Orthodontics Market Outlook:

Orthodontic Market size was over USD 7.13 billion in 2025 and is projected to reach USD 27.14 billion by 2035, witnessing around 14.3% CAGR during the forecast period, i.e., between 2026-2035. In the year 2026, the industry size of orthodontics is evaluated at USD 8.05 billion.

The market has witnessed rapid growth in recent years, propelled by its growing relevance in modern dentistry. With rising awareness, consumers have been demanding corrective treatments with aesthetically appealing solutions. This shift has been fostered by the rising usage of social media and increasing emphasis on personal grooming. Furthermore, new technology in the use of 3D imaging, along with a clear aligner system, has recently gained popularity among many for its treatment options, as well as becoming accessible and more attractive to a wider age range.

Governments are placing emphasis on making a robust supply chain to ensure the consistent availability of the products and to reduce disruptions. A strong supply chain enables stakeholders to respond swiftly to a volatile demand and handle inventory efficiently. Additionally, partnerships with trustworthy suppliers and the amalgamation of advanced technologies such as AI-enabled demand forecasting and real-time tracking systems enhance trust and resilience. This reliability not only lowers lead times and costs but also enhances patient satisfaction and trust among dental professionals, ultimately accelerating market growth globally.

Key Orthodontics Market Insights Summary:

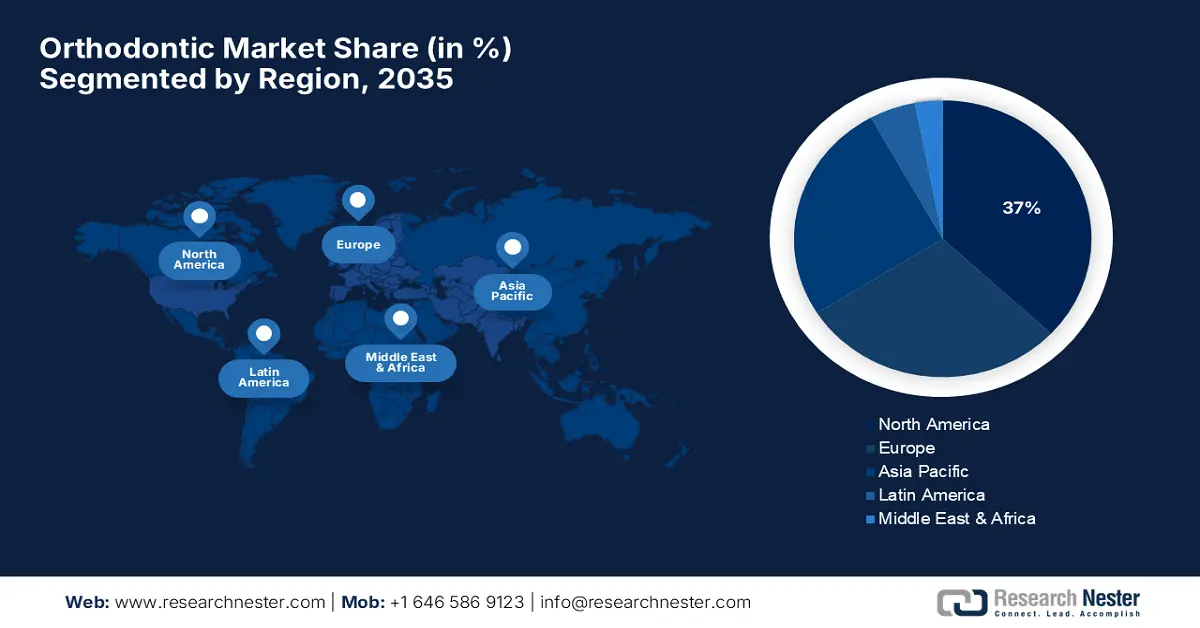

Regional Highlights:

- The North American orthodontic market is projected to hold a 37% share by 2035, impelled by the expansion of medicare coverage and increased adult orthodontic procedures.

- Asia-Pacific is anticipated to secure around 29% of the global orthodontic market by 2035, owing to urbanization and rising focus on cosmetic dentistry.

Segment Insights:

- The dental distributors sub-segment is projected to account for 41% share by 2035 in the orthodontic market, driven by various channels through which supply chain solutions are merchandized, ensuring proper inventory management and product availability.

- Orthodontics is expected to capture a 36% share of the end-user segment by 2035, owing to the growing number of adult patients and increasing government and insurance reimbursement programs.

Key Growth Trends:

- Surge in prevalence of malocclusion and dental disorders

- Growing adoption of clear aligners and aesthetic dentistry

Major Challenges:

- Pricing restraints and reimbursement limitations

- Regulatory approval delays

Key Players: Align Technology, 3M Company, Dentsply Sirona, Straumann Group, American Orthodontics, Ormco Corporation, Henry Schein Orthodontics, Forestadent, GC Orthodontics, Tomy International, American Orthodontics Europe, Carestream Dental, Hanel Orthodontics, Ivoclar Vivadent AG, Danaher Corporation.

Global Orthodontics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.13 billion

- 2026 Market Size: USD 8.05 billion

- Projected Market Size: USD 27.14 billion by 2035

- Growth Forecasts: 14.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Mexico, Australia

Last updated on : 7 October, 2025

Orthodontic Market - Growth Drivers and Challenges

Growth Drivers

- Surge in prevalence of malocclusion and dental disorders: One of the primary growth drivers of the market is the surge in incidents of malocclusion and dental irregularities among the population of all age groups. Factors such as genetic predisposition and amplified sugar intake have significantly contributed to the surge in cases of dental deformities globally. According to data published by the American Association of Orthodontics in 2023, 50% of people in the U.S. have malocclusion conditions which is severe enough to need specified healthcare. These factors are continuing to propel the growth of the market in the coming period.

- Growing adoption of clear aligners and aesthetic dentistry: In modern orthodontic treatment, people are giving utmost importance to the aesthetic appeal. Invisalign and Spark are a few such clear aligners that are gaining traction among the people of the younger generation, as well as adults. These types of aligners cater to the burgeoning demand for convenient solutions. Additionally, the rising usage of social media and the trend of influencers is further compelling people to invest money in various smile correction procedures. The economic development has also increased access to advanced dental care.

- Expansion of dental service organization and clinics: The surge in the number of dental clinics is also a prominent growth driver. These organizations are enhancing the accessibility and standardization of the treatments across the regions. Moreover, the collaborations between manufacturers and clinics are speeding up the penetration of modern technologies globally. Also, consumers are increasingly acknowledging the long-term advantages of orthodontic treatments that eradicate the chances of the occurrence of periodontal disease. Also, according to data published by the Observatory of Economic Complexity in 2023, the global trade of dental appliances reached USD 6.58 billion. This reflects the rising adoption of orthodontic devices and the strengthening a market growth.

Challenges

- Pricing restraints and reimbursement limitations: Price pressures and reimbursement options are standing in the way of growth in the orthodontic market. In the U.S., Medicaid covers fewer patients eligible for coverage, due to strict cost caps and eligibility rules. This hampers the ability to grow volumes and forces manufacturers to always look for less costly alternatives, which is why the demand stays constrained, which limits revenue potential in both developed and emerging markets.

- Regulatory approval delays: Lengthy regulatory approval timelines could significantly hamper the ability to rapidly introduce an orthodontic product into the market. These kinds of delays add up to increased costs for R&D and compliance and reduce the agility for immediate response to market needs. For global players, the complexities inherently embedded within these rules demand enormous resources for navigation across multiple jurisdictions, thus impairing swift commercialization. Ultimately, the delay in approvals slows down the innovation adoption pace and market growth, especially the highly developed markets stand and with where the compliance requirements are fairly stringent.

Orthodontic Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14.3% |

|

Base Year Market Size (2025) |

USD 7.13 billion |

|

Forecast Year Market Size (2035) |

USD 27.14 billion |

|

Regional Scope |

|

Orthodontic Market Segmentation:

Distribution Channel Segment Analysis

The dental distributors sub-segment is expected to grasp the largest revenue share of 41% by 2035 in the orthodontic market, due to various channels through which supply chain solutions are merchandized, ensuring proper inventory management and enormous product availability. Distributors are intermediaries who ensure the delivery of specialized orthodontic products in a timely fashion-whether that is digital orthodontic equipment or the 3D printing of aligners that require very special logistics arrangements. Through considerable networking and gaining expertise in procuring advanced equipment, they alleviate the burden on orthodontic clinics in preventing violations of some mechanisms of laws and reducing general market penetration by special manufacturers, and faster delivery of services.

End User Segment Analysis

Orthodontics is projected to dominate the end-user segment with an estimated market share of 36% by 2035. Clinics are the first point of care to provide orthodontic treatment, thus creating a steady demand for various orthodontic supplies. An increase in adult orthodontic patients and rising government and insurance reimbursement programs further fuel the demands arising from this segment. Such clinical expertise within orthodontic clinics also strengthens patient choices, which mature into preferences for aesthetic and functional treatment, thus providing a good growth scenario for suppliers with this segment in focus as a strategic option for market expansion.

Product Type Segment Analysis

Under the product type segment, revenue share of brackets is forecasted to be 29% by the year 2035, with high acceptance levels given continuous innovation in materials and changing consumer preferences for aesthetic treatments. However, gaining rapid market share is ceramic brackets that are increasingly being preferred chiefly for their translucent feature and biocompatibility. From treatment value enhancement with self-ligating and low-profile products, there is a great attraction for manufacturers. Brackets are increasingly being defined as core products in the orthodontic supply’s portfolio, with the integration of digital orthodontic workflows in enhancing the precision of outcomes.

Our in-depth analysis of the orthodontic market includes the following segments:

|

Segment |

Subsegment |

|

Product Type |

|

|

Material Type |

|

|

End user |

|

|

Distribution Channel |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Orthodontic Market - Regional Analysis

North America Market Insight

The North American market is forecast to hold 37% of the overall orthodontic market in 2035. The region has a well-equipped healthcare system and a strong government focus on dental care. This growth is fueled by the expansion of medicare coverage and increased adult orthodontic procedures. The recent acceptance of digital orthodontics and 3D printing has spurred innovation in product designs and efficient manufacturing. On the pricing side, these preventive treatments in government-sponsored care are put under pressure, although reimbursement remains a little uncertain. Hence, North America presents itself as a premium market for sustainable orthodontic products.

The market in the U.S. is thriving significantly, as there is a strong demand for aesthetic and discreet treatments. There are advances in digital scanning, imaging, AI-enabled planning, etc. These types of technologies are allowing for swift turnaround and shorter treatment times. According to The Journal of the American Dental Association conducted a survey in 2023, and found that people were 3.5 times more willing for direct-to-consumer treatment for mild malocclusions. These factors are showcasing a higher demand for the clear aligner kits, further propelling the market growth.

In Canada, the market growth is propelled by robust support from the government. There has been increased adoption of digital modelling and 3D printing. Such technologies are shifting demand toward dental supplies. Also, a greater public awareness regarding oral health, amalgamated with the interest in cosmetic dentistry, is compelling people to look for orthodontic treatment. This increases demand for supplies that improve patient convenience; clinics that render preferred features may attract more clients, which in turn drives suppliers to innovate and stock state-of-the-art products.

Asia-Pacific Market Insight

Asia-Pacific is the fastest-growing region in the orthodontic market, which is anticipated to capture around 29% of the global market in 2035 as a result of urbanization and increased focus on cosmetic dentistry. Regional governments are pushing local production and digitalization of the clinical industry, most prominently so in China, India, and Japan. Regional reimbursement systems being fragmented as they are, Asia's expanding middle class and increasing private dental expenditure, however, place the Asia-Pacific region as the world's fastest-growing orthodontic devices market. The market in China is flourishing owing to rising demand for aesthetic treatments and advancements in orthodontic technology. The government initiatives and healthcare reforms endeavor to enhance dental care accessibility is contributing significantly to the growth of the orthodontic market.

In India, the market is witnessing staggering growth on the back of a growing middle-class population and rising disposable incomes. Also, the technological innovations are attracting more patients and improving the outcomes of the treatments. The government is focusing on making quality healthcare accessible to a large population. The rising establishment of dental clinics across India is enhancing access to orthodontic care. This expansion is promoting the availability of a wide range of orthodontic supplies and services to urban and rural populations alike.

Europe Market Insight

By 2035, Europe is projected to hold roughly 26% of the market. The market in Europe is fueled by a high prevalence of malocclusion and increasing demand for aesthetic treatments such as clear aligners. The advanced digital orthodontics technologies using CAD/CAM and 3D printing promote treatment precision and efficiency. Due to the maturity of the market, treatment charges are high, limiting patients from getting treatment, while several insurance schemes reimburse different amounts for services rendered. However, the region continues to enjoy steady growth and remains one of the key technology-driven areas for orthodoxy through high awareness in dental health and a fertile ecosystem for innovations.

In Germany, the market growth is driven by a rise in dental issues in the aging population. The geriatric population is looking for orthodontic intervention, such as tooth misalignment and bite problems. Germany's reputation for high-quality dental care and the presence of skilled orthodontists are appealing a lot of global patients. This reputation bolsters the demand for advanced and efficient orthodontic supplies. In the UK, the burgeoning middle class, amalgamated with a surge in disposable incomes, is contributing to rising spending on dental care, including orthodontic treatments. Also, there is a surge in the establishment of dental clinics that are enhancing orthodontic care.

Key Orthodontic Market Players:

- Align Technology

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 3M Company

- Dentsply Sirona

- Straumann Group

- American Orthodontics

- Ormco Corporation

- Henry Schein Orthodontics

- Forestadent

- GC Orthodontics

- Tomy International

- American Orthodontics Europe

- Carestream Dental

- Hanel Orthodontics

- Ivoclar Vivadent AG

- Danaher Corporation

In the global orthodontic supplies, a few major players are innovation-oriented and are innovating in product diversification and digital integration. Both Align Technology and 3M have investments in digital orthodontics and clear aligners for dominance in the market. The geographic expansion and diversification of product portfolios happen through strategic alliances, mergers, and acquisitions. Asian manufacturers have a competitive edge, owing to quality and R&D, particularly those from Japan. Lately, leaders in the market are ready to price for value and invest in solutions that are patient-friendly, as these solutions facilitate short-term adherence and improved outcomes. Optimization of distribution networks and delivery of technology-assisted services is expected to become the key to sustaining growth through changing regulatory and reimbursement landscapes around the world.

Here is a list of key players operating in the global market:

Recent Developments

- In September 2025, Dentsply Sirona hosted the SureSmile global orthodontics symposium in London, showcasing the latest advancements in orthodontic treatments. In the meeting, it was highlighted the advancements in 3D digital orthodontics were highlighted, focusing on how these technologies are transforming treatment planning and execution.

- In April 2025, Straumann Group introduced the iEXCEL high-performance implant system in Europe, receiving positive feedback from clinicians for its innovative design. The iEXCEL system integrates four implant designs—Bone Level, Tissue Level, C-Design, and X-Design—into a single platform. This consolidation allows clinicians to address a wide range of patient needs with one surgical kit and a unified prosthetic connection.

- Report ID: 7113

- Published Date: Oct 07, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Orthodontics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.