OTC Consumer Health Products Market Outlook:

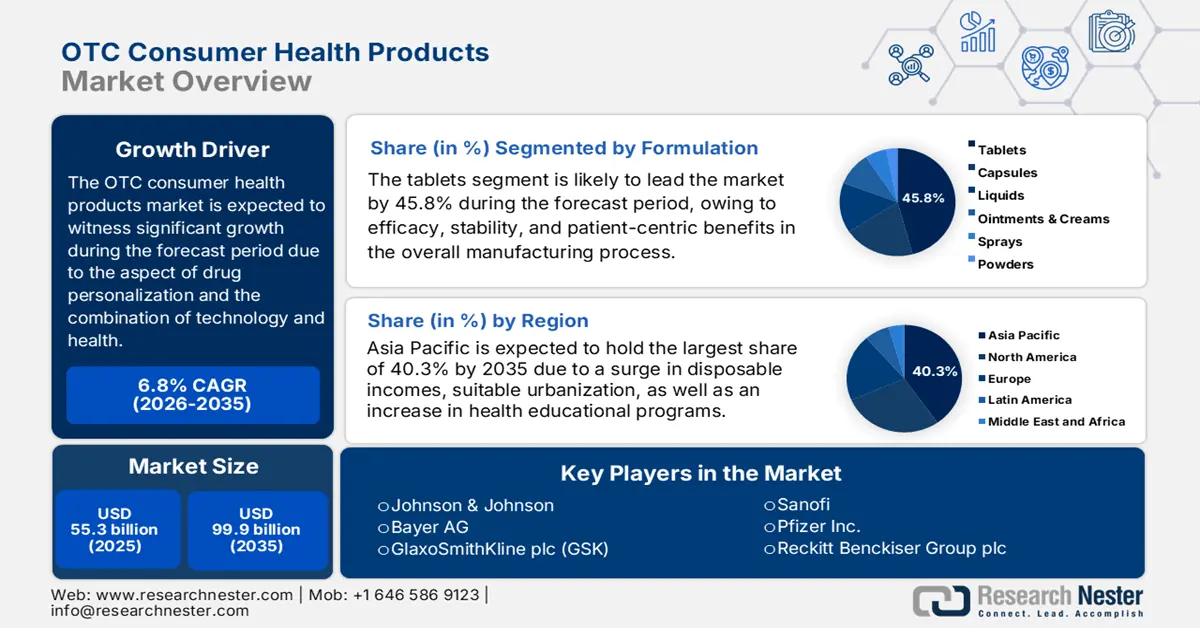

OTC Consumer Health Products Market size was over USD 55.3 billion in 2025 and is estimated to reach USD 99.9 billion by the end of 2035, expanding at a CAGR of 6.8% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of OTC consumer health products is assessed at USD 59 billion.

The international market is continuously experiencing increased attention, owing to factors such as increased focus on personalization as well as customization, the convergence of technology and health, and the aspect of the natural and clean label movement. According to an article published by NLM in October 2022, the adoption of unstructured data and healthcare patient profiling has been successful, with almost 80% of health data currently residing in semi-structured or unstructured formats. Besides, a pulse oximeter is considered to be suitable to measure the oxygen saturation level, which is either above or below 89%, thus enhancing the market’s exposure.

Furthermore, the differentiation between offline and online commerce is readily dissolving, and the omnichannel channel strategy is rising, which positively impacts the market internationally. Besides, as per an article published by the U.S. FDA in September 2025, the regulatory organization has put forth the OTC Monograph Drug User Fee Program (OMUFA), stating USD 34,166 as of 2024, and USD 37,556 as of 2025 fee rates. This also caters to contract manufacturing organization (CMO) fee amounting to USD 22,777 as of 2024 and USD 25,037 as of 2025. Therefore, with the presence of such bodies, the market is poised to witness continuous growth with a suitable pricing strategy.

Key OTC Consumer Health Products Market Insights Summary:

Regional Insights:

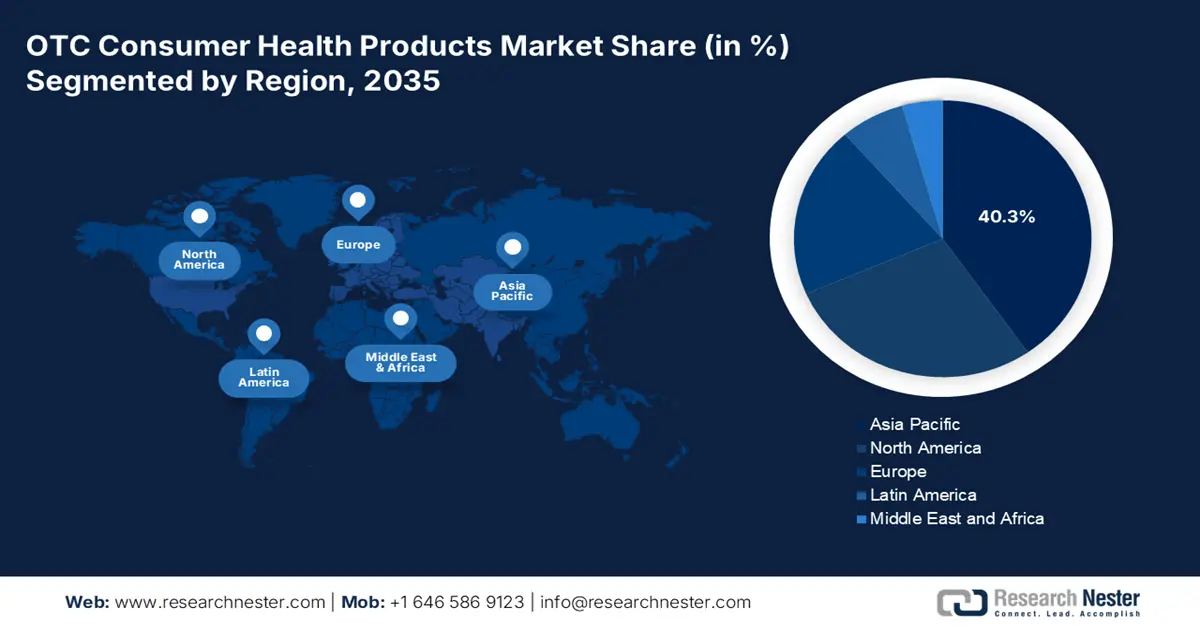

- Asia Pacific is projected to hold 40.3% share by 2035, owing to rising disposable incomes, urbanization, and increased health literacy.

- Europe is anticipated to emerge as the fastest-growing region during 2026–2035, impelled by a growing elderly population, active self-care adoption, and healthcare digitalization.

Segment Insights:

- Tablets segment is projected to account for 45.8% share by 2035, driven by its superior patient-centric benefits, stability, and efficiency.

- Geriatric segment is anticipated to secure the second-largest share by 2035, owing to the rising prevalence of chronic diseases and frequent self-medication.

Key Growth Trends:

- An increase in the aging population

- Expansion in digitalized health

Major Challenges:

- Inflation in input costs and volatility in the supply chain

- Price-based competition and proliferation in private label

Key Players: Johnson & Johnson (U.S.),Bayer AG (Germany),GlaxoSmithKline plc (GSK) (UK),Sanofi (France),Pfizer Inc. (U.S.),Reckitt Benckiser Group plc (UK),Procter & Gamble (U.S.),Perrigo Company plc (Ireland),Daiichi Sankyo Company, Limited (Japan),Takeda Pharmaceutical Company Limited (Japan),Sun Pharmaceutical Industries Ltd. (India),Cipla Ltd. (India),Dr. Reddy's Laboratories Ltd. (India),CSPC Pharmaceutical Group Limited (China),Yunnan Baiyao Group Co., Ltd. (China),Herbalife Nutrition Ltd. (U.S.),Amway (U.S.),Blackmores Limited (Australia),Dong-A ST (South Korea),Kotra Pharmaceuticals Sdn. Bhd. (Malaysia)

Global OTC Consumer Health Products Market Forecast and Regional Outlook:

-

Market Size & Growth Projections:

- 2025 Market Size: USD 55.3 billion

- 2026 Market Size:USD 64.7 billion

- Projected Market Size: USD 99.9 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

-

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.3% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Mexico, Indonesia

Last updated on : 23 October, 2025

OTC Consumer Health Products Market - Growth Drivers and Challenges

Growth Drivers

- An increase in the aging population: The international aging population is a long-lasting and reliable growth driver for the market. Old-age people have an increased incidence of chronic and minor ailments, such as digestive issues and joint pain. According to an article published by NLM in March 2025, there has been a demographic transition in the U.S., especially with patients aged over 65 years expected to almost double and reach an estimated 95 million by the end of 2060. This increase is further driven by an upsurge in the 85-year-old age category, which is also predicted to triple from 6 million in 2020 to 19 million within the same year, thereby boosting the market’s upliftment.

- Expansion in digitalized health: The extension in the development of digital channels for standard health and medical services has immensely increased consumer choice and product accessibility, denoting an optimistic outlook for the market internationally. As stated in the February 2022 Invest India Government report, the global digital health market is expected to witness a 29.6% growth by the end of 2025, with a valuation of USD 500 billion. This denotes the utilization of modernized technology within healthcare facilities to allow medical professionals to diminish inefficiency, ensure accurate diagnosis, save time, and aid disorders, thus suitable for the market’s growth.

- Transition to self-care: The aspect of fundamental behavioral modification is effectively underway, with customers increasingly empowering themselves to manage their respective health, which in turn is uplifting the OTC consumer health products market internationally. In this regard, a clinical study was published by NLM in November 2023, wherein 540 participants were included to evaluate self-medication. It was found that self-medication was readily prevalent among 78.6% of participants, with the highest among the middle-aged group, ranging between 21 to 40 years, in comparison to the young and old age groups. Therefore, this denotes a massive growth opportunity for the market with increased focus on self-medication as a suitable medical solution.

Pharmaceutical Markets Prevalence in Different Nations Uplifting the Market (2022)

|

Countries |

Valuation |

|

U.S. |

USD 631.5 billion |

|

China |

USD 112.6 billion |

|

Japan |

USD 67.2 billion |

|

Germany |

USD 59.5 billion |

|

France |

USD 41.8 billion |

|

Italy |

USD 36.1 billion |

|

UK |

USD 33.4 billion |

|

Canada |

USD 29.4 billion |

Source: Financing Desa UN Organization

Challenges

- Inflation in input costs and volatility in the supply chain: The market experiences inflationary trends, as well as persistent pressure from international supply chain disruptions. The dependency on APIs as well as raw materials from geographic sources develops geopolitical instability, trade restrictions, and logistical bottlenecks. Besides, packaging, transportation, and energy expenses have increased, leading to squeezed profit margins. Therefore, manufacturers are readily caught between passing these costs to consumers or absorbing them, resulting in negatively impacting the market demand.

- Price-based competition and proliferation in private label: The increasing growth of retailer-based private labels displays an effective risk to branded manufacturers in the market. The majority of retail chains have leveraged customer trust and their own shelf space to provide OTC products at lower price points. This has significantly commoditized notable categories, such as basic vitamins and analgesics, which has eroded brand loyalty and pressured wide-ranging price competition. However, to overcome this, branded organizations need to justify their premium through standard investment in meaningful product advancement, superior consumer experiences, and brand-building.

OTC Consumer Health Products Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 55.3 billion |

|

Forecast Year Market Size (2035) |

USD 99.9 billion |

|

Regional Scope |

|

OTC Consumer Health Products Market Segmentation:

Formulation Segment Analysis

Based on the formulation, the tablets segment is anticipated to garner the largest share of 45.8% by the end of 2035. The segment’s exposure is effectively propelled by the aspect of its outstanding combination of manufacturing patient-based advantages, strong stability, and efficiency. For instance, in January 2024, the U.S. FDA successfully approved Opill as a suitable nonprescription oral birth control tablet. The recommended dosage as put forth by the regulatory body, caters to 0.075 mg, thus uplifting the segment’s growth internationally.

Consumer Demographics Segment Analysis

Based on consumer demographics, the geriatric segment is predicted to garner the second-largest share during the forecast duration. The segment’s upliftment is highly attributed to an increased prevalence of chronic diseases and frequent self-medication. According to an article published by the Journal of the American Pharmacists Association in February 2022, 96% of people over the age of 65 years reportedly utilize OTC drugs, and also consume 40% of these drugs, which are readily commercialized in the U.S., thereby bolstering the segment’s growth in the overall market.

Distribution Channel Segment Analysis

Based on the distribution channel, the online stores segment is projected to account for the third-largest share by the end of the timeline. The segment’s development is extremely driven by the unparalleled customer demand for vast product selection, price transparency, and convenience. This particular channel has successfully encompassed a suitable and diversified ecosystem, which includes e-commerce firms, such as Amazon, direct-to-consumer (DTC) brand platforms, and online pharmacies. Additionally, DTC models have permitted brands to develop direct relationships with customers by gathering standard first-party data, denoting a positive impact of the segment.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Formulation |

|

|

Consumer Demographics |

|

|

Distribution Channel |

|

|

Pricing Category |

|

|

Product |

|

|

Drug Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

OTC Consumer Health Products Market - Regional Analysis

APAC Market Insights

Asia Pacific market is projected to account for the largest share of 40.3% by the end of 2035. The market’s upliftment in the region is highly attributed to a confluence of strong social and macroeconomic drivers, along with a rise in disposable incomes, standard urbanization, and a growth in health literacy. According to a data report published by the Lymphoma Coalition Organization in 2023, 55% of patients reside in urban areas, and 14% reside in rural locations. Besides, a clinical study was conducted on these patients to evaluate guidance regarding lymphoma, and 77% preferred doctors. Therefore, this denotes an increase in health consciousness, which positively impacts the overall market.

Asia-Pacific Patients’ Responses to Receiving Lymphoma Clinical Guidance from Different Sources (2022)

|

Source Type |

Patient Percentage |

|

Internet |

58 |

|

Patient Organization |

57 |

|

Social Media/Online Blogs |

20 |

|

Nurse |

25 |

|

Friends/Family |

12 |

|

Others |

5 |

Source: Lymphoma Coalition Organization

The OTC consumer health products market in China is gaining increased importance, owing to the presence of huge population, government strategies, and digital commerce, along with the existence of the NMPA’s approval processes for both imported and regional OTC products to cater to the soaring demand. According to an article published by NLM in April 2025, the NMPA has successfully cleared a total of 256 drugs in the country. In addition, the number of Class 1 advanced drug approvals reached 101 from 2019 to 2023, and these drugs further reached 33, thereby effectively denoting a 136% upsurge from the preceding year, thus bolstering the market’s demand.

The OTC consumer health products market in India is also developing due to an explosive growth in rising incomes, along with increased accessibility. Additionally, the government’s focus is effectively on affordability and regulation, with the Ministry of Health and Family Welfare proactively operating to amend the Drugs and Cosmetics Rules for creating a strong and clear framework for OTC drugs. For instance, the 2022 CDSCO Government report has stated standard dosage forms for certain drugs, including 10 to 50 mg/mL for ketamine. This standardization also includes 0.5 to 1 g of thiopentone powder for injection, and 5, 10, and 20 mg of baclofen, thus suitable for boosting the market’s exposure.

Europe Market Insights

Europe in the OTC consumer health products market is expected to emerge as the fastest-growing region during the predicted period. The market’s development in the region is effectively driven by an increase in the elderly population to manage chronic disease, robust cultural transition towards active self-care, along with digitalization and harmonization of healthcare across the overall region. According to an article published by NLM in January 2023, multi-morbidity is extremely common among the adult population in the region, with 65% prevalence among the 65-year-old group, as well as 85% among the 85-year-old group, thereby suitable for uplifting the market.

The OTC consumer health products market in Germany is gaining increased traction, owing to the existence of a well-established pharmacy network, an upsurge in the per-capita health and medical spending, the contribution of the Federal Ministry of Health in ensuring self-medication, and an increase in the incidence of joint pain and digestive issues. As stated in the May 2025 NLM article, the country’s actual health expenditure was EUR 415 billion in 2019, which increased to EUR 498 billion as of 2022, denoting more than 20% growth. Besides, 88% of the population is readily covered under the statutory health insurance, wherein they pay only 7.3% of their overall gross wages, thereby bolstering the market in the country.

The OTC consumer health products market in the UK is also developing due to the sudden transition of minor treatment options from the state to individuals, along with the presence of the NHS England guidance, and a robust consumer trend towards preventative health and wellness. As stated in the 2022 UK Clinical Research Collaboration analytical report, the Health Research Classification System has been effectively utilized to categorize more than 23,500 health projects, which are backed by 173 funding organizations. This has amounted to £4 billion in the country as of 2022 to spend on health-based research projects, thereby denoting a huge growth opportunity for the market.

North America Market Insights

North America in the OTC consumer health products market is poised to grow steadily by the end of the projected timeline. The market’s growth in the region is propelled by an upsurge in per-capita expenditure, sophisticated retail landscape, robust brand loyalty, the existence of health and medical consumerism, and aging demographics. According to the April 2025 AMA Organization article, the healthcare expenditure in the U.S. has surged by 7.5% as of 2023, amounting to USD 4.9 trillion or USD 14,570 per capita. This denotes an increase in the growth rate from 4.6% in 2022, thereby making it suitable for the market’s growth.

The OTC consumer health products market in the U.S. is gaining increased exposure, owing to the FDA’s contribution to approving the Rx-to-OTC switch program, an increase in consumers’ demand for personalized wellness, and the government’s influence. As per the June 2023 NLM article, the U.S. FDA cleared a total of 45 RTO switches between 2022 and 2023. This included 82.2% of follow-on products, 51.1% comprised OTC API, 22.2% catered to the latest pharmacological medication classes, and 6.6% accounted for exceptional advancements. Therefore, this denotes a huge growth opportunity for the overall market in the country.

The OTC consumer health products market in Canada is also growing due to the presence of a strict regulatory framework, a growing focus on natural health products, Health Canada’s NNHPD, which constitutes a strong clearance process for National Product Numbers (NPNs), and OTC integration into public health approaches. Besides, as per the December 2023 CDA-AMC article, the government of Canada has been investing USD 89.5 million for more than 5 years to successfully establish the CDA. In addition, the government also provided USD 34.2 million to the current federal funding yearly to support CADTH, thereby making it suitable for enhancing the market in the country.

Key Over-the-Counter (OTC) Consumer Health Products Market Players:

- Johnson & Johnson (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bayer AG (Germany)

- GlaxoSmithKline plc (GSK) (UK)

- Sanofi (France)

- Pfizer Inc. (U.S.)

- Reckitt Benckiser Group plc (UK)

- Procter & Gamble (U.S.)

- Perrigo Company plc (Ireland)

- Daiichi Sankyo Company, Limited (Japan)

- Takeda Pharmaceutical Company Limited (Japan)

- Sun Pharmaceutical Industries Ltd. (India)

- Cipla Ltd. (India)

- Dr. Reddy's Laboratories Ltd. (India)

- CSPC Pharmaceutical Group Limited (China)

- Yunnan Baiyao Group Co., Ltd. (China)

- Herbalife Nutrition Ltd. (U.S.)

- Amway (U.S.)

- Blackmores Limited (Australia)

- Dong-A ST (South Korea)

- Kotra Pharmaceuticals Sdn. Bhd. (Malaysia)

- Johnson & Johnson is one of the foundational pillars of the market, with its Kenvue currently managing an outstanding portfolio, with inclusion of Band-Aid bandages and Tylenol analgesics. According to its 2024 annual report, there has been a surge in its operational sales by 7%, with USD 24.2 billion as net earnings, and USD 9.9 billion as net earnings per share.

- Bayer AG is considered the ultimate powerhouse for its Aspirin brand, and upholds a notable position in the supplement and vitamin sector, with the existence of brands such as Berocca and One A Day. Additionally, the organization has leveraged its robust pharmaceutical and agricultural heritage to effectively drive progression and instill trust in consumer self-care services.

- GlaxoSmithKline plc (GSK) is currently the largest consumer health firm through its Haleon product, and boasts mega brands, including Centrum, Panadol, and Sensodyne. This tactical approach has enabled Haleon to focus and drive growth in the rapidly evolving OTC category. As per the 2024 yearly report, the company’s group turnover was valued at £31.4 billion, with £11.8 billion for specialty medicines, £9.1 billion for vaccines, and £10.4 billion for general medicines.

- Sanofi is one of the players in Europe, comprising a strong OTC portfolio, which includes the allergy powerhouse, Allegra, and the international pain management brand, Doliprane. The firm has significantly leveraged its prescription medication expertise to execute successful Rx-to-OTC switch strategies, along with developing trusted consumer brands.

- Pfizer Inc. readily maintains an effective presence in the global OTC market, with the presence of historic brands such as Centrum (presently a part of Haleon) and Advik. The organization, however, continues to explore the current OTC growth opportunities through its pipeline of potential Rx-to-OTC switches and strategic partnerships.

Here is a list of key players operating in the global market:

The international market is significantly consolidated, but also constitutes a dynamic arena, which is readily dominated by Japan and West-based multinationals, such as GSK, Bayer, and Johnson & Johnson. However, agile-based generic firms from India, including Cipla and Sun Pharma, successfully extended their worldwide OTC footprint through tactical acquisitions and leveraged their manufacturing prowess. For instance, in December 2024, Cipla Limited declared that it has achieved the administrative clearance for its Afrezza from the CDSCO to distribute and commercialize it in India. Besides, notable players are incorporating a long-lasting growth approach, with increased focus on DTC e-commerce, targeted acquisitions, and generous investment in digitalized marketing.

Corporate Landscape of the Over-the-Counter Consumer Health Products Market:

Recent Developments

- In March 2025, Emcure Pharmaceuticals Ltd. announced its successful entry into the regular supplements field by extending its OTC portfolio with Arth range, with the intention to provide efforts for women’s health education and quality.

- In October 2024, Mankind Pharma Limited effectively accomplished the transaction by acquiring 100% stake in Bharat Serums and Vaccines Limited (BSV) for a purchase valuation of Rs. 13,738 Crores, and transferred its OTC business to Mankind Consumer Products Private Limited (MCPPL).

- In July 2022, AFT Pharmaceuticals as well as RooLife Group notified the introduction of a range of AFT’s OTC pharmaceuticals through their store on the China Cross Border E-Commerce (CBEC) online platform Tmall Global.

- Report ID: 512

- Published Date: Oct 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

OTC Consumer Health Products Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.