Oxygen-free Copper Market Outlook:

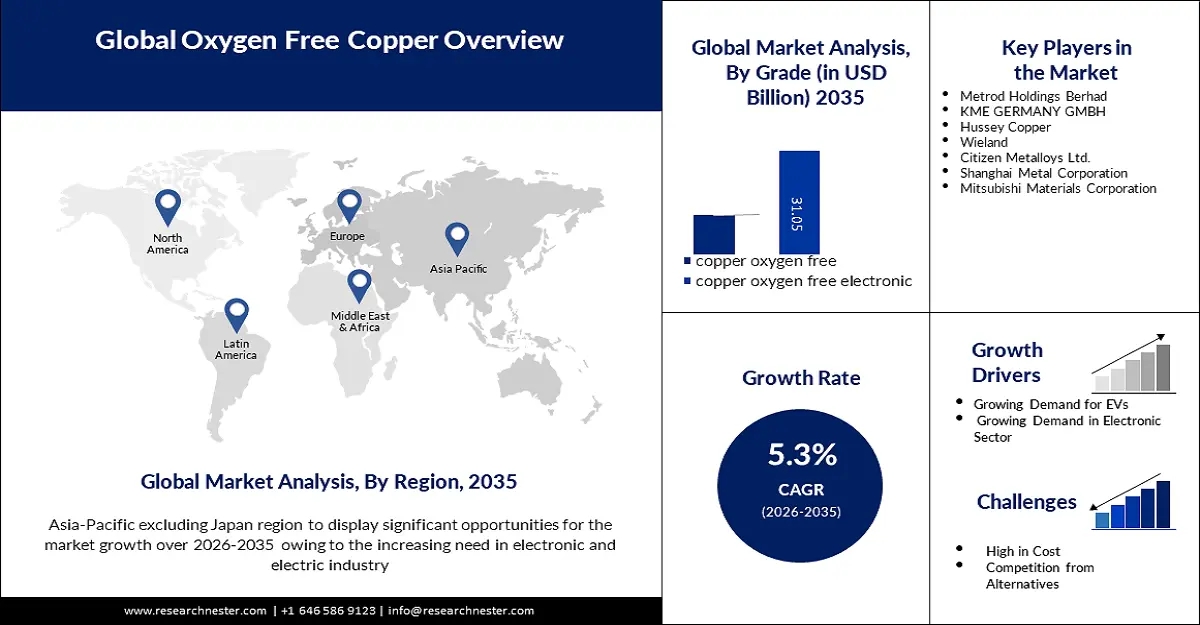

Oxygen-free Copper Market size was valued at USD 26.06 billion in 2025 and is likely to cross USD 43.68 billion by 2035, registering more than 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of oxygen-free copper is assessed at USD 27.3 billion.

Market expansion is driven by the increasing use of oxygen-free copper in the automotive industry. Thus, the market is heavily influenced by the growth of the automotive industry and the increase in the number of electric vehicles. due to its excellent electrical conduction ability, which is essential for the development of efficient electric motors, charging infrastructure, and energy transmission systems for electric vehicles.

According to the IEA, global spending on electric vehicles reached approximately USD 425 billion in 2022, an increase of 50% compared to 2021. Most of the money was spent directly by customers purchasing vehicles, with the government investing about USD 40 billion through direct purchase incentives.

Oxygen-free copper is used in speaker cables, audio video connectors, and amplifier cable assemblies. Due to its unique purity, it has a higher conductivity and can transmit sound at lower frequencies. Some manufacturers claim oxygen-free copper cables have better sound quality and a longer lifespan than other less pure copper cables.

There are many advantages to using oxygen-free copper in the production process because of its characteristics such as exceptional physical and electric conductivity. Copper has one of the highest electrical conductivity values among all metals in existence, and this allows copper to operate a wide range of electric currents without difficulty.

Key Oxygen-free Copper Market Insights Summary:

Regional Highlights:

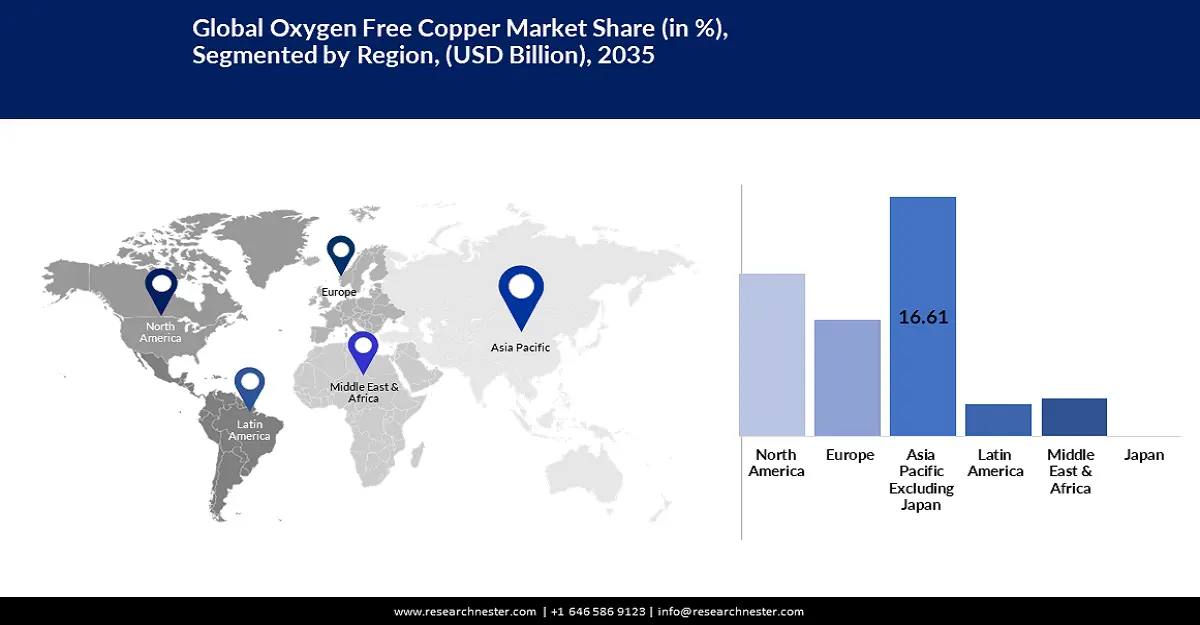

- Asia Pacific oxygen-free copper market will secure over 44% share by 2035, driven by escalating demand for semiconductor devices in China and India.

- North America market will exhibit substantial CAGR during 2026-2035, driven by increasing penetration of oxygen-free copper in industries.

Segment Insights:

- The wire (product form) segment in the oxygen-free copper market is projected to hold a 30% share by 2035, driven by the wire's ability to withstand extreme temperatures while decreasing settings.

Key Growth Trends:

- Escalating new product developments

- Growing integration in a wide range of industries

Major Challenges:

- Escalating new product developments

- Growing integration in a wide range of industries

Key Players: Aviva Metal, KGHM Polska Miedz SA, Sam Dong Ohio Inc, Metrod Holdings Berhad, KME GERMANY GMBH, Hussey Copper Ltd, Wieland, Citizen Metalloys Ltd., Shanghai Metal Corporation, Mitsubishi Materials Corporation.

Global Oxygen-free Copper Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 26.06 billion

- 2026 Market Size: USD 27.3 billion

- Projected Market Size: USD 43.68 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 16 September, 2025

Oxygen-free Copper Market Growth Drivers and Challenges:

Growth Driver

- Escalating new product developments - Growth among the market players indulging in investments and collaborations is considered a significant growth factor for the market. Such as Superior Essex Inc. has agreed to acquire Lacroix + Kress GmbH, Europe's leading oxygen-free copper producer, from Mutares SE & Co. KGaA in 2023. Given that OFC is an essential ingredient in electric vehicles, this strategic acquisition ensures that Superior Essex's commitment to the expanding electric vehicle sector will improve consumer satisfaction and market competition.

- Growing integration in a wide range of industries - Oxygen-free copper offers lucrative applications in numerous sectors, and compared to other forms of copper alloys, the mechanical properties of OFC are exceptional. It is the strongest of these materials and can be used at high temperatures without being affected by thermal expansion or contraction. In addition, it is also very ductile, so it can be easily formed into various shapes while maintaining its integrity and strength. Finally, it has excellent wear resistance, making it suitable for use in a variety of industrial applications where wear resistance is important.

Challenges

- Growing availability of electrolytic tough pitch copper as a substitute - Electrolytic tough pitch copper is used in electrical installations, including the installation of welding equipment, anodes, and bus bars, as well as ground straps, commutator devices, and current hardware. Special manufacturing properties allow it to be bent, soldered, drilled, blasted, riveted, and formed to virtually any design standard. Copper is known for its strong electrical and thermal properties, and it is easy to process at very high temperatures. This is estimated to hamper the market in the forecast period.

- The high cost of oxygen-free copper is set to pose a limitation on the market growth in the upcoming period.

- Geopolitical issues and economic instability are assumed to pose restrictions over the projected period

Oxygen-free Copper Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 26.06 billion |

|

Forecast Year Market Size (2035) |

USD 43.68 billion |

|

Regional Scope |

|

Oxygen-free Copper Market Segmentation:

Grade (Copper Oxygen-free Electronic, Copper Oxygen-free)

Based on grade, the copper oxygen-free electronic segment in the oxygen-free copper market is anticipated to dominate industry share by the end of 2035. Copper which is not oxidized by phosphorus and has a 99.99% purity guarantee shall be known as CuOFE or oxygen-free electronic grade.

The minimum electrical conductivity of this pure copper is 101%, according to the International Association of Annealed Copper Standards. When exposed to hydrogen, copper alloys containing oxygen, such as CuETP, may be severely damaged, and tt's because of a reduction in copper oxide from hydrogen.

Product Form Segment Analysis

In terms of product form, the wire segment share in the oxygen-free copper market is predicted to cross 30% by 2035. This product's ability to withstand extreme temperatures while decreasing settings without the risk of hydrogen melting makes it special.

Manufacturers of wire are employing oxygen-free copper to minimize the amount of spaces in the wire that obstruct the movement of electric impulses. Numerous acoustic cables are made of copper alloys free of oxygen because superior electric signal transmission properties are required for these cables.

Our in-depth analysis of the global oxygen-free copper market includes the following segments:

|

Product Form |

|

|

Application |

|

|

End Use Industry |

|

|

Grade |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oxygen-free Copper Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific industry is likely to hold largest revenue share of 44% by 2035. The escalating demand for electronic semiconductor devices in developing countries such as China and India is the primary reason behind the growth of the market in this particular region. The demand for consumer electronics, including laptops and smartphones, as well as additional medical electronic equipment, is rising quickly in the Asia-Pacific area, with China and India predicted to continue to be the leading growth areas.

China and India being the leading regions for the high demand of consumer electronics such as laptops, smartphones or medical electronic devices is giving rise to the market expansion in the Asia Pacific region. A new analysis projects that China will lead the consumer electronics sector in revenue generation, with estimates of over USD 200 billion in 2023. With an expected GDP of USD 60 billion India stands out at third position.

North American Market Insights

The oxygen-free copper market in the North America region is anticipated to grow at a substantial CAGR during the estimated period. This can be impelled by the back of increasing penetration of oxygen-free copper in numerous industries and rising production creation with top-notch advanced technologies.

The market in the region is expanding as a result of improved production techniques that provide producers more control over the product's purity and quality. Additionally, Prime Materials Recovery, Inc. said in 2023 that it would be acquiring a Southwire Company SCR 4500 copper rod system to be installed at its affiliate, IMC - Metals America, LLC, located in Shelby, North Carolina. In a separate project, IMC will buy and install a new line from Upcast OY, a company based in Pori, Finland, to improve the manufacturing capacity of oxygen-free copper rods.

Oxygen-free Copper Market Players:

- Aviva Metal

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- KGHM Polska Miedz SA

- Sam Dong Ohio Inc

- Metrod Holdings Berhad

- KME GERMANY GMBH

- Hussey Copper Ltd

- Wieland

- Citizen Metalloys Ltd.

- Shanghai Metal Corporation

- Mitsubishi Materials Corporation

Recent Developments

- Mitsubishi Materials Corporation declared in February 2020 that they have made a deal to acquire a 20% stake in Mantos Copper Holding SpA’s copper mine in Mantoverde and is also going to be a part of the Mantoverde Development Project. After the acquisition, Mitsubishi Materials Corporation would invest USD 263 million in return for a 30% stake. The company will get the materials generated as copper concentrate and will have the right to offtake thirty percent of the copper produced, which is equal to its equity shares.

- KME acquired 49% of the shares of Tréfimétaux SAS through an agreement with ECT-European Copper Tubes Limited on March 11, 2019, subject to the fulfillment of the above conditions, and reacquired 100% of the shares. They announced that they had signed a contract to do so. It is stipulated there. Share control over the company. The acquisition price at closing was USD 2.24 million.

- Report ID: 5560

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oxygen-free Copper Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.