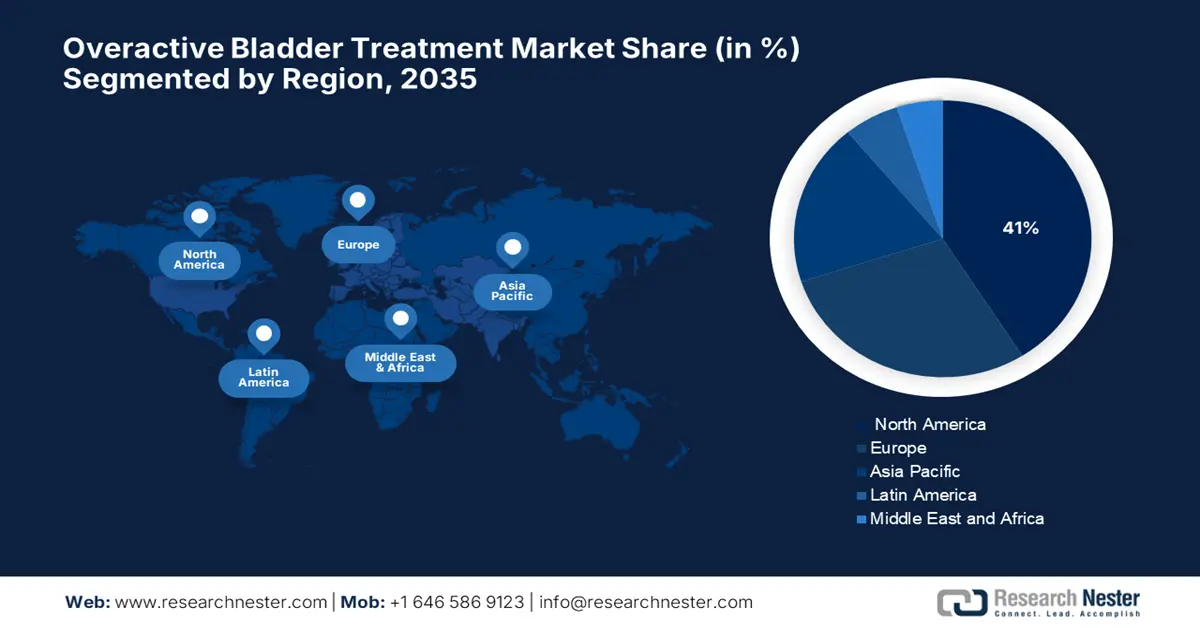

Overactive Bladder Treatment Market - Regional Analysis

North America Market Insight

The overactive bladder treatment market in North America is expected to hold the highest market share of 41% during the forecast period. According to a report by NIH in February 2024, research sponsored by agencies such as the NIH and NIDDK in the U.S. has helped to increase intervention studies in the fields of behavioral therapy and neuromodulation for OAB, fitting into safer and patient-centered care. Public resources, such as datasets and clinical trial registries, serve as a testament to the public sector's commitment to advancing meaningful innovation in OAB treatment, thereby ensuring quality in healthcare.

The market in the U.S. is expected to grow steadily within the forecast period. Advancements in healthcare research come as the top priority in the U.S. within the forecast period. According to a report by NIH in January 2023, the U.S. government, through its NIH and NIDDK, has supported research into OAB, with funding going to projects on innovative treatments and diagnostics. The innovative treatments include the manufacture of wireless implantable devices for the real-time monitoring of the bladder and multi-interdisciplinary action plans targeting OAB care and the diminution of cognitive risks stemming from certain therapies. These serve the dual purpose of improving clinical practices and patient outcomes.

The overactive bladder treatment market in Canada is growing due to the aging population within the forecast period. The OAB treatment market in Canada showcases serious gaps in cost-effectiveness data, especially for first- and third-line therapies. Bringing much strength to health technology assessments (HTAs) with fresh data collection is expected to inform reimbursement decisions, support market access strategies, and lead to innovations that would promote treatment adoption and improve outcomes in Canada’s publicly funded health care system.

Asia Pacific Market Insight

The overactive bladder treatment market in the Asia Pacific is expected to hold the fastest-growing market within the forecast period due to increasing healthcare awareness, a growing aging population, and expanding access to advanced diagnostic and treatment options. According to a report by NIH in December 2023, the prevalence of an overactive bladder has been greatly different in the Asia Pacific Region, with surveys proving that 53% of women suffer from symptoms in China, yet very few undergo treatment for the condition. This points to an unmet need and an opportunity for market expansion, as well as for government-driven awareness programs and healthcare infrastructure.

The market in China is expected to grow steadily within the forecast period. OAB has been noted to be on the rise in women in China, which is indicative of a broad public health issue. More specifically, the middle-aged group and people with higher BMI have been most affected by the rising OAB prevalence in China. The need for diverse and more advanced treatment options requires greater public health intervention and improvement of healthcare services in China’s growing OAB market. This growing demand is driving increased investment in innovative therapies and improved healthcare infrastructure to better manage and treat OAB across the country.

The overactive bladder treatment market in India is expected to grow steadily within the forecast period due to urinary incontinence (UI), including the urge incontinence associated with OAB, which continues to be a major but under-reported health problem. A recent study by the International Journal of Community Medicine and Public Health, June 2023, has shown that UI, with a prevalence rate of 27.1% and 25% of urge UI, suggests the need for awareness generation, government intervention, and treatment opportunities to meet patient care and enhance their quality of life in India. The Indian government has launched campaigns for women’s health and increased focus on chronic disease management, which would help in the management of OAB and improve patient outreach.

Europe Market Insight

The overactive bladder treatment market in Europe is expected to continue to rise during the forecast period. According to a study by the UK Parliament in May 2025, the European arena, especially in the UK, government initiatives aim to detail advanced UTI management techniques due to antibiotic resistance threatening OAB treatment protocols. Investments in rapid diagnostics and treatments are swiftly building up in support of the strategies of antibiotic stewardship: lessening recurrence rates and patient outcome improvements are the prime factors for market growth and strategic stakeholder engagement investments.

The U.K. urinary health market is growing due to increasing UTI cases are accompanied by treatment demands for OAB. According to a report by the Government of the UK in July 2024, almost 200,000 hospital admissions in England occurred for UTI between 2023-24, leading to a heavy load on healthcare in addition to resource utilization. To ease the situation for urinary condition patient management and rare expensive hospital stays, government programs have been developed to promote diagnostics and outpatient pathways for urinary conditions.

In Germany, the OAB treatment market is growing due to the aging population and upsurge in its prevalence. The early treatment and detection of urological disorders is now more possible due to the increasing knowledge about the disorders and the new methods in healthcare technologies. Moreover, the novel treatment options and advanced healthcare facilities further fuel the growth of the market. The initiatives for elderly care and urological health from the government also have an impact. Thus, the market is expected to grow steadily throughout the forecast period.

Exporters and Importers of Medical Instruments in 2023 in Europe:

|

Country |

Export Value (2023) |

Country |

Import Value (USD) (2023) |

|

Germany |

18.4 billion |

Netherlands |

14.1 billion |

|

Netherlands |

9.38 billion |

Germany |

13.1 billion |

|

Ireland |

9.0 billion |

France |

6.4 billion |

|

Switzerland |

4.5 billion |

Italy |

4.6 billion |

|

France |

3.9 billion |

Belgium |

4.5 billion |

|

Belgium |

3.2 billion |

UK |

4.4 billion |

|

Italy |

3.1 billion |

Russia |

2.0 billion |

|

UK |

3 billion |

Spain |

3.3 billion |

|

Poland |

1.4 billion |

Ireland |

1.9 billion |

|

Austria |

1.3 billion |

Austria |

1.6 billion |

|

Hungary |

1.1 billion |

Portugal |

694 million |

|

Denmark |

1.1 billion |

Sweden |

1.1 billion |

|

Finland |

924 million |

Hungary |

587 million |

|

Czechia |

917 million |

Greece |

538 billion |

Source: OEC August 2025