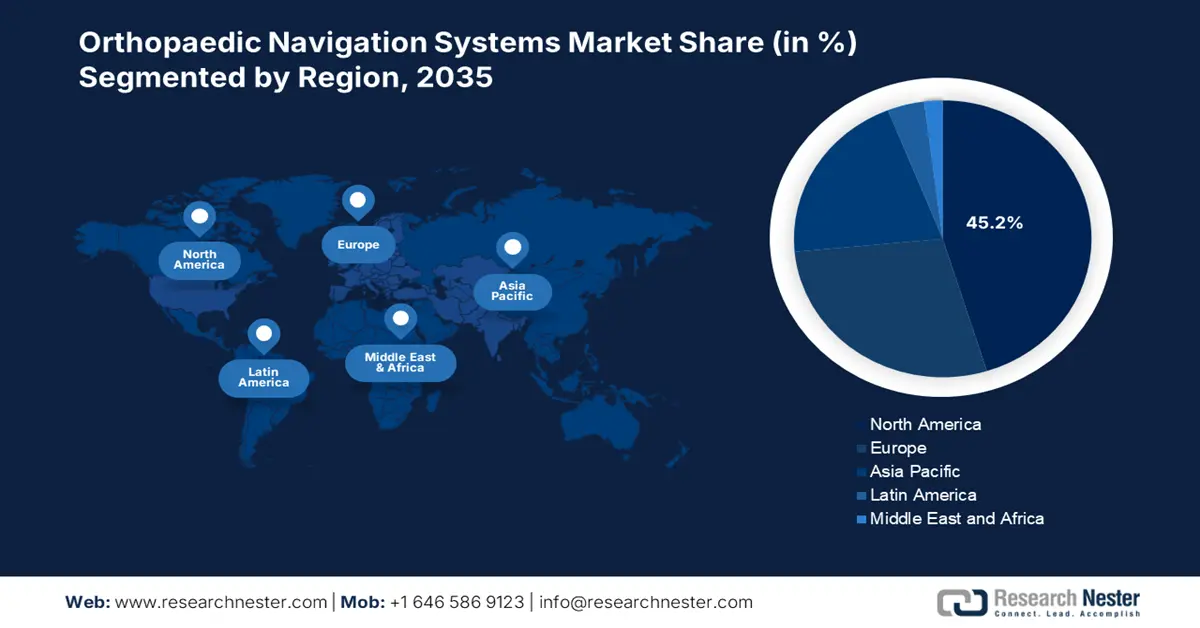

Orthopaedic Navigation Systems Market - Regional Analysis

North America Market Insights

North America orthopaedic navigation systems market is projected to be the dominating region, garnering the largest share of 45.2% by the end of 2035. The market’s growth in the region is propelled by the aspect of commercial payer influence, the medical and legal environment, an increase in procedural volume, technological adoption, and centralized-specific integration. As per the April 2025 AMA report, there has been a surge in the healthcare expenditure by 7.5% as of 2023, accounting for USD 4.9 trillion, which is higher than the 4.6% rise in 2022, thereby suitable for the market’s growth in the overall region.

The orthopaedic navigation systems market in the U.S. is growing significantly, owing to the presence of reimbursement policies, AI implementation, federal research funding, and the competitive landscape. As stated in the 2025 Arthritis National Research Foundation data report, the organization has been established to provide funds ranging from USD 50,000 to USD 250,000 to support research-based projects for two years. Therefore, with the establishment of such organisations to provide generous funds, there is a huge opportunity for the market to expand in the country.

The orthopaedic navigation systems market in Canada is also growing due to the existence of provincial government stewardship, administrative fund provision, suitable procurement processes, provincial health technology, and cost-effective patient outcomes. According to the November 2023 ITA data report, the medical device market in the country has been estimated to be USD 6.8 billion as of 2022, which is projected to increase at a 5.4% growth rate. In addition, the overall health and medical expenditure in the country was valued at CAD 331 billion in 2022, thereby denoting an optimistic outlook for the overall market.

2022 Diagnosed Arthritis in the U.S. and Osteoarthritis in Canada

|

U.S. |

Prevalence |

Canada |

Prevalence |

|

Adults over 18 years of age |

18.9% |

More than 20 years |

13.6% |

|

Women |

21.5% |

Female |

16.1% |

|

Men |

16.1% |

Male |

11.1% |

|

18 to 34 years |

3.6% |

Mortality rates among females |

8.0 per 1,000 persons |

|

More than 75 years |

53.9% |

Mortality rates among males |

12.3 per 1,000 persons |

|

Income less than 100% of the federal poverty line |

24.7% |

Age-standardized all-cause mortality rate ratios (females) |

1.1 to 1.2 |

|

Income at 400% of the federal poverty line |

16.6% |

Age-standardized all-cause mortality rate ratios (males) |

Around 1.2 |

Sources: CDC, Government of Canada

APAC Market Insights

Asia Pacific orthopaedic navigation systems market is anticipated to emerge as the fastest-growing region during the projected timeline. The market’s upliftment in the region is highly fueled by the aspect of extreme market heterogeneity, the medical tourism centre, and rapid infrastructure development. As stated in the 2023 Asia-based Development Bank Institute data report, there has been an expansion in the universal health coverage from 46% to 61% over the past six years. Besides, the gross domestic product (GDP) in the Republic of Korea surged from USD 1,055.9 to USD 5,817, which also denotes a huge opportunity for the market to expand in the overall region.

The orthopaedic navigation systems market in China is growing steadily, owing to the presence of the Healthy China 2030 strategy, followed by strong support from the government, an increase in sourcing orthopaedic appliances, and an increase in patient volume. As per an article published by NLM in August 2023, the out-of-pocket expenses accounted for 60% of the overall healthcare spending, while 23% of workers from urban areas readily enrolled themselves in social health insurance schemes. Besides, the overall health and medical expenditure in the country reached RMB 7.5 trillion, which is 6.6% of GDP over the past 4 years, thereby creating an optimistic outlook for the market.

The orthopaedic navigation systems market in India is also developing due to the effective adoption of corporate healthcare chains, cost-effective medical devices, and an intense focus on technology to address massive patient volumes. According to the August 2025 Invest India data report, the government has readily approved the Medical Devices Policy, which in turn has envisaged a worldwide share ranging between 10% to 12% in the upcoming 25 years. Besides, the valuation of medical devices export has accounted for USD 3.3 billion between 2022 and 2023, while the share for regional MedTech players is USD 2.5 billion, as of 2023, thus suitable for boosting the market in the country.

Orthopaedic Appliances 2023 Export and Import in the Asia Pacific

|

Countries |

Export |

Import |

|

China |

USD 3.4 billion |

USD 3.9 billion |

|

Singapore |

USD 3.3 billion |

USD 1.0 billion |

|

Malaysia |

USD 1.4 billion |

USD 289 million |

|

South Korea |

USD 713 million |

USD 709 million |

|

India |

USD 355 million |

USD 956 million |

|

Japan |

USD 271 million |

USD 2.8 billion |

|

Philippines |

USD 303 million |

USD 221 million |

|

Hong Kong |

USD 346 million |

USD 537 million |

Source: OEC

Europe Market Insights

Europe in the orthopaedic navigation systems market is expected to account for a considerable share by the end of the forecast timeline. The market’s development in the region is highly driven by the presence of a strict regulatory framework, increased demand for hospitals, cost-effective technologies, and a centralized budgeting system. For instance, in July 2025, the Medicines and Healthcare products Regulatory Agency (MHRA) has declared the latest steps through which patient accessibility for the newest medical technologies can be made available in the overall region, thereby suitable for the market’s exposure.

The orthopaedic navigation systems market in Germany is gaining increased exposure, owing to the aspect of hospital funding system for new technologies, the power of undertaking clinical-based decision-making, and a surge in the procedure volume. According to a survey conducted on 185 heads of department, which was published by NLM in August 2023, 47% of hospitals comprised vacant positions, 33% for board-based specialists, and 89% for junior doctor positions. Therefore, there is a huge opportunity for the market to flourish in the country, with employment facilities for orthopaedic health and medical providers.

The orthopaedic navigation systems market in France is also uplifting due to modernized initiatives proposed by the domestic government, the presence of centralized gatekeeping through the Haute Autorité de Santé (HAS), and price-sensitive devices. As stated in the August 2024 ITA report, there has been a turnover in the regional medical device market, amounting to €37.4 billion as of 2023, while the export turnover was €9.5 billion, constituting almost 25% of the overall market. However, there is an expectation that the market will witness a yearly growth of 2% for the upcoming years, thereby denoting a huge opportunity for the market to boost in the country.