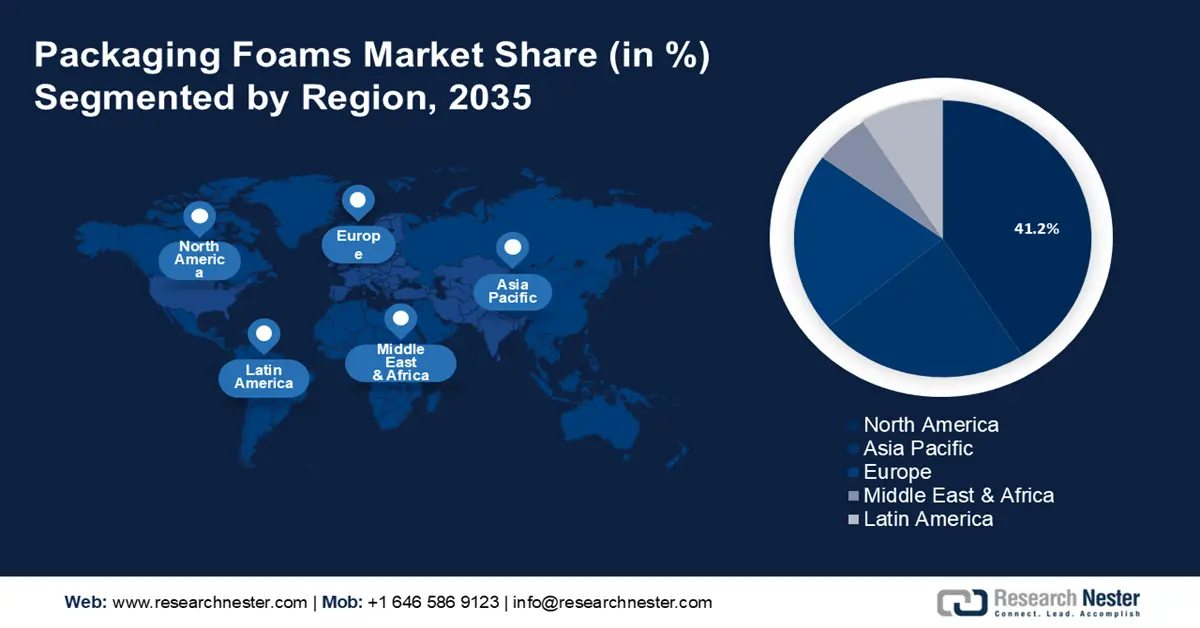

Packaging Foams Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to account for largest revenue share by 2035, owing to their lightweight, shock-absorbing, and insulation properties. Countries like China, India, and Japan are key contributors, fueled by rapid industrialization, and urbanization. Additionally, rising environmental awareness is propelling further growth in the Asia Pacific market.

The government’s push towards the Make in India policy and the growth of manufacturing industries is driving the packaging foam market in India. Furthermore, as India becomes a major hub for automotive manufacturing, packaging foams are increasingly used for automotive parts protection during transport. The expansion of India’s pharmaceutical sector, particularly with cold chain logistics for vaccines, and medicines, is also driving the market growth in the country. Rapid urbanization and infrastructure projects are further leading the packaging foams market growth as the consumption of packaged goods increases.

China’s growing domestic e-commerce platforms such as Alibaba, and JD.com are creating a surge in demand for packaging foams. Moreover, the increased export activity of China continues to dominate global exports. This advances the need for durable packaging solutions to ensure safe international transportation. China’s rapid expansion of the EV market is also promoting the growth of the packaging foams industry for protection of sensitive battery components and other EV parts during manufacturing and distribution.

North America Market Insights

With increasing consumer awareness in terms of the protection of the surroundings and the impact of waste disposal, companies in North America are shifting towards biodegradable foams. Innovations in foam materials are leading to more efficient and effective packaging solutions. In addition, with the rise in online food delivery, and frozen food market, there is a rising demand for foam insulation solutions to control the temperature throughout the supply chain.

The U.S. e-commerce sector has surged in recent years, increasing demand for packaging foams, particularly for electronics, fragile goods, and luxury items. Retail giants including Amazon and Walmart are major contributors to the growth. According to the U.S. Census Bureau, in August 2024, U.S. retail e-commerce sales for the second quarter of 2024 were USD 291.6 billion, an increase of 1.3% (±0.7) from the first quarter of 2024. This factor is contributing significantly to market growth.

Canada’s rising cross-border e-commerce engagement with the U.S. is one of the major packaging foams market driving factors. Foam packaging is also an essential part of meal delivery services and frozen food product delivery in Canada's tighter government regulations concerning environmental protection are driving the companies to invest in biodegradable foams to meet the demand. In the upcoming years, the country is predicted to witness several significant developments in terms of sustainable packaging.