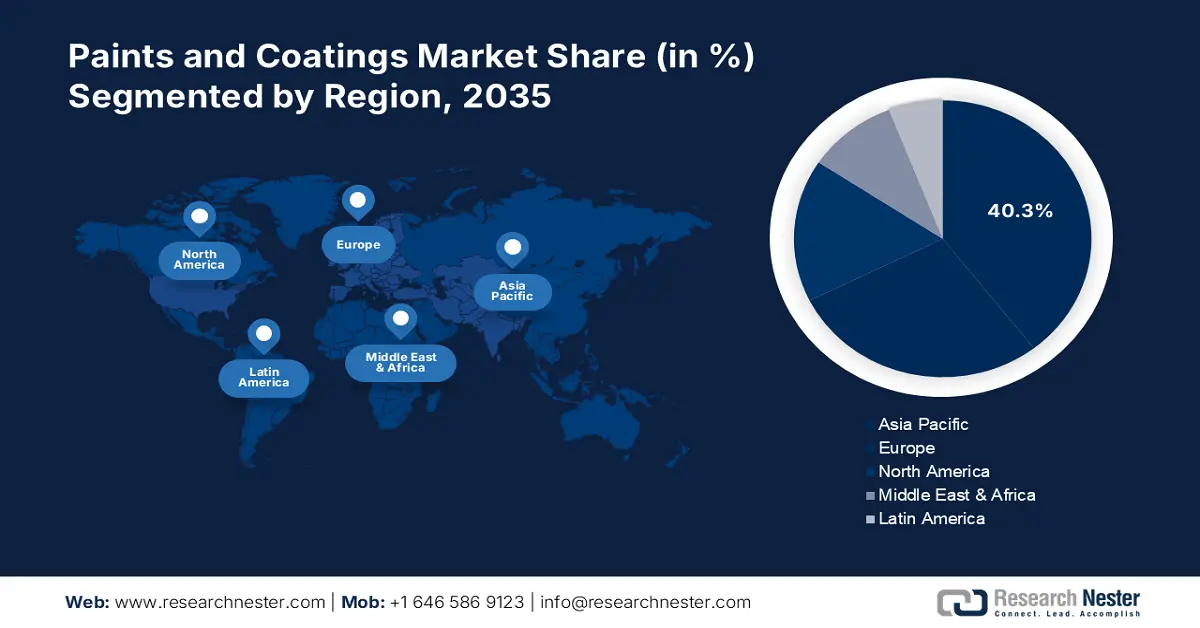

- Asia Pacific’s paints and coatings market will dominate around 40.3% share by 2035, driven by rapid industrialization and urbanization.

- Europe’s paints and coatings market will account for 29.5% share by 2035, driven by environmental regulations and sustainable development focus.

Segment Insights:

- The architectural and decorative segment in the paints and coatings market is forecasted to achieve a 59% share, influenced by rising constructions and renovations worldwide by 2035.

- The acrylic segment in the paints and coatings market is expected to dominate by 2035, driven by the excellent durability and UV resistance of acrylics.

Key Growth Trends:

- Technological development

- Sustainability initiatives

Major Challenges:

- Stringent regulations

- Economic fluctuations

Key Players: Akzo Nobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, Jotun, Axalta Coating Systems, LLC, RPM International Inc., Henkel AG & Company, KGaA, BASF SE, Kansai Paint Co., Ltd.

Global Paints and Coatings Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 211.89 billion

- 2026 Market Size: USD 219.9 billion

- Projected Market Size: USD 319.73 billion by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Indonesia, Thailand, Vietnam

Last updated on : 18 September, 2025

Paints and Coatings Market Growth Drivers and Challenges:

Growth Drivers

- Technological development: New technologies are transforming the paints and coatings market. In June 2022, PPG launched the PPG DIGIMATCH camera and PPG VisualizID software, which apply to faster and more accurate color matching in the global refinish industry. This is anticipated to enhance efficiency with the growing demand for high-quality finishes.

- Sustainability initiatives: The use of eco-friendly products is also promoting the demand for sustainable paints and coatings. In February 2022, AkzoNobel Powder Coatings introduced the Interpon Futura Collection, which emits no solvents or volatile organic compounds, contributing to AkzoNobel's overall sustainability program. Such initiatives are finding wider acceptance as people and industries become more ecologically responsible.

- Growth in the automotive sector: Growing sales of electric vehicles are driving demand for specialty coatings. As per a 2024 report by the International Energy Agency (IEA), electric car sales worldwide jumped over 140 percent in the first quarter of 2023 compared to the same three-month period in the previous year, as China and Europe contributed to this record-breaking increase. This growth in electric vehicle sales is likely to increase the demand for more high-tech coatings to deliver durability and good finish, promoting market growth.

Challenges

- Stringent regulations: A major challenge faced by the industry is the stringent regulations issued by governmental bodies. For instance, governmental regulations have made it tough for solvent-based products to show revenue growth due to VOC emission legislation by the EU. In December 2020, the European Union imposed more stringent limits on VOC for manufacturers, forcing them to reformulate their products.

- Economic fluctuations: Economic instability also hampers market growth to a certain extent. The paints and coatings industry is highly susceptible to economic shrinkage, which highly influences production and consumption. In 2022, the IMF report stated that uncertainty continues to prevail in the recovery of the global economy, even post-pandemic. Such factors pose various limitations to the market growth.

Paints and Coatings Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 211.89 billion |

|

Forecast Year Market Size (2035) |

USD 319.73 billion |

|

Regional Scope |

|

Paints and Coatings Market Segmentation:

Material Segment Analysis

The acrylic segment is expected to hold a 45.9% share in the forecast period due to better properties of acrylic, such as excellent durability, UV resistance, and fast-drying properties. These are some of the reasons coatings based on acrylics are in high demand from both architectural as well as industrial applications. In addition, Akzo Nobel N.V. announced that it had finalized the acquisition of the aluminum wheel liquid coatings business of Lankwitzer Lackfabrik GmbH in December 2022, enhancing its global outreach coupled with an enriched portfolio of acrylic-based products.

Product Segment Analysis

In paints and coatings market, waterborne coatings segment is expected to hold more than 42.5% revenue share by 2035. Waterborne coatings are more in demand as they contain low VOCs and, thus have fewer impacts on the environment. The waterborne coatings have excellent performance, meeting the strictest environmental regulations. In August 2021, PPG announced the introduction of PPG ENVIROCRON PCS P4 powder coatings. These address the increasing demand for environmentally friendly coatings in architectural and furniture applications, thus boosting the growth of the waterborne segment.

Application Segment Analysis

Architectural and decorative segment is likely to dominate paints and coatings market share of around 59% by the end of 2035. Rising constructions and renovations worldwide are driving this segment category. Higher-grade decorative coatings for better appearance and durability are required to promote the better stability of a structure. In February 2022, The Sherwin-Williams Company signed an agreement regarding the expansion of its production capacity of architectural paints and coatings in Statesville, North Carolina State, which shows the potential and growth of the segment.

Our in-depth analysis of the market includes the following segments:

|

Material |

|

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Paints and Coatings Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific in paints and coatings market is predicted to account for around 40.3% revenue share by 2035 due to rapid industrialization and urbanization, especially in China and India. The rapidly growing construction sector, coupled with rising production in the automotive industry, acts as a strong factor for growth. Besides, the surging demand for eco-friendly products is driving the market. The market outlook is positive as governments and industries are inclined toward sustainable development.

China continues to be one of the major players in the Asia Pacific paints and coatings market, based on large construction and automotive industries. In 2023, electric vehicle sales in China surpassed global levels, surging nearly threefold to 6.2 million units. This surge in EV manufacture, automatically enhances the need for advanced coatings solutions, boosting this market further. This growth underlines China's strategic importance in the global market.

Another key market in Asia Pacific includes India. The rapid urbanization in India and the need for the growth of infrastructure in the country have fueled market growth. The government has also put in place policies that continue to enhance the use of sustainable products. In January 2023, Asian Paints Ltd launched a new water-based paint production facility after investing USD 267 million. The development is an indication of the country’s commitment and focus on eco-friendly solutions and places it among the leading players in Asia Pacific.

Europe Market Insights

By 2035, Europe paints and coatings market is likely to dominate over 29.5% share owing to stringent environmental regulations related to the need for sustainability. The region’s well-established automotive and construction industry acts as a major source for driving demand. It is estimated that the improvement of eco-friendly coatings across Europe is impacting the market and will continue to do so in future years. The growth momentum is positive as many countries in Europe are focused on developing and technologically advancing in the green movement.

Germany is one of the leading markets in Europe primarily due to its well-established automotive and industrial sectors. The environmental regulations imposed by the government are driving up the need for sustainability in coatings. In November, Sherwin-Williams Company acquired Oskar Nolte GmbH and Klumpp Coatings GmbH. This is in line with a strategy to diversify its coating business and expand its industrial-machinery coatings business in Germany. These factors hint that the country is a significant market for paints and coatings.

France is another key market for paints and coatings due to a notable construction sector and an active aerospace industry. The local government is pushing sustainable development with many legislative measures. A French Ministry of Ecological Transition report in 2022 claims that the country is expected to achieve carbon neutrality by 2050. In addition, there is a high demand for eco-friendly coatings as the coatings manufacturers work to align with national goals.

Paints and Coatings Market Players:

- Akzo Nobel N.V.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- PPG Industries, Inc.

- The Sherwin-Williams Company

- Jotun

- Axalta Coating Systems, LLC

- RPM International Inc.

- Beckers Group

- 3M

- The Chemours Company

- Henkel AG & Company, KGaA

- BASF SE

- Sika AG

- Hempel A/S

The global paints and coatings sector features numerous prominent businesses committed to advancing their respective positions. Industry pioneers such as PPG Industries, Akzo Nobel N.V., Sherwin-Williams, Asian Paints, and Axalta Coating Systems consistently lead the way through cutting-edge research and expanded operations. These companies invest heavily in developing novel products and advanced technologies to satisfy the evolving needs of diverse industries. Strategic partnerships and targeted acquisitions also allow companies to diversify their portfolios while amplifying their notable market presence.

A noteworthy development was by PPG in June 2022, the launch of the PPG DIGIMATCH camera system and PPG VisualizID software application. Together, these digital solutions comprise PPG's comprehensive LINQ platform serving the worldwide automotive refinishing sector, underscoring PPG's dedication to pioneering technological breakthroughs. Such industry-advancing innovations are indispensable for maintaining a competitive advantage and addressing the increasing demand for high-performance coatings.

Here are some leading players in the paints and coatings market:

Recent Developments

- In June 2024, DecoArt unveiled the industry’s first reclaimed and recycled acrylic craft paint, promoting sustainability in the paint sector. This innovative approach encourages the adoption of eco-conscious materials, which may spur developments in gold plating chemicals that prioritize environmental sustainability in their production and application processes.

- In May 2024, Astral Limited announced the launch of Astral Paints, marking its entry into the paint industry. This new venture aims to expand the company's portfolio, potentially increasing demand for gold plating chemicals as decorative finishes in high-end coatings and paints that enhance aesthetics and value.

- In February 2024, Grasim Industries ventured into the paint business with its brand Birla Opus, aiming for a significant market position in the sector. The expansion into decorative paints may influence the gold plating chemicals market, as manufacturers seek quality plating solutions to enhance the performance and visual appeal of their products.

- Report ID: 6401

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Paints and Coatings Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.