Outdoor TV Market Outlook:

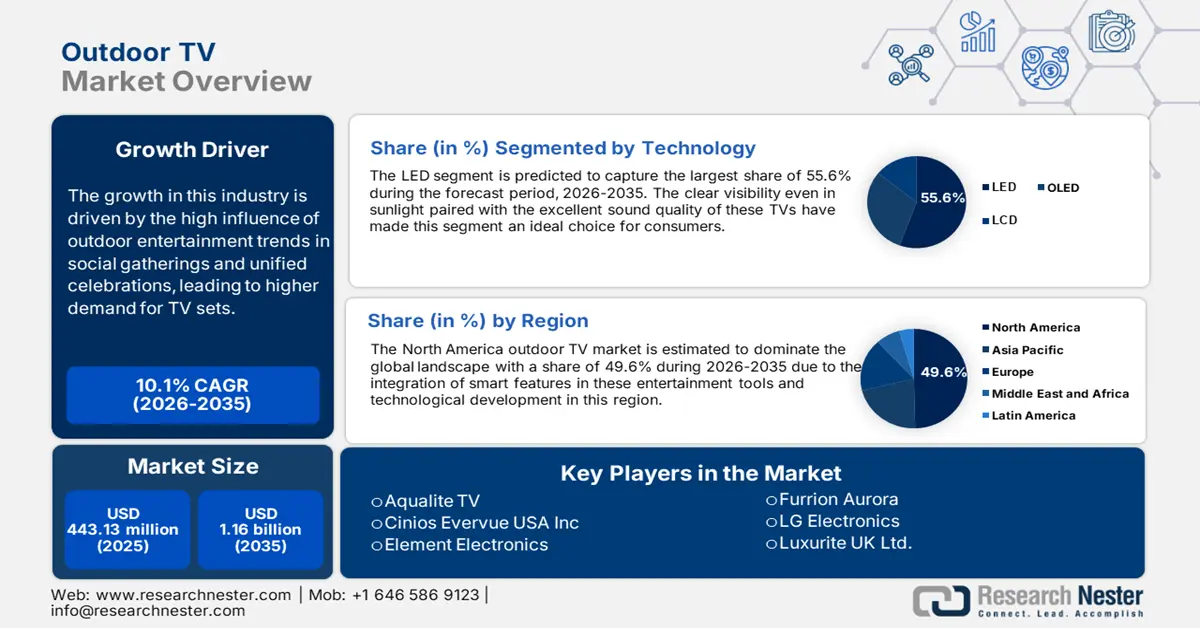

Outdoor TV Market size was valued at USD 443.13 million in 2025 and is set to exceed USD 1.16 billion by 2035, expanding at over 10.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of outdoor TV is evaluated at USD 483.41 million.

The growth in this industry is driven by the high influence of outdoor entertainment trends in social gatherings and unified celebrations. This has further led to higher demand for TV sets to be used in outdoor living spaces including backyards and patios. The new-generation systems are equipped with smart features that seamlessly enhance the user experience by integrating connectivity.

The popularity of watching sports, concerts, and other events outside the residential territory has significantly fueled demand in the outdoor TV market. The new generation TVs come with larger screens and high picture clarity, making them suitable for streaming big sports events. Thus, the usage of these TV systems in live-streaming major events to grab larger audiences has become more frequent than ever. For instance, in November 2024, The Outdoor Screen Company collaborated with Casa Dundee to set up a 3m x 2m Aqualite P.5 LED screen, offering an outdoor football viewing experience. The team aims to boost business in the private street seating area by captivating football enthusiasts while promoting the flexibility and reliability of the fully weatherproof and high-resolution display.

Key Outdoor TV Market Insights Summary:

Regional Highlights:

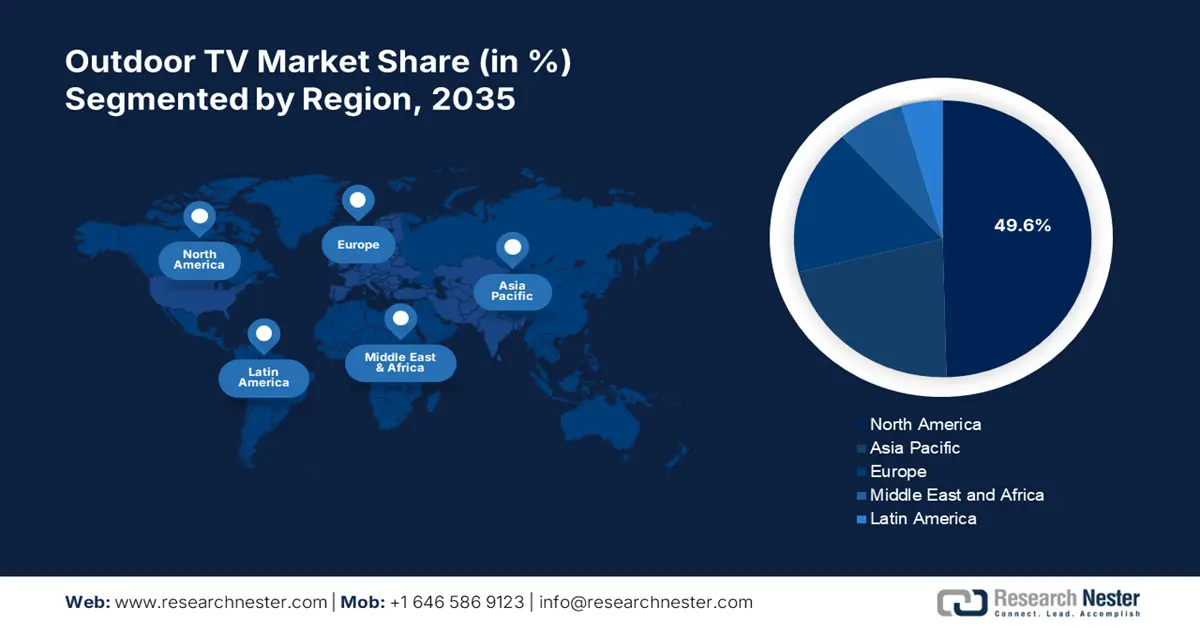

- North America leads the Outdoor TV Market with a 49.6% share, fueled by integration of smart features and awareness about outdoor TVs in the region, driving growth through 2026–2035.

- The APAC outdoor TV market is anticipated to experience remarkable growth through 2035, fueled by rapid urbanization and increasing popularity of outdoor living culture.

Segment Insights:

- The LED segment of the Outdoor TV Market is forecasted to secure over 55.6% share by 2035, supported by its suitability for outdoor conditions with clear visibility and excellent sound quality.

- The Medium Screen Size segment is forecasted to achieve significant market share by 2035, driven by the affordability and excellent performance of medium-sized TVs for group viewing.

Key Growth Trends:

- Improved visibility and durability

- Enlarging affluent consumer base

Major Challenges:

- Expensive purchase and installation

- Competition in functionality

- Key Players: Aqualite TV, Cinios Evervue USA Inc, Element Electronics, Furrion Aurora, LG Electronics, Luxurite UK Ltd., Mirage Vision, Peerless AV, Samsung Electronics, Sealoc, Seura, SkyVue, SunBrite TV, Sylvox, Weatherized TVs.

Global Outdoor TV Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 443.13 million

- 2026 Market Size: USD 483.41 million

- Projected Market Size: USD 1.16 billion by 2035

- Growth Forecasts: 10.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (49.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, China, Japan, Germany

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Outdoor TV Market Growth Drivers and Challenges:

Growth Drivers

-

Improved visibility and durability: The advancements in screening and audio technologies have inflated the demand in the outdoor TV market. Features such as high brightness levels, anti-glare screens, and waterproofing have made these systems an attractive outdoor entertainment medium for consumers. In addition, many leaders now have introduced smart functionalities such as streaming apps, voice assistance, and connectivity options, making them perfect for outdoor use. For instance, in June 2024, ProofVision launched an outdoor smart TV range, Lifestyle Plus NX televisions in three screen sizes, 43-inch, 55-inch, or 65-inch. The 4K UHD resolution offers sharp image quality in both residential and commercial outdoor use.

-

Enlarging affluent consumer base: With the increment in disposable incomes in developing countries, investments in the outdoor TV market have increased. According to the PIB report published in February 2024, the gross national disposable income growth in 2022-2023 was estimated to be 14.5% greater than in 2021-2022. Consumers are now interested in creating audio-visual outdoor experiences as a statement of a luxurious lifestyle. Outdoor TVs are often considered a premium entertainment tool that can fit in backyards, patios, and gardens. Such flexibility in operation has made these TV sets appealing to consumers, expanding the product reach.

Challenges

-

Expensive purchase and installation: The high cost of sets is one of the major setbacks for maximum roll-out in the outdoor TV market. The specialized build quality, increased brightness, weatherproofing, and enhanced audio-video features are the reason for the pricing being higher than the indoor models. This may further become an economic barrier for consumers with a limited budget. In addition, these are only used for occasions, which may make buyers rethink before investing such an amount of money in this sector.

-

Competition in functionality: The first comparison of the outdoor TV market starts with the indoor sets, which may further hinder the investment. The industry is still a niche compared to traditional outdoor models such as projectors or portable devices. The installation of these outdoor entertainment packages is also more complex than indoor TVs due to the difficulty in finding proper power supply and connectivity. Moreover, a lack of resources while installing these sets may push consumers to switch to alternatives.

Outdoor TV Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.1% |

|

Base Year Market Size (2025) |

USD 443.13 million |

|

Forecast Year Market Size (2035) |

USD 1.16 billion |

|

Regional Scope |

|

Outdoor TV Market Segmentation:

Technology (LED, OLED, LCD)

Based on technology, the LED segment is anticipated to hold over 55.6% outdoor TV market share by the end of 2035. The growth in this segment is majorly driven by the suitability of LED TVs in outdoor conditions. The clear visibility even in sunlight paired with the excellent sound quality of these TVs have made this segment an ideal choice for consumers. The leaders are now focusing on developing more compact, durable, and energy-efficient displays for these TVs to withstand harsh weather while offering premium entertainment. For instance, in August 2023, Samsung launched a 110-inch Micro LED TV, specially designed for outdoor viewing, suitable for all weather conditions in India.

Screen Size (Small (upto 40 inches), Medium (41-65 inches), Large (66 inches and above))

In terms of screen size, the medium segment is expected to hold a significant share of the outdoor TV market by the end of 2035. The affordable price range and excellent performance have led to increased demand for these sized TVs. Generally consisting of 41 to 65-inch displays, the sets offer the advantage of easy positioning and group viewing without being overly expensive. These screens are built to deliver 4K resolution, better brightness levels, and weather resistance, making them the perfect fit for consumers with middle-class economic backgrounds. However, medium-sized outdoor TV sets have limitations in offering top-of-the-line HDR performance or cutting-edge color accuracy as the premium models.

Our in-depth analysis of the global market includes the following segments:

|

Technology |

|

|

Screen Size |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Outdoor TV Market Regional Analysis:

North America Market Analysis

North America industry is likely to hold largest revenue share of 49.6% by 2035. Integration of smart features in these entertainment tools due to technological development in this region is one of the major reasons behind the growth. The awareness about the technical operations of these sets among users is also inflating the demand in this sector. Many companies are now considering this region to be a good marketplace for business expansion. For instance, in April 2024, Peerless-AV launched Neptune Full Sun Outdoor Smart TVs, equipped with a free commercial-grade Outdoor Tilting Wall Mount. The design of these sets is dedicated to serving all kinds of conditions in North America, solidifying the company’s position in this region.

The U.S. is expected to garner remarkable revenue in the outdoor TV market due to the increasing demand for premium entertainment resources. The growing interest in luxury outdoor living is propelling the demand for premium viewing experiences. This has further inspired domestic leaders to introduce innovative features in these sets. For instance, in May 2022, the subsidiary of Snap One Holdings, SunBrite TV launched the Veranda 3 Series. The Android TV is equipped with built-in Wi-Fi, allowing users to access their favorite channels without the need for a wired LAN connection.

The outdoor TV market is presenting great scope for Canada due to the increased popularity of sports, movie nights, and social gatherings. This further contributes to notable growth in this sector due to the enlarged consumer base. Many global leaders are now investing to improve their product lines with better connectivity and durability. Further, the trend of high-end, integrated outdoor spaces is inflating the demand for high-quality TV options. This encourages leaders to implement smart and premium features in the TV sets.

APAC Market Statistics

The Asia Pacific outdoor TV market is poised to generate remarkable revenue during the forecast period due to the inflated demand for luxury items, caused by rapid urbanization. The increasing popularity of outdoor living culture is highly influenced by the favorable mild climate of this region. This is further inspiring homeowners to elevate their outdoor space by investing in entertainment tools including TV sets. Many developing countries are now taking it as an opportunity to create a profitable marketplace for both international and domestic leaders.

India is paving its way to fostering greater opportunities for global leaders to expand their outdoor TV market. The increasing amount of disposable income and enlarging volume of the middle-class economy are creating a large consumer base for many suppliers. For instance, in January 2024, Sony launched the EZ20L series to grow the family of professional BRAVIA displays in India. This launch aims to fit all requirements and budget lines, suitable for the country’s mixed economic culture.

China is advancing its progress in the global outdoor TV market by outstretching the reach of its domestic leaders. The leaders are focused on introducing more innovative features in the TV sets to attract a large range of consumers. For instance, in January 2023, Skyworth launched the world's First Outdoor Google TV series at the CES event in Las Vegas. The new Clarus Outdoor S1 Full Sun Mini-LED 4K Series features IP66-rated dust and weather protection, and an IK10-rated impact-resistant glass panel, making it suitable for any outdoor condition.

Key Outdoor TV Market Players:

- Aqualite TV

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cinios Evervue USA Inc

- Element Electronics

- Furrion Aurora

- LG Electronics

- Luxurite UK Ltd.

- Mirage Vision

- Peerless AV

- Samsung Electronics

- Sealoc

- Seura

- SkyVue

- SunBrite TV

- Sylvox

- Weatherized TVs

The key players in the outdoor TV market are extending their research and development to create a pipeline of affordable sets to capture the maximum volume of consumers. This further creates an opportunity for newcomers to introduce their additional and innovative features in delivering unforgettable outdoor experiences. Many global companies are now focusing on offering better picture quality by implementing high-resolution displays in the TVs. For instance, in August 2023, Samsung launched an 85-inch Terrace Outdoor Neo QLED 4K TV with improved weather resistance and video quality. The new IP56 rating for durability offers protection from direct sunlight, making it functional even on the sunniest days. Such key players include:

Recent Developments

- In June 2024, Furrion launched a new lineup, Aurora Full Sun Pro Series to solidify its leading position in the market. The 4K UHD LED outdoor smart TVs are designed to be used in both commercial and residential spaces in direct sunlight. The sets are perfect for outdoor living with superior visual performance and resilience.

- In April 2024, Samsung launched its new flagship offerings, Full Sun and Partial Sun models, updating the lineup of its Terrace outdoor TVs at the CEDIA Expo. The new units are equipped with Neo QLED display with Mini LEDs that can upscale any SD/HD content into 4K.

- Report ID: 6757

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Outdoor TV Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.