- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Executive Summary

- Global Industry Overview

- Market Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROT

- Driver

- Restraint

- Opportunities

- Trends

- Evolution of Industry till 2050

- Government Regulation: How they would Aid the Business?

- Competitive Landscape

- ArcelorMittal

- Precision Castparts Corp.

- Sandvik AB

- VDM Metals

- Kansai Pipe Industries, Ltd.

- MBN Nanomaterialia S.p.A.

- Proterial Metals, Ltd.

- Haynes International, Inc.

- Cadi Company, Inc.

- Rolled Alloys, Inc.

- Ongoing Technological Advancements

- Future Expected Technologies

- PORTER Analysis

- Patent Analysis

- SWOT Analysis

- Pricing Analysis

- Pricing Analysis by Type

- Application Analysis

- Analysis of Strategic Initiatives Adopted by Key Players

- Recent Development Analysis

- Industry Risk Assessment

- Global Outlook and Projections

- Global Overview

- Market Value (USD Million), Volume (Million Kgs), Current and Future Projections, 2024-2040

- Increment $ Opportunity Assessment, 2024-2040

- Segmentation (USD Million), 2024-2040, By

- Type, Value (USD Million), Volume (Million Kgs)

- Iron-Based ODS

- Nickel-Based ODS

- Chromium-Based ODS

- Aluminum-Based ODS

- Others

- Application, Value (USD Million)

- Turbine

- Space Launch Systems

- Nuclear Reactor

- Chemical Processing System

- Others

- End use Industry, Value (USD Million)

- Aerospace

- Marine

- Chemical

- Energy

- Others

- Regional Synopsis, Value (USD Million), Volume (Million Kgs), 2024-2040

- North America, Value (USD Million), Volume (Million Kgs)

- Europe, Value (USD Million), Volume (Million Kgs)

- Asia Pacific, Value (USD Million), Volume (Million Kgs)

- Latin America, Value (USD Million), Volume (Million Kgs)

- Middle East and Africa, Value (USD Million), Volume (Million Kgs)

- Cross Analysis of Type W.R.T. Application (USD Million), 2024-2040

- Type, Value (USD Million), Volume (Million Kgs)

- Global Overview

- North America Market

- Overview

- Market Value (USD Million), Volume (Million Kgs), Current and Future Projections, 2024-2040

- Increment $ Opportunity Assessment, 2024-2040

- Segmentation (USD Million), 2024-2040, By

- Type, Value (USD Million), Volume (Million Kgs)

- Iron-Based ODS

- Nickel-Based ODS

- Chromium-Based ODS

- Aluminum-Based ODS

- Others

- Application, Value (USD Million)

- Turbine

- Space Launch Systems

- Nuclear Reactor

- Chemical Processing System

- Other

- End use Industry, Value (USD Million)

- Aerospace

- Marine

- Chemical

- Energy

- Others

- Country, Value (USD Million), Volume (Million Kgs), 2024-2040

- U.S.

- Canada

- Cross Analysis of Type W.R.T. Application (USD Million), 2024-2040

- Type, Value (USD Million), Volume (Million Kgs)

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Volume (Million Kgs), Current and Future Projections, 2024-2040

- Increment $ Opportunity Assessment, 2024-2040

- Segmentation (USD Million), 2024-2040, By

- Type, Value (USD Million), Volume (Million Kgs)

- Iron-Based ODS

- Nickel-Based ODS

- Chromium-Based ODS

- Aluminum-Based ODS

- Others

- Application, Value (USD Million)

- Turbine

- Space Launch Systems

- Nuclear Reactor

- Chemical Processing System

- Other

- End use Industry, Value (USD Million)

- Aerospace

- Marine

- Chemical

- Energy

- Others

- Country, Value (USD Million), Volume (Million Kgs), 2024-2040

- UK

- Germany

- France

- Italy

- Spain

- NORDIC

- Russia

- Rest of Europe

- Cross Analysis of Type W.R.T. Application (USD Million), 2024-2040

- Type, Value (USD Million), Volume (Million Kgs)

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Volume (Million Kgs), Current and Future Projections, 2024-2040

- Increment $ Opportunity Assessment, 2024-2040

- Segmentation (USD Million), 2024-2040, By

- Type, Value (USD Million), Volume (Million Kgs)

- Iron-Based ODS

- Nickel-Based ODS

- Chromium-Based ODS

- Aluminum-Based ODS

- Others

- Application, Value (USD Million)

- Turbine

- Space Launch Systems

- Nuclear Reactor

- Chemical Processing System

- Other

- End use Industry, Value (USD Million)

- Aerospace

- Marine

- Chemical

- Energy

- Others

- Country, Value (USD Million), Volume (Million Kgs), 2024-2040

- China

- Japan

- India

- Australia

- South Korea

- Vietnam

- Thailand

- Singapore

- Malaysia

- Rest of Asia Pacific

- Cross Analysis of Type W.R.T. Application (USD Million), 2024-2040

- Type, Value (USD Million), Volume (Million Kgs)

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Volume (Million Kgs), Current and Future Projections, 2024-2040

- Increment $ Opportunity Assessment, 2024-2040

- Segmentation (USD Million), 2024-2040, By

- Type, Value (USD Million), Volume (Million Kgs)

- Iron-Based ODS

- Nickel-Based ODS

- Chromium-Based ODS

- Aluminum-Based ODS

- Others

- Application, Value (USD Million)

- Turbine

- Space Launch Systems

- Nuclear Reactor

- Chemical Processing System

- Other

- End use Industry, Value (USD Million)

- Aerospace

- Marine

- Chemical

- Energy

- Others

- Country, Value (USD Million), Volume (Million Kgs), 2024-2040

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Cross Analysis of Type W.R.T. Application (USD Million), 2024-2040

- Type, Value (USD Million), Volume (Million Kgs)

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Volume (Million Kgs), Current and Future Projections, 2024-2040

- Increment $ Opportunity Assessment, 2024-2040

- Segmentation (USD Million), 2024-2040, By

- Type, Value (USD Million), Volume (Million Kgs)

- Iron-Based ODS

- Nickel-Based ODS

- Chromium-Based ODS

- Aluminum-Based ODS

- Others

- Application, Value (USD Million)

- Turbine

- Space Launch Systems

- Nuclear Reactor

- Chemical Processing System

- Other

- End use Industry, Value (USD Million)

- Aerospace

- Marine

- Chemical

- Energy

- Others

- Country, Value (USD Million), Volume (Million Kgs), 2024-2040

- GCC

- Israel

- South Africa

- Rest of Middle East & Africa

- Cross Analysis of Type W.R.T. Application (USD Million), 2024-2040

- Type, Value (USD Million), Volume (Million Kgs)

- Overview

- Global Economic Scenario

- World Economic and Risk Outlook for 2024

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

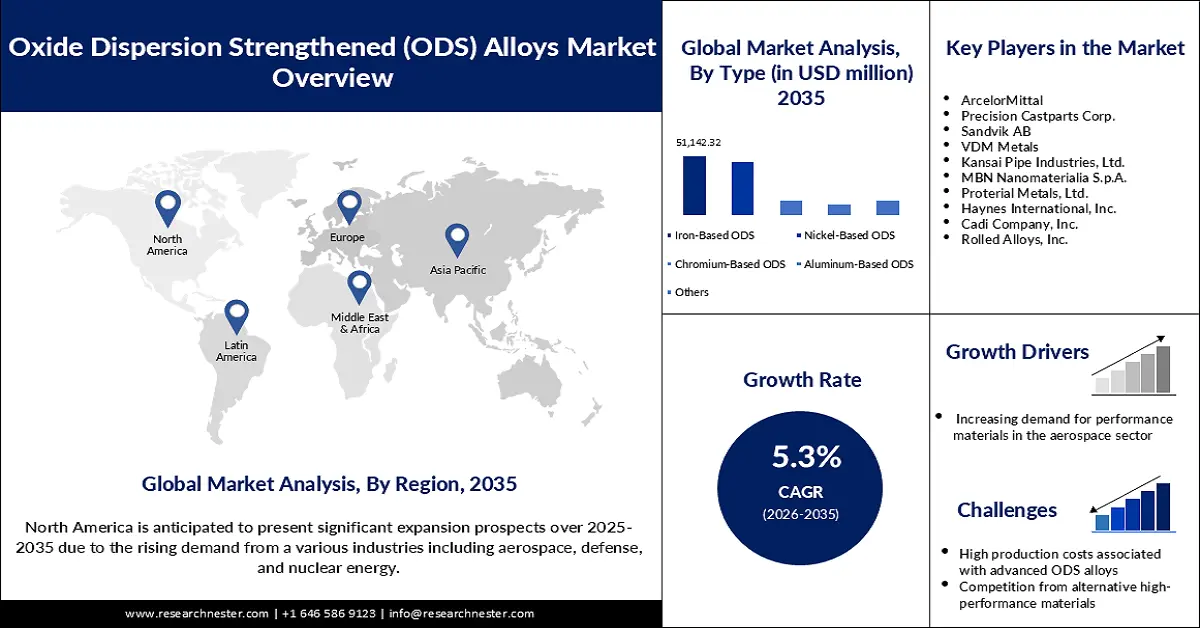

Oxide Dispersion Strengthened Alloys Market Outlook:

Oxide Dispersion Strengthened Alloys Market size was valued at USD 125.09 million in 2025 and is set to exceed USD 209.66 million by 2035, expanding at over 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of oxide dispersion strengthened alloys is estimated at USD 131.06 million.

Increasing demand from various sectors, such as aerospace, defense, and nuclear power, makes the future of oxide dispersion-strengthened alloys promising. The unique properties of ODS alloys include enhanced strength and resistance to extreme temperatures, making them highly suitable for high-performance applications. The ODS alloys market is expected to record robust growth in the near future since the growing demands for materials by industries experiencing non-friendly environmental conditions gain prominence.

Some other factors contributing to the oxide dispersion strengthened alloys market growth include breakthroughs in technology and collaborations between different companies. In March 2021, Texas A&M University realized a breakthrough in nuclear material research at its campus through the development of a new resilient ODS alloy. The performance of the material was excellent against both fission and fusion reactors. Hence, it established the role of ODS alloys in these critical energy industries. This is a pointer to the fact that ODS alloys are gaining wider importance across industries, from aerospace to nuclear energy hinting toward lucrative prospects for the key players.

Key Oxide Dispersion Strengthened Alloys Market Insights Summary:

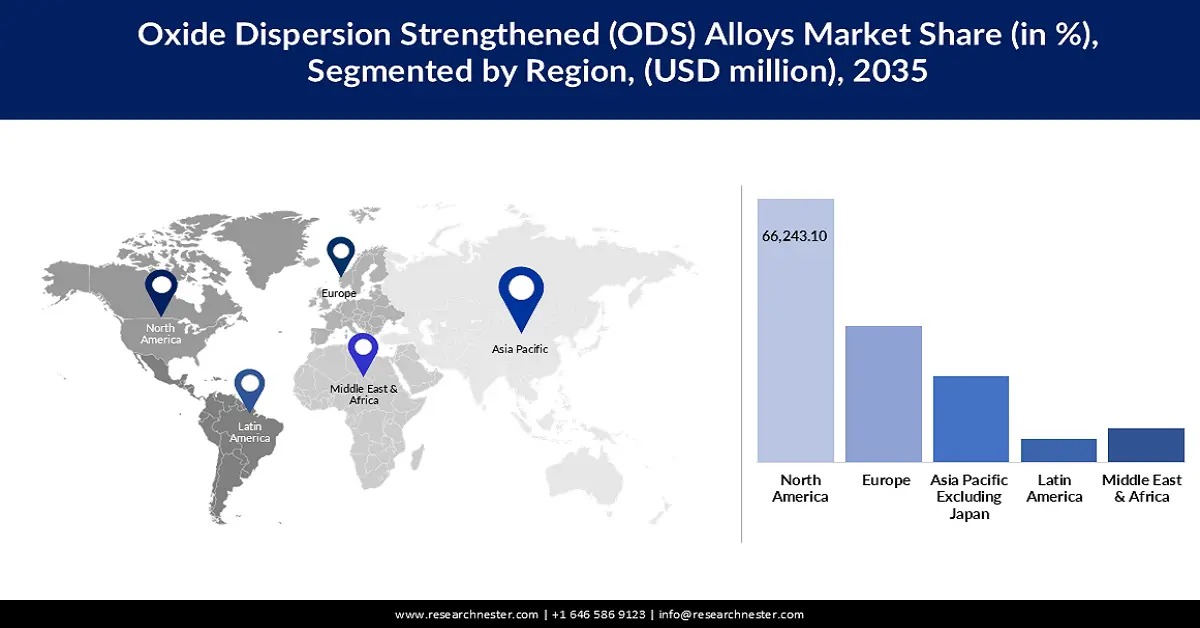

Regional Highlights:

- North America oxide dispersion strengthened (ods) alloys market will dominate around 33.20% share by 2035, driven by demand from aerospace, defense, and nuclear energy sectors.

- Asia Pacific market is set for significant growth from 2026 to 2035, fueled by growing investments in aerospace, defense, and nuclear sectors.

Segment Insights:

- The iron-based ods segment in the oxide dispersion strengthened alloys market is projected to hold a 37.40% share by 2035, driven by iron-based ODS alloy's good mechanical properties and thermal stability.

- The space launch systems segment in the oxide dispersion strengthened alloys market is projected to hold a 28.30% share by 2035, attributed to growing demands for lightweight and enduring material solutions in space exploration.

Key Growth Trends:

- Growing demand from aerospace applications

- Latest additive manufacturing techniques

Major Challenges:

- Regulatory barriers

Key Players: ArcelorMittal, Precision Castparts Corp., Sandvik AB, VDM Metals, Kansai Pipe Industries, Ltd., MBN Nanomaterialia S.p.A., Proterial Metals, Ltd., Haynes International, Inc., Cadi Company, Inc., and Rolled Alloys, Inc.

Global Oxide Dispersion Strengthened Alloys Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 125.09 million

- 2026 Market Size: USD 131.06 million

- Projected Market Size: USD 209.66 million by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Mexico

Last updated on : 16 September, 2025

Oxide Dispersion Strengthened Alloys Market Growth Drivers and Challenges:

Growth Drivers:

- Growing demand from aerospace applications: Growth in the aerospace sector, which has a strong demand for lightweight and high-strength metals that are resilient in extreme environmental conditions, is one of the major factors driving demand for ODS alloys. Advanced development of ODS alloys has been typically carried out by various aerospace manufacturers to achieve better performance with higher fuel efficiency. Since aerospace manufacturers are focusing on fuel economy and performance, the demand for ODS alloys is likely to increase and, hence, may provide significant growth opportunities.

- Latest additive manufacturing techniques: Emerging additive manufacturing techniques have spurred growth in industries that rely on ODS alloys. These manufacturing techniques have improved the production capability, as well as opened up new perspectives for developing new material designs. Companies like the US-based 3D systems group express their interest in conducting further research for the development of ODS alloys for additive manufacturing applications.

- Government initiatives and funding: The government's initiatives concerning the development of materials research and development have been very substantial in driving the oxide dispersion strengthened alloys market. The European Union has also started several funding programs connected to research into new innovative materials, including ODS alloys. As a result, such initiatives are likely to drive ODS alloys market expansion during the forecast period.

Challenges:

- Processing difficulty: ODS alloy processing is a formidable task and, therefore, may pose serious problems to manufacturing companies. Overcoming such technical challenges is of paramount importance for the wide use of ODS alloys in many further applications. Apart from that, there is still a lack of test standards on the material, which creates obstacles for use in critical industries.

- Regulatory barriers: There are some regulatory hurdles that the oxide dispersion strengthened alloys market players need to overcome, which could impede their growth. For instance, ODS alloys are a costly investment and other resources to meet strict safety and performance parameters in industries such as aerospace and nuclear energy. In addition, the international regulatory environment can be challenging for companies interested in venturing into new territories. As a result, there is an urgent need for broad-based simplification of the regulatory compliance burden.

Oxide Dispersion Strengthened Alloys Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 125.09 million |

|

Forecast Year Market Size (2035) |

USD 209.66 million |

|

Regional Scope |

|

Oxide Dispersion Strengthened Alloys Market Segmentation:

Type Segment Analysis

Iron-based ODS segment is projected to hold oxide dispersion strengthened (ODS) alloys market share of more than 37.4% by 2040. This leading position is due to the iron-based ODS alloy's good mechanical properties and thermal stability, making them useful in aerospace and energy applications. In addition, advanced iron-based ODS alloys are being introduced by manufacturers, an indication of the growth that has constantly been driving this segment. With the growing industry demand for materials withstanding extreme conditions, the iron-based ODS segment is anticipated to continue to dominate.

Application Segment Analysis

In oxide dispersion strengthened alloys market, space launch systems segment is anticipated to account for revenue share of around 28.3% by 2040. This segment is driven by growing demands for lightweight and enduring material solutions in space exploration, where performance and reliability are critical. Innovative developments by key players illustrate the sector's commitment to leveraging sophisticated materials.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oxide Dispersion Strengthened Alloys Market Regional Analysis:

North America Market Insights

North America in oxide dispersion strengthened (ODS) alloys market is expected to capture around 33.2% revenue share by the end of 2040. Growth in the region is driven by the demand emanating from a wide range of industries including aerospace, defense, and nuclear energy. Considering the preference-based tendency, companies are looking for superior-performance materials to bear extreme conditions. Owing to the benefits provided by these unique properties, including improved mechanical strength and thermal degradation resistance, ODS steel is attracting fiction.

The U.S. is one of the leading players in the development and application of ODS alloys, with leading manufacturers and research institutions well involved in the development of material technologies. The U.S. Department of Energy, in January 2023, awarded a grant of USD 22.1 million to a team at the University of California, Berkeley, that came up with new ODS alloys for nuclear reactors. Government initiatives in promoting the development of high-performance help companies or researchers solve some of the most important challenges during production. With this, the U.S. remains poised to retain its lead with continuous development in ODS alloy technology and drive growth and investment in the oxide dispersion strengthened alloys market.

Canada is also aiding in driving growth momentum in the North America oxide dispersion strengthened (ODS) alloys market. The country is focused on heavy investment in high-performance materials research for the betterment of its aerospace and defense industries. Furthermore, support from the government and academia-industry partnerships will most likely accelerate the pace of innovation in the industry of ODS alloys and consequently make it more competitive. Indeed, this step shows the growth of Canada and its commitment to strengthening the nation's industries associated with aerospace and establishing a firm position in the global market for ODS alloys.

Asia Pacific Market Insights

Asia Pacific region is set to witness significant growth till 2035. Geographically, Asia Pacific represents one of the largest oxide dispersion strengthened alloys market with impressive growth potential in countries such as India and China. These countries are investing considerably in the aerospace, energy, and defense sectors, thus opening high-growth opportunities for ODS alloy manufacturers to cater to the growing demand for high-performance materials in these industries.

With the continuous interest in innovation and development, the oxide dispersion strengthened (ODS) alloys market in India is preparing for a rapid surge. The government's initiatives toward indigenous manufacturing and advancements in technology in the aerospace sector drive the surge in demand for the market. In March 2024, a rise in its nuclear capacity was announced by India's Department of Atomic Energy, boosting the growth prospects of high-performance material markets such as ODS. This will not only help in strengthening India's position in space explorations but also in the usage of advanced materials, opening up further avenues of growth in the market.

Meanwhile, China is also witnessing a rapid spike in the oxide dispersion strengthened alloys market due to its developing aerospace and energy industries. The government impetus for innovation and development of technology has garnered high-speed investments in advanced materials research. China has recently been ramping up its production capacities for ODS alloys and is poised to be one of the leading countries in the global market.

Oxide Dispersion Strengthened Alloys Market Players:

- ArcelorMittal

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Precision Castparts Corp.

- Sandvik AB

- VDM Metals

- Kansai Pipe Industries, Ltd.

- MBN Nanomaterialia S.p.A.

- Proterial Metals, Ltd.

- Haynes International, Inc.

- Cadi Company, Inc.

- Rolled Alloys, Inc.

Some of the key players in the competitive landscape of oxide dispersion strengthened alloys include GE Aviation, NASA, and several specialized manufacturers. These companies continuously invest in research and development to improve the properties of ODS alloys and extend their applications in various industries. Growing demand for high-performance materials further intensifies competition and forces manufacturers to come up with innovations that distinguish them from other market participants.

In October 2022, GE Aviation announced the development of a new ODS alloy called GEnx-1A intended for use in jet-engine components. According to reports, the new alloy is stronger and more durable compared with conventional alloys, reducing fuel consumption by up to 2 percent. Such developments showcase not only the company’s commitment to innovation but also the competitive dynamics at work in the oxide dispersion strengthened alloys market to ensure that the needs of the aerospace industry are met in the future.

Here are some leading companies in the oxide dispersion strengthened (ODS) alloys market:

Recent Developments

- In September 2024, TWI Ltd. was appointed as the UK Technology Broker for the European Space Agency (ESA), aiming to boost innovation in the space sector by facilitating technology transfers between space and terrestrial industries. This initiative opens up new opportunities across various sectors, helping drive collaboration and technological advancements in both space-related and non-space industries.

- In February 2022, a significant breakthrough was made in the development of a nanoscale ZrC dispersion-strengthened molybdenum alloy by a research team from the Hefei Institutes of Physical Science (HFIPS), Chinese Academy of Sciences (CAS) and the Nuclear Power Institute of China. This molybdenum alloy demonstrated both high strength and excellent ductility at room temperature, marking a major advancement in high-performance materials.

- Report ID: 5869

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oxide Dispersion Strengthened Alloys Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.