Outpatient Oncology Infusion Market Outlook:

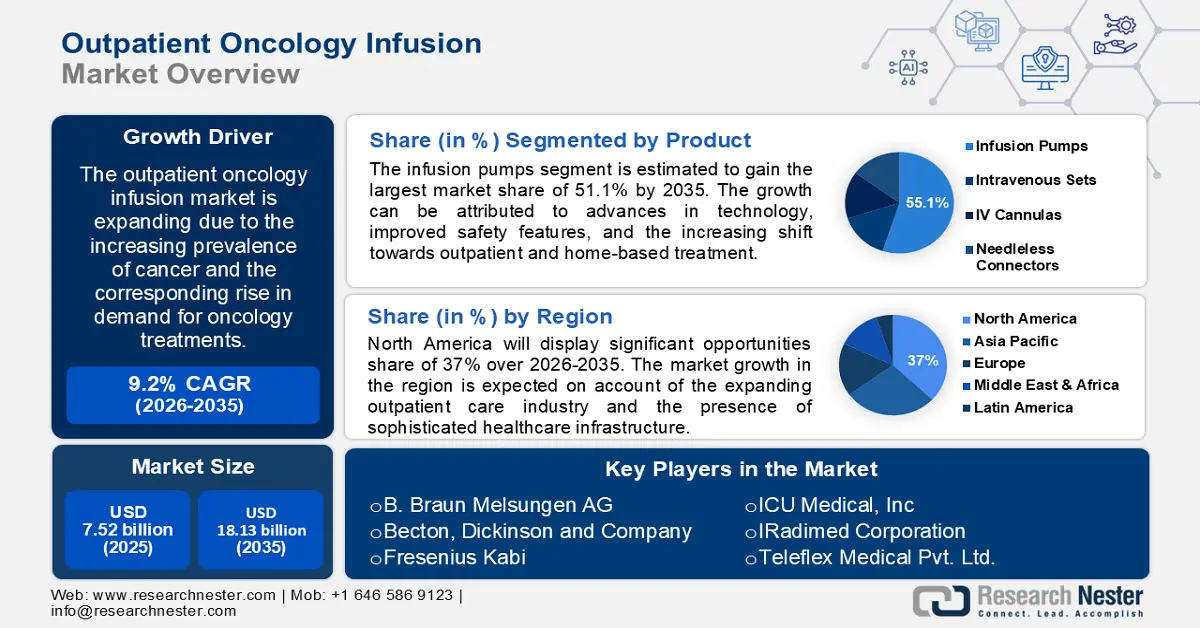

Outpatient Oncology Infusion Market size was over USD 7.52 billion in 2025 and is projected to reach USD 18.13 billion by 2035, witnessing around 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of outpatient oncology infusion is evaluated at USD 8.14 billion.

The outpatient oncology infusion market is driven by the increasing prevalence of cancer and the corresponding rise in demand for oncology treatments. The global incidence of cancer continues to rise due to aging populations, lifestyle, and environmental factors. As more individuals are diagnosed with cancer, there is a greater need for oncology treatments, including infusion therapies administered in outpatient settings. A 2024 report published by the World Health Organization (WHO) stated that in 2022, there were about 20 million new cancer cases and 9.7 million deaths, and over 35 million new cancer cases are expected in 2050. There is a growing preference among patients and healthcare providers for outpatient care due to its cost-effectiveness, convenience, and ability to provide specialized treatments without hospitalization. This shift has led to the expansion of outpatient infusion settings specializing in oncology treatments.

Key Outpatient Oncology Infusion Market Insights Summary:

Regional Highlights:

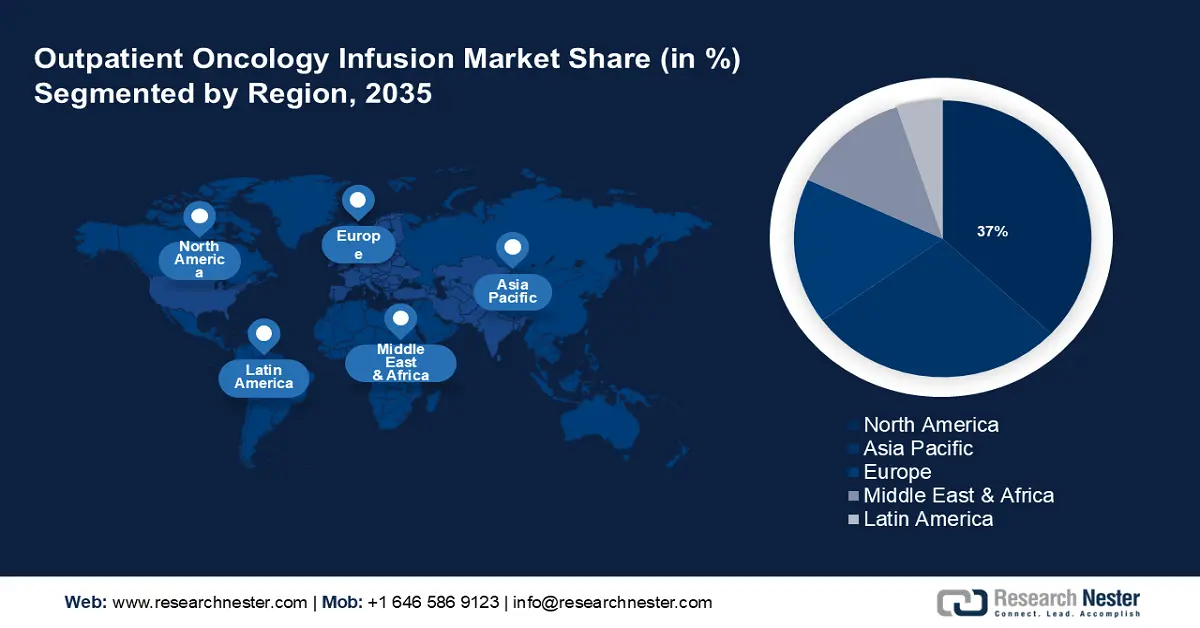

- The North America outpatient oncology infusion market is anticipated to capture 37% share by 2035, driven by the expanding outpatient care industry and advanced healthcare infrastructure.

- The Asia Pacific market will exhibit tremendous growth during the forecast timeline, driven by rising telemedicine adoption and initiatives to enhance cancer treatment accessibility.

Segment Insights:

- The infusion pumps segment in the outpatient oncology infusion market is projected to achieve significant growth till 2035, attributed to precision drug delivery, safety features, and a shift to outpatient and home care.

- The chemotherapy segment in the outpatient oncology infusion market is projected to hold a 32.10% share by 2035, driven by its widespread use across multiple cancers and suitability for outpatient infusion.

Key Growth Trends:

- Advancement in oncology treatments

- Economic factors

Major Challenges:

- Complex reimbursement processes

- Shortage of skilled professionals

Key Players: B. Braun Melsungen AG, Becton, Dickinson and Company, Fresenius Kabi, ICU Medical, Inc., IRadimed Corporation, Teleflex Medical Pvt. Ltd., Smiths Medical, Inc., Medtronic plc.

Global Outpatient Oncology Infusion Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.52 billion

- 2026 Market Size: USD 8.14 billion

- Projected Market Size: USD 18.13 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Outpatient Oncology Infusion Market Growth Drivers and Challenges:

Growth Drivers

- Advancement in oncology treatments - Technological advancements and innovations in cancer therapies, such as immunotherapies, targeted therapies, and personalized medicines, often have manageable side effects and are suitable for outpatient administration. For instance, the administration of chimeric antigen receptor (CAR)-T cell therapies in outpatient settings is rapidly expanding and appears to have comparable outcomes in safety, efficacy, and QoL to inpatient administration while reducing the economic burden. Moreover, the development of portable and wearable infusion pumps allows for continuous or periodic infusion of therapies in an outpatient setting. These devices enhance patient mobility and comfort.

- Economic factors - Economic factors are significantly driving the outpatient oncology infusion market by promoting cost savings, improving insurance coverage, providing financial incentives for healthcare providers, and enhancing patient affordability. These factors contribute to the growth and expansion of outpatient infusion services, making them a more viable and attractive option within the healthcare system. For instance, a multicenter study between 2020 and 2022 on cancer patients conducted by top medical institutions in India observed that approximately 60% of patients seeking outpatient treatment were found to be covered under health insurance schemes.

- Growing trend of remote patient monitoring (RPM) - RPM enables healthcare providers to constantly monitor patients’ vital signs, treatment responses, and side effects. This real-time data helps in making timely adjustments to therapy, enhancing the effectiveness of outpatient treatments. Additionally, RPM tools often include features that engage patients in their own care, such as reminders for medication, self-monitoring instructions, and direct communication channels with healthcare providers. Increased patient engagement is linked to higher adherence to prescribed therapies, which is crucial for the success of outpatient treatments. According to estimates, in 2023, 72 million people were using the RPM system. By 2027, 120.5 million patients worldwide, or 1.4% of the world's population, will utilize RPM devices.

Challenges

- Complex reimbursement processes - For outpatient oncology infusion therapy, there are multiple steps involved in the reimbursement process, such as pre-authorization, extensive documentation, and compliance with different payment standards. Moreover, frequent changes in reimbursement policies and regulations can lead to confusion and administrative challenges for healthcare providers, limiting their capacity to administer and manage outpatient oncology infusion treatments efficiently. As a result, navigating the complicated reimbursement landscape remains a substantial barrier to growing and expanding the outpatient oncology infusion market.

- Shortage of skilled professionals - Outpatient oncology infusion therapies frequently require highly competent oncology staff who are trained in administering complex infusions and managing side effects. A shortage of skilled professionals can impact outpatient oncology infusion market expansion. Furthermore, recruiting and retaining qualified staff can be challenging, particularly in underserved or rural areas.

Outpatient Oncology Infusion Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 7.52 billion |

|

Forecast Year Market Size (2035) |

USD 18.13 billion |

|

Regional Scope |

|

Outpatient Oncology Infusion Market Segmentation:

Product Segment Analysis

Infusion pumps segment is expected to account for outpatient oncology infusion market share of around 51.1% by 2035. The growth can be attributed to advances in technology, improved safety features, and the increasing shift towards outpatient and home-based treatments. Advanced infusion pumps provide high-precision drug delivery, which is critical for managing complex oncology treatments. This precision reduces the likelihood of dosage errors and ensures that patients receive the appropriate dose of medication. These pumps come with programmable features that allow healthcare providers to set specific infusion rates, delivery schedules, and dose adjustments. This flexibility is crucial for managing various chemotherapy regimens and individual patient needs.

Additionally, several infusion pump manufacturers are incorporating cutting-edge features, like wireless communication, connectivity to electronic health records, and compatibility with other medical devices. The key players are focused on accrediting approvals to launch new products and gain a competitive edge. For instance, in 2022, Baxter International Inc. received FDA approval for its revolutionary Novum IQ syringe infusion pump with Dose IQ Safety Software, which represents the company's most recent innovations in infusion therapy.

Application Segment Analysis

By 2035, lung cancer segment in the outpatient oncology infusion market is expected to account for significant revenue. Lung cancer (small cell and non-small cell) is the main cause of cancer-related mortality. A report by the American Cancer Society stated that in 2023, around 238,340 individuals were diagnosed with lung cancer, and 127,070 died from the disease in the United States.

The rise in lung cancer cases and the introduction of new therapies requiring frequent infusions drive the demand for outpatient infusion services. Many healthcare providers are expanding their outpatient infusion centers to meet this growing demand. Immunotherapies are increasingly used for lung cancer treatment, which generally involves outpatient infusions and is often part of long-term treatment plans.

Therapy Segment Analysis

Chemotherapy segment is anticipated to account for outpatient oncology infusion market share of around 32.1% by 2035. Chemotherapy is used to treat a broad range of cancers, including breast, lung, colon, and lymphoma. Its widespread use ensures a high demand for infusion services. Many chemotherapy treatments require multiple cycles of infusions, which contributes to the need for ongoing outpatient care. Outpatient infusion allows patients to receive chemotherapy without the need for hospitalization, resulting in a better quality of life and less disruption to daily tasks. Patients are able to receive treatment in a less clinical and more comfortable setting, which can assist in reducing the psychological burden associated with cancer treatment.

Our in-depth analysis of the outpatient oncology infusion market includes the following segments:

|

Product |

|

|

Application |

|

|

Therapy |

|

|

Mode |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Outpatient Oncology Infusion Market Regional Analysis:

North America Market Insights

North America industry is likely to dominate majority revenue share of 37% by 2035. The market growth in the region is expected on account of the expanding outpatient care industry and the presence of sophisticated healthcare infrastructure. As a result, outpatient facilities and services are growing in the region, which has enabled medical centers to lower the number of visits and reduce healthcare costs for cancer patients. For instance, the North America outpatient care landscape is anticipated to expand by around 4% between 2024 and 2029.

Additionally, in the U.S., the outpatient oncology infusion market is constantly changing owing to growing healthcare spending. With increased funds, researchers can focus on innovation, and offer more precise and effective options for patients. A 2024 report published by the American Medical Association stated that healthcare spending in the U.S. increased by 4.1% in 2022.

Furthermore, in Canada, there are currently more IV infusion therapies approved than ever before, and several more are being considered for approval in the future, which may propel improvements in cancer treatment and aid in the market's expansion.

APAC Market Insights

Asia Pacific will encounter tremendous growth in the outpatient oncology infusion market owing to the increasing adoption of telemedicine. Through 2024, telehealth adoption is anticipated to soar in the region, enabling healthcare professionals to democratize the delivery of outpatient oncology infusion services easily in distant areas. Several countries are expected to reach telehealth adoption rates of over 70 percent by 2024, with China leading the way at 76 percent. Besides this, regional governments have pledged to create legislation and carry out initiatives to enhance cancer care and treatment accessibility.

Telemedicine adoption in Japan has accelerated in recent years, driven by advancements in technology and a push to improve healthcare accessibility. The government and healthcare organizations have increasingly recognized the value of telemedicine, particularly in the context of chronic disease management.

The government of China launched the National Cancer Control Program to reduce the cancer burden through early detection, treatment, and prevention. This program includes efforts to enhance outpatient care and support for cancer patients.

Outpatient Oncology Infusion Market Players:

- Baxter International Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- Fresenius Kabi

- ICU Medical, Inc

- IRadimed Corporation

- Teleflex Medical Pvt. Ltd.

- Smiths Medical, Inc.

- Medtronic plc

Numerous important companies in the outpatient oncology infusion market are starting several tactical projects to increase their market share and strengthen their positions in the industry. It is predicted that the top five companies will control the majority of the outpatient oncology infusion market share by taking calculated risks, expanding, forming agreements, and participating in joint ventures.

Recent Developments

- In June 2023, B. Braun Melsungen AG introduced the next generation of infusion management software, DoseTrac Enterprise Infusion Management Software that enables users to control their infusion pumps from a single, central application, and can contribute to better data management, which might reduce the need for clinical IT infrastructure related to infusion pumps.

- In August 2023, ICU Medical Inc., a global leader in medical device development and sales, has received 510(k) regulatory clearance from the FDA for the Plum Duo infusion pump with LifeShield infusion safety software.

- Report ID: 6292

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Outpatient Oncology Infusion Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.