Orthopedic Software Market Outlook:

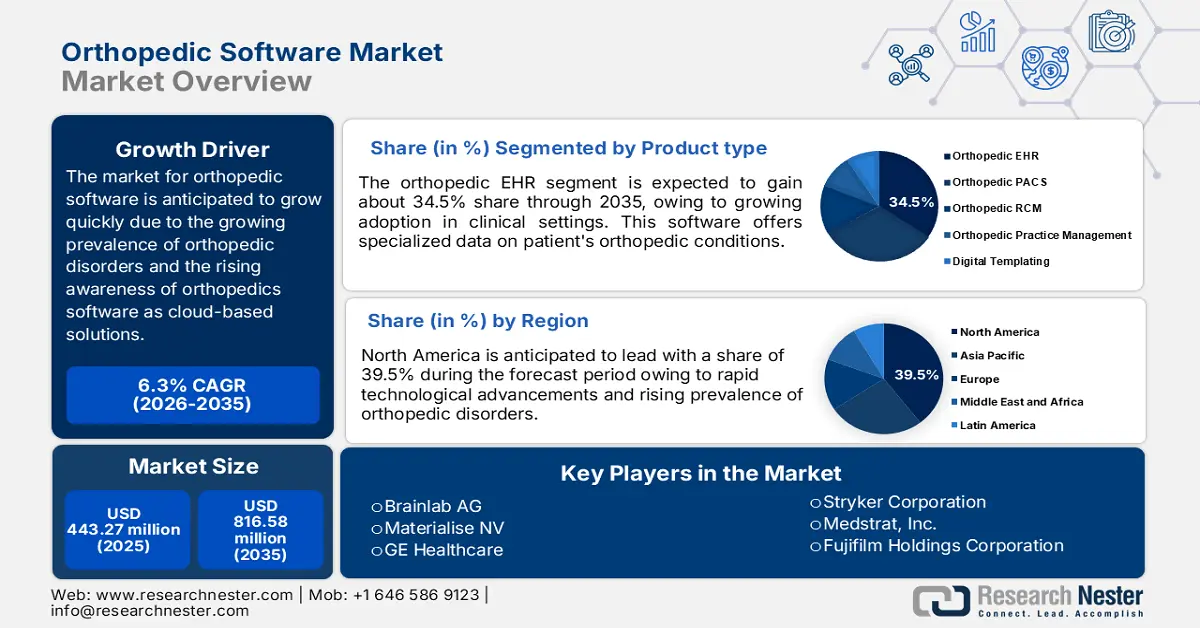

Orthopedic Software Market size was valued at USD 443.27 million in 2025 and is expected to reach USD 816.58 million by 2035, registering around 6.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of orthopedic software is assessed at USD 468.4 million.

The orthopedic software market is expected to grow rapidly during the forecast period owing to the rising prevalence of orthopedic diseases such as arthritis, osteoporosis, bursitis, and other musculoskeletal disorders among the elderly population across the globe. According to the Centers for Disease Control and Prevention (CDC) report, about 18.3 million people in the U.S. visit emergency departments annually owing to orthopedic injuries. This highlights the crucial need for effective management solutions. Moreover, government support and initiatives from orthopedic organizations additionally promote the adoption of innovative technologies, thereby accelerating the advancement and implementation of specialized orthopedic software solutions to meet the rising healthcare demands.

Another factor boosting orthopedic software market growth is the rising demand for minimally invasive surgeries (MIS). This is mainly influenced by low complication rates and reduced postoperative pains associated with these procedures. As more patients and healthcare providers seek options that encourage faster recovery and better outcomes orthopedic software solutions are developing to support these advanced surgical techniques. For instance, in March 2023, Stryker launched the Mako Total Knee 2.0 which improves robotic-assisted surgeries and aligns with the increasing trend of MIS.

Key Orthopedic Software Market Insights Summary:

Regional Highlights:

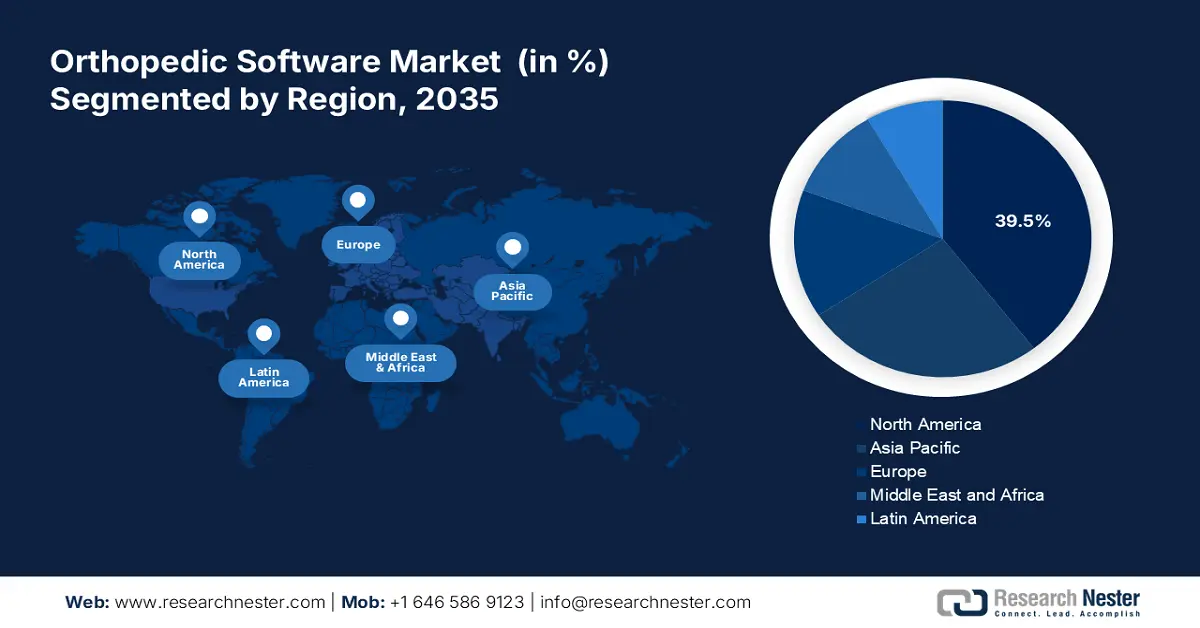

- North America leads the Orthopedic Software Market with a 39.5% share, propelled by technological developments and robust healthcare infrastructure, fostering significant growth by 2035.

- The Orthopedic Software Market in Asia Pacific is anticipated to maintain stable growth through 2026–2035, driven by rising orthopedic conditions and adoption of advanced healthcare software.

Segment Insights:

- The Orthopedic EHR segment is expected to achieve a 34.5% share by 2035, driven by rising adoption in clinical settings and advancements in medical imaging technology.

- The Orthopedic Surgeries segment is anticipated to achieve 45.8% market share by 2035, propelled by the increasing number of orthopedic surgeries and greater access to advanced treatment and screening tools.

Key Growth Trends:

- Accessibility of orthopedics software as cloud-based solutions

- Technological advancements in orthopedic software

Major Challenges:

- Integrating orthopedic software with recent hospital systems

- Lack of awareness causes hesitancy in adopting innovative solutions

- Key Players: Brainlab AG, Materialise NV, GE Healthcare, Stryker Corporation, and Medstrat, Inc.

Global Orthopedic Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 443.27 million

- 2026 Market Size: USD 468.4 million

- Projected Market Size: USD 816.58 million by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Orthopedic Software Market Growth Drivers and Challenges:

Growth Drivers

- Accessibility of orthopedics software as cloud-based solutions: Cloud-based solutions are transforming how orthopedic practices manage patient records streamline workflows and offer care remotely with major developments recently boosting their adoption. Progressions in cybersecurity and data privacy have also increased the appeal of cloud-based orthopedic software. Leading companies are heavily investing in data protection and encryption measures to safeguard compliance with regulations such as the Health Insurance Portability and Accountability Act (HIPAA). For instance, developments in secure cloud infrastructure by key tech players including Amazon Web Services and Microsoft Azure are helping orthopedic software providers offer HIPAA-compliant platforms to ensure that sensitive patient data remains protected.

- Technological advancements in orthopedic software: Technological developments are significantly transforming the orthopedic industry by improving surgical precision, patient outcomes, and overall efficiency. Robotic-assisted surgeries are also becoming popular with systems such as Mazor X Stealth by Medtronic offering enhanced precision in spinal procedures. These robots aid surgeons by accurately positioning instruments and implants significantly reducing the risk of errors and improving recovery times. Orthopedic software market growth is powered by the growing demand for minimally invasive surgical options, developments in medical technologies, and the necessity for integrated healthcare IT solutions that improve patient care and streamline clinical workflows.

Challenges

- Integrating orthopedic software with recent hospital systems: One of the major hurdles that can hamper orthopedic software market growth due to lack of interoperability between various software platforms. According to a survey conducted by the National Coordinator for Health Information Technology in 2023, approx. 71% of hospitals stated that they have a system that allows the exchange of patient information with other providers apart from their organization. This lack of seamless data sharing can hamper the integration of orthopedic software with various hospital systems.

Additionally, fear about patient privacy and data security can slow the adoption of orthopedic software. HIPAA needs healthcare organizations to safeguard the integrity and confidentiality of electronically protected health data. This ensures that orthopedic software meets strict security requirements which can be time time-consuming and complex process, this may discourage hospitals from integrating the software with their existing systems. - Lack of awareness causes hesitancy in adopting innovative solutions: Lack of awareness is a barrier to adopting modernized solutions such as digital imagining systems, electronic health records (EHRs), and cloud-based solutions. Healthcare providers mainly smaller practices or those in rural areas, often lack the necessary information or exposure to cutting-edge technologies. This hesitancy in adopting orthopedics software stems from a less understanding of its benefits such as streamlined operations enhanced patient outcomes and growing efficiency in practice management.

Orthopedic Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 443.27 million |

|

Forecast Year Market Size (2035) |

USD 816.58 million |

|

Regional Scope |

|

Orthopedic Software Market Segmentation:

Product Type (Orthopedic EHR, Orthopedic PACS, Orthopedic RCM, Orthopedic Practice Management, Digital Templating/ Preoperative Planning Software)

Orthopedic EHR segment is estimated to account for more than 34.5% orthopedic software market share by the end of 2035, due to rising adoption in clinical settings. Different types of EHR systems are currently available that offer specialized data associated with patient's orthopedic conditions. For example, in May 2024, Atlantis Orthopedics in Florida selected eClinicalWorks cloud EHR and healow patient engagement solutions to progress operational efficiency and patient engagement. The growth is also driven by the developments in medical imaging technology and the growing demand for precision in surgical outcomes.

Application (Orthopedic surgeries, Fracture management, Joint replacements, Other applications)

By the end of 2035, orthopedic surgeries segment is poised to account for more than 45.8% orthopedic software market share, due to the increasing number of orthopedic surgeries and rising availability of advanced treatment and screening equipment. For example, according to the American College of Rheumatology, around 544,000 hip replacements and 790,000 total knee replacements are completed yearly in the U.S. Additionally, the rising prevalence of bone issues such as arthritis the growing incidence of road accidents and sports injuries are driving the orthopedic software market growth. According to the Arthritis Society Canada, approx. 6 million Canadians have arthritis, with women being more affected than men. The number of people with arthritis is anticipated to reach 9 million by 2040.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Delivery Mode |

|

|

Application |

|

|

End-use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Orthopedic Software Market Regional Analysis:

North America Market Analysis

North America industry is expected to hold largest revenue share of 39.5% by 2035, owing to technological developments in the region, presence of key players and robust healthcare infrastructure. Also, the increasing preference for minimally invasive procedures and continuously improving reimbursement scenarios can further propel the market.

In the U.S., the market is expected to account for a significant revenue share between 2025 and 2035 due to increasing orthopedic surgeries, rising demand for efficiency and precision in treatment, and the presence of well-developed healthcare systems. According to the American Joint Replacement Registry (AJRR), in 2021, over 2.2 million knee surgeries were conducted in over 1,150 hospitals, ambulatory surgery centers, and other healthcare centers in the U.S. and the District of Columbia. Moreover, the rising adoption of data sharing and orthopedic EHRs in the country further boosts the market.

The Canada orthopedic software market is expected to grow at a steady pace between 2025 and 2035 attributed to rising healthcare expenditures, increasing digitalization across, and high adoption of cloud-based orthopedic solutions. In January 2024, Sawbones and Numalogics announced the launch of ENDPOINT, a new software that allows orthopedic implant manufacturers to test devices as per industry standards.

Asia Pacific Market Analysis:

Asia Pacific is expected to experience a stable CAGR during the forecast period owing to the rising prevalence of orthopedic conditions, increasing awareness of early diagnosis and treatment, and rapid adoption of advanced healthcare techniques and software. Moreover, healthcare providers and governments in the Asia Pacific are focused on reducing medical expenses and enhancing overall patient outcomes. China, India, Japan, and South Korea are some of the largest revenue-generating countries in this region.

In India, the orthopedic software market is expected to register significant revenue growth during the forecast period owing to rising digital transformation, improving healthcare infrastructure, and increasing adoption of advanced screening solutions. In addition, rising investments in R&D activities is expected to boost market growth in India. For instance, in July 2023, Stryker announced the launch of the Ortho Q Guidance system and software to enable advanced surgical planning for knee and hip surgeries.

The Japan orthopedic software market is anticipated to expand at a robust rate during the forecast period. This growth can be attributed to rising orthopedic surgeries, the presence of well-established healthcare infrastructure and facilities, and the high adoption of digital health solutions. Additionally, the local government actively supports healthcare innovations and developments through several funding programs and initiatives. This support raises the advancement and adoption of cutting-edge orthopedic software solutions to boost healthcare delivery.

Key Orthopedic Software Market Players:

- Brainlab AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Materialise NV

- GE Healthcare

- Stryker Corporation

- Medstrat, Inc.

The global orthopedic software market is highly competitive, including key players operating at global and regional levels. Top players are adopting many strategies, such as partnerships and collaborations, to raise market share. For example, in October 2022, Brainlab AG collaborated with the German Society for Orthopedics and Orthopedic Surgery (DGOOC) to develop medical research in clinics by encouraging the advancement of a data protection-compliant registry infrastructure for processing patient data. Here are some leading players in the orthopedic software market:

Recent Developments

- In July 2024, Stryker Corporation declared that it received FDA 510(k) clearance for its Q Guidance System with Spine Guidance 5 software featuring Copilot. The Copilot feature offers multiple feedback modalities for supporting bone resection and screw delivery among others. This advancement is predicted to improve the company's product offering and surge business prospects.

- In June 2024, Zimmer Biomet partnered with RevelAi Health mainly to market their AI-powered clinical software for conditions such as osteoarthritis. It aims to improve orthopedic care by partnering with RevelAi to develop an equity-driven, whole-person approach to value-based care through integrated AI-enabled tools.

- In November 2023, OPIE Software declared a partnership with Professional Orthopedic Products (P.O.P.). This partnership allows Canadian facilities to streamline the ordering process for P.O.P. orthotic devices through the OPIE Inventory and Purchasing portal. Users can access P.O.P.’s digital catalog, select specialized products, place orders, and receive confirmations efficiently via the OPIE platform.

- Report ID: 6619

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Orthopedic Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.