Global Overhead Conductor Market

- An Outline of the Global Overhead Conductor Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Secondary Research

- Primary Research

- Data Triangulation

- SPSS Approach

- Executive Summary

- Market Overview

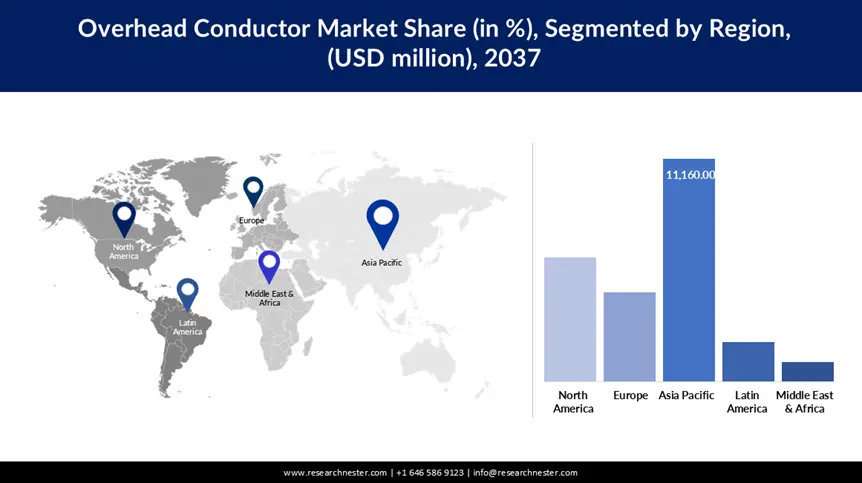

- Regional Synopsis

- Industry Supply Chain Analysis

- DROT

- Driver

- Restraint

- Opportunities

- Trends

- Government Regulation

- Competitive Landscape

- Nexans

- Prysmian Group

- Sumitomo Electric Industries, Ltd.

- CTC Global Corporation

- Southwire Company, LLC

- General Cable (Prysmian subsidiary)

- 3M

- LS Cable & System

- Taihan Electric Wire & Cable

- Apar Industries Ltd.

- KEI Industries Ltd.

- Lamifil NV

- Tratos S.p.A.

- LUMPI BERNDORF Draht und Seilwerk GmbH

- NKT A/SOngoing Technological Advancements

- SWOT Analysis

- Patents Filed in the Industry

- Product Type Analysis

- Root Cause Analysis (RCA) for the Market

- Recent News/ Developments

- Porter Five Forces Analysis

- Industry Risk Assessment

- Growth Outlook

- EXIM Analysis

- Global Outlook and Projections

- Global Overview

- Market Revenue by Value (USD Million), Volume (Million Meters), Current and Future Projections, 2019-2037

- Global Segmentation (USD million), 2019-2037, By

- Type, Value (USD Million)

- AAC (All Aluminum Conductor)

- ACSR (Aluminum Conductor Steel Reinforced)

- ACAR (Aluminum Conductor, Alloy Reinforced)

- AAAC (All Aluminum Alloy Conductor)

- Aluminum Clad Steel Conductor (ACS)

- Aluminum Clad Invar (ACI)

- Others

- Material, Value (USD Million)

- Aluminum

- Steel

- Aluminum Alloy

- Others

- Voltage, Value (USD Million)

- Up to 170kV

- 221-345kV

- 550 - 745kV

- Above 745kV

- Current Type, Value (USD Million)

- HVAC (High Voltage Alternating Current)

- HVDC (High Voltage Direct Current)

- Rated Strength, Value (USD Million)

- High Rated Strength

- Extra High Rated Strength

- Ultra-High Rated Strength

- Application, Value (USD Million)

- Power Distribution

- Transmission Line

- Regional Synopsis, Value (USD million), 2019-2037

- North America Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Europe Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Asia Pacific Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Latin America Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Middle East and Africa Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Type, Value (USD Million)

- Global Overview

- North America Market

- Overview

- Market Revenue by Value (USD Million), Volume (Million Meters), Current and Future Projections, 2019-2037

- Increment $ Opportunity Assessment, 2019-2037

- Segmentation (USD million), 2019-2037, By

- Type, Value (USD Million)

- AAC (All Aluminum Conductor)

- ACSR (Aluminum Conductor Steel Reinforced)

- ACAR (Aluminum Conductor, Alloy Reinforced)

- AAAC (All Aluminum Alloy Conductor)

- Aluminum Clad Steel Conductor (ACS)

- Aluminum Clad Invar (ACI)

- Others

- Material, Value (USD Million)

- Aluminum

- Steel

- Aluminum Alloy

- Others

- Voltage, Value (USD Million)

- Up to 170kV

- 221-345kV

- 550 - 745kV

- Above 745kV

- Current Type, Value (USD Million)

- HVAC (High Voltage Alternating Current)

- HVDC (High Voltage Direct Current)

- Rated Strength, Value (USD Million)

- High Rated Strength

- Extra High Rated Strength

- Ultra-High Rated Strength

- Application, Value (USD Million)

- Power Distribution

- Transmission Line

- Country Level Analysis, Value (USD million)

- U.S. Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Canada Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Type, Value (USD Million)

- Overview

- Europe Market

- Overview

- Market Revenue by Value (USD Million), Volume (Million Meters), Current and Future Projections, 2019-2037

- Increment $ Opportunity Assessment, 2019-2037

- Segmentation (USD million), 2019-2037, By

- Type, Value (USD Million)

- AAC (All Aluminum Conductor)

- ACSR (Aluminum Conductor Steel Reinforced)

- ACAR (Aluminum Conductor, Alloy Reinforced)

- AAAC (All Aluminum Alloy Conductor)

- Aluminum Clad Steel Conductor (ACS)

- Aluminum Clad Invar (ACI)

- Others

- Material, Value (USD Million)

- Aluminum

- Steel

- Aluminum Alloy

- Others

- Voltage, Value (USD Million)

- Up to 170kV

- 221-345kV

- 550 - 745kV

- Above 745kV

- Current Type, Value (USD Million)

- HVAC (High Voltage Alternating Current)

- HVDC (High Voltage Direct Current)

- Rated Strength, Value (USD Million)

- High Rated Strength

- Extra High Rated Strength

- Ultra-High Rated Strength

- Application, Value (USD Million)

- Power Distribution

- Transmission Line

- Country Level Analysis, Value (USD million)

- UK Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Germany Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- France Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Italy Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Spain Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Netherlands Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Russia Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Switzerland Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Poland Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Belgium Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Rest of Europe Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Type, Value (USD Million)

- Overview

- Asia Pacific Market

- Overview

- Market Revenue by Value (USD Million), Volume (Million Meters), Current and Future Projections, 2019-2037

- Increment $ Opportunity Assessment, 2019-2037

- Segmentation (USD million), 2019-2037, By

- Type, Value (USD Million)

- AAC (All Aluminum Conductor)

- ACSR (Aluminum Conductor Steel Reinforced)

- ACAR (Aluminum Conductor, Alloy Reinforced)

- AAAC (All Aluminum Alloy Conductor)

- Aluminum Clad Steel Conductor (ACS)

- Aluminum Clad Invar (ACI)

- Others

- Material, Value (USD Million)

- Aluminum

- Steel

- Aluminum Alloy

- Others

- Voltage, Value (USD Million)

- Up to 170kV

- 221-345kV

- 550 - 745kV

- Above 745kV

- Current Type, Value (USD Million)

- HVAC (High Voltage Alternating Current)

- HVDC (High Voltage Direct Current)

- Rated Strength, Value (USD Million)

- High Rated Strength

- Extra High Rated Strength

- Ultra-High Rated Strength

- Application, Value (USD Million)

- Power Distribution

- Transmission Line

- Country Level Analysis, Value (USD million)

- China Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- India Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- South Korea Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Australia Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Indonesia Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Malaysia Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Vietnam Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Thailand Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Singapore Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- New Zeeland Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Rest of Asia Pacific Excluding Japan Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Type, Value (USD Million)

- Overview

- Latin America Market

- Overview

- Market Revenue by Value (USD Million), Volume (Million Meters), Current and Future Projections, 2019-2037

- Increment $ Opportunity Assessment, 2019-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2019-2037, By

- Type, Value (USD Million)

- AAC (All Aluminum Conductor)

- ACSR (Aluminum Conductor Steel Reinforced)

- ACAR (Aluminum Conductor, Alloy Reinforced)

- AAAC (All Aluminum Alloy Conductor)

- Aluminum Clad Steel Conductor (ACS)

- Aluminum Clad Invar (ACI)

- Others

- Material, Value (USD Million)

- Aluminum

- Steel

- Aluminum Alloy

- Others

- Voltage, Value (USD Million)

- Up to 170kV

- 221-345kV

- 550 - 745kV

- Above 745kV

- Current Type, Value (USD Million)

- HVAC (High Voltage Alternating Current)

- HVDC (High Voltage Direct Current)

- Rated Strength, Value (USD Million)

- High Rated Strength

- Extra High Rated Strength

- Ultra-High Rated Strength

- Application, Value (USD Million)

- Power Distribution

- Transmission Line

- Country Level Analysis, Value (USD million)

- Brazil Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Argentina Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Mexico Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Rest of Latin America Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Type, Value (USD Million)

- Overview

- Middle East & Africa Market

- Overview

- Market Revenue by Value (USD Million), Volume (Million Meters), Current and Future Projections, 2019-2037

- Increment $ Opportunity Assessment, 2019-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2019-2037, By

- Type, Value (USD Million)

- AAC (All Aluminum Conductor)

- ACSR (Aluminum Conductor Steel Reinforced)

- ACAR (Aluminum Conductor, Alloy Reinforced)

- AAAC (All Aluminum Alloy Conductor)

- Aluminum Clad Steel Conductor (ACS)

- Aluminum Clad Invar (ACI)

- Others

- Material, Value (USD Million)

- Aluminum

- Steel

- Aluminum Alloy

- Others

- Voltage, Value (USD Million)

- Up to 170kV

- 221-345kV

- 550 - 745kV

- Above 745kV

- Current Type, Value (USD Million)

- HVAC (High Voltage Alternating Current)

- HVDC (High Voltage Direct Current)

- Rated Strength, Value (USD Million)

- High Rated Strength

- Extra High Rated Strength

- Ultra-High Rated Strength

- Application, Value (USD Million)

- Power Distribution

- Transmission Line

- Country Level Analysis, Value (USD million)

- Saudi Arabia Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- UAE Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Israel Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Qatar Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Kuwait Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Oman Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- South Africa Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Rest of Middle East & Africa Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Type, Value (USD Million)

- Overview

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Overhead Conductor Market Outlook:

Overhead Conductor Market size was valued at USD 12.5 billion in 2024 and is projected to reach a valuation of USD 24.8 billion by the end of 2037, rising at a CAGR of 5.7% during the forecast period, i.e., 2025-2037. In 2025, the industry size of overhead conductor is estimated at USD 13.3 billion.

The market is garnering significant growth as global energy needs and grid modernization activities drive investment and innovation. Businesses are focusing on new materials and intelligent technology to enhance transmission efficiency and reliability, particularly for the integration of renewable energy. APAR Industries launched new-generation HTLS conductors in June 2024, featuring improved corrosion resistance, targeting U.S. and European utilities for the replacement of existing network lines. Governments around the world are prioritizing sustainable energy infrastructure, with policy support for high-capacity, low-loss conductors to meet carbon reduction goals. In 2024, the United States Department of Energy reported that grid modernization efforts could save up to 348 terawatt-hours of electricity by 2035, utilizing efficient transmission systems. This regulatory push, combined with urbanization, is opening the door for robust market development.

Players are observing a significant opportunity in the rising application of smart grid technology and cross-border transmission grids, offering new prospects for conductor utilization. In June 2025, a project sponsored by the DOE began to develop ACNT conductors in partnership with Prysmian and DexMat, laying the groundwork for next-generation overhead conductor technology based on aluminum-carbon nanotube cores for all-weather reliability. Advances such as the deployment of real-time monitoring sensors are gaining traction, which is making grids more resilient. Governments are also investing heavily in renewable energy projects, which can be seen in the ambitious grid expansion plans of Asia Pacific. All these factors are driving the overhead conductor market towards a future that is innovative and sustainable in nature.

Key Overhead Conductor Market Insights Summary:

Regional Highlights:

- Asia Pacific is anticipated to hold 45% share during the forecast period, owing to urbanization, industrialization, and substantial grid investments.

- North America is projected to expand at a 4.9% CAGR between 2025 and 2037, driven by grid modernization, renewable energy integration, and infrastructure investments.

Segment Insights:

- ACSR (aluminum conductor steel reinforced) segment is anticipated to hold 32% share during the forecast period, propelled by its cost-effectiveness, high tensile strength, and suitability for long-span transmission lines.

- Aluminum segment is expected to command 62.5% share through 2037, driven by its lightweight, high conductivity, and alignment with sustainable energy transmission needs.

Key Growth Trends:

- Increasing global electricity consumption

- Technology advancements in conductor materials

Major Challenges:

- Regulatory intricacies and pending approvals

- Lack of technical skills and trained workforce

Key Players: Nexans, Prysmian Group, Sumitomo Electric Industries, Ltd., CTC Global Corporation, Southwire Company, LLC, General Cable (Prysmian subsidiary), 3M, LS Cable & System, Taihan Electric Wire & Cable, Apar Industries Ltd., KEI Industries Ltd., Lamifil NV, Tratos S.p.A., LUMPIBERNDORF Draht und Seilwerk GmbH, NKT A/S

Global Overhead Conductor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2024 Market Size: USD 12.5 billion

- 2025 Market Size: USD 13.3 billion

- Projected Market Size: 24.8 billion by 2037

- Growth Forecasts: 13.3% CAGR (2025-2037)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45% Share)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, South Korea

- Emerging Countries: India, Singapore, Thailand, Australia, Mexico

Last updated on : 7 October, 2025

Overhead Conductor Market - Growth Drivers and Challenges

Growth Drivers

- Increasing global electricity consumption: One of the primary growth drivers is the rising global electricity demand, triggered by rapid urbanization and industrialization, which necessitates high-capacity transmission infrastructure. In June 2024, China State Grid Corporation approved a USD 3.9 billion investment in transmission and storage infrastructure, including high-capacity conductor upgrades to enable renewables. This massive investment is a testament to the necessity for efficient power delivery infrastructure, especially in urban and industrialized zones. In addition, utilities and governments are massively investing in grid expansion and reinforcement, driving the need for high-technology overhead conductors. Applications for renewable energy sources like solar and wind also increase the demand for reliable, high-capacity transmission lines. As energy consumption patterns change, the market is likely to grow significantly.

- Technology advancements in conductor materials: Technology development in conductor materials, such as high-temperature low-sag (HTLS) and composite core conductors, enhancing the efficiency of the grid, is another major driver. In February 2025, Sumitomo Electric invested in highly conductive and low-sag advanced aluminum alloy conductors for 220–660 kV HV lines, reducing transmission losses. These technologies allow more ampacity without new infrastructure, enabling renewable energy feed-in. Demand for smart grids and real-time monitoring systems is also increasing with the adoption of high-tech conductors. As utilities replace aging grids to meet increasing power demand, a focus on long-lasting, energy-efficient materials is reshaping market dynamics. This technological breakthrough is a cornerstone of sustained market growth.

Challenges

- Regulatory intricacies and pending approvals: A significant hurdle is over-complex regulation and lengthy approval periods for grid infrastructure projects, often delaying deployment. In December 2024, the EU imposed stricter environmental rules of compliance for transmission projects under the Green Deal framework, requiring comprehensive impact assessments for the installation of new conductors. The regulations, while aimed at sustainability, increase project durations and require much paperwork, causing hurdles for manufacturers and utilities. Public opposition, based on visual and environmental concerns, further complicates approvals. This regulation can slow market growth, particularly in urban areas.

- Lack of technical skills and trained workforce: There is also a lack of technical skills and trained labor to commission and maintain advanced conductor systems. In August 2024, the U.S. Department of Labor projected a shortage of 10,000 trained electric line workers by 2027, impacting grid upgrade projects. Industry innovation in new conductors, such as digital technologies like HTLS and intelligent systems, requires sophisticated training, which is often lacking. This shortfall leads to installation errors and delays in maintenance, compromising the success of projects. Investment in workforce development is necessary for manufacturers and utilities to prevent these risks. Overcoming this handicap is crucial to ensure market growth.

Overhead Conductor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

5.7% |

|

Base Year Market Size (2024) |

USD 12.5 billion |

|

Forecast Year Market Size (2037) |

USD 24.8 billion |

|

Regional Scope |

|

Overhead Conductor Market Segmentation:

Type Segment Analysis

The ACSR (aluminum conductor steel reinforced) segment is anticipated to hold a 32% share during the forecast period as it is cost-effective, has high tensile strength, and is suitable for long-span transmission lines. A report published by the U.S. Department of Energy (DOE) on Advanced Conductor in December 2023 stated that Aluminum Conductor Composite Core (ACCC) offers significantly improved performance. Moreover, it includes up to 40% less energy losses, 50% less sag, and can double transmission capacity without necessitating additional right-of-way. These characteristics are augmenting the segment growth during the forecast period.

Material Segment Analysis

The aluminum segment is anticipated to command a 62.5% share through 2037 owing to its light weight, low cost, and better conductivity for overhead transmission. Its widespread availability and recyclability conform to the sustainability model, further driving adoption. The segment growth is supported by rising demand for efficient transmission of power in industrial and urban areas. With energy efficiency and grid reliability becoming the focus for utilities, the application of aluminum in conducting production is likely to continue to increase.

Current Type Segment Analysis

The High Voltage Alternating Current (HVAC) segment is anticipated to hold 77% of the market by 2037. The growth of the segment can be attributed to its widespread usage in long-distance power transmission and compatibility with the current grid infrastructure. The segment is fueled by development in transmission network upgradation to deal with the rising demand. HVAC remains the pillar of global power systems. The HVAC industry also benefits from the development of new technologies like HTLS and smart conductors that enhance ampacity and reduce losses without the need for new infrastructure.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Material |

|

|

Voltage |

|

|

Current Type |

|

|

Rated Strength |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Overhead Conductor Market - Regional Analysis

APAC Market Insights

Asia Pacific overhead conductor market is anticipated to hold a 45% share during the forecast period, owing to urbanization, industrialization, and enormous grid investments. In August 2024, Galaxy Transmissions put into commission a 500 kt composite conductor line in India for export to wind corridor projects in Texas. The regional market was USD 389.6 million in 2024 and is anticipated to grow at a CAGR of 7.9% from the year 2034 onwards.

China market is projected to sustain over USD 257 million by 2034 with the impetus from aggressive grid expansion and integration of renewable power. Demand for advanced conductors is supported by China's focus on uninterruptible power supply, as well as remote connectivity. Government policies like the Belt and Road Initiative boost cross-border transmission schemes. The market is evolving from changing intra-regional patterns of power consumption and capacity investment. With more intra-regional treaties, China's conductor industry will be at the forefront. This makes China a world manufacturing giant.

India's overhead conductor market is growing rapidly, due to record levels of infrastructure investments and smart city initiatives. Government programs like RDSS are instigating demand for effective conductors. Carbon reduction and sustainable power solutions propel the growth of the market. As rural electrification expands, India's conductor sector is set to witness robust growth.

North America Market Insights

North America is predicted to expand at a 4.9% CAGR between 2025 to 2037, driven by grid modernization, integration of renewable energy, and heavy infrastructure investment. The regional market is supported by state programs like the U.S. Infrastructure Investment and Jobs Act, which invests billions into renewing transmission wires. The focus on sustainability and smart grids in North America is pushing the rate of demand for premium conductors even faster. The market is also boosted by cross-border energy transactions, enhancing grid interconnection. As electricity demand rises, North America remains a prime growth driver.

The U.S. is providing lucrative growth opportunities in North America, fueled by humongous investments in grid strength and renewable energy infrastructure. State initiatives and increased federal funding are catalyzing upgrades to the transmission system to incorporate wind and solar energy. The data published by the U.S. Energy Information Administration in 2022 stated that U.S. electric utilities have 119 million smart metering infrastructure installed. Also, the surge in deployment of renewable energy sources is propelling the market growth.

In Canada, the market is witnessing unprecedented growth owing to rising government funding. The government has invested more than USD 13 million to update the Ontario electricity grid. The investment is made to upgrade reliability and amalgamate advanced technologies. Also, there is a requirement to change the aging infrastructure, which is further propelling stakeholders to invest in modern conductors, which render longevity.

Europe Market Insights

Europe is a significant industry due to renewable integration, grid modernization, and stringent sustainability regulations. Europe's focus on smart grids and cross-border transmission networks is driving the demand for cutting-edge conductors. EU Green Deal and municipal policies pay back low-sag and high-capacity solutions. Government investment in wind and solar projects also boosts market growth. With energy transformation taking hold, Europe remains at the forefront of innovation.

In Germany, the government is focusing on "Energiewende," which has led to a remarkable increase in the adoption of renewable energy. According to data published by the government in January 2023, the share of renewables in the country reached 49.6% which is almost half of the power generation. Additionally, the advancements in consumer materials have enhanced the efficiency as well as capacity of the transmission lines. These innovations enable the transmission of more power over existing lines without the need for additional infrastructure.

The UK overhead conductor market is rising steadily, complemented by grid modernization and a robust push towards the integration of renewable energy. The UK 2050 net-zero target fuels investment towards high-capacity, low-loss conductors. Government policies are also pushing sustainable transmission solutions and smart grid technologies. The market is also positively influenced by urban power demand growth and electrification activities. Demand for state-of-the-art conductors will grow with increasing renewable project developments.

Key Overhead Conductor Market Players:

- Nexans

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Prysmian Group

- Sumitomo Electric Industries, Ltd.

- CTC Global Corporation

- Southwire Company, LLC

- General Cable (Prysmian subsidiary)

- 3M

- LS Cable & System

- Taihan Electric Wire & Cable

- Apar Industries Ltd.

- KEI Industries Ltd.

- Lamifil NV

- Tratos S.p.A.

- LUMPIBERNDORF Draht und Seilwerk GmbH

- NKT A/S

The overhead conductor market is competitive, with global industry leaders focusing on innovation, sustainability, and strategic partnerships as they seek to capture market share. A significant development was in December 2024, when KEI Industries introduced intelligent overhead conductor joint kits to streamline installation and sensor integration for efficient distribution grid installations in North America and Europe. The solution reduces installation time and maintenance costs, enhancing utility efficiency. With regulatory pressure on grid reliability and sustainability intensifying, competition will drive emerging trends in conductor technology, material science, and digital integration into the global market.

Here are some leading companies in the market:

Recent Developments

- In July 2025, Nexans and RTE launched an industrial initiative in France to recycle aluminum from high- and extra high-voltage cables, promoting sustainability in conductor manufacturing.

- In May 2025, Prysmian deployed E3X coated conductors and advanced monitoring solutions for a 400 kV overhead transmission line in Saudi Arabia, in collaboration with GCCIA. This milestone marks a significant advancement in energy efficiency, reducing transmission losses and lowering carbon emissions in the Middle East.

- Report ID: 5612

- Published Date: Oct 07, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Overhead Conductor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.