Outsourced Software Testing Market Outlook:

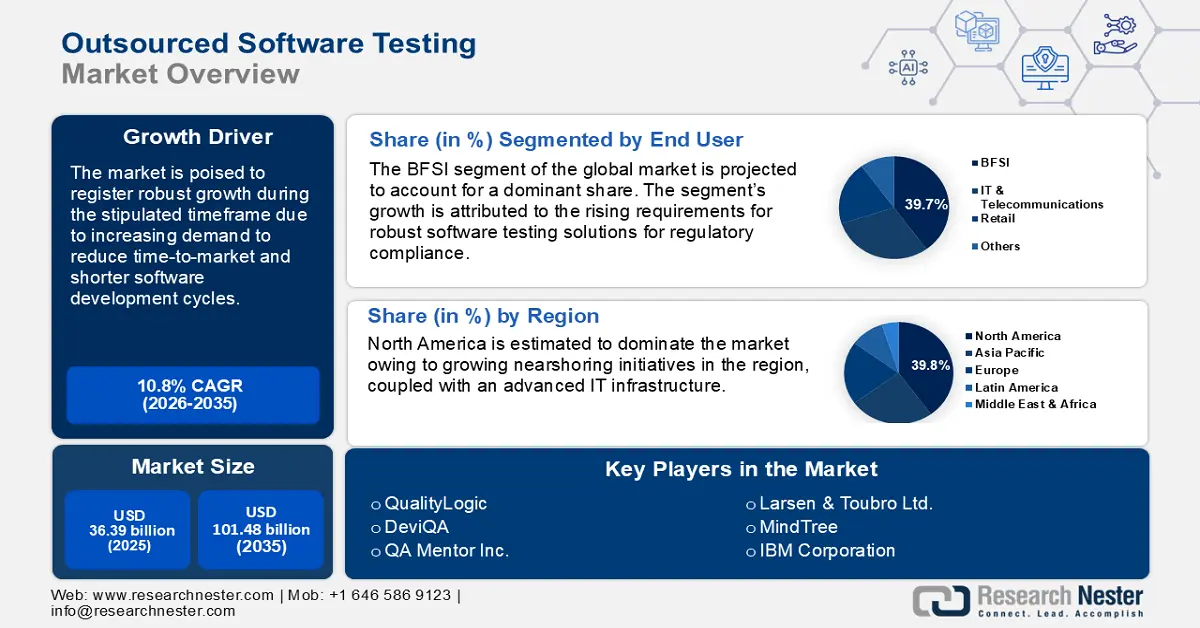

Outsourced Software Testing Market size was over USD 36.39 billion in 2025 and is poised to exceed USD 101.48 billion by 2035, growing at over 10.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of outsourced software testing is estimated at USD 39.93 billion.

A major factor for the market’s growth is the rising demand to increase time-to-market which requires third-party service providers to handle the testing of a software product or application. Furthermore, the cost-effectiveness of outsourcing drives demand for specialized third-party testing services. The outsourced software testing market is impacted by the proliferation of Agile and DevOps methodologies which stresses continuous testing throughout the software development cycle.

Additionally, key players in the sector are expected to find lucrative opportunities from the public sector, while the demand for third-party software services from the private sector is projected to increase during the forecast period. For instance, in March 2024, the U.S. Army announced a new policy to drive the adoption of agile software development practices. The new policy will institutionalize modern software development approaches across the U.S. Army, in line with the industry’s best practices creating opportunities for lucrative contracts for outsourcing software testing. The table below highlights a key trend indicating the increasing demand for software developers and quality assurance analysts.

Growth in demand for Occupations related to Third-Party Software Testing

|

Name of Occupation |

Percentage of Growth |

Forecast Timeline |

|

Software Developers Employment Growth |

17% |

2023 to 2033 |

|

Quality Assurance Analysts Employment Growth |

17% |

2023 to 2033 |

|

Testers Employment Growth |

17% |

2023 to 2033 |

Source: The U.S. Bureau of Labor Statistics

The growing demand for these occupations underscores the favorable trends for the growth of the outsourced software testing market. Additionally, the global digital transformation initiatives are a major driver of the sector’s growth. Industries such as banking, healthcare, retail, telecom, etc., are rapidly adopting digital solutions which in turn creates a burgeoning market for outsourcing for software testing. Enterprises prioritize meeting customer expectations in a competitive market landscape where positive user experience is the basis for a company’s success. The table below indicates recent investments in digitalization efforts across major established economies which is expected to drive the demand for outsourced software testing from multiple industries.

Investments and Trends in Digitalization Efforts

|

Name of the Country |

Investment Details |

Date |

|

The U.S. |

USD 140 million in federal funds as part of the Investing in America Agenda. |

December 2023 |

|

UK |

Investment package worth USD 162 million to boost digital connectivity by 2030. |

April 2023 |

|

China |

China’s digital economy reached USD 7.26 trillion and accounted for 41.5% of the country’s GDP. |

2022 |

Source: The U.S. Department of Treasury, Digital China Development Report, GOV.UK

The outsourced software testing market is predicted to hold its robust growth by the end of 2037, with mobile applications becoming integral to consumer and enterprise ecosystems. Furthermore, the introduction of AI-powered test managers is poised to usher new dynamics in software testing. AI algorithms are implemented to predict high-risk areas and automate test scenarios, which can improve an application’s time-to-market. The convergence of trends is favorable for the continued expansion of the market.

Key Outsourced Software Testing Market Insights Summary:

Regional Highlights:

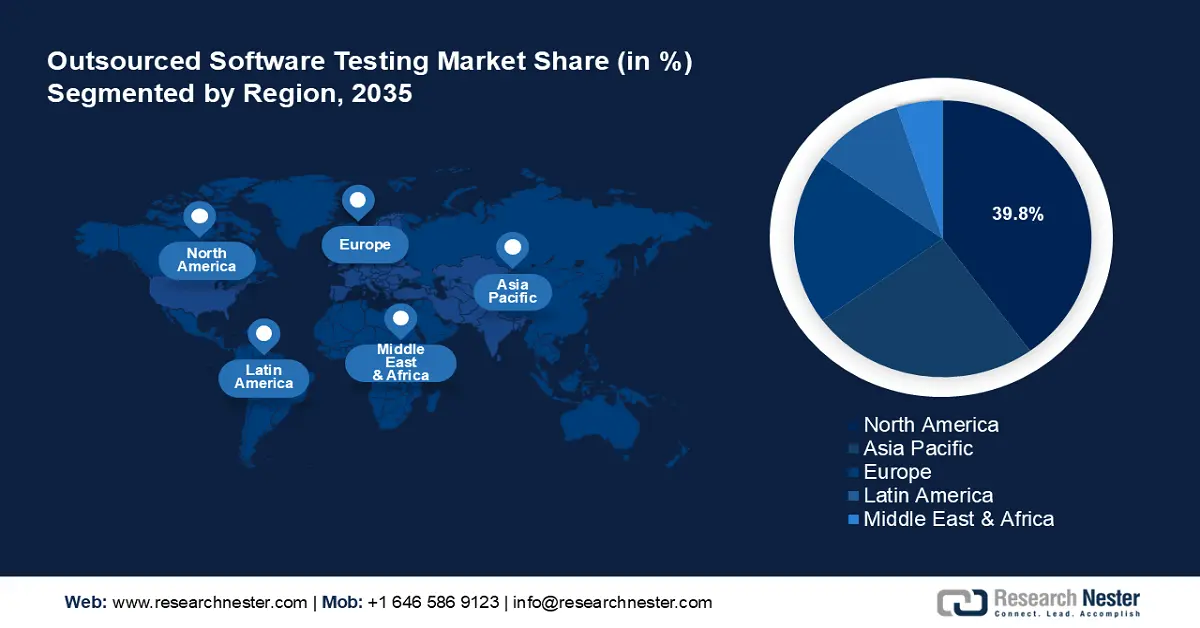

- North America leads the Outsourced Software Testing Market with a 39.8% share, supported by advanced IT infrastructure and rapid digitalization across the region, driving growth through 2035.

Segment Insights:

- The BFSI segment is anticipated to hold over 39.7% share in the Outsourced Software Testing Market by 2035, driven by the need for software security and regulatory compliance.

- The Telecommunications segment of the Outsourced Software Testing Market is expected to capture a prominent share by 2035, fueled by growing demand for issue management to mitigate adverse impacts on end users.

Key Growth Trends:

- Proliferation of mobile applications

- Rapid adoption of Agile & DevOps methodologies

Major Challenges:

- Concerns regarding data security

- Communication barriers in outsourcing

- Key Players: QualityLogic, DeviQA, QA Mentor Inc., Cigniti Technologies, Larsen & Toubro Ltd., Luvina, Mindtree, ThinkSoft, IBM Corporation, Wipro, Cognizant, iBeta Quality Assurance.

Global Outsourced Software Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 36.39 billion

- 2026 Market Size: USD 39.93 billion

- Projected Market Size: USD 101.48 billion by 2035

- Growth Forecasts: 10.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, India, China, United Kingdom, Germany

- Emerging Countries: India, China, Poland, Romania, Vietnam

Last updated on : 13 August, 2025

Outsourced Software Testing Market Growth Drivers and Challenges:

Growth Drivers

- Proliferation of mobile applications: The rapid proliferation of mobile applications is a major factor in the expansion of the outsourced software testing market With billions of mobile devices in use globally, the demand for user-friendly apps has surged and in the competitive market, where multiple apps strive to offer a similar solution to the customer, the requirement for seamless performance of applications has increased. Furthermore, businesses must find the correct test case for mobile applications based on user persona, target audience, requirements, etc.

Major players in the outsourced software testing market are investing in new suites and tools to empower developers in testing high-quality apps. For instance, in June 2024, Apple launched a suite of new tools and resources for developers to create apps on the Apple platform. Additionally, the burgeoning requirement for faster application releases and reduced development cycles is driving reliance on outsourced testing services. A key factor in the growing downloads of mobile applications is the demand for gaming apps which creates lucrative opportunities for third-party testing. For instance, in June 2021, KRAFTON announced that Battlegrounds Mobile India (BGMI), which is one of the most downloaded games in South Asia, was open for beta testing for a limited number of testers. Furthermore, the demand for advanced bug-free mobile games is expected to rise further during the forecast period, creating a steady demand for outsourced software tests. - Rapid adoption of Agile & DevOps methodologies: The surge in adoption of Agile & DevOps methodologies has redefined the software development cycle. The heightened development cycles have created a very competitive market, prompting third-party testing solutions providers to expand portfolios and the scope of their services. Furthermore, the shorter TTM benefits companies in maintaining an edge in the outsourced software testing market.

Additionally, outsourcing software testing allows businesses to bypass constraints faced by in-house teams and leverage access to advanced automation tools. It is in business interests to align with Agile and DevOps processes seamlessly, to ensure that final software products are delivered without defects. In July 2024, the Attract Group, an emerging player in the outsourced software testing market published case studies of successful application of DevOps methodologies which are highlighted in the table below.

DevOps Use Cases/Case Studies

|

Name of the Company |

Case Study |

|

Etsy |

|

|

Netflix |

|

Source: The Attract Group

The successful use cases are indicative of the growing adoption of DevOps methodologies which is expected to create new opportunities for specialized software testing services.

- Rising demand for quality assurance & cost efficiency: The growth in user demands has ensured that businesses must invest in improving quality assurance while seeking cost-effective solutions. Through outsourcing software testing tasks to third-party testers in cost-effective regions, such as India, China, Eastern Europe, etc., organizations can access skilled labor at significantly lower prices than maintaining in-house teams. Additionally, the outsourcing hubs offer a robust testing ecosystem for complex requirements. The dual advantage of quality coupled with cost-effectiveness has made outsourcing indispensable in the current software development ecosystem.

Moreover, the current business trends call for one-stop outsourcing software testing solutions instead of outsourcing a bundle of services across multiple vendors. For instance, in January 2025, Keysight Technologies Inc. launched AppFusion, as an all-in-one multi-vendor solution to assist in the reduction of operational expenses of businesses. New opportunities are expected to arise from government agencies embracing digitalization and outsourcing software testing solutions to third-party vendors. Key players in the outsourced software testing sector are investing to earn regulatory validation to cater to the public sector demands. For instance, in September 2023, Actellis Networks Inc. announced that it had achieved the Federal Information Protection Standard (FIPS) 140-2 Level 1 by NIST to cater to the software demands of U.S. Federal agencies.

Challenges

- Concerns regarding data security: Outsourcing software testing requires businesses to grant access to sensitive information to third-party vendors. The access to source code and user data raises data security concerns and any breach can negatively impact the outsourced software testing market’s growth. Organizations invest in NDAs and secure communication protocols to curb these risks, but the challenge arises in maintaining compliance to region-specific data privacy regulations. Additionally, testing solutions providers in regions with cost-effective solutions may sometimes have lax data privacy laws which can be detrimental to protecting intellectual property.

- Communication barriers in outsourcing: Outsourcing software testing to third-party solutions providers requires robust communication channels. Businesses require detailed workflows and timely updates to mitigate challenges in communication breakdowns. Additionally, testing solutions providers can face challenges in integrating evolving technologies to maintain profit by reducing investments in advanced tools. This can lead to sub-par testing support which can lead to businesses investing to build robust in-house testing teams. Market players who are unable to keep pace with the technological advancements risk losing market share.

Outsourced Software Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.8% |

|

Base Year Market Size (2025) |

USD 36.39 billion |

|

Forecast Year Market Size (2035) |

USD 101.48 billion |

|

Regional Scope |

|

Outsourced Software Testing Market Segmentation:

End User (BFSI, IT & Telecommunications, Retail, Others)

By 2035, BFSI segment is expected to capture over 39.7% outsourced software testing market share by the conclusion of the stipulated timeframe. A major factor in the segment’s growth is the requirement for software security and regulatory compliance. Comprehensive software testing solutions that can provide security assessments are expected to experience greater demand from the BFSI sector. Additionally, national banks are increasingly relying on third-party service providers for new mobile applications, and maintenance of websites that experience high user traffic. Globalization has ensured that international banks outsource testing requirements to third-party vendors that can provide solutions for domestic and international user clients.

Furthermore, financial institutions are striving to maintain pace with the rapid digitalization trends. Banks are competing to expand revenue shares by launching easy-to-use mobile applications that boost user experience. For instance, in November 2023, the State Bank of India (SBI) launched its online banking app, Yono Global, in the U.S. and Singapore. Again, in November 2024, SBI partnered with APIX to launch the SBI innovation hub for fintechs and financial institutions to design next-generation financial solutions. A user-friendly app in the BFSI sector ensures that the financial institution maintains an edge over its competitors, and the trends are feasible for third-party testing solutions providers to experience steady demand during the market’s forecast period.

The telecommunications segment of the outsourced software testing market is projected to account for a prominent share by the end of 2035. The segment is poised to provide lucrative opportunities within the stipulated forecast period owing to the growing demand for issue management to mitigate adverse impacts on end users. Outsourcing enables businesses in the telecommunications sector to focus on their core competencies while ensuring that the software meets quality standards.

Software Testing Type (Software, Hardware)

The software segment in the outsourced software testing market is predicted to expand its revenue share during the forecast period. Key players in the market are striving to offer multiple software testing types tailored to ensure the functionality and quality of software applications creating profitable opportunities within the segment. Outsourcing software testing allows businesses to leverage specialized expertise. Additionally, the software testing type has multiple segments, which allows vendors to offer various tailored solutions from non-functional testing to manual testing. An emerging trend within the market is the growing demand for outsourcing software testing solutions from the healthcare industry. For instance, in August 2024, Sonata Software announced a multi-million-dollar, multi-year deal as a strategic outsourcing partner from a U.S.-based healthcare & wellness company.

Our in-depth analysis of the global outsourced software testing market includes the following segments:

|

End user |

|

|

Software Testing Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Outsourced Software Testing Market Regional Analysis:

North America Market Forecast

North America outsourced software testing market is expected to account for revenue share of around 39.8% by 2035 and account for the largest revenue share in the global market. The market’s growth is attributed to the presence of advanced IT infrastructure and rapid digitalization across the region. Furthermore, businesses with hubs in North America are seeking cost-effective software testing solutions, and to reduce TTMs of their products, creating lucrative opportunities for outsourcing software testing requirements. In August 2024, the U.S. Bureau of Labor Statistics reported that the overall employment in computer and IT occupations is poised to grow faster than the average for all occupations from 2023 to 2033, indicating a burgeoning market for software developers, and quality assurance analysts.

The U.S. outsourced software testing market is projected to hold a dominant share in North America. The market is characterized by strong demand for quality assurance owing to competitiveness in the region, where businesses seek to gain an edge by deploying solutions in the market faster than their competitors. Furthermore, the proliferation of automation and AI-based testing tools to streamline the software development process has assisted key players in North America in forging long-term relationships with clients.

Key players in the region that offer automated analytics-driven software testing are expected to expand their revenue share. QualityLogic, a major player in the U.S. outsourced software testing market, published the State of Digital Accessibility Report for 2024, highlighted that adoption of proactive accessibility practices during planning and design phases rose to 61% in 2024 from 52% in 2023, and the proportion of respondents who addressed digital accessibility after the product is live decreased to 6% in 2024. The findings bode well for the continued growth of the sector in the U.S. with more firms seeking to outsource testing requirements to boost ROI.

The Canada outsourced software testing market is poised to expand during the forecast period. Businesses in Canada are competing with third-party software testing solutions providers from APAC, and improving the scope of their software testing solutions to maintain their revenue share in the global market. Additionally, the outsourced software testing market in Canada benefits from the emerging nearshoring trends prompting businesses in the U.S. to seek software testing solutions in Canada. Moreover, the exchange rate is beneficial for organizations based in the U.S. with the strong value of U.S. dollar, allowing better ROI. Nearshoring to Canada can navigate communications challenges that may emerge in outsourcing to APAC, while in 2020, the country led globally in adult population with tertiary education which indicates the abundance of skilled workforce in the country.

APAC Market Forecast

The APAC outsourced software testing market is expected to account for the fastest growth during the forecast period. The cost-effective third-party software testing solutions are a significant factor in the market’s growth in APAC, making it a lucrative destination for software testing. In July 2024, EPAM, a leading player in the outsourced software testing sector, released an estimate indicating the 2023 hourly rate for South Asia at USD 24 to USD 71 per hour and Southeast Asia at USD 18 to USD 70 per hour which is lesser than the hourly rate in North America, which stood at USD 62 to USD 209 per hour. The comparatively lower testing costs in APAC leverage established North America and Europe players to outsource software testing requirements, creating a competitive regional sector.

The India outsourced software testing market is poised to register the largest revenue share in APAC. A major driver of the industry’s growth in India is attributed to the expansive IT services sector in the country coupled with a vast pool of skilled professionals. Domestic companies in India are investing to expand the scope of services offered to attract larger clients and forge long-term relationships. The global growth in mobile applications is beneficial for the sector’s expansion in India as more businesses seek to reduce TTM. In April 2023, the Reserve Bank of India (RBI) issued a draft Master Direction setting out a risk management framework for the outsourcing of IT services with the new framework set to benefit third-party risk management in the BFSI sector.

The China outsourced software testing market is projected to increase its revenue share during the forecast period. China is undergoing major investments in digital transformation which makes it a significant market for outsourcing software testing solutions. The rapid adoption of mobile applications, cloud computing, and AI in China has created a burgeoning market requiring robust testing of a product’s software development cycle. Additionally, China has a large talent pool of skilled software developers and offers comparatively cost-effective solutions which makes it a lucrative market to outsource software testing requirements. The Ministry of Industry and Information Technology of China stated that Big Tech in China employs more than 7 million software engineers, AI trainers, data scientists, and programmers indicating a lucrative outsourcing ecosystem.

Key Outsourced Software Testing Market Players:

- QualityLogic

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DeviQA

- QA Mentor Inc.

- Cigniti Technologies

- Larsen & Toubro Ltd.

- Luvina

- Mindtree

- ThinkSoft

- IBM Corporation

- Wipro

- Cognizant

- iBeta Quality Assurance

The outsourced software testing market is set to expand during the slated timeframe. Major players in the market are investing in service diversification to strengthen position in the industry. Additionally, the advent of AI-driven testing solutions has led to evolving client demands. Businesses are expanding their global presence through collaborations and acquisitions to offer more cost-effective solutions. In January 2025, Accenture accounted the acquisition of AOX, which is a German company specializing in embedded software for carmakers, and the acquisition is expected to improve Accenture’s capabilities to assist automotive clients in solving issues of transitioning to software-defined vehicles.

Here are some key players in the outsourced software testing market:

Recent Developments

- In August 2024, Pick n Pay announced 95% automation in software testing by leveraging OpenText AI innovation. The testing times have been reduced by three days improving its digital services for e-commerce customers.

- In August 2024, AudioEye, Inc. announced the availability of its Accessibility Software Development Kit. The software development testing tool is set to assist developers address accessibility issues early in the software development life cycle to publish web content that is accessible to specially abled people.

- Report ID: 6989

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Outsourced Software Testing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.