Oxalic Acid Market Outlook:

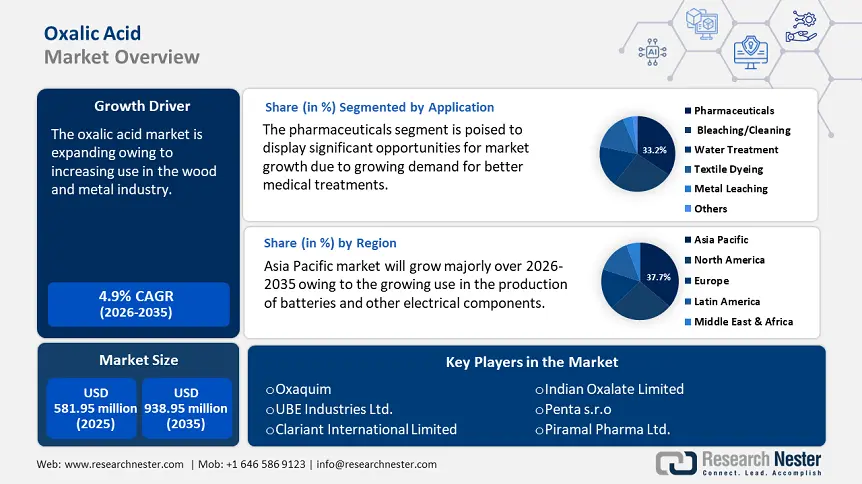

Oxalic Acid Market size was over USD 581.95 million in 2025 and is anticipated to cross USD 938.95 million by 2035, witnessing more than 4.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of oxalic acid is assessed at USD 607.61 million.

The global oxalic acid market is anticipated to escalate owing to the increasing use in the wood and metal industries. Due to its effectiveness as a metal and wood bleach, oxalic acid is becoming more widely used in these industries. It is used in the wood industry for bleaching, which improves the visual appeal of timber goods. Oxalic acid is used in the metal industry to clean and remove rust, which helps to preserve and repair metal surfaces. The need for oxalic acid in various applications is increasing due to the ongoing growth of the worldwide furniture, metalworking, and construction sectors. The compound's capacity to meet specific requirements in the processing of metal and wood makes it a valued component that propels oxalic acid market expansion.

Ethanedioic acid, another name for oxalic acid, is a colorless, toxic chemical compound that is a member of the carboxylic acid family. As it transforms the majority of indissoluble iron complexes into a dissoluble complex ion, oxalic acid is mostly used as an acid wash in homes and businesses, where it helps remove rust and grimy stains. It is the main ingredient in several commercial treatments meant to remove scale from car radiators for the same reason. Many different plants and vegetables, such as spinach, rhubarb, and cocoa, contain oxalic acid, a naturally occurring chemical.

Key Oxalic Acid Market Insights Summary:

Regional Highlights:

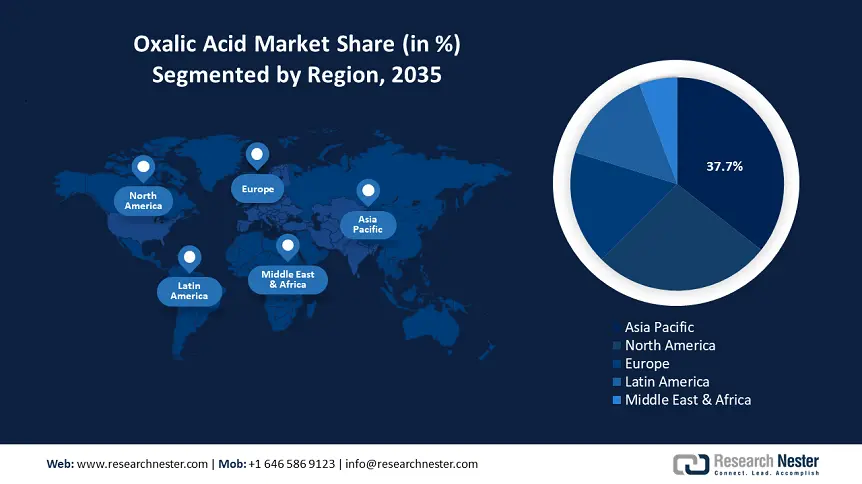

- Asia Pacific holds a 37.7% share in the Oxalic Acid Market, driven by rapid industrialization and expansion of automotive and textile sectors, positioning it as a leader through 2035.

- North America’s oxalic acid market is set for significant growth by 2035, fueled by increasing popularity of oxalic acid in textile, chemical, and pharmaceutical industries.

Segment Insights:

- Pharmaceuticals segment are projected to hold over a 33.2% share by 2035, fueled by rising demand for better medical treatments and healthcare sector expansion.

Key Growth Trends:

- Growing adoption rate in the pharmaceutical sector

- Increasing commercialization of oxalic acid, its salts & esters

Major Challenges:

- High in toxicity

- Growing environmental concerns

- Key Players: Oxaqum, Mudajiang Fengda Chemical Co., Ltd., UBE Industries Ltd., Clariant International Limited, Indian Oxalate Limited, Shijiazhuang Taihe Chemical Co., Ltd., Spectrum Chemical Manufacturing Corp., Shandong Fengyuan Chemical Co., Ltd., Penta s.r.o., Piramal Pharma Ltd..

Global Oxalic Acid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 581.95 million

- 2026 Market Size: USD 607.61 million

- Projected Market Size: USD 938.95 million by 2035

- Growth Forecasts: 4.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 12 August, 2025

Oxalic Acid Market Growth Drivers and Challenges:

Growth Drivers

- Growing adoption rate in the pharmaceutical sector: The global oxalic acid market is expected to grow at a moderate rate over the forecast period due to the growing demand for oxalic acid in the petrochemical industry in developing countries. The growing worldwide pharmaceutical industry is creating new opportunities for the oxalic acid market. To lower their risk of allergies and illnesses, people invest heavily in medications.

Increased concerns about the necessity to sterilize pharmaceutical equipment are driving the need for technical/pharma-grade oxalic acid. One cleaning or disinfecting agent that medical practitioners are increasingly adopting to sterilize medical equipment is oxalic acid. Furthermore, it is anticipated that the need for cleaning and purifying agents, such as oxalic acid, to sterilize medical equipment will increase as concerns about the growth in surgical site infections develop.

Furthermore, pharmaceutical companies use oxalic acid to make medications, including Borneol, tetracycline, and antibiotics. Additionally, oxalic acid is a component in tooth-whitening solutions. One of the main advantages of oxalic acid is the reduced use of antibiotics. Inhibiting the growth of naturally existing bacteria and deproteinizing, and dechelating drugs are other uses for oxalic acid. - Increasing commercialization of oxalic acid, its salts & esters: International trade plays a key role in meeting the surging demand for oxalic acid, with countries such as China, the U.S., and India being major exporters. The growing demand for oxalic acid in emerging economies, coupled with its use in new applications, is expected to further boost global trade and escalate market growth. The Observatory of Economic Complexity (OEC) revealed that with a total commerce of USD 224 million in 2023, oxalic acid, its salts, and esters ranked 3586th in the world in terms of trade. Exports of oxalic acid, its salts, and esters fell by 25.5% from USD 301 million to USD 224 million between 2022 and 2023. Oxalic acid, its salts, and its esters account for 0.00099% of global trade.

|

Exporter |

Export Revenue of Oxalic Acid, its salts & esters (in USD million) |

Importer |

Import Revenue of Oxalic Acid, its salts & esters (in USD million) |

|

China |

128 |

Peru |

36.6 |

|

India |

17.1 |

Switzerland |

32.6 |

|

Spain |

14.7 |

Belgium |

18.7 |

|

Italy |

14.4 |

Japan |

14.9 |

|

Germany |

12.9 |

India |

11.2 |

Source: OEC

Challenges

- High in toxicity: Another name for oxalates is anti-nutrients. This is because they bind to certain minerals and prevent the body from utilizing and absorbing them. Small dosages of oxalate are safe. On the other hand, elevated amounts could prevent the body from absorbing minerals and encourage kidney stones to form. The most common type of kidney stone is calcium oxalate, while there are additional types that are composed of different minerals. Therefore, when oxalic acid or oxalate concentrations increase, kidney stones may form. Growing health concerns indicate that toxicity risks with oxalic acid are impeding industry growth.

- Growing environmental concerns: Since oxalic acid is poisonous and caustic at high concentrations, it must be handled carefully to prevent soil and water contamination. When oxalic acid waste is improperly disposed of, it can pollute the environment and damage flora, aquatic life, and soil quality. Many nations have enacted stringent environmental laws controlling the disposal of dangerous substances such as oxalic acid in response to these risks. To reduce environmental harm, these regulations mandate that businesses invest in appropriate waste management methods, such as neutralization or treatment procedures.

Oxalic Acid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 581.95 million |

|

Forecast Year Market Size (2035) |

USD 938.95 million |

|

Regional Scope |

|

Oxalic Acid Market Segmentation:

Application (Bleaching/Cleaning, Pharmaceuticals, Water Treatment, Textile Dyeing, Metal Leaching, Others)

Pharmaceuticals segment is set to capture over 33.2% oxalic acid market share by 2035. Some analgesics, antibiotics, and other medicinal substances are made from oxalic acid. The need for premium raw materials, such as oxalic acid, has increased in the pharmaceutical industry due to the growing demand for better medical treatments and the growth of the global healthcare sector. As the pharmaceutical segment of the oxalic acid market continues to be driven by the rising prevalence of chronic diseases and the growing emphasis on finding new medicines, the growing population further supports this demand.

The bleaching/cleaning segment is anticipated to garner a significant share during the assessed period. In both residential and commercial cleaning applications, oxalic acid is frequently employed because of its ability to dissolve organic stains and remove mineral deposits and rust. The market for solutions based on oxalic acid has increased as a result of growing consumer knowledge of the advantages of cleaning with safer, less hazardous chemicals. Furthermore, its extensive use in wood and metal cleaning procedures, as well as the textile industry for fabric bleaching, has greatly supported its market expansion. Oxalic acid is a great substitute for harsher, conventional cleaning agents as people seek more environmentally friendly and effective options.

Our in-depth analysis of the global oxalic acid market includes the following segments:

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oxalic Acid Market Regional Analysis:

APAC Market Statistics

Asia Pacific oxalic acid market is anticipated to hold revenue share of more than 37.7% by 2035. Since it is widely used in the chemical, leather, and textile sectors for bleaching, dyeing, and reducing agents, the market is growing. Rapid industrialization in nations such as China, India, and Southeast Asia has increased the need for chemicals like oxalic acid in these industries. Additionally, the expansion of the automotive sector, particularly in China, has increased the demand for oxalic acid in the production of batteries and other electronic components, as well as a cleaning agent. The need for oxalic acid in various production processes is driven by this increase in industrial activity.

Furthermore, China’s rapid industrialization and urbanization have increased the demand for oxalic acid in various sectors, including pharmaceuticals, textiles, and metal processing. In the pharmaceutical industry, oxalic acid is utilized in the production of antibiotics and other medicines. China’s dominance in rare earth element production also boosts oxalic acid demand, as it is essential for extracting and processing these metals. For instance, an estimated 350,000 tons of rare earth oxide (REO) equivalent were produced at rare earth mines worldwide in 2023. With more than 69% of the world's rare earth output in that same year, China currently leads the world in this regard. China processes around 90% of the rare earth elements produced worldwide, demonstrating its dominance in industries outside mining. Additionally, the textile industry’s expansion, supported by government investments, has increased the need for oxalic acid as a bleaching agent. Furthermore, the nation’s position as a leading producer and exporter of oxalic acid, coupled with favorable regulatory policies and access to raw materials, has strengthened its dominance.

Moreover, the growing focus on wastewater treatment and metal polishing in industrial applications is also increasing its use in India. The International Trade Administration revealed that the main category of environmental technology that the U.S. exports to India is water and wastewater treatment. With a market value of almost USD 11 billion, India ranks fifth globally in terms of water and wastewater treatment. By 2026, it is anticipated to have increased to more than USD 18 billion. Moreover, government initiatives supporting domestic chemical manufacturing and import substitution are encouraging local production, driving the oxalic acid market growth.

North America Market Analysis

North America for oxalic acid market is expected to grow at a significant rate during the projected period. The market is expanding due to its growing popularity in various industries. The textile, chemical, and pharmaceutical sectors all make extensive use of oxalic acid, which is essential to procedures like bleaching, dying, and cleaning. The increasing trend of producing high-quality fabrics, especially in nations including the U.S. and Canada, supports the need for oxalic acid in the textile sector.

The oxalic acid market is being driven by a number of reasons, including the growth of the pharmaceutical sector and the increased prevalence of surgical site infections (SSIs). Prominent pharmaceutical firms are using oxalic acid to create a range of medications, including tetracycline, borneol, and terramcyin. Additionally, medical professionals sterilize surgical instruments using oxalic acid and other disinfectants. Because of its disinfecting qualities, oxalic acid is then used in the production of numerous household cleaning products. Therefore, it is expected that the rising use of these household cleaning products will increase oxalic acid sales.

Key Oxalic Acid Market Players:

- Oxaquim

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mudajiang Fengda Chemical Co., Ltd.

- UBE Industries Ltd.

- Clariant International Limited

- Indian Oxalate Limited

- Shijiazhuang Taihe Chemical Co., Ltd.

- Spectrum Chemical Manufacturing Corp.

- Shandong Fengyuan Chemical Co., Ltd.

- Penta s.r.o

- Piramal Pharma Ltd.

The oxalic acid market will continue to rise as a result of major companies in the industry making significant R&D investments to broaden their product ranges. Important market developments include new product releases, contractual agreements, mergers and acquisitions, increased investments, and cooperation with other organizations. Market participants are also engaging in a range of strategic actions to broaden their presence. The oxalic acid industry needs to provide affordable products to grow and endure in a more competitive and expanding oxalic acid market environment.

Recent Developments

- In September 2024, Piramal Pharma Solutions (PPS), a leading worldwide Contract Development and Manufacturing Organization (CDMO) and part of Piramal Pharma Ltd., announced a USD 80 million investment plan to expand its Lexington, Kentucky, plant. The location specializes in sterile compounding, liquid filling, and lyophilization for injectable sterile drugs, supporting Piramal Pharma Solutions' integrated antibody-drug conjugate development and production program, ADCelerate.

- In February 2021, to meet the growing demand for new technical applications, Oxaquim intended to make additional investments to raise its production capacity to 25,000 metric tons annually by 2022.

- Report ID: 7493

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oxalic Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.