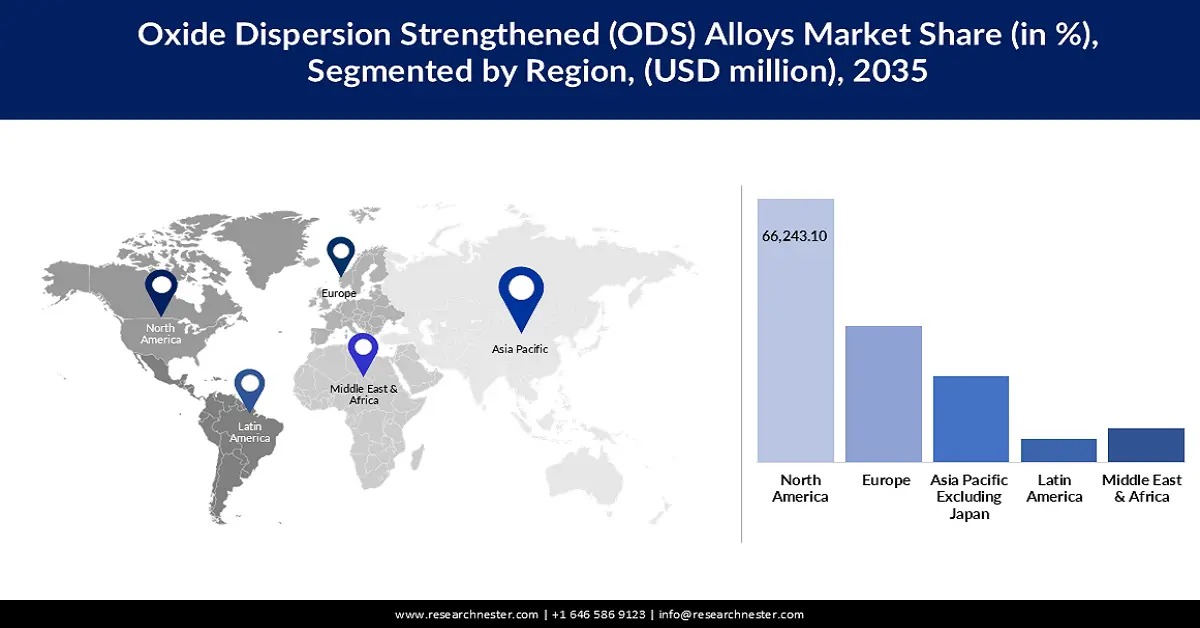

Oxide Dispersion Strengthened Alloys Market Regional Analysis:

North America Market Insights

North America in oxide dispersion strengthened (ODS) alloys market is expected to capture around 33.2% revenue share by the end of 2040. Growth in the region is driven by the demand emanating from a wide range of industries including aerospace, defense, and nuclear energy. Considering the preference-based tendency, companies are looking for superior-performance materials to bear extreme conditions. Owing to the benefits provided by these unique properties, including improved mechanical strength and thermal degradation resistance, ODS steel is attracting fiction.

The U.S. is one of the leading players in the development and application of ODS alloys, with leading manufacturers and research institutions well involved in the development of material technologies. The U.S. Department of Energy, in January 2023, awarded a grant of USD 22.1 million to a team at the University of California, Berkeley, that came up with new ODS alloys for nuclear reactors. Government initiatives in promoting the development of high-performance help companies or researchers solve some of the most important challenges during production. With this, the U.S. remains poised to retain its lead with continuous development in ODS alloy technology and drive growth and investment in the oxide dispersion strengthened alloys market.

Canada is also aiding in driving growth momentum in the North America oxide dispersion strengthened (ODS) alloys market. The country is focused on heavy investment in high-performance materials research for the betterment of its aerospace and defense industries. Furthermore, support from the government and academia-industry partnerships will most likely accelerate the pace of innovation in the industry of ODS alloys and consequently make it more competitive. Indeed, this step shows the growth of Canada and its commitment to strengthening the nation's industries associated with aerospace and establishing a firm position in the global market for ODS alloys.

Asia Pacific Market Insights

Asia Pacific region is set to witness significant growth till 2035. Geographically, Asia Pacific represents one of the largest oxide dispersion strengthened alloys market with impressive growth potential in countries such as India and China. These countries are investing considerably in the aerospace, energy, and defense sectors, thus opening high-growth opportunities for ODS alloy manufacturers to cater to the growing demand for high-performance materials in these industries.

With the continuous interest in innovation and development, the oxide dispersion strengthened (ODS) alloys market in India is preparing for a rapid surge. The government's initiatives toward indigenous manufacturing and advancements in technology in the aerospace sector drive the surge in demand for the market. In March 2024, a rise in its nuclear capacity was announced by India's Department of Atomic Energy, boosting the growth prospects of high-performance material markets such as ODS. This will not only help in strengthening India's position in space explorations but also in the usage of advanced materials, opening up further avenues of growth in the market.

Meanwhile, China is also witnessing a rapid spike in the oxide dispersion strengthened alloys market due to its developing aerospace and energy industries. The government impetus for innovation and development of technology has garnered high-speed investments in advanced materials research. China has recently been ramping up its production capacities for ODS alloys and is poised to be one of the leading countries in the global market.