Packaging Foams Market Outlook:

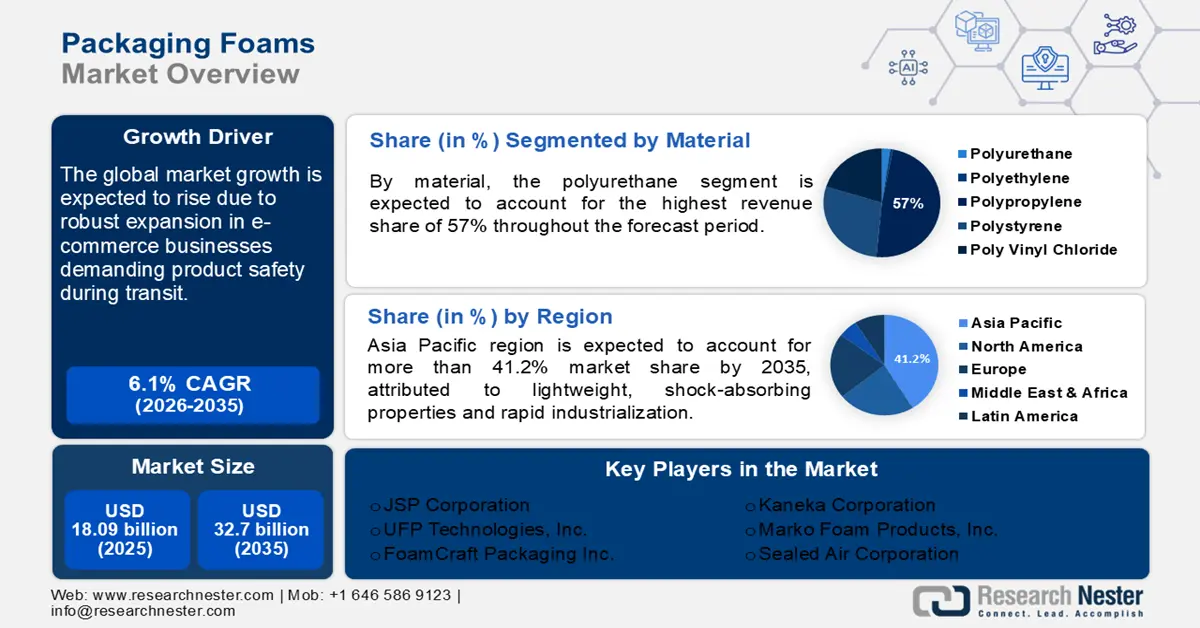

Packaging Foams Market size was over USD 18.09 billion in 2025 and is anticipated to cross USD 32.7 billion by 2035, witnessing more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of packaging foams is assessed at USD 19.08 billion.

Key factors driving the packaging foams market growth include the expansion of the e-commerce sector that demands protective packaging to safeguard products during transit. This is further escalated by the rising number of online shopping that require high-quality packaging of electronics and pharmaceuticals. While the healthcare sector demands secure and sterile packaging, consumer electronics and appliances require cushioned and protective packaging. Recent advancements in the market are reflecting a significant focus on sustainability, as companies try to meet environmental regulations. For instance, in July 2022, Sealed Air announced the launch of the BUBBLE WRAP brand paper bubble mailer which is a fiber-based padded mailer that can be recycled in bins.

Key Packaging Foams Market Insights Summary:

Regional Highlights:

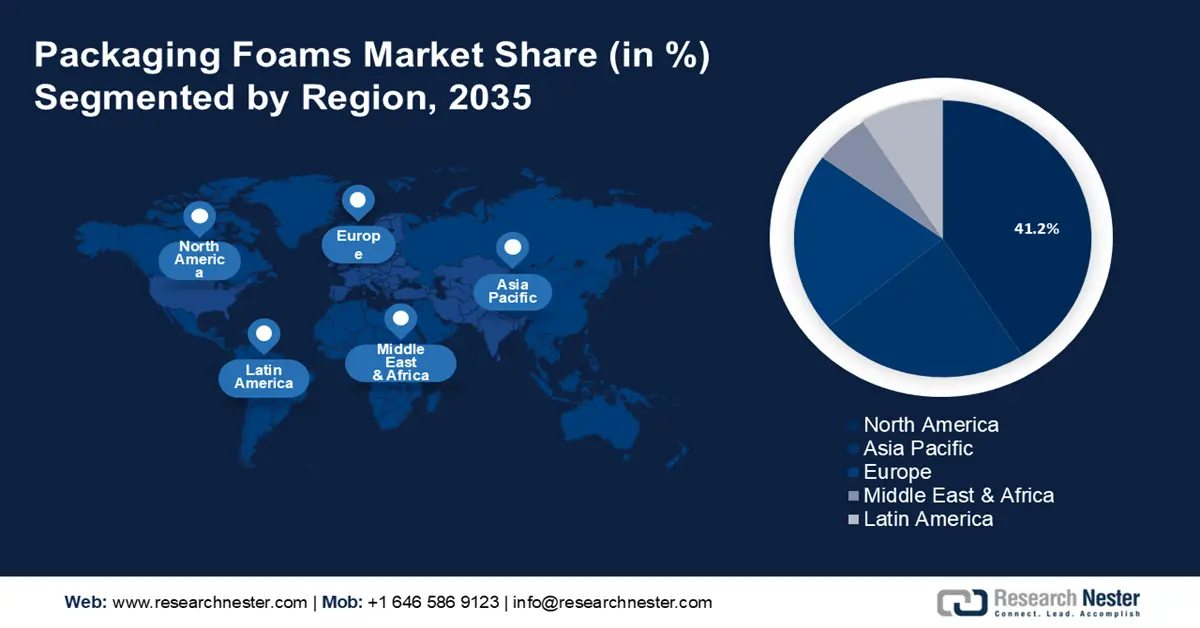

- Asia Pacific packaging foams market will account for 41.20% share by 2035, driven by lightweight, shock-absorbing properties and rapid industrialization.

Segment Insights:

- The flexible foam segment in the packaging foams market is projected to hold an 87.70% share by 2035, driven by e-commerce expansion and adaptability for custom packaging of sensitive items.

- The polyurethane material segment in the packaging foams market is expected to dominate by 2035, attributed to exceptional cushioning properties and versatility for various packaging needs.

Key Growth Trends:

- Expanding e-commerce sector

- Focus on sustainable eco-friendly packaging

Major Challenges:

- Rising preference for alternative packaging materials

- Volatility in raw materials prices

Key Players: Sealed Air Corporation, Zotefoams Plc, Armacell International S.A., Pregis LLC, Sonoco Products Company, BASF SE, Dow Inc., Recticel NV/SA, ACH Foam Technologies, Inc., Rogers Corporation.

Global Packaging Foams Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 18.09 billion

- 2026 Market Size: USD 19.08 billion

- Projected Market Size: USD 32.7 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Thailand, Indonesia, Brazil

Last updated on : 18 September, 2025

Packaging Foams Market Growth Drivers and Challenges:

Growth Drivers

-

Expanding e-commerce sector: Growing e-commerce is a significant driver in the packaging foams market. the growing engagement in online purchasing among the population demands durable and protective packaging to ensure the safe delivery of products. For instance, the skyrocketing e-commerce sales during the COVID-19 pandemic led to higher demand for packaging foams, particularly in cushioning materials to protect fragile items such as electronics, and glassware. Furthermore, in November 2022, Alibaba’s Singles’ Day sales exceeded USD 84.5 billion, significantly boosting the demand for packaging solutions, including foam materials.

-

Focus on sustainable eco-friendly packaging: The growing focus on sustainability and eco-friendly packaging is reshaping the packaging foams market as both consumers and businesses seek to reduce environmental damage. Companies are increasingly turning to biodegradable, recyclable, and bio-based foam materials to meet regulatory requirements. For instance, according to FSSAI August 2011 report, containers made of plastic materials, used as appliances or receptacles for packing or storing whether partly or wholly, food articles, should conform to the Indian Standards Specification. This shift is driving the global packaging foams market and encouraging innovations majorly in to develop biodegradable foam packaging for fragile and perishable food products, that provide both environmental protection and benefits. For instance, in April 2020, JSP Corporation launched polymer foam known as Arpro 35 Ocean made with 15% recycled maritime waste recovered from fishing nets and ropes.

Challenges

-

Rising preference for alternative packaging materials: The rising preference for alternative packaging materials, such as paper-based packaging, poses a challenge to the packaging foam industry. Many companies are shifting towards paper packing due to its biodegradable properties and lower environmental impact. This trend is driven by sustainability goals and regulatory pressure, reducing the demand for traditional foam-based packaging. This is further compelling the existing companies to develop more sustainable packaging foam to remain competitive.

-

Volatility in raw materials prices: This presents a significant challenge for the industry. The production of foam materials, such as polyurethane and polystyrene, depends severely on petrochemical derivatives. These derivatives undergo several price fluctuations. This increases production costs, making it difficult for the manufacturers to maintain stable pricing of their products. As a result, raw material price volatility is impacting the industry to a certain range.

Packaging Foams Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 18.09 billion |

|

Forecast Year Market Size (2035) |

USD 32.7 billion |

|

Regional Scope |

|

Packaging Foams Market Segmentation:

Product Type Segment Analysis

Flexible foam will hold the largest packaging foams market share of 87.7% by 2035. Owing to its frequent usage for packing sensitive items, like electronic parts, glass products, and glass products, the segment’s growth is significantly impacted by the e-commerce sector expansion. Flexible foam’s adaptability to various shapes and sizes makes it ideal for custom packaging solutions, making it high in demand in several other industries.

Rigid foams are known for their durability, strength, and superior insulating properties. These are commonly used for products requiring protection against impact and temperature fluctuations. Rigid foam’s ability to provide structural support, while maintaining a lightweight profile makes it ideal for packaging delicate items. Additionally, its growing use in sustainable, recyclable foam materials is contributing to its increasing popularity in the packaging foams market. For instance, in December 2021, Stora Enso launched bio-based foams made from wood, which are fully recyclable and can be used for thermal and protective packaging.

Material Type Segment Analysis

By material, the polyurethane segment will capture a packaging foams market revenue share of 57.7% by 2035, owing to its exceptional cushioning properties. It offers superior shock absorption, thermal insulation, and resistance to impact, making it ideal for protective sensitive items. Additionally, its ability to be customized in terms of density and rigidity allows it to cater to a wide range of packaging needs, from delicate electronics to heavy industrial goods, further solidifying its market dominance.

Polyethylene has gained considerable traction owing to its durability, and flexibility. Its closed-cell structure provides heavy resistance to impact. Moreover, it is moisture-resistant, chemically inert, and cost-effective, which appeals to industries requiring long-term storage or shipping solutions. The material’s versatility is contributing significantly to the segment’s growth, and it is projected to witness further expansion during the forecast period.

Our in-depth analysis of the packaging foams market includes the following segments:

|

Material Type |

|

|

Product Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Packaging Foams Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to account for largest revenue share by 2035, owing to their lightweight, shock-absorbing, and insulation properties. Countries like China, India, and Japan are key contributors, fueled by rapid industrialization, and urbanization. Additionally, rising environmental awareness is propelling further growth in the Asia Pacific market.

The government’s push towards the Make in India policy and the growth of manufacturing industries is driving the packaging foam market in India. Furthermore, as India becomes a major hub for automotive manufacturing, packaging foams are increasingly used for automotive parts protection during transport. The expansion of India’s pharmaceutical sector, particularly with cold chain logistics for vaccines, and medicines, is also driving the market growth in the country. Rapid urbanization and infrastructure projects are further leading the packaging foams market growth as the consumption of packaged goods increases.

China’s growing domestic e-commerce platforms such as Alibaba, and JD.com are creating a surge in demand for packaging foams. Moreover, the increased export activity of China continues to dominate global exports. This advances the need for durable packaging solutions to ensure safe international transportation. China’s rapid expansion of the EV market is also promoting the growth of the packaging foams industry for protection of sensitive battery components and other EV parts during manufacturing and distribution.

North America Market Insights

With increasing consumer awareness in terms of the protection of the surroundings and the impact of waste disposal, companies in North America are shifting towards biodegradable foams. Innovations in foam materials are leading to more efficient and effective packaging solutions. In addition, with the rise in online food delivery, and frozen food market, there is a rising demand for foam insulation solutions to control the temperature throughout the supply chain.

The U.S. e-commerce sector has surged in recent years, increasing demand for packaging foams, particularly for electronics, fragile goods, and luxury items. Retail giants including Amazon and Walmart are major contributors to the growth. According to the U.S. Census Bureau, in August 2024, U.S. retail e-commerce sales for the second quarter of 2024 were USD 291.6 billion, an increase of 1.3% (±0.7) from the first quarter of 2024. This factor is contributing significantly to market growth.

Canada’s rising cross-border e-commerce engagement with the U.S. is one of the major packaging foams market driving factors. Foam packaging is also an essential part of meal delivery services and frozen food product delivery in Canada's tighter government regulations concerning environmental protection are driving the companies to invest in biodegradable foams to meet the demand. In the upcoming years, the country is predicted to witness several significant developments in terms of sustainable packaging.

Packaging Foams Market Players:

- JSP Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- UFP Technologies Inc.

- Synbra Holding bv

- Armacell LLC

- ACH Foam Technologies

- FoamCraft Packaging Inc

- Plastifoam Company

- Marko Foam Products Inc.

- Sealed Air Corporation

- FoamPartner Group

The foam protective packaging market is critically fragmented and competitive by nature, owing to the presence of several established players, adopting different marketing strategies. These companies operating in the market differentiate the products based on quality, and price. The companies are focusing increasingly on product customization majorly via customer interaction, in addition to sustainability, durability, and lightweight packaging. These companies offer a wide range of foam types, including polyethylene, polyurethane, and polystyrene foams. Their strong distribution networks, extensive product portfolio, and partnerships with other industries ensure their leadership in the packaging foams market.

Recent Developments

- In December 2023, Stora Enso announced the launch of Papira, which is a fibre-based mono-material, designed to be compostable. With this launch, the company is introducing renewable alternatives in the packing segment

- In February 2023, CruzFoam launched a revolutionary new family of earth-friendly protective packaging products, including Cruz Foam, Cruz Cool, and Eco Vino. These brand-new products are aimed at replacing plastic bubble wraps, and plastic foam coolers to deliver superior protection to the products

- In March 2022, BASF launched Neopor Mcycled expandable polystyrene (EPS) granulate that contains 10% recycled EPS waste.

- Report ID: 6433

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Packaging Foams Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.