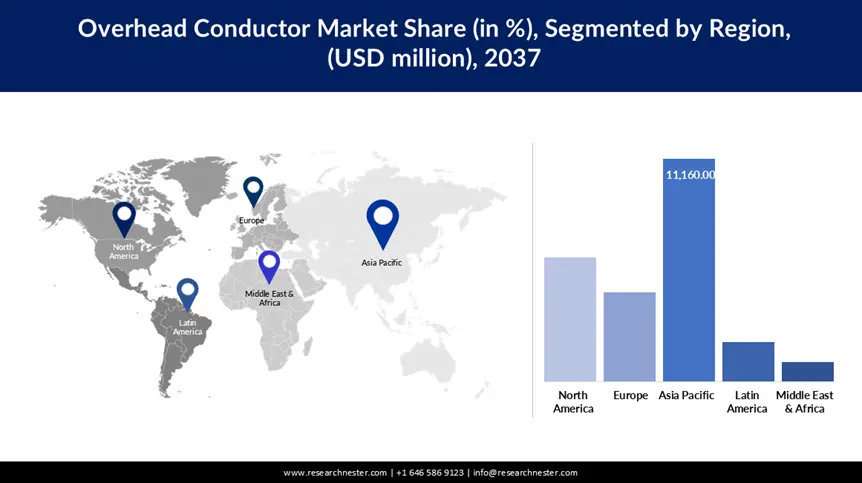

Overhead Conductor Market - Regional Analysis

APAC Market Insights

Asia Pacific overhead conductor market is anticipated to hold a 45% share during the forecast period, owing to urbanization, industrialization, and enormous grid investments. In August 2024, Galaxy Transmissions put into commission a 500 kt composite conductor line in India for export to wind corridor projects in Texas. The regional market was USD 389.6 million in 2024 and is anticipated to grow at a CAGR of 7.9% from the year 2034 onwards.

China market is projected to sustain over USD 257 million by 2034 with the impetus from aggressive grid expansion and integration of renewable power. Demand for advanced conductors is supported by China's focus on uninterruptible power supply, as well as remote connectivity. Government policies like the Belt and Road Initiative boost cross-border transmission schemes. The market is evolving from changing intra-regional patterns of power consumption and capacity investment. With more intra-regional treaties, China's conductor industry will be at the forefront. This makes China a world manufacturing giant.

India's overhead conductor market is growing rapidly, due to record levels of infrastructure investments and smart city initiatives. Government programs like RDSS are instigating demand for effective conductors. Carbon reduction and sustainable power solutions propel the growth of the market. As rural electrification expands, India's conductor sector is set to witness robust growth.

North America Market Insights

North America is predicted to expand at a 4.9% CAGR between 2025 to 2037, driven by grid modernization, integration of renewable energy, and heavy infrastructure investment. The regional market is supported by state programs like the U.S. Infrastructure Investment and Jobs Act, which invests billions into renewing transmission wires. The focus on sustainability and smart grids in North America is pushing the rate of demand for premium conductors even faster. The market is also boosted by cross-border energy transactions, enhancing grid interconnection. As electricity demand rises, North America remains a prime growth driver.

The U.S. is providing lucrative growth opportunities in North America, fueled by humongous investments in grid strength and renewable energy infrastructure. State initiatives and increased federal funding are catalyzing upgrades to the transmission system to incorporate wind and solar energy. The data published by the U.S. Energy Information Administration in 2022 stated that U.S. electric utilities have 119 million smart metering infrastructure installed. Also, the surge in deployment of renewable energy sources is propelling the market growth.

In Canada, the market is witnessing unprecedented growth owing to rising government funding. The government has invested more than USD 13 million to update the Ontario electricity grid. The investment is made to upgrade reliability and amalgamate advanced technologies. Also, there is a requirement to change the aging infrastructure, which is further propelling stakeholders to invest in modern conductors, which render longevity.

Europe Market Insights

Europe is a significant industry due to renewable integration, grid modernization, and stringent sustainability regulations. Europe's focus on smart grids and cross-border transmission networks is driving the demand for cutting-edge conductors. EU Green Deal and municipal policies pay back low-sag and high-capacity solutions. Government investment in wind and solar projects also boosts market growth. With energy transformation taking hold, Europe remains at the forefront of innovation.

In Germany, the government is focusing on "Energiewende," which has led to a remarkable increase in the adoption of renewable energy. According to data published by the government in January 2023, the share of renewables in the country reached 49.6% which is almost half of the power generation. Additionally, the advancements in consumer materials have enhanced the efficiency as well as capacity of the transmission lines. These innovations enable the transmission of more power over existing lines without the need for additional infrastructure.

The UK overhead conductor market is rising steadily, complemented by grid modernization and a robust push towards the integration of renewable energy. The UK 2050 net-zero target fuels investment towards high-capacity, low-loss conductors. Government policies are also pushing sustainable transmission solutions and smart grid technologies. The market is also positively influenced by urban power demand growth and electrification activities. Demand for state-of-the-art conductors will grow with increasing renewable project developments.